Mortgage choice increases with 5,000 deals now available

The number of mortgage deals available has broken through the 5,000 barrier for the first time in more than a year.

A total of 5,146 mortgage products are now available, the highest level since February 2022, according to financial information group Moneyfacts.

The increase in choice is across all deposit levels, with nearly 140 new products launched for people with only a 10% deposit, taking the total number to 684 and putting it on a par with availability for those with a 40% deposit.

Meanwhile, the number of different mortgages available for people with a 15% deposit has reached its highest level since Moneyfacts records began.

What's happening with mortgage rates?

Mortgage rates rose sharply and lenders withdrew large numbers of products in the wake of former Chancellor Kwasi Kwarteng’s mini-budget in September last year.

But rates have been on a steadily downward path since October, as lenders repriced their deals following falls in the rate at which they borrow money for fixed rate mortgages.

The average interest rate charged on a five-year fixed rate mortgage dropped by 0.23%, despite the Bank Rate increasing by 2% during the same period.

However, inflation remains stubbornly high, meaning interest rates are unlikely to drop much further for the rest of this year.

Average rates for different loan-to-value mortgages

Product choice for first-time buyers has increased, not just for those with a 10% deposit, but also for those with a 5% one, with the number of deals in this space rising to 204 now, up from 161 in March and just 34 two years ago.

The average interest rate charged on five-year fixed rate mortgages for people with a 5% deposit has also fallen slightly, dropping by 0.06% to 5.27%.

However, mortgage costs for buyers with a 10% deposit have seen slight increases, with two-year deals rising by 0.14% and five-year ones by 0.27% to stand at 5.64% and 5.26% respectively.

For people borrowing 60% or less of their home’s value, the cost of deals has bucked the trend in the wider mortgage market.

Two-year fixed rate products have dropped by 0.06% to average 4.95%, while five-year ones have fallen by 0.11% to 4.65%, as lenders continue to compete for business in this sector.

What should I do if I need to remortgage?

The average interest rate charged on a standard variable rate mortgage – the rate you are automatically moved to when your existing deal ends if you do not remortgage – has risen to 7.3%, the highest level since February 2008.

The cost of a two-year tracker mortgage compared with a two-year fixed rate one has narrowed during the past month, with tracker deals now averaging 5.02%.

Unlike a fixed rate mortgage, the interest rate charged on a tracker mortgage moves up and down in line with changes to the Bank Rate.

This means that if interest rates rise again, so will your monthly mortgage repayments, but if they fall, the amount you pay will go down.

Meanwhile, five-year fixed rate mortgages continue to be cheaper than two-year ones.

Mortgage rates crept up a little in April, with the average cost of a five-year deal edging ahead by 0.05% to 5.05%, while two-year fixed rate mortgages rose by 0.03% to 5.35%.

This suggests that mortgage lenders expect interest rates to remain high in the short term, but be lower again in three to five years’ time.

Best buy deals offering interest rates of below 4% are still available to homeowners with large deposits and we expect new fixed-rate mortgages to largely remain between 4% to 4.75% on average for most of 2023.

Key takeaways

- 5,000 different mortgages are now available for the first time since February 2022

- More deals are available across all deposit levels, with nearly 140 new products launched for buyers with a 10% deposit

- Five-year fixed rate mortgages continue to be cheaper than two-year ones, suggesting mortgage lenders expect interest rates to remain high in the short term, but to be lower again in three to five years’ time

First-time buyers take out longer mortgage terms

Nearly four in 10 first-time buyers are taking out mortgages with a term of between 30 to 35 years, while 17% choose one that's even longer.

The number of mortgage searches done on behalf of first-time buyers jumped by more than a fifth during February and March.

The uplift suggests first-time buyers are taking advantage of the slowdown in activity in the housing market to step on to the property ladder.

However, following steep house price rises during the pandemic, first-time buyers are employing a range of strategies to own a home.

First-time buyers taking out longer mortgage terms

The number of first-time buyers opting for longer mortgage terms is continuing to increase, according to data from trade body UK Finance.

Nearly four out of 10 first-time buyers are taking out a mortgage over 30 to 35 years, while 17% choose a term that is even longer.

Repaying a mortgage over a longer period can significantly reduce monthly repayments, making the loan more affordable.

For example, if you borrowed £200,000 over 25 years with an interest rate of 4%, your monthly mortgage payments would be £1,056.

If the mortgage term was extended to 35 years, the monthly repayments would be £886, while with a 40-year term they would fall to £836.

However, there is a downside to this strategy, as it means you end up paying significantly more interest on your mortgage.

Interest payments on the example above would total £116,702 if the mortgage was repaid over 25 years, but would soar to £201,221 if it was repaid over 40 years.

First-time buyers look to purchase smaller homes

Another trend that has emerged in recent months is for first-time buyers to settle for smaller properties.

Higher mortgage rates mean people’s buying power has fallen by 20% in the past year.

As a result, the majority of first-time buyers are now purchasing one and two-bedroom homes for the first time since 2010, according to estate agents Hamptons.

With rents increasing and competition for rental homes intensifying, many first-time buyers have decided they would rather choose to live in a smaller property that they own.

Saving less for a deposit

One of the biggest hurdles first-time buyers face is saving for a deposit, with people taking their first step on the property ladder putting down an average of £62,500, according to Halifax.

The good news is that the number of mortgages that require low deposits has increased in recent months.

There are now 204 mortgages for people with only a 5% deposit, up from just five in March 2021 and 132 in October last year, and 684 for those who have 10% to put down, compared with 295 six months ago.

The government’s Mortgage Guarantee Scheme, under which first-time buyers and home-movers can purchase a property with just a 5% deposit, has also been extended to run until the end of this year.

Government schemes for first-time buyers

There are also a raft of government schemes first-time buyers can use to help step onto the property ladder.

-

Shared Ownership enables people to buy a share in a property and pay rent on the rest.

-

First Homes enables local first-time buyers and key workers to purchase a home at a 30% discount to its market price.

-

The Lifetime ISA enables first-time buyers to save up £4,000 a year and the government then adds a 25% bonus - up to a maximum of £1,000 annually. The money must be used to either purchase a first home or for retirement.

House builders are also offering their own schemes, such as Fairview New Homes’ Save to Buy initiative.

The scheme enables first-time buyers to move into their home and pay ‘rent’ at a fixed cost for between six months and two years.

This money is then set aside until they have a big enough deposit to qualify for a mortgage on the property.

Key takeaways

- The number of mortgage searches done on behalf of first-time buyers jumped by more than a fifth during February and March

- With rents increasing and competition for rental homes intensifying, many first-time buyers have decided they would rather choose to live in a smaller property that they own

- The majority of first-time buyers are now purchasing one and two-bedroom homes for the first time since 2010

How will the latest Bank Rate rise impact the housing market?

The Bank of England has increased the Bank Rate to 4.5%, its highest level in nearly 15 years. In this Q&A, I'll answer your questions about the Bank Rate rise and its impact on the housing market.

Why has the Bank Rate risen again?

The Bank Rate influences all the other interest rates in the UK, including those you have for a mortgage, loan or savings account.

Inflation is currently at 10.1% and the Bank of England needs to try to meet an inflation target of 2% set by the government.

They will increase the Bank Rate when they want to dampen demand, encouraging people to save money rather than spend. In turn, this should slow the price inflation of goods and services.

Will the Bank Rate rise affect my mortgage rate?

The Bank Rate has risen 12 times in a row since December 2021. This initially caused mortgage rates to rise quickly to reach over 6% at the end of 2022, but they have since fallen back to the 4-5% range with little change in recent weeks.

Mortgage lenders have been pricing their products in anticipation of further Bank Rate rises, which means many have already factored it into the cost of borrowing for new home buyers.

Plus with the cost-of-living rises and fewer homebuyers in the market than last year, mortgage lenders need to keep their rates competitive to attract new business.

We expect mortgage rates to remain within the 4-5% range over the coming months and for the rest of the year.

If you already have a mortgage, it depends on what type of mortgage you have as to whether you will be affected by the Bank Rate rise.

Many homeowners with mortgages are on fixed rates and so will feel no immediate impact from a change in the Bank Rate.

However, most households with mortgages will face paying more when they remortgage onto a higher mortgage rate. If you're worried about having problems paying back your mortgage when this happens, discuss the interest rate rises with your bank or mortgage broker.

Will the Bank Rate rise cause house prices to drop further?

Our predictions for house prices haven’t changed with today’s Bank Rate rise.

We think UK house prices will be 1% lower on average than today by the end of 2023. With mortgage rates set to remain higher than in the past, house price growth is going to be much lower than in recent years, with prices rising more slowly than earnings.

If the outlook for the economy deteriorated rapidly and unemployment increased, there would be greater likelihood of larger house price falls.

Many households are wondering if they should wait before making any housing moves.

If you're considering moving house or buying your first home, it’s hard to see a strong case for waiting. Mortgage rates have settled at between 4-5% and we expect them to remain this way for the rest of the year.

Buying a home is a 4 to 9 month process. As long as it’s the right home for you, you’ve considered all your options, you don’t plan to move again soon and your job prospects look good, there is not a strong case to delay.

Predicting house prices and timing of when to make a move is a challenge. Most homeowners only move once every 20 years - or 5 to 12 years if you’re moving on from your first home.

We expect house price growth to return to very low positive growth over the next few years so falls of 1% this year are unlikely to leave you in negative equity over the time you’re in your home.

It’s really important you don’t make your home buying decision expecting prices to rise quickly like in the past.

House price growth will be much lower than in the past but, as you pay down your mortgage, you end up with your own home and no monthly repayments as you enter retirement.

What are the chances of seeing rapid house price growth again in the near future?

The rate of house price inflation is going to be much lower in future than what the UK has experienced over recent decades.

In the 30 years to 2007 house prices increased by an average 9% a year. In the last decade growth has been less than half this rate at 4%.

Over the long run house prices tend to track growth in household incomes or earnings which have averaged 3-4% a year.

House prices are going through an adjustment phase as a higher cost of living and rising mortgage rates reduce buying power.

We do not think there will be double digit price falls but prices look set to remain broadly flat for some time at the national level.

How much less should I expect to sell my house for now than I would have a year ago?

If you’re selling your home, you’re very unlikely to get the price you would have got a year ago.

At the start of 2022 most sellers got 100% of the asking price. Today, buyers are negotiating harder and the average seller is having to accept 4-6% below the asking price.

Many sellers have adjusted asking prices slightly lower in the last six months to reflect the reduction in buying power resulting from higher mortgage rates.

The positive is that the average homeowner made £45,000 in capital gains over the pandemic. So while you may now have to accept a £14,000 discount if you sell, you are still up and can move onto your next home - where you will also be able to get a discount.

There is a big variation in house price growth at a localised level. Prices in Oldham and Wolverhampton are up by 5% in the last year whereas prices are falling in parts of London.

Ultimately it will depend on the house you are looking to sell or buy and how attractive it is to who is in the market at the current time.

There are fewer buyers in the market than this time last year but sales are still being agreed.

People want to move for a whole range of reasons such as retirement, working from home, relocating and looking to reduce running costs.

Speaking to a local estate agent is the best way to get a view on the likely selling prices of your home and who is in the market to buy.

Will the cost of buying a house increase more in or outside of London in the coming year?

It is likely that the cost of buying a house outside of London will increase at a faster rate than in London in the coming year.

This is because market activity is holding up best in more affordable housing markets across the North of England and Scotland. There are more sales agreed and stronger demand from buyers in these areas, which gives rise to stronger house price growth.

However, national house price growth has slowed to 3% so prices of homes outside London and the South East aren't going to race away.

They are likely to register very low house price growth in the coming year, rather than the modest price falls of up to 5% that are likely in London and the South East.

Key takeaways

- The Bank of England has today increased the Bank Rate to 4.5% - this 12th consecutive rise brings it to the highest level in nearly 15 years

- The 0.25 percentage point increase is part of the Bank of England’s ongoing efforts to curb rising inflation in the UK

- Many mortgage lenders have already factored this expected Bank Rate rise into the cost of borrowing for new home buyers

- With mortgage rates set to remain at 4-5% this year, house price growth is going to be much lower than in recent years

- Here's my take on the Bank Rate rise, how it will impact the housing market and what to consider with your next property decision.

Renters' Reform Bill comes to Parliament next week

Notice periods for rent increases to be doubled, no-fault evictions banned and minimum housing standards established. What's in the Renters' Reform Bill?

A new bill protecting renters from unfair rent increases and ‘no fault’ evictions is set to be introduced to Parliament next week.

The Renters' Reform Bill contains a package of measures to improve the private rented sector and increase the rights of tenants.

The bill, which will be published for the first time next week is expected to set minimum standards that all rental homes will have to meet, make it easier for renters to have pets, and prevent landlords from having blanket bans on families with children or people receiving benefits.

The government has described the measures as the biggest shake up to the private rented sector for 30 years.

But it is unclear when the measures will come into force. The bill will take time to go through the legislative process, so it could be 12 to 18 months before it becomes law.

The bill comes as renters face a shortage of homes in the private rented sector, pushing rents higher at a time when renters are already struggling with the cost-of-living squeeze.

What will change?

While the exact contents of the bill are not yet known, many of the measures have been widely flagged by the government.

The key aim of the bill is to enhance renters’ rights and ensure their homes are fit to live in.

Here's what's expected to be announced:

-

Arbitrary rent review clauses will be outlawed.

-

The amount of notice renters will be given about rent increases will be doubled.

-

Renters will have stronger powers to challenge rent rises if they think they are unjustified.

-

The Decent Homes Standard will be extended to cover the private rented sector for the first time, to ensure all private rented properties are fit for occupation. If homes fall below this standard, people will have their rent repaid.

-

Section 21 ‘no fault’ evictions will be banned, meaning tenancies will only end if a renter wants them to, or the landlord has a valid reason, defined in law, to do so.

-

Going forward, all renters will be moved into a single system of ‘periodic tenancies’, enabling them to leave poor quality housing without remaining liable for the rent, and making it easier for people to move if their circumstances change.

-

Councils will be given stronger powers to tackle rogue landlords, including larger fines for serious offences.

-

A new Private Renters’ Ombudsman will also be created to settle disputes between renters and landlords quickly, at a low cost and without having to go to court.

-

Renters will be given the right to ask to have a pet in their home. Landlords must consider the request and cannot unreasonably refuse it.

-

Renters will also be able to demand information on their landlord and rate them following the introduction of a mandatory landlords’ register.

Why is this happening?

Around 4.4 million people currently rent their home in the private sector.

But one in five live in properties that are deemed to be unfit, more than half of which pose a risk to renters’ health and safety, according to the government.

Meanwhile, research shows that more than a fifth of private renters who moved in 2019 and 2020 did not do so by choice.

The government hopes the new bill will redress the balance between landlords and tenants and, by banning ‘no fault’ evictions, provide renters with more stability.

Who does it affect?

While the bill is good news for renters and provides them with additional protections, there are concerns that it could lead to some landlords leaving the private rented sector.

Research by the National Residential Landlords Association found that 76% of landlords felt their business was threatened by the bill, with 93% saying it would increase the financial risk of being a private sector landlord.

Rents have increased by 10.9% during the past year to average £1,120.

The rise has been caused by a large increase in demand combined with a shortage of available homes to rent, according to our latest research.

A combination of tax changes, increased regulation and higher interest rates have caused many buy-to-let landlords to exit the sector in recent years.

If the bill causes more landlords to sell up, it could put further upward pressure on rents.

Key takeaways

- A new bill protecting renters from unfair rent increases and ‘no fault’ evictions is set to be introduced to Parliament next week

- The Renters Reform Bill is expected to set minimum standards that all rental homes will have to meet, make it easier for renters to have pets and prevent landlords from having blanket bans on certain tenants

- The bill could take 12 to 18 months to go through Parliament and become law

First-time buyers need to earn an extra £7.5K to step on the property ladder

The rapid rise in house prices over the last three years means first-time buyers now need to earn more to buy a home. Let’s look at the options.

Higher mortgage rates have a major impact on first-time buyers.

But many first-time buyers come from the rental market, where there have been steep increases in rental costs over the last year, with rents up £1,120.

This, combined with a chronic shortage of supply, which is currently down by a third, is now pushing more first-time buyers towards home ownership.

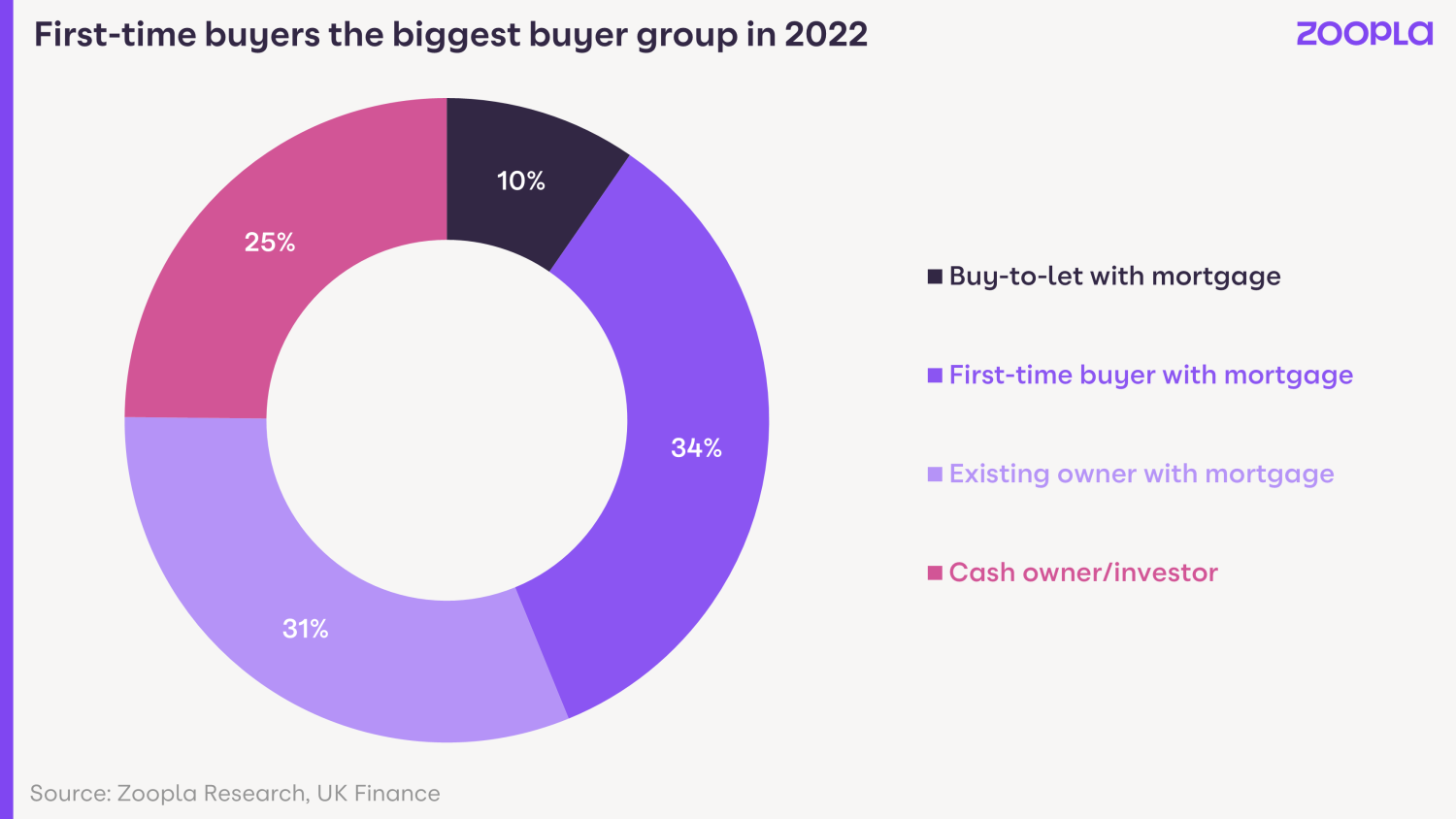

In fact in 2022, first-time buyers have proven to be highly resilient. We estimate that first-time buyers using a mortgage accounted for over 1 in 3 sales last year (34%).

This made them the largest group of home buyers, followed by existing owners using a mortgage (31%) and cash buyers (25%).

The main constraints to stepping onto the property ladder for first-time buyers are access to a suitable deposit and the right level of income to afford a mortgage.

While the jump in house prices over the last 3 years has increased the amount of income and deposit needed to buy a first home.

How much money do first-time buyers need?

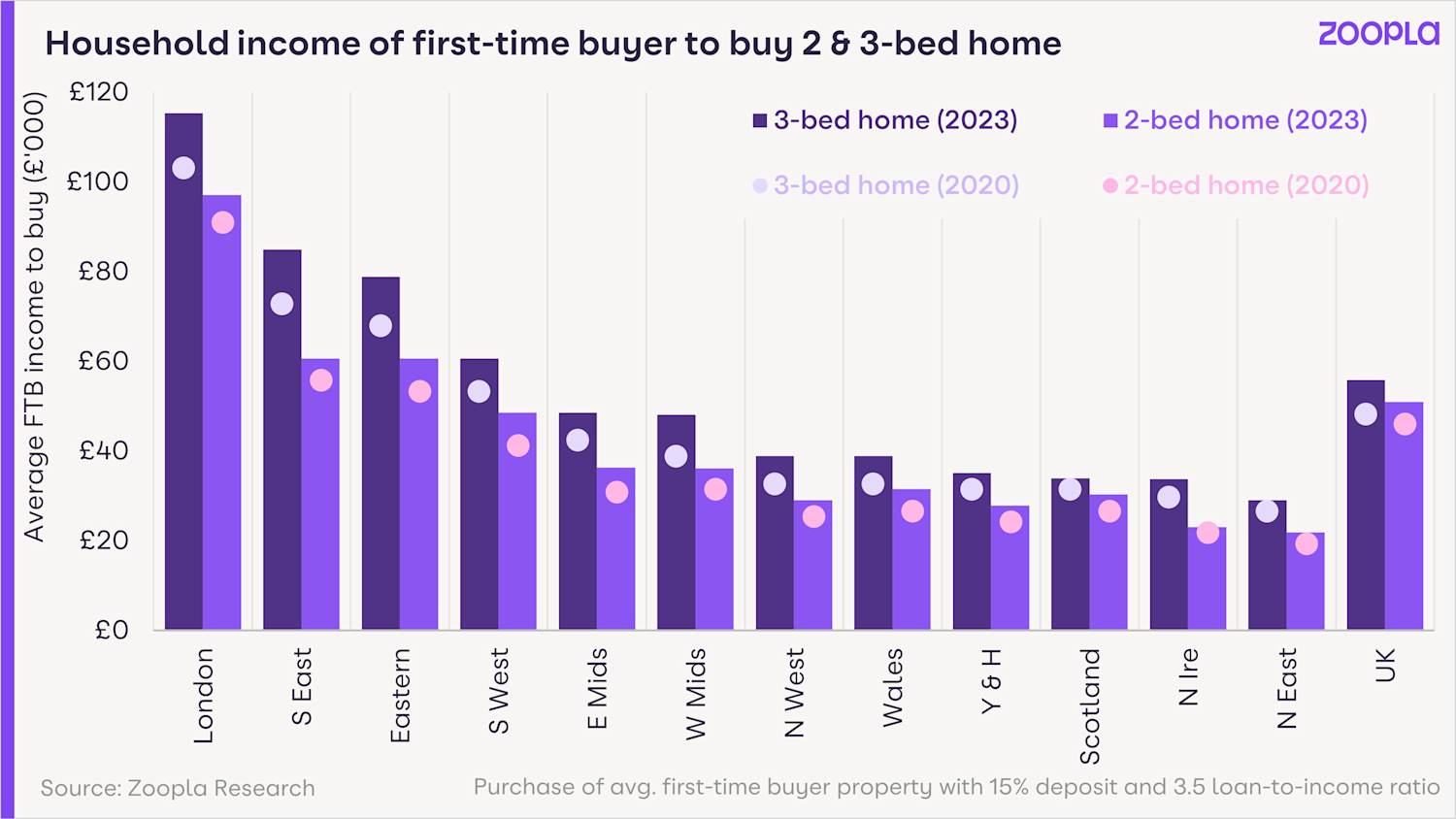

First-time buyers now need to earn nearly £7.5K more to buy a home than they did in 2020.

That means you’ll need to earn a household income of £55,900 for a 3 bed home, or £51,000 for a 2 bed home (an increase of £4,900) .

In London and the South East, the income needed to buy a home has now increased by over £12,000 to buy a 3-bed home and £7,300 to buy a 2-bed home.

Yet wages have only risen by £4,800 since 2020, according to the Office for National Statistics.

The average amount needed for a house deposit has also risen.

For the average three-bed home costing £230,000, a first-time buyer would need to have a deposit of £34,500 (an increase of nearly £5,000).

For a two-bed home costing £210,000, you would need a deposit of £31,500 (an increase of £3,000).

Traditionally, 3-bed houses have been the most popular choice for first-time buyers, but we are seeing clear evidence of first-time buyers seeking better value for money with one and two-bed flats.

The ability to work from home has also enabled first-time buyers to look further afield to secure the home they need at the right price.

So what can first-time buyers do in 2023?

A quick checklist:

1: Save for a larger deposit

One option is to try and save for a larger deposit, which may be challenging when rental costs are taking up a larger portion of people’s earnings.

2: Borrow from the bank of mum and dad

Another might be to borrow from the ‘bank of mum and dad’ if that’s a possibility.

3: Look to buy a more affordable home

We’re seeing that some first-time buyers are looking to purchase cheaper and lower-cost homes.

Lower mortgage rates in recent years have enabled first-time buyers to purchase larger, typically 3-bed homes.

But higher mortgage rates and prices are now pushing some to adjust their requirements, particularly in the areas where prices have increased the most since 2020.

Three-bed homes are still the most in-demand property type but buyer interest has fallen back to 40% in Q1 2023, while demand for 1 and 2-bed flats increases.

Outside of London, the average asking price for a 2-bed flat (£200,000) is 29% lower than a 3-bed house (£280,000).

4: Take out a longer term mortgage

Finally, you might consider taking out a longer term mortgage.

In the past, mortgage terms have usually been around 25 years.

But there has been a steady increase in the number of mortgages with terms of over 30 years.

Taking out a 35-year loan gives buyers an extra 20% boost to buying power, compared to a 25 year loan.

But it’s important to be aware that this comes at the cost of an extra 48% in mortgage interest payments over the longer term.

Key takeaways

- Rising rents and a shortage of rental properties are pushing more renters to become first-time buyers

- In 2023, first-time buyers need to earn a household income of £55,900 to buy a 3-bed home, or £51,000 to buy a 2-bed home

- There are options available for first-time buyers, including saving for larger deposits, extending the mortgage term or looking for more affordable housing in less expensive areas

What are the main advantages of making mortgage overpayments?

To combat rising mortgage rates, homeowners have begun making record numbers of overpayments in a bid to reduce how much they owe.

Homeowners overpaid their mortgages by a record £6.7 billion in the final three months of 2022.

It marks the first time overpayments have exceeded £6 billion in one quarter since records began in 1999.

According to the Equity Release Council, the total value of mortgage overpayments reached £23.3 billion last year.

The jump in overpayments is likely to have been triggered by rising interest rates as the Bank of England tries to bring down stubbornly high inflation.

By making mortgage overpayments, homeowners reduce the amount they owe, helping to offset some of the impact of higher borrowing costs.

What are mortgage overpayments?

Mortgage overpayments refer to the money you pay to your lender that’s above the standard monthly repayments you have to make.

You can generally make them as either a one-off lump sum payment or by increasing the amount you pay each month over your mortgage term.

Most lenders will allow you to make overpayments of up to 10% of the outstanding amount you owe each year without incurring a penalty, with some allowing you to repay as much as 20%.

What are the main advantages of making mortgage overpayments?

There are many advantages to making mortgage overpayments.

The main one is that it reduces the amount of interest you pay over the lifetime of your mortgage.

For example, if you borrow £200,000 over 25 years at an interest rate of 4%, you will pay a total of £116,702 in interest.

But if you increase your monthly repayments by £100 a month, from £1,055 to £1,155, you will pay only £98,681 in interest, saving you just over £18,000.

Not only that, but you will also repay your mortgage three years and five months sooner, meaning you will be mortgage-free quicker.

What other benefits are there to mortgage overpayments?

Making mortgage overpayments can also help to offset the impact of rising interest rates.

For example, if you have a £200,000 mortgage on which you are currently paying interest of 2%, your monthly repayments will be £848.

But if you are coming to the end of your deal and need to remortgage, your monthly repayments will jump to £1,055, based on a best-buy mortgage rate of 4%.

However, you can offset some of this increase by overpaying your mortgage to reduce the outstanding amount you owe.

For example, it you make a 10% overpayment reducing your outstanding mortgage to £180,000, based on the example above, your new monthly repayments will rise to only £950.

If you are able to make a 20% overpayment, the impact will be even bigger, reducing your new monthly repayments to £845 – broadly in line with what you are currently paying.

Another advantage of making overpayments is that it reduces the amount you owe relative to your home’s value. Lenders call this your loan to value (LTV) ratio.

Banks and building societies typically reserve their best deals for people with an LTV of 60% or less.

Even if you don’t qualify for one of the best deals, making overpayments could still help you move into a lower LTV tier, enabling you to benefit from a lower mortgage rate.

Finally, if you are struggling to keep up with your mortgage payments, lenders are often more likely to grant you a payment holiday if you have made overpayments in the past.

How to overpay your mortgage

There are two ways to make overpay your mortgage. You can either make a lump sum one-off overpayment or smaller, regular overpayments.

Both types of overpayment have benefits, and the most important thing is to only do what you can afford.

But if you are struggling to decide what to do, making one-off overpayments tends to have a bigger impact on your mortgage.

For example, if you take out a £200,000 mortgage with a 4% interest rate, making a one-off overpayment of £20,000 at the beginning of the term will save £30,179 in interest.

It will also mean you repay your loan three years and 11 months early.

By contrast, making overpayments of £100 a month on the same deal will save you just £18,020 in interest, even though the amount you are overpaying will amount to £25,900.

It will also knock three years five months off your mortgage term.

Can you overpay an interest-only mortgage?

When you overpay a repayment mortgage, you reduce the total amount you owe, which means you'll pay less interest on your mortgage and you'll pay it off more quickly.

When you overpay on an interest-only mortgage - and it is possible to do this - you don't get the same benefits.

With interest-only mortgages, you're only ever paying the interest on the loan, rather than reducing the actual debt itself.

Overpaying an interest-only mortgage can help to reduce future interest payments or the overall interest you pay, but it can't help to pay down the overall debt you owe.

Key takeaways

- Homeowners have overpaid their mortgages by a record £6.7 billion

- The jump is likely to have been triggered by rising interest rates, as the Bank of England tries to bring down stubbornly high inflation

- You can either overpay your mortgage using a lump sum, or by overpaying by smaller amounts each month

The best coronation events in London to celebrate King Charles III

London is filled with events and gets a big bank holiday weekend to mark the King’s coronation.

It’s time to ring off a big long weekend in your calendar in regal purple. Yep, there’s another big royal event on the horizon: King Charles III’s coronation, and it’s shaping up to be one big, long party. Plans for the shindig have been in the works since Charles took the throne back in September and the festivities are expected to include no less than two processions, a religious service and big ol’ concert at Windsor Castle.

Whether you’re a flag-wielding monarchist or a staunch Republican, there’s no getting away from the celebrations and one thing we can all get behind as part of the proceedings is that Monday May 8 will be a bank holiday. So we can all *fingers crossed* bag an extra day off.

You’ll probably be spared being marched up the Tower of London if you don’t fancy taking part in the festivities. But if you do want to have a royally good time there’s plenty going on across London in the name of a ‘National Celebration’. Here are the best ways in London to celebrate the start of Charles III’s reign in London.

When is King Charles’s coronation and where is it taking place?

The coronation will take place on Saturday May 6 2023, eight months on from his appointment as King on September 8 2022. Get excited.

We’ll all be getting an extra bank holiday to mark the occasion. Monday May 8 2023 has been named as the day. two days after the official coronation service at Westminster Abbey.

The ceremony will be held at Westminster Abbey. Charles will be crowned alongside the Queen Consort Camilla.

1. King Charles III Coronation Procession

Heads of state, British VIPs and other important-sounding people will descend on London for the coronation of King Charles III taking place on the morning of Saturday May 6 2023. The service will take place at Westminster Abbey, but you’ll have to have an invite in order to see that. However, if you still want to glimpse a slice of the action you can line the parade route to the service for free, also known as ‘The King’s Procession’.

The procession is due to start at Buckingham Palace and will head down The Mall before turning right around the corner of St James’s Park, through the Horse Guards Parade, down Parliament Street before ending at Westminster Abbey.

Hundreds of thousands of people are expected to line the route, so best get there early if you want a front row spot. There’ll also be screens in key areas if you sleep through your alarm.

2. The Coronation Concert

How do you celebrate a King’s coronation in the twenty-first century? With a big ol’ concert apparently. The Royal Family has confirmed a massive shindig will take place in Windsor Castle the day after King Charles III’s official ascension to the throne, promising to ‘bring together music icons and contemporary stars’. A world-class orchestra will play interpretations of musical favourites fronted by musicians and other performers and spoken word performances, all topped off with staging and effects on the Castle’s East Lawn.

3. The Royal Palace at Madame Tussauds

Marylebone

Step into Buckingham Palace and meet the Royals (kind of). Okay okay, it’s actually a recreation of the Royal gaff at Madame Tussauds, but on your visit you’ll be able to brush shoulders with the King and the Queen Consort (in wax form, of course) and snap as many pictures as you like, have a spot of afternoon tea and wave from the Royal Balcony.

4. Coronation Events at Biscuiteers

5. Mayfair’s Coronation Garden Party

Grab a deckchair, sip on some sparkling wine and watch the Coronation on a big screen in Grosvenor Square at this garden party. The soiree will also include plenty of food and drink stalls, immersive floral installations, live music and special offers in the nearby shops and eateries.

6. London Eye ‘Coronation Capsule’

Inflation stubbornly high but mortgage rates edge lower

Mortgage deals now available at sub 4% rates - and inflation still expected to fall quickly in the second half of this year.

Inflation remains stubbornly high suggesting the Bank of England will increase interest rates further.

The rate at which the cost of goods and services are rising – as measured by the Consumer Prices Index – fell slightly in March, dropping from 10.4% to 10.1%.

But the fall was lower than economists had been expecting, with inflation still more than five times higher than the Bank’s 2% target.

As a result, commentators are predicting the Bank’s Monetary Policy Committee (MPC) will increase the Bank Rate again when it meets in May, and possibly make further hikes later in the year, dashing hopes that interest rates had already peaked.

But despite rising interest rates, mortgage rates are continuing to fall, with best buy deals currently available with rates of less than 4%.

Why is this happening?

Inflation has remained stubbornly high, despite the MPC increasing the official cost of borrowing from 0.1% in December to 4.25% now.

The high level of inflation is being driven by a number of factors including the conflict in Ukraine, which has pushed food and energy prices higher, the resumption of normal life after Covid and issues relating to the weather.

A very hot summer in Asia and cold winter in Europe in 2022 increased the demand for electricity to power air con and heating, at a time when suppliers were hit by the invasion of Ukraine, which pushed fuel prices higher.

Adverse weather has also impacted food production, with hot weather across Europe affecting salad and soft fruit crops, while droughts in Argentina have affecting soybean harvests, further driving up food prices.

(Soybeans are used to make soybean oil, the main substitute for sunflower oil, which is in short supply due to the war in the Ukraine.)

However, economists are still expecting inflation to start falling quickly in the second half of the year.

In particular, they are predicting steep price falls in gas and electricity prices, which is good news for consumers.

Once inflation gets closer to its 2% target, the MPC can then consider cutting the Bank Rate to help support the economy.

What should I do if I need to remortgage?

While the prospect of another rise in interest rates may be alarming if you need to remortgage, you shouldn’t panic.

Mortgage rates have actually been moving in the opposite direction to interest rates for some time now, with the average cost of a five-year fixed rate mortgage falling by 0.23% since October, despite the Bank Rate increasing by 2% during the same period.

If you need to remortgage, you will have to decide whether or not to opt for a fixed rate deal or a tracker product.

Under a fixed rate mortgage, the amount of interest you pay will stay the same for the duration of your product term, typically two or five years, giving you the security that your monthly repayments will not increase.

If you take out a tracker deal, your interest rate will move up and down in line with changes to the Bank Rate.

Average tracker rates are currently 0.48% lower than the average two-year fixed rate mortgage, but this could change if the MPC increases interest rates again, as any rise would be passed on to you.

That said, if inflation does start to fall and interest rates are cut, you would benefit from the reduction if you are on a tracker mortgage.

If you opt for a fixed rate mortgage, you will need to decide whether to fix for two years or five years.

Five-year deals are currently 0.32% cheaper than two-year ones, but remember that despite high inflation, interest rates are still likely to be close to peaking, so if you fix for five-years you will be locked into these higher rates for longer.

It is also important to remember that fixed rate mortgages typically have early redemption penalties, so if you take out a five-year deal, you need to be confident you will not need to end it early.

Whatever you decide to do, it is important to shop around. The average rate charged on a two-year fixed rate mortgage is currently 5.32%, but the most competitive rates on offer start at 3.99%, with some five-year fixed rate mortgages available for 3.92%.

If you are coming to the end of your mortgage term, you should start planning now.

Lenders will let you ‘book’ a rate up to six months before you need to remortgage.

The average standard variable rate – the rate you are automatically put on if you do not remortgage - is currently 7.12%, so you want to avoid that if possible.

What does this mean for the housing market?

Although mortgage rates are significantly higher than they were a year ago, the number of people falling behind with their monthly repayments remains low by historic standards.

Lenders are expecting to see an increase in the number of people struggling with their mortgage, but this is unlikely to lead to a big jump in homeowners who are forced to sell their property.

This is partly because banks are obliged by the regulator to work with customers to find a solution and can only repossess a home as a last resort.

At the same time, employment levels remain high. In fact, recent government data showed that the unemployment rate is currently just 3.8%.

As a result, there are unlikely to be a high level of forced sales, which is good news for the property market.

Instead, higher interest rates are likely to cause activity in the housing market to be more subdued than in recent years.

The number of people looking to buy a home fell sharply in the wake of the mini-Budget, which caused a steep rise in mortgage rates.

But there are already signs that demand is recovering, with buyer numbers reaching their highest level since October in March.

Property values are just 1% lower than they were in October, and while some ‘soft repricing’ is expected to continue, with sellers making modest downward adjustments to match what buyers are prepared to pay, there are not likely to be steep house price falls.

Meanwhile, the number of homes for sale has increased, offering more choice for potential buyers following years in which the market has been plagued by a shortage of stock.

Key takeaways

- Inflation remains stubbornly high suggesting the Bank of England will increase interest rates further

- But mortgage rates are continuing to fall, with best buy deals currently available for below 4%

- And economists still expect inflation to start falling quickly in the second half of the year.

Landlords support new standards for rented homes

Six out of 10 landlords are in favour of the introduction of the Decent Homes Standard, the biggest shake up in the private rented sector for 30 years.

Six out of 10 landlords are in favour of government plans to introduce new minimum standards for rented homes.

A third of landlords said they strongly supported the Decent Homes Standard for properties in the private rented sector, while 28% said they generally supported it, according to research by Paragon Bank.

Only 8% of landlords questioned said they were unaware of the change.

The government has pledged to introduce the Decent Homes Standard for the private rented sector as part of the Renters Reform Bill, which will be introduced during the current parliamentary session.

Not only do landlords support the move, but 74% also expressed frustration with the lack of action taken against rogue landlords, saying local authorities should do more to drive out those who let sub-standard homes.

Richard Rowntree, managing director of mortgages at Paragon Bank, said: “The vast majority of landlords have nothing to fear from a Decent Homes Standard as they are providing a good quality home to their tenants already.

“It’s the minority of landlords who don’t meet these standards that are tarnishing the wider reputation of the sector.”

Why is this happening?

Although the majority of renters live in homes that are safe, the government wants to do more to help the one in five people who live in a property that is considered to be unfit, more than half of which pose a risk to renters’ health and safety.

The proportion of homes that are classed as being non-decent has nearly halved during the past five-years, falling from 44% in 2018 to 23% in 2023, according to the latest English Housing Survey.

Even so, nearly 1 million properties in the private rented sector are still classed as being non-decent.

The Decent Homes Standard requires homes to be in a reasonable state of repair, have reasonably modern facilities and services, and provide a reasonable degree of thermal comfort.

If homes fall below this standard, renters can have their rent repaid.

Who does it affect?

The introduction of a Decent Homes Standard is great news for those who rent in the private sector, as it means they will no longer have to put up with sub-standard accommodation.

The move also brings the private rental sector in line with the social one, which has had a Decent Homes Standard since 2001.

The research suggests the majority of landlords are also in favour of the change.

In fact, a separate study conducted by Paragon Bank found that 81% of landlords in the private rented sector upgrade each new property they buy, with 18% spending between £10,000 and £20,000 on improvements and 22% spending more than £25,000.

Around 83% of landlords said they made the changes to ensure they were providing a decent home to their tenants, while 82% said they wanted to make the property more attractive to tenants and 66% hoped to increase the rent they could charge.

What’s the background?

Alongside introducing the Decent Homes Standard, the Renters Reform Bill includes a number of measures to protect renters, including ending section 21 ‘no fault’ evictions.

Other changes include making it illegal for landlords to have blanket bans on families with children or people receiving benefits, and it will also be easier for renters to have pets.

Arbitrary rent review clauses will be outlawed, and notice periods for rent increases will be doubled. Renters will also have stronger powers to challenge rent rises if they think they are unjustified.

The introduction of the bill will also see all renters moved into a single system of ‘periodic tenancies’, enabling them to leave poor quality housing without remaining liable for the rent, and making it easier for people to move if their circumstances change.

The government claims the changes are the biggest shake up for the private rented sector for 30 years.

Key takeaways

- 74% of landlords also expressed frustration with the lack of action taken against rogue landlords, saying local authorities should do more to drive out those who let sub-standard homes

- The proportion of homes that are classed as being non-decent has nearly halved during the past five-years, falling from 44% in 2018 to 23% in 2023

- The change is part of the Renters Reform Bill, which gives renters greater rights

New planning permission rules for holiday lets in tourist hotspots?

New short term let rules being considered to protect communities in England's holiday destinations.

The government is proposing new rules for holiday lets to protect local communities in tourist hotspots.

Under the news rules, which are currently out for consultation, homeowners in England would be required to get planning permission before renting out their property as a short-term let.

The move aims to help prevent local people from being priced out of the property market in areas that are popular holiday destinations.

Michael Gove, Secretary of State for Levelling Up Housing and Communities, said: “Tourism brings many benefits to our economy but in too many communities we have seen local people pushed out of cherished towns, cities and villages by huge numbers of short-term lets.

“I’m determined that we ensure that more people have access to local homes at affordable prices, and that we prioritise families desperate to rent or buy a home of their own close to where they work.”

Why is this happening?

The popularity of short-term lets has soared in recent years due to a combination of online platforms, such as Airbnb, and a rise in people opting for staycations following the COVID-19 pandemic.

But while the jump in availability of holiday properties is good for tourists, local people in some tourist hotspots have found themselves priced out of the property market.

There have also been complaints that popular destinations have become ghost towns outside of the holiday season, while they also face labour shortages due to the lack of affordable local accommodation to rent or buy.

Who does it affect?

The move is potentially good news for people who live in tourist hotspots who are struggling to get on to the property ladder, as it should help to ensure that house price rises are more sustainable.

It is less good for people who had hoped to invest in a holiday let in a popular area, particularly if they are considering this as an alternative to a buy-to-let property, after these have been hit by significant tax rises in recent years.

But the move should not impact homeowners in holiday areas who want to rent out their home on an occasional basis, such as while they go away themselves.

The consultation is looking at whether homeowners should have the flexibility to rent out their home for a set number of nights, such as 30, 60 or 90 nights each year without needing to obtain planning permission.

The changes will only impact short-term lets, and will not affect hotels, hostels or B&Bs.

What’s the background?

The proposals come as the Department for Culture, Media and Sport launches a separate consultation on a new registration scheme for short-term lets.

The scheme aims to build a picture of how many short-term lets there are across the country and where they are located, to try to understand what impact short-term lets have on local communities.

Culture Secretary Lucy Frazer explained that while the government understood the benefits for tourists that flexible short-term lets offered, these should not come at the expense of local people who wanted to buy their own home.

It hopes that through gathering data on the situation, it will be able to help get the balance right and address some of the concerns of local communities.

Key takeaways

- The government is proposing new rules for holiday lets to protect local communities in tourist hotspots

- Homeowners in England would be required to get planning permission before renting out their property as a short-term let

- The move aims to help stop local people from being priced out of the property market in areas that are popular holiday destinations