The persistence of high inflation suggests that more challenges lie ahead in terms of interest rates.

May saw core inflation reach its highest level in 31 years, indicating that the Bank of England may need to raise interest rates beyond previous expectations.

Inflation rose to a new 31-year high in May, suggesting further interest rate rises will be needed to bring it under control.

Core inflation, which excludes volatile categories such as food and energy, increased to 7.1% during the month, while headline Consumer Prices Inflation stalled at 8.7%.

The data caught economists by surprise, as both the Bank of England and markets had expected the figures to show a fall in inflation.

It led to predictions that interest rates may have to rise to 6% to bring it back under control.

The figures came as the Bank’s Monetary Policy Committee (MPC) begins its two-day interest rate setting meeting, with some economists predicting it will now increase the Bank Rate by 0.5% - rather than the 0.25% previously expected - to 5% on Thursday.

Why is this happening?

While inflation is now falling in the US and Eurozone, it remains stubbornly high in the UK.

This is because inflation in the UK is now being driven by wage increases, rather than external factors, such as the conflict in Ukraine.

In fact, fuel price inflation, which had previously driven inflation up, fell from -8.9% to -13.1% in May, while the rate at which food prices are rising eased from 19.1% to 18.3%.

With inflation in the UK becoming more entrenched, it will take longer to tackle, and this means interest rates are likely to have to rise higher than previously expected.

But it is important to remember that if the Bank Rate does peak at 6%, this is only slightly higher than the 5.5% to 5.75% markets had previously been expecting, while some commentators think rates will only have to rise to 5.25%.

Despite today’s figures, economists continue to expect inflation to fall steeply in the second half of this year, enabling the MPC to begin cutting the Bank Rate during the first quarter of 2024.

What does this mean for mortgages?

The mortgage market is already responding to higher than expected inflation, with lenders withdrawing nearly 400 products for repricing during the past month.

The situation has pushed up the average cost of a two-year fixed rate mortgage up to 6.15%, while five-year ones now stand at 5.79%.

The recent large-scale reprising means much of the bad news has already been factored into mortgage rates, so they should not rise too much further in response to today’s news.

After increasing by nearly 1% during the past month, two-year Swap rates, upon which fixed rate deals are based, edged only fractionally higher in early trading.

What should I do if I’m struggling with my mortgage?

Chancellor Jeremy Hunt today said he would ensure that banks were living up to the commitments they made to the government in December to help borrowers who got into difficulties.

At the time, lenders agreed to be more flexible in the way they approached borrowers who have been impacted by the cost-of-living squeeze.

Alongside offering tailored support to those in difficulties, they also agreed to enable customers who were up to date with their payments to switch to a new mortgage deal without having to do another affordability test.

In addition, they pledged to ensure highly trained and experienced staff were on hand to help customers when needed.

If you are struggling to pay your mortgage, you should contact your lender as soon as possible.

Options to help you are likely to include increasing your mortgage term or switching you to an interest-only mortgage to help reduce your monthly repayments.

Your lender may also offer you a short-term payment holiday to give you some breathing space, although interest accrued during this time will be added to the total amount you owe.

21 Months of Rental Increases Outpacing Earnings

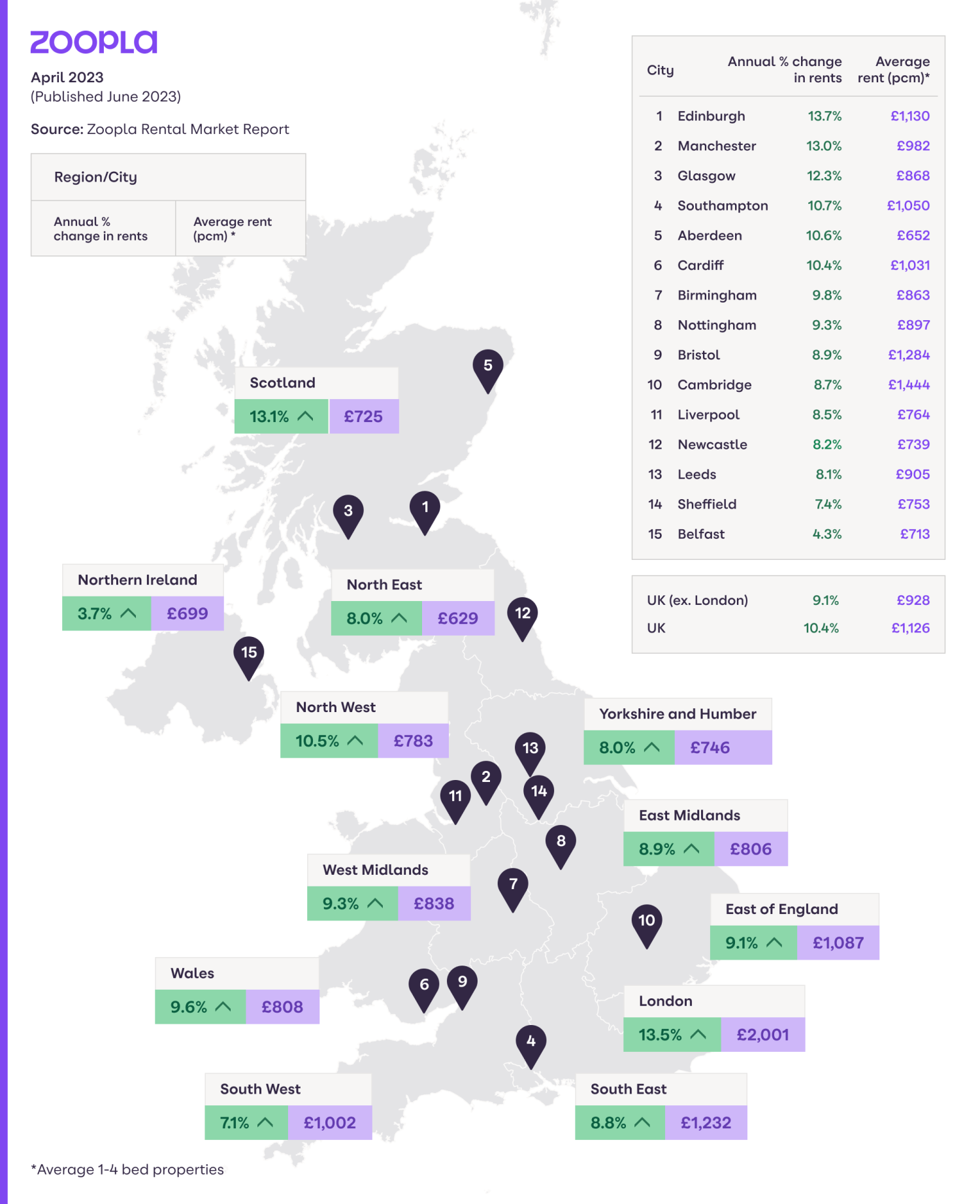

The average monthly rent in the UK has reached £1,126, with London rents exceeding £2,000 per month. Discover the regions where rental prices are experiencing the fastest and slowest growth in the UK.

Rents increase by more than 10% for 15th month in a row

In April 2023, the average cost of a new let rose to £1,126 per month, following 21 consecutive months in which rental rises outstripped wage rises.

The average UK rent has now increased by £110-a-month - or 10.4% - since April 2022, marking the 15th consecutive month that we’ve seen double digit growth in rental inflation.

This level of rental inflation is high by historical standards and ahead of average earnings growth, which is currently at 6.5%.

The gap between these measures highlights the impact on rental affordability, which is now at a record high in seven out of 12 UK regions.

The good news is that rents for new lets have been starting to slow reflecting seasonal trends. In the last 3 months, the average rent increased by 0.6% - that’s the smallest amount since May 2021.

Rental inflation lowest in Northern Ireland

London and Scotland, two of the largest rental markets, have seen the highest level of rental inflation at +13% since April 2022. This is well ahead of the typical annual growth of 4.5% to 5% we’ve seen in these regions over the previous 5 years.

Northern Ireland remains the region with the lowest rental inflation - 3.7% or an increase of £30 per calendar month since April 2022.

Average rent in London reaches £2,000 per month

Over the last 2 years and since the economy reopened after Covid lockdowns, the average London rent has increased by £490 a month. This brings the average rent in the capital to £2,001.

At present, the largest annual increases are recorded in the eastern boroughs of Newham (+18.1%), Greenwich (+18.0%) and Tower Hamlets (16.5%).

Those living in the suburbs and western edges of central London are seeing a smaller level of rental growth. The annual rental inflation is weakest in Kensington and Chelsea (10.2%), Havering (11.3%) and Richmond (11.4%).

Prices of new lets in inner London start to slow down

The good news for many renters is that the rate of rental inflation is slowing down in inner London. The monthly rent for a new let in inner London is only £26 higher today than it was in January 2023.

This is an indication of prices hitting their ceiling in this area, as renters struggle to afford higher rents. We are yet to see if this trend will continue with the high-demand summer season ahead of us.

Prices of new lets are growing at a much faster rate in suburban boroughs. Over the last quarter, rental prices in outer London increased by 3% - or £47 - per month. These more affordable areas are now attracting more demand from renters looking for cheaper alternatives to inner London.

Varying rental growth in UK cities

Fast-growing rental inflation is not only a London problem.

Our rental index identifies three urban areas where rents are increasing faster than in London: Dundee (+14.5%), Luton (14.0%) and Edinburgh (13.7%).

Renters looking for new lets in these locations will find the average monthly rent has increased by up to £140 over last year.

We also record above-average rental inflation in Manchester, where the average monthly rent has increased by £110 over the last year.

The cities where rents are also increasing faster than average include Glasgow (12.3%), Southampton (10.7%) and Cardiff (+10.4%).

The average rent in these cities is now £100 higher than a year ago.

The lowest rental growth is currently happening in the city of Doncaster and the towns of Grimsby and Blackpool.

The typical monthly rent in these areas has increased by less than £30 per month - or 4.3% - since April 2022.

The cheapest and most expensive areas to rent in each region

|

Region |

Cheapest area to rent |

Monthly rent |

Most expensive area to rent |

Monthly rent |

|

North East |

Hartlepool |

£493 |

Newcastle upon Tyne |

£862 |

|

Yorkshire & the Humber |

North East Lincolnshire |

£569 |

York |

£1,034 |

|

Wales |

Powys |

£595 |

Cardiff |

£1,031 |

|

Scotland |

East Ayrshire |

£519 |

Edinburgh |

£1,130 |

|

West Mids |

Stoke-on-Trent |

£630 |

Warwick |

£1,107 |

|

North West |

Burnley |

£514 |

Manchester |

£1,099 |

|

East Mids |

East Lindsey |

£619 |

South Northamptonshire |

£1,076 |

|

South West |

Torridge |

£766 |

Bath and North East Somerset |

£1,333 |

|

East of England |

Waveney |

£732 |

Epping Forest |

£1,516 |

|

London |

Bexley |

£1,426 |

Kensington and Chelsea |

£3,538 |

|

South East |

Dover |

£929 |

Elmbridge |

£1,705 |

Key takeaways

- The average UK rent hit £1,126 in April, £110 higher than a year ago

- London remains the region with the fastest growing rents - up 13.5%, while rental inflation in Northern Ireland slows to 3.7%

- The average rent in London reaches £2,000 per month, but rental growth slows in inner London over last 3 months

- Outside the capital, rents are increasing the most in Dundee, Edinburgh and Luton

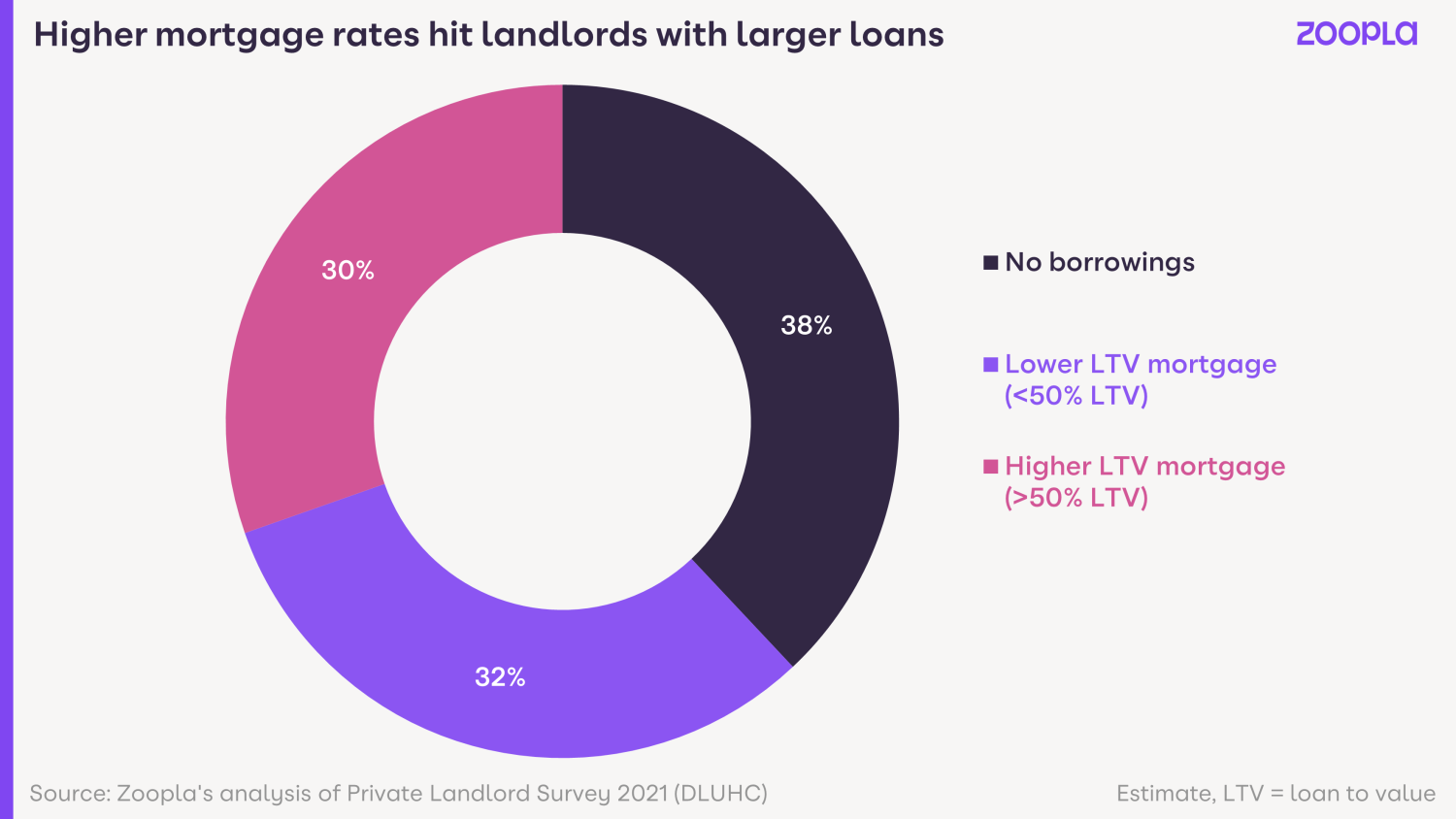

The Impact of Higher Mortgage Rates on Landlords: Squeezing Rental Home Availability

The number of rental homes available could face additional pressure as nearly a third of landlords are being affected by higher mortgage rates.

More than a third of landlords own their properties outright, while another third have loan to value mortgages of less than 50%.

But for the remaining 20-30% of landlords, whose mortgages have a loan to value of 50-75%, higher mortgage rates are hitting hard.

As mortgage rates creep up, landlords are forced to use more of their rental income paying back lenders, which in turn reduces their own income and creates a squeeze on cashflow.

The net result is the increased likelihood of a sale as landlords approach refinancing.

Higher mortgage rates are unwelcome but more manageable for landlords at lower LTVs as there is greater free rental cashflow to absorb higher mortgage rates.

In London and the South East, the two most expensive property regions in the UK, so many landlords are selling that these two regions account for 51% of all landlord sales.

Because homes in these areas are expensive to buy - and therefore offer low rental yields (or profit) once the monthly mortgage is paid, the economics of being a landlord here are tougher than other areas.

Rising mortgage rates are hitting profitability hardest in these regions, especially for higher rate taxpayers.

How can I keep my buy-to-let property in the face of rising mortgage rates?

The main option for landlords facing a big increase in mortgage interest payments is to inject equity at refinancing.

However, this will be an unattractive option for many with concerns over low yields and the risk of further price falls.

Is there a mass exodus of landlords selling up?

While some landlords are selling up, talk of an exodus is probably overdoing it.

Our sales data continues to show a steady, constant flow of private landlords selling up but this has been the case since 2018. And the level of landlords' sales isn’t accelerating.

Corporate and institutional landlords are continuing to invest in homes and for this reason the number of private rented homes available has remained at the same level since 2016.

We don’t expect to see a worsening of supply. However, the market does need significant investment from more private and corporate landlords to help with the demand for rental homes.

Right now, there are 33% less homes available to rent than the five year average, yet demand is currently running at 50-85% above average.

Key takeaways

- Higher mortgage rates are hitting landlords who have loan to value mortgages of 50-75% hard. And that accounts for 20-30% of landlords

- 51% of all landlord sales are taking place in London and the South East, the two most expensive property regions in the UK

- While some landlords are selling up, talk of an exodus is probably overdoing it

How to negotiate a rent increase in 2023

In a rental market characterized by fierce competition, rising costs, and a scarcity of available homes, renters may wonder what actions they can take.

Across the UK rents are rising amid fierce competition for rental properties.

Lack of stock is becoming a major issue, as tighter legislation and tax changes push some landlords to exit the market after years of low new investment.

Currently there are 20-40% less homes available for renters to live in than there were in 2019.

Yet across the UK, demand for rental properties is now running at 50-85% above normal levels.

How much are rents increasing by?

As renters are all too painfully aware, rents on new lets are up 10.4% year-on-year, and rents have risen by £2,800 over the last 5 years for the average renter.

There are several reasons why rent is increasing right now:

-

Landlords are facing increased mortgage costs and lenders are stress-testing their ability to repay those mortgages at much higher levels

-

The shortage of properties is leading some renters to pay more, if they are able to, to secure the property they want to live in

-

Many tenants are staying in their rental properties to avoid paying higher rents elsewhere, meaning fewer new rentals are coming to market

-

High immigration is adding to demand, especially in university towns and cities

The levels at which rents are increasing varies across different regions of the UK.

In London, a single renter now pays 40% of their pre-tax income on renting, while in the North East, that figure is closer to 19%

What can you do if your rent increases and you can’t afford the payments?

1. Talk to your landlord

Not all landlords are seeking to increase rents. If you have just moved in and are on a initial fixed term period the rent won't increase.

But if your landlord does ask to increase the rent and you’re worried you can’t afford to pay it, the best thing to do is have an honest and open conversation with them.

Have that conversation in person if you can, or on the telephone.

This subject is too important to discuss on email or via text messages, where sentiments can easily be misinterpreted or misunderstood.

See if you can find a compromise. And try to be understanding of each other.

It could be that your landlord is facing rising mortgage costs and is worried they may have to sell the property if they can’t cover those costs.

Most landlords would rather keep their tenants than risk the property being empty for a month or two, so if there’s a middle ground you can both reach it will be better for everyone.

In Scotland, unlike in England and Wales, the situation is slightly different as rent rises are capped until at least 30 September 2023.

Landlords cannot increase their tenants' rent by more than 3% of their current rent, unless they can prove that there has been an increase in certain costs.

2. Know your rights

For a periodic tenancy (a rolling weekly or monthly contract), your landlord cannot increase your rent by more than once a year without your prior agreement.

For a fixed-term tenancy, your landlord can only increase your rent if you agree.

If you don’t agree, the rent can only be increased when your fixed term ends.

3. Consider moving to a more affordable area

Rents are charged at vastly different rates across the UK. Could you consider moving to a cheaper area, or a smaller property, where the rent might be more affordable?

4. Consider becoming a first-time buyer

Saving for a deposit is the biggest hurdle many renters face when trying to step onto the property ladder

But 100% mortgages are now available for tenants with a strong track record of rental payments who can show they can afford a mortgage.

The new 5-year fixed rate mortgage comes at an interest rate of 5.49% over a maximum term of 35 years.

Discover more in 100% no-deposit mortgages back!

The 95% mortgage guarantee scheme is also running until the end of this year, meaning you don’t need to save up quite so much for a deposit.

How do you secure a rental property when so many people are competing for it?

1. Try to be the first one to view it if possible

If the first viewing is at 4pm, get there for 3.45pm.

2. Be ‘renter ready’

Have your ID with you and bring your proof of residency. (Landlords and agents are eventually going to ask for this, so if you have it with you, you’re already going up the list.)

3. Know what you can afford

Think about your finances and be realistic about what you can afford. The rule of thumb for affordability is that you generally need to earn 2.5 times the monthly rent.

So if the rent is £950 and you multiply that by 30, then you’ll need to earn £28,500 a year.

The credit check referencing companies want to know that you can afford the rent and still have enough money to be able to live. So don’t overstretch yourself.

What would a landlord look for in a perfect renter right now?

Having all your paperwork and documentation in place will help to speed the process up.

But really most landlords simply want someone who’s going to care for the property, be a good neighbour and be able to pay the rent.

Will the current situation in the rental market ease this year?

Unfortunately this is looking unlikely.

The chronic imbalance between the number of homes available for rent and the demand out there for them is likely to keep pushing rents higher across the whole of the UK.

And we’re about to enter the busiest time of the year for renting. In the summer, demand typically increases by 40%.

That said, there is only so much renters can afford to pay and we expect rental growth to slow towards 8% by the end of the year.

However, that is still above the rate of earnings growth, which is currently 6%.

The situation will only ease when there’s an increase in new investment from corporate and private landlords.

And right now, legislative changes and higher mortgage rates are putting the breaks on investment from the latter.

Key takeaways

- Have an honest conversation with your landlord or letting agent in person if you can, or on the telephone. Talking is better than emailing or messaging

- Know your rights as a renter, including how and when your landlord can increase your rent

- Consider moving to a more affordable area or smaller property

- Could now be the time to become a first-time buyer? 100% and 95% mortgages are available

Experience an array of unmissable events and things to do in London June 2023.

Discover a vibrant lineup of exciting events taking place in London throughout the month of June. Immerse yourself in the cultural, entertainment, and artistic offerings that the city has to offer during this time.

June in London is one of those months that’s filled with a sense of excitement. It’s that ‘school’s out!’ feeling, until you remember that you left school years ago, and ‘summer holidays’ don’t really exist for adults. Shame.

June is also the start of summer in London, which means the capital’s beer gardens are at their prime, the city parks are at their prettiest, the open-air theatre season gets into full swing and eating alfresco is on the cards at some of London’s best restaurants. Plus, expect to see long queues in south west London as tennis fans line up to bag a place at the epic Wimbledon championships.

1. Summer Exhibition 2023

it’s back. The RA’s annual showcase of all the artists you need to know about right now returns for its 255th edition to brighten up the summer holidays. The world’s oldest open submission exhibition (which means anyone can enter their work to be considered for inclusion), the artist with the big job of sifting through the works and curating them this year is David Remfry. He’ll be exploring the theme ‘Only Connect’, inspired by a quote from the novel ‘Howards End’ by E. M. Forster.

Here are the three things you'll see at the Summer Exhibition

Big names

Now in its 255th year, the Summer Exhibition still knows how to get the big art names in. Expect work from the likes of Frank Bowling, Michael Craig-Martin, Tracey Emin, Gillian Wearing and the late Paula Rego, as well as Honorary Royal Academicians Mimmo Paladino, Pipilotti Rist and Kiki Smith. Newly elected Royal Academicians Roger Hiorns, Hew Locke, Veronica Ryan and Barbara Walker will be submitting works, as well as newly elected Honorary Royal Academician Kara Walker.

Little names

The great thing about the Summer Exhibition is that it’s open to all, and the selectors pick from thousands of entries. That means that your mate’s mum’s weird little whittled sculptures of George Michael might be shown alongside something by Antony Gormley. It’s a good opportunity to spot an art star of the future. And also see weird stuff by your mate’s mum.

And a huge amount of art

There are usually hundreds of works in this sprawling show. From miniature paintings to enormous canvases, architectural models to photography, there’s something for everyone. And hey, most of it is for sale, so you may just be able to nab a bargain.

2. Serpentine Pavilion

As sure as the sun will rise and winter will turn into spring, Hyde Park will play host to a new Serpentine Pavilion every year, and 2023’s has just hatched into the world. This one was designed by French-Lebanese architect Lina Ghotmeh and is inspired by the Mediterranean urge to sit around a dining table and put the world to rights. The name of the pavilion is ‘À table’, French for ‘sit the f**k down at the dinner table or you’re going to get a whack around the ear’. The idea is that it’s meant to make visitors think about the table as a place of discussion, engagement, dialogue and exchange, all while sharing a meal.

3. River Stage

4. Pub in the Park

5. ‘Newsies’

✡ till June 25 at Troubadour Wembley Park Theatre, Wembley

Highlights

-

- Olivier Award-winning musical now in the UK

- Performing at the Troubadour Wembley Park Theatre

- Tickets from just £16.50!

Imagine a cross between ‘Annie’, ‘Les Miserables’, and one of those elaborate gymnastic-based spectacles staged by communist countries and you’re halfway there to imaging Disney’s cult classic musical ‘Newsies’ about striking that has finally hit the UK. The Troubadour Theatre’s high-octane production captures all its vigorous spirit, sending its huge cast of plucky, rebellious paperboys tumbling and leaping across its mammoth stage as they stand up to the big bosses who are determined to grind them down.

Need to know

- This is valid for a ticket to Disney's Newsies at Troubadour Wembley Park Theatre.

- This booking is only valid for your selected date/time option and band.

- E-tickets will be sent directly from the box office via email, please present your tickets upon arrival at the venue. If you do not receive your e-tickets by the day of your performance, please contact the box office via wptboxoffice@kxtickets.com, for assistance.

- Time Out booking confirmations cannot be used to gain entry as seats are allocated by the box office and not by Time Out. Customers purchasing multiple tickets in the same transaction under the same name will be sat together.

- Doors open 30 minutes before each performance. The show runs approximately 2 hours 30 minutes, including interval.

- Location: 3 Fulton Road, Wembley Park, Wembley HA9 0SP.

- This voucher cannot be cancelled, amended, exchanged, refunded or used in conjunction with any other offer.

6. ‘Crazy for You’

The legendary Susan Stroman directs this massive new West End production of the beloved retro musical

‘Crazy for You’ is a golden age musical comedy that’s actually from 1992: writer Ken Ludwig took a load of classic songs by George and Ira Gershwin – largely from the 1930 musical ‘Girl Crazy’ – and spun them into a shimmeringly delightful retro confection that’s almost indistinguishable from the era it’s paying homage to, the odd knowing flourish aside. Following Bobby Child, a rich banking scion who must – for complicated reasons – stage a successful musical in a backwater Nevada town in order to win over the woman he loves, it’s a loving tribute to a bygone era of great American musicals that probably seemed more distant in the Lloyd Webber-dominated early ’90s than it does now.

The original production was choreographed by the great Susan Stroman; for this revival – which has already played to great acclaim at the Chichester Festival Theatre – she also directs a cast headed up by Charlie Stemp and Tom Edden.

Details

- Event website: www.CrazyForYouMusical.com

- Address: Gillian Lynne Theatre. 166. Drury Lane (corner of Parker Street), London. WC2B 5PW

- Transport: Tube: Covent Garden/Holborn

- Price: £25-£250

7. Gouqi

Chef Tong Chee Hwee, who helped earn Mayfair Chinese spot Hakkasan its Michelin star is back on the London food scene cooking up elevated and refined dishes using techniques and ingredients from across China at Gouqi. Try the Angus tenderloin beef with black pepper sauce, sautéed crystal jumbo prawns with yellow chive in XO sauce, or clay pot silken egg tofu with wild mushroom and vegetable for yourself with this eqclusive deal letting you enjoy top-tier dining for just £45 per person.

Highlights

- Three courses of Chinese fine dining from seven Michelin-starred chef Tong Chee Hwee

- Plus a glass of wine

- Now just £45 per person (minimum booking of two required)

Everyone loves a comeback. This restaurant marks a return to London’s restaurant scene for Chef Tong, who worked across Singaporean and Malaysian restaurants, before securing a spot at Hakkasan (when the restaurant earned its Michelin star). Now, he’s cementing his place as a figurehead at Gouqi, where he creates elevated and refined dishes using techniques and ingredients from across China. Enjoy top-tier dining for just £45 per person, where you indulge in dishes like Angus tenderloin beef with black pepper sauce, sautéed crystal jumbo prawns with yellow chive in XO sauce, or clay pot silken egg tofu with wild mushroom and vegetable. How dreamy does that sound?

What's on the menu?

Starter - choose one:

Crispy aromatic duck salad

Lotus root salad with courgette and black fungus (V)

Main - choose one:

Angus tenderloin beef with black pepper sauce

Sautéed crystal jumbo prawns with yellow chive in XO sauce

Claypot silken egg tofu with wild mushroom and vegetable (V)

with seasonal vegetables and steamed Jasmine rice (V)

Dessert - choose one:

Banana, Miso, Caramelised White Chocolate and Coffee

Mango, Passion Fruit and Coconut (V)

Need to know

- This voucher is valid for three courses and a drink at Gouqi.

- Minimum of two people to book

- Availability: Monday to Friday noon - 2.30 pm, daily 5.30 pm - 6.30 pm / 9.30 pm - 10 pm. Blackout dates may apply. Subject to availability.

- To redeem, please send your booking confirmation to reservations@gouqi-restaurants.co.uk or call 0203 771 8886 with your preferred date and time. Your voucher, security code and QR code must be clear.

- Please present your voucher upon arrival.

- Voucher valid until > July 30, 2023.

- Menu subject to change. Offer includes house wine only.

- Please inform the restaurant of any allergies or dietary requirements in advance.

- The restaurant must be informed of any changes/cancellations within 48 hours of your booking. If the booking is cancelled after this time, the voucher will be deemed to have been redeemed for the current booking and cannot be used towards a new booking.

- Dress code is smart casual.

- Prices and menus online are subject to changes.

- Gouqi is located opposite the Canadian Embassy on Cockspur Street, and next to Trafalgar Hotel.

- Location: 25-34 Cockspur Street, London, SW1Y 5BN.

- This voucher cannot be cancelled, amended, exchanged, refunded or used in conjunction with any other offer.

What's the average first-time buyer deposit by region in 2023?

Discover the varying amounts being saved by first-time buyers across different regions in the UK to secure a home, ranging from £26,400 to £144,500. Explore the regional variations in savings required to purchase a property in the UK.

The average deposit paid by a UK first-time buyer for a 3-bed home in 2023 is £34,500 for a £240,000 home.

That amounts to a 15% deposit for the property.

However, the amount you need to save varies according to where you live in the UK and of course, the level of deposit you wish to pay.

100% mortgages are now available, meaning you don’t have to pay any deposit at all to buy a house.

The 95% mortgage scheme is also running until the end or 2023, meaning you only need to save a 5% deposit for the home you want to buy.

According to UK Finance, most first-time buyers try to put down a larger deposit for their first home - amounting to 24% of the total property price.

That’s because a bigger deposit opens up better mortgage rates from lenders.

To put a 24% deposit on a £240,000 property, you would need to save £57,600.

Let’s take a look at how much first-time buyers are paying to step onto the property ladder across the UK.

We’ve used our data to calculate the average property prices for first-time buyers in each region, based on sold house prices.

UK Finance have provided the information on the average deposit paid by first-time buyers within each region.

And we’ve also shown how much a 15% deposit would be for each regional property value.

From the most expensive areas to the cheapest, these are the average deposits paid by first-time buyers in 2023.

Average first-time buyer deposits paid across the UK

| Region | Average first-time buyer property price | Average deposit | 15% deposit |

|---|---|---|---|

| UK | £240,000 | £34,500 | £34,500 |

| London | £425,000 | £144,500 | £63,750 |

| South East | £300,000 | £72,000 | £45,000 |

| East England | £300,000 | £72,000 | £45,000 |

| South West | £220,000 | £52,800 | £33,000 |

| East Midlands | £190,000 | £45,600 | £28,500 |

| West Midlands | £190,000 | £45,600 | £28,500 |

| North West | £150,000 | £36,000 | £22,500 |

| Wales | £150,000 | £36,000 | £22,500 |

| Yorkshire & The Humber | £140,000 | £33,600 | £21,000 |

| Scotland | £135,000 | £32,400 | £20,250 |

| Northern Ireland | £130,000 | £31,200 | £19,500 |

| North East | £110,000 | £26,400 | £16,500 |

Zoopla

Working from home to help keep property affordable

According to a prominent economist at the Office for Budget Responsibility, it is anticipated that affordable rural areas will experience higher growth in house prices, while city centers are expected to witness a slower rate of growth.

The rise of remote working is anticipated to have a positive impact on the affordability of house prices for first-time buyers in the coming years. The Office for Budget Responsibility predicts a decline in house prices from their peak in the fourth quarter of 2022, followed by a recovery in the second quarter of 2024. Projections indicate that by the end of 2025, house prices will experience a year-on-year increase of 2.8%, with further uplifts of 3.6% in both 2026 and 2027.

Remote working, which gained momentum during the pandemic, is expected to bring about permanent changes in the housing market by allowing individuals to relocate from cities and opt for a countryside lifestyle. According to David Miles, a leading economist at the Office for Budget Responsibility, this shift will lead to an upward pressure on property values in rural areas, while house price growth in city centers and London is anticipated to slow down.

Why is this happening?

The Covid-19 pandemic has brought about lasting transformations in people's work habits, with a significant number of individuals now being granted the option to work remotely, either partially or entirely.

Traditionally, cities experienced more pronounced increases in house prices compared to rural areas, primarily due to a disparity between supply and demand driven by employees seeking residences within convenient commuting distance of their workplaces.

However, the ability to work from home has mitigated this imbalance, resulting in increased demand for homes in rural areas. As a result, house price growth in these countryside locations is expected to be higher, reflecting the shift in demand.

Who does it affect?

The trend is good news for first-time buyers. Earnings growth has failed to keep pace with house price rises for much of the past decade, making property increasingly unaffordable for those trying to get on to the housing ladder.

Slower house price growth not only gives earnings a chance to catch up, but it also means first-time buyers will not face the race to put together a deposit before they get priced out of the market.

The situation is also positive for those living outside of city centres, as it suggests house price growth will be more evenly spread going forward.

This should make it easier for people to relocate from the countryside to towns and cities if they choose to, as well as move between different regions.

What’s the background?

House price growth has already slowed down compared with previous years due to the impact of higher mortgage rates and the rising cost-of-living on affordability.

Latest UK House Price Index found that buyer demand is currently below average in the Midlands, South East, South West and East of England, areas that have seen the highest house price rises in the past three years, which has impacted affordability.

Across the UK as a whole, house prices have edged down by 1.3% during the past six months, and are expected to remain broadly unchanged for the rest of the year.

Key takeaways:

• The housing market will undergo permanent changes due to the rise of remote working, allowing individuals to relocate from cities to rural areas.

• This shift is expected to result in higher price growth in rural areas, while cities may experience lower growth, leading to a more balanced market for homebuyers.

• According to the Office for Budget Responsibility, house prices are projected to decline from their peak in the fourth quarter of 2022 but rebound in the second quarter of 2024.

House prices hold steady for sellers

Housing market activity levels recover as falling mortgage rates and a strong labour market boost buyer confidence.

UK house prices have fallen 1.3% over the last 6 months but the rate of price falls has now slowed.

Activity levels are recovering and more sellers are coming into the market as falling mortgage rates and a strong labour market boost buyer confidence.

And we’re not seeing any evidence of a build-up of unsold homes.

The number of homes listed for more than 90 days in most areas is in line with the 5-year average.

So while new sellers will need to set their asking prices carefully if they are serious about moving, there’s no need for larger price falls to clear stock at this stage.

The best areas to sell a home right now

Sellers in the North East, Scotland and London are seeing above average activity, with sales levels 10% higher than the rest of the UK.

That’s because the North East and Scotland are both more affordable markets.

And while London isn’t (homes in the capital cost twice as much as those in the rest of the UK on average), its affordability has improved over the last 7 years as prices failed to rise inline with the rest of the UK.

What's happening with house prices?

In fact, house price inflation in London is currently at -0.2% year-on-year.

That means homes are now better value for would-be buyers in the capital, especially those looking to buy flats, since their values haven’t risen since 2016.

Increased migration into the UK is also likely to be supporting above-average demand and sales rates here.

However, it’s a different picture in the South and Midlands, where house prices shot up over the last 3 years. Here demand remains below average.

That’s because higher prices, combined with higher mortgage rates and the cost of living, have taken more buyers out of the market in these areas.

That said, there are still active buyers in these markets, shown by above-average sales, albeit at a lower level.

Higher mortgage rates push landlords to sell-up

Some landlords are looking to sell their properties in the face of higher mortgage rates, which is also adding to the supply of homes for sale.

Some 1 in 10 (11%) of homes listed for sale were previously rented out, a level that peaked at 14% in 2020 and which has drifted lower over the last 3 years.

Ex-rental homes have an asking price that is 25% lower than previously owned homes (£190,000 v £250,000), which makes them appealing to first-time buyers.

What should I do if I’m planning to sell my home this year?

While more sales are being agreed, sellers must remain realistic on pricing to attract buyer interest.

Some 18% of homes currently listed for sale on Zoopla have had their asking price reduced by 5% or more, compared to 28% in February.

Price reductions typically come 8 weeks after a property is first listed, as sellers try to boost interest from buyers.

What’s going to happen to the housing market in the second half of this year?

While demand is down due to rising mortgage rates, lending regulations have helped to temper the impact this has on house prices.

That said, we do expect prices to continue to drift lower throughout 2023.

The increased likelihood of further interest rate rises, meaning higher mortgage rates, is likely to weaken demand and activity in the second half of 2023.

Rising mortgage rates reduce buying power and demand for homes, leading to a downward pressure on house prices.

And the number of home sales taking place in 2023 are on track to be 20% lower than last year.

Key takeaways

- Rate of house price falls slows as buyer confidence returns

- Sellers need to set asking prices carefully but no need for larger reductions

- Sales in the North East, Scotland and London are going well with activity levels 10% higher than the rest of the UK

New credit scoring to help first-time buyers get a mortgage

Leeds Building Society has teamed up with Experian to incorporate regular direct debit payments into credit scores for first-time buyers.

Leeds Building Society is taking a new approach to credit scoring to help more first-time buyers get a mortgage and buy a home.

The building society has joined forces with credit reference agency Experian. They’ll allow first-time buyers applying for a mortgage to prove their financial track record with a wider range of payments.

Traditionally, credit scores only incorporate repayments for debt, such as credit cards, mortgages or loans.

But Leeds will now consider other regular direct debits during the past 12 months. They’ll include payments for council tax, subscriptions and even Netflix or Spotify.

Richard Fearon, chief executive at Leeds Building Society, said: “We’re proud to be the first mortgage lender in the UK to make it easier for aspiring homeowners by incorporating free ‘boosted’ credit scores.”

Leeds offers mortgages that require only a 5% deposit, with rates starting at 4.94% for a five-year fixed rate deal with a £999 product fee.

How does the new credit scoring work for first-time buyer mortgages?

Leeds Building Society will incorporate information from Experian’s free Experian Boost service. This will show you have kept up with regular payments.

The service uses Open Banking to look at payments made through your current account.

The Open Banking initiative allows you to share your banking data with third parties that are regulated by the Financial Conduct Authority through secure connections. The data cannot be shared without your explicit consent.

While Experian Boost is free for consumers to use, Leeds is the first mortgage lender to use it for lending decisions.

How many first-time buyers will be helped by this credit-scoring approach for mortgages?

Testing for the new approach found that 7.5% of applicants improved their credit score through using Experian Boost.

For some first-time buyers, this could be the difference between qualifying for a mortgage and not qualifying for one.

Leeds believes Experian Boost is particularly helpful for younger borrowers, first-time buyers, and those on lower incomes, who typically face the toughest challenges in proving they are credit-worthy.

Fearton said: “Often through no fault of their own, these groups can struggle to build a good credit score because they need to spend most of their earnings on rent and other regular payments. Indeed, the vast majority of existing Boost users are renters.”

How is your credit score worked out?

Credit reference agencies like Experian collect information about you from registers, lenders and other service providers.

Lots of factors impact your credit score, including credit applications, the amount you’ve borrowed and missed or late payments.

What is a good credit score?

Most credit agencies in the UK use a points system to determine your credit score.

This usually ranges from 0 - which is the lowest possible credit score - to 999 or 1000, which is the best credit score.

With Experian for example, a good credit score is anything above 721, while scores above 961 are deemed ‘excellent’.

What credit score do you need for a mortgage?

In general, the higher your credit score, the better your chances of getting a mortgage.

Lenders will take your score into account to decide how risky it is to lend to you.

So if you’ve shown you can pay all your bills on time, they deem you safer to lend to. This can mean they offer you a lower interest rate.

However, lenders also look at other things like affordability, income and account history to decide if you’re eligible for a mortgage.

In some cases, you can still get a mortgage if you have a bad credit score.

Each mortgage lender considers different scores to be ‘bad’. How much you owe and whether you’ve repaid debts can also make a difference.

What other initiatives can help first-time buyers get on the property ladder?

The Leeds Building Society initiative comes as Skipton Building Society has launched the first 100% mortgage to be offered since 2008.

The mortgage enables first-time buyers to purchase a property without a deposit and without a guarantor.

Instead, borrowers must provide evidence they have paid their rent on time for the past 12 months, as well as meeting the lender’s credit score and affordability criteria.

Another innovative scheme that was launched earlier this year to help first-time buyers is the Save to Buy initiative.

Offered by housebuilder Fairview New Homes, Save to Buy enables first-time buyers to move into their home and pay ‘rent’ at a fixed cost for between six months and two years. The money is set aside until it is enough to use as a deposit to qualify for a mortgage.

Key takeaways

- Leeds Build Society will enable first-time buyers to use a wider range of payments as proof of their financial record when they apply for a mortgage

- It will include regular direct debits made during the past 12 months, including payments for council tax, subscriptions and even Netflix or Spotify

- Testing found the new approach improved the credit score for 7.5% of mortgage applicants

100% no-deposit mortgages are back!

Skipton Building Society has introduced a 100% no-deposit mortgage, which allows renters to buy their first home without a deposit. Here's everything you need to know about the new no-deposit mortgage.

100% no-deposit mortgages have made a return for the first time since 2008.

It means first-time buyers can step onto the property ladder without saving for a deposit or having a guarantor.

Instead, first-time buyers must show they have paid their rent on time for the past 12 months. They must also meet the lender’s credit score and affordability criteria.

Skipton Building Society's Track Record Mortgage is aimed at first-time buyers who are currently renting.

The Track Record Mortgage offers a fixed interest rate of 5.49% for five years, with a maximum term of 35 years.

What is a 100% no-deposit mortgage?

A 100% no-deposit mortgage is a loan for the full purchase price of the property you’re buying.

Normally, you would put down a deposit - often around 10% to 20% of the property price - and borrow the rest from a mortgage lender.

With a 100% mortgage, you need zero deposit - which overcomes the challenge of saving for a deposit.

The no-deposit mortgage from Skipton is a fixed-rate mortgage for five years, which means the interest you pay will stay the same for the first five years of your term.

What Skipton Building Society said about their new no-deposit mortgage

Charlotte Harrison, Skipton's CEO of Home Financing, said: "With escalating rents and the cost-of-living squeeze further impacting people’s ability to save for a house deposit – it’s making it almost impossible for people get onto the property ladder.

"We recognise there’s a clear gap in the market for people who have a strong history of making rental payments over a period of time - so can evidence affordability of a mortgage. But there is currently no solution for them to buy a property due to lack of savings or access to family wealth.

"This is why we’re introducing our Track Record Mortgage."

Is the 100% no-deposit mortgage more expensive than other mortgage products?

The new no-deposit mortgage is good news for first-time buyers who want to get on to the property ladder but are struggling to save a deposit.

But it’s important to note that the product is slightly more expensive than the average five-year fixed rate mortgage, which currently has an interest rate of 5%.

On a £200,000 mortgage, this would cost you an extra £60 a month.

It is also worth remembering that 100% mortgages do not offer you any cushion if house prices fall. This means you face a higher risk of ending up in negative equity, when you owe more than your property is worth.

That said, if you’re frustrated about paying high rent and are not able to put together a deposit, the deal could still make sense for you.

When did 100% no-deposit mortgages stop?

Before 2008, 100% no-deposit mortgages were widely available. Some lenders even offered mortgages of up to 125% of the property’s value.

But the financial crisis of 2008 saw most 100% no-deposit mortgages stop. Mortgage lenders saw them as too risky to lend on during more difficult economic times.

They currently make up just 0.3% of all available mortgage products in the UK, according to moneyfacts.co.uk.

And they all require some form of financial backing from family or friends of the borrower. This makes the guarantor responsible for any missed mortgage payments.

It means Skipton's new no-deposit mortgage is the first of its kind to be available since 2008.

Can I afford to buy the home I rent with a 100% mortgage?

In the North East and Scotland, it works out cheaper to buy the home you rent with a 100% mortgage than to continue renting.

However, as you travel further south, the cost of paying a mortgage becomes more expensive as property values increase.

In London, where the average rent is £1,815 pcm, the monthly mortgage repayments on a £512K mortgage tested to an 8% stress rate would work out to be more than double the cost of renting, at £3,787.

That said, the repayments at a 5% mortgage rate would be considerably lower at £2,773.

A similar picture emerges for the South East, where rents are currently £1,160 pcm but monthly mortgage payments for a £300K mortgage tested to 8% would be £2,236.

The repayments at a 5% mortgage rate would be £1,638.

How much would it cost to buy the home I rent with a 100% mortgage?

The calculations below compare the cost of renting a home versus the cost of buying it across the UK.

The chart shows calculations based on a 35-year mortgage term for maximum buying power.

| Region | Rent pcm | Home value / mortgage | Deposit | Monthly payments at 5% mortgage rate | Mortgage repayments vs rent costs | Monthly repayment to pass 8% stress rate | Household income to rent | Household income needed to meet 5% mortgage | Loan to income | Household income needed to pass 8% stress test |

|---|---|---|---|---|---|---|---|---|---|---|

| North East | £598 | £105,926 | £0 | £574 | -4% | £784 | £23,920 | £25,750 | 4.11 | £37,250 |

| Scotland | £671 | £122,979 | £0 | £667 | -1% | £910 | £26,840 | £30,750 | 4.00 | £44,000 |

| Northern Ireland | £658 | £138,739 | £0 | £752 | 14% | £1,027 | £26,320 | £35,500 | 3.91 | £50,500 |

| Yorkshire & The Humber | £696 | £145,305 | £0 | £788 | 13% | £1,076 | £27,840 | £37,500 | 3.87 | £53,750 |

| North West | £727 | £146,141 | £0 | £792 | 9% | £1,082 | £29,080 | £37,750 | 3.87 | £54,000 |

| Wales | £749 | £160,093 | £0 | £868 | 16% | £1,185 | £29,060 | £41,750 | 3.83 | £60,500 |

| East Midlands | £758 | £173,937 | £0 | £943 | 24% | £1,288 | £30,320 | £45,750 | 3.80 | £67,000 |

| West Midlands | £784 | £176,840 | £0 | £959 | 22% | £1,309 | £31,360 | £46,750 | 3.78 | £68,500 |

| South West | £957 | £241,056 | £0 | £1,307 | 37% | £1,784 | £38,280 | £68,250 | 3.53 | £87,750 |

| Eastern | £1,025 | £265,239 | £0 | £1,438 | 40% | £1,963 | £41,000 | £76,750 | 3.46 | £115,500 |

| South East | £1,160 | £302,118 | £0 | £1,638 | 41% | £2,236 | £46,200 | £89,500 | 3.38 | £136,250 |

| London | £1,815 | £511,604 | £0 | £2,773 | 53% | £3,787 | £72,600 | £172,250 | 2.97 | £243,000 |

Why has Skipton Building Society brought out a 100% no-deposit mortgage?

Skipton has said that their 100% no-deposit mortgage aims to help renters trapped in renting cycles.

“We know there isn’t one quick solution to addressing this huge societal challenge of tenants being trapped in renting cycles, with rents escalating faster than mortgage payments and the increasing costs of living,” says Charlotte Harrison from Skipton.

“But doing nothing isn’t going to solve this UK housing issue.

"As a responsible lender, we need to be sensible with our approach for bringing this product to the market and ensure tenants don’t take on more than they can realistically afford.

“We know this product will not be able to help everyone and is only part of the solution for this group of people, but as a lender, we’re taking a stand to offer innovation in this space to help turn generation rent into generation buy.”

Our take on the 100% no-deposit mortgage

Our Executive Director of Research, Richard Donnell says: "The reduction in availability of higher LTV mortgages has had a big impact on first-time buyers, where the deposit required is the biggest barrier to home ownership.

"Data from the FCA shows that just 6% of first time buyers used a mortgage at or over 90% LTV in 2021."

Understanding loan-to-value ratios

"First time buyers who can raise a 20% deposit would see their mortgage repayments become up to 20% less than the monthly cost of renting in all regions of the UK outside of the south east of England, even with mortgage rates of 5%.

"But to do this, many will need to get help from parents and family.

"The introduction of 100% loans is designed to assist those with small deposits to access home ownership.

"The proposals from Skipton require the mortgage to cost the same - or less - than the monthly rental payments.

"This means the scheme will primarily benefit renters in more affordable housing markets in the north of England and Scotland, where house prices are lower, making a 100% mortgage more attainable.

"The scheme is unlikely to work as well in southern England, where prices are much higher, meaning mortgage repayments would be well over the level of rents.

"The exception would be if first-time buyers were moving from a home where the rent is currently high, for example central London or central Manchester, to the outskirts of a city where the mortgage for a property is likely to be cheaper.

"High loan to value lending is set to remain a niche product but innovations such as this do help improve home ownership options for some households.

"That said, households will be wary of negative equity, should prices fall back in the areas where this product works."

What other 100% mortgages are available?

A handful of lenders already offer 100% mortgages that require some form of guarantee from a parent, family member or friend.

For example, Barclay’s Family Springboard Mortgage enables first-time buyers to borrow 100% of their property’s value if a ‘helper’ deposits savings equivalent to 10% of the purchase price in a designated savings account.

Other deals require family members to guarantee a portion of the loan above a certain level.

Compare 100% mortgage deals at Money.co.uk

Other financial help for first-time buyers

If a 100% no-deposit mortgage isn’t right for you, a buying scheme could be an option instead.

There are a number of schemes available to help you buy a property if you’re able to save a small deposit.

The government’s Mortgage Guarantee Scheme enables first-time buyers and home-movers to purchase a property with just a 5% deposit.

Meanwhile, First Homes enables local first-time buyers and key workers to purchase a home at a 30% discount to its market price, and Shared Ownership enables people to buy a share in a property and pay rent on the rest.

Housebuilder Fairview New Homes recently launched a Save to Buy initiative, under which first-time buyers move into their home and pay ‘rent’ at a fixed cost for between six months and two years, with the money set aside until it is enough to use as a deposit to qualify for a mortgage.

Key takeaways

- Skipton Building Society has launched its Track Record Mortgage, a 100% no-deposit mortgage for first-time buyers

- Tenants who can show they can afford a mortgage and have a strong track record of rental payments can borrow up to 100% of a property's value

- With the new 5-year fixed rate mortgage, first-time buyers get an interest rate of 5.49% over a maximum term of 35 years

- The no-deposit mortgage will mainly benefit renters living in Scotland and the North East, where home values are cheaper than in the South