Are You Paying Too Much for Your London Mortgage?

27% of homeowners with a mortgage are on their lender’s standard variable rate. Could you be one of them?

When your mortgage deal period ends, you’ll normally move onto your lender’s standard variable rate.

A standard variable rate (or SVR) is usually a lot higher than your existing rate. Currently the average is around 7.5%, and it can change at any time your lender decides.

Some lenders move you onto a ‘follow on’ rate instead, which can be even higher than their standard variable rate.

According to recent research by mortgage broker Habito, one in 10 mortgagees believe that paying a more expensive rate on their mortgage meant they’d be paying off their mortgage quicker.

It doesn’t. It simply means you’re paying the lender more interest instead.

Your lender will be able to tell you in advance what your monthly payment will be once your current deal ends.

How much more expensive is a lender’s standard variable rate?

An SVR or ‘follow on’ rate can be between 2% and 3% higher than the average five-year or two-year fixed rate mortgage.

And the lender can raise the rate at any time.

When the Bank of England increases the Base Rate (which has currently risen 13 times since December 2021) SVR and tracker rate mortgages may increase too, as they usually follow the Base Rate.

However there are exceptions. And some lenders have opted not to increase the rate on their SVR mortgages when the Base Rate has risen.

Your lender will always let you know what’s happening with your mortgage rate.

Current SVRs and fixed rate deals from major lenders

Let’s take a look at the standard variable rate and fixed rate mortgage deals currently being offered by some of the major lenders.

|

Lender |

SVR |

10-year fixed |

5-year fixed |

2-year fixed |

|

Barclays |

7.99% |

5.15% |

5.32% |

5.9% |

|

Halifax / Lloyds |

8.49% |

5.33% |

5.83% |

5.23% |

|

HSBC |

6.99% |

- |

5.61% |

6.14% |

|

Nationwide |

7.99% |

5.04% |

5.59% |

6.09% |

|

Santander |

7.75% |

- |

5.84% |

5.44% |

|

The Mortgage Works (buy to let) |

8.49% |

5.49% |

5.74% |

6.19% |

|

Virgin Money |

8.74% |

5.18% |

5.63% |

6.13% |

|

Yorkshire BS |

7.99% |

5.72% |

5.6% |

5.34% |

If you had a £200,000 mortgage spread over 25 years on a £250,000 property, you could end up paying several hundred of pounds more in interest each month on the lender’s SVR.

To cite Virgin Money’s rates above as an example:

On the standard variable rate of 8.74%, you’d be paying £1,642 a month.

At the two-year fixed rate of 6.13%, you’d be paying £1,304 a month.

With the five-year fixed rate of 5.63%, you’d be paying £1,243 a month.

And with the 10-year fixed rate of 5.18%, you’d be paying £1,190 a month.

That’s a potential difference of £452 a month, or £5,424 a year, between a lender’s standard variable rate mortgage and fixed rate deal.

Use our mortgage calculator to work out what your monthly payments could be.

Why are so many people on standard variable rate mortgages?

Habito’s research suggests many homeowners are slipping onto their lender’s SVR without even realising it or knowing that they have an alternative.

But it’s always worth contacting a broker 3-6 months before your current mortgage deal is due to end.

You can book in a new deal up to six months in advance.

And if a better rate comes up between the time you booked the deal and the time it’s due to begin, you can simply book in that rate instead.

Your mortgage broker will be the best person to advise you on what to do.

Trusted partner is Mojo Mortgages, a free online mortgage broker.

Financial concerns

One in 10 homeowners were frightened of lenders scrutinising their finances, given the current economic climate.

This is where a broker can help. They have an in-depth knowledge of the mortgage market and know the rules that different lenders operate by.

Once your broker has an understanding of your financial circumstances, they’ll know which lenders to approach on your behalf.

Unaware of mortgage alternatives

One in 10 didn’t realise it could be possible to get a cheaper mortgage deal.

A mortgage broker will scour the market for you to find the cheapest mortgage rates available to you.

Too much hassle to switch mortgages

In a recent survey by Which?, 41% of homeowners on an SVR mortgage said they’d be unlikely to switch to a cheaper deal.

They felt it ‘wasn’t worth the hassle’ or they ‘hadn’t really thought about it’.

This in part may be because homeowners with smaller mortgages are less likely to feel the financial hit when moving onto an SVR.

But when the savings can run into hundreds of pounds a month, it’s a call to a broker that’s worth making.

Fears of being in negative equity

Other homeowners were concerned that they might be in negative equity.

Negative equity is when a property you own is worth less than the mortgage you're paying on it.

What is negative equity?

Most lenders won't let people with negative equity switch to a new mortgage deal when their existing one ends. Instead, they'll normally be moved onto their standard variable rate.

You can find out if you’re in negative equity by checking the balance left on your mortgage and inviting estate agents round to value your home.

If you are in negative equity, it could still be worth speaking with a mortgage broker, as they may be able to find a lender that could help.

Mortgage rates are set to come down this autumn

In good news for homeowners and buyers, mortgage rates look set to hit their peak this summer.

Inflation is now on its way down and so are swap rates - the rates the banks pay to borrow money.

Swap rates are based on what the markets think the interest rate will be in the future.

Right now, the average mortgage rate for a 5-year fixed rate at 75% loan to value has reached 5.4%, compared to 4% in the Spring.

The reduction in swap rates will take time to feed through into mortgage rates, but our Executive Director - Research, Richard Donnell, believes they could fall below 5% this autumn.

Whether you need to remortgage now or in six months time, if your current mortgage deal is coming to an end soon, it’s well worth contacting a mortgage broker.

They will be fully up to speed on the latest mortgage market trends and current rates available.

And they are in the best place to advise you on getting the cheapest possible mortgage deal for you.

Which Properties Are Selling Best in London Right Now?

The UK property market is currently in a state of flux, with rising mortgage rates and a cost-of-living crisis putting pressure on buyers. However, there are still some properties that are selling well, especially in London.

Family-sized homes are still in demand, but buyers are looking for bargains.

In the past, 3- and 4-bedroom family homes were the most popular type of property in London. However, rising mortgage rates have made these homes more expensive, and buyers are now looking for good deals.

Flats are also selling well, especially in central London.

Flats are often seen as a more affordable option than houses, and they are also becoming more popular with investors. In central London, flats are selling at a premium, and there is a shortage of supply.

What does this mean for sellers?

If you are selling a family-sized home in London, you may need to be prepared to negotiate on price. However, if you are selling a flat, you may be able to get a good price, especially if it is in a desirable location.

Here are some tips for sellers in London:

- Get your property valued by a professional.

- Price your property competitively.

- Make sure your property is in good condition.

- Market your property widely.

The London property market is always changing, so it is important to stay up-to-date on the latest trends. If you are thinking of selling your property, it is a good idea to speak to a property expert to get advice on the current market conditions.

Here are some additional details about the UK property market:

- The average house price in the UK is currently £280,000.

- The average house price in London is currently £525,000.

- The number of house sales in the UK fell by 12% in July 2022.

- The number of house sales in London fell by 10% in July 2022.

Key takeaways

- Demand falls as higher mortgage rates prompt buyers to reassess what they can afford

- Family-sized homes are hardest hit as buyers have less money to spend on larger properties

- Flats make a comeback, gaining popularity as buyers look for more affordable options

Will mortgage rates go down in autumn 2023?

Mortgage rates are expected to peak this summer, as inflation begins to fall and swap rates - the rates banks pay to borrow money - also decline.

The last six weeks have seen mortgage rates rise quickly towards 6%, impacting both buyers and sellers in the housing market. Some buyers, cautious about taking on higher rate mortgages, have stepped back and demand has fallen by 18% in the last two months. This marks a turnaround from the first half of the year, when rates were edging towards 4% and sales increased.

What happens in the housing market for the rest of 2023 all hinges on what happens with mortgage rates. Our Executive Director - Research, Richard Donnell, says: 'Higher mortgage rates have hit home buyer demand, but the impact is not uniform across the country. Southern England is set to experience above average price falls, while some areas may not post any.'

When will mortgage rates go down?

Inflation is now coming down and is currently running at 7.9%, compared with the recent high of 11.1% in October 2022. The Bank of England has stated that it expects it to fall significantly further this year because:

- Wholesale energy prices have fallen significantly

- The price of imported goods is falling as production difficulties ease

- Reduced spending power means less demand for goods and services in the UK

That means it now looks less likely that the Bank of England will need to raise rates as much as financial markets expected just a few weeks ago.

We believe mortgage rates are likely to peak this summer, because swap rates - the rates banks pay to borrow money - have fallen by 0.6% over the last 3 weeks. Swap rates are based on what the markets think the interest rate will be in the future.

Right now, the average mortgage rate for a 5-year fixed rate at 75% loan to value has reached 5.4%, compared to 4% in the Spring. The reduction in swap rates will take time to feed through into mortgage rates, but they could fall below 5% this autumn. That said, there is a risk that mortgage rates may remain higher for longer as the Bank of England works to get inflation back down to 2%.

What does all this mean for house prices?

Higher mortgage rates are having a detrimental effect on house prices, particularly in the south of England where homes are more expensive. However, the decline in buyer demand is not as marked as that seen in the wake of the mini budget. Overall, it's running at 6% below 2019 levels. When looking at the picture year on year, demand is 40% lower than it was this time last year. That said, the number of actual sales being agreed is only 17% lower, as buyers and sellers currently in the market remain committed to moving home.

Southern England, where the average house price is over £300,000, is being hit hardest in terms of prices. House prices here are falling by up to 0.6% year-on-year. However in the Midlands, Northern England, Wales and Scotland, where properties are cheaper, the picture is brighter and homes are registering growth of over 1% year-on-year. In Scotland, homes are up 2%.

On average across the UK, house price inflation is currently running at just 0.6%, whereas this time last year it was running at 9.6%.

First-time buyers are also feeling the strain of higher mortgage rates, weakening demand at the bottom end of the housing ladder.

'Weaker buyer demand will push down prices over H2 2023,' says Donnell. 'We expect modest price falls over the coming months, with UK house prices expected to fall by up to 5% over 2023. This would mean that prices are still 15% higher than at the start of the pandemic. Even if mortgage rates fall back into the 4-5% window later this year and into 2024 H1, we expect house price growth to remain very low for the next 1-2 years.'

Key takeaways

- Mortgage rates are set to peak this summer and look likely to return to 4-5% this autumn

- However, there is a risk that rates may stay higher for longer

- Higher mortgage rates have hit buying power in the south of England hardest

The 25 locations where homes sell the fastest in July 2023

We track the speed of property sales in the UK. We can tell you where homes are selling the fastest in July 2023.

We track the speed of property sales in the UK - the time it takes from a property being listed for sale to being sold subject to contract.

Our latest analysis into how long it takes to sell a house shows that UK homes are selling in 30 days on average.

But some homeowners could expect to sell in just 21 days, depending on where you live.

With all this data to hand, we can estimate how long it’d take to sell your house. Just track your home and head to your local market stats.

Time to sell a UK home matches the 5-year average

The current average sell time of 30 days is in line with the 5-year average and one day slower than in January 2023.

The amount of time a property spends on the market is a very seasonal measure. Generally, you’ll sell more quickly in the first half of the year than the second half.

However, the current time to sell is 10 days slower than this time last year, when more people were moving after the pandemic.

Higher mortgage rates, cost-of-living pressures and lower consumer confidence have hit buyer demand, which is translating into slower sales across much of the country.

The 25 fastest locations to sell a home in the UK

With value for money now playing a much bigger role in the housing market, there’s been a great deal of change to our list in the last year.

Only 8 of last year’s fastest housing markets are still in the top 25. Demand has dropped in locations that saw fast sales - and subsequently strong price growth - in 2022.

| Local authority area | Region | Average time to sell a home (days) | 5-year average time to sell a home (days) |

|---|---|---|---|

| Eden | North West | 21 | 32 |

| Newcastle upon Tyne | North East | 21 | 28 |

| Bristol | South West | 22 | 23 |

| Carlisle | North West | 22 | 28 |

| Knowsley | North West | 22 | 24 |

| Waltham Forest | London | 22 | 22 |

| Cardiff | Wales | 23 | 25 |

| North Tyneside | North East | 23 | 30 |

| Sheffield | Yorkshire and The Humber | 23 | 25 |

| Stoke-on-Trent | West Midlands | 23 | 24 |

| Gateshead | North East | 24 | 30 |

| Halton | North West | 24 | 27 |

| Newcastle-under-Lyme | West Midlands | 24 | 25 |

| Plymouth | South West | 24 | 26 |

| South Gloucestershire | South West | 24 | 25 |

| Woking | South East | 24 | 23 |

| Allerdale | North West | 25 | 32 |

| Bexley | London | 25 | 28 |

| Birmingham | West Midlands | 25 | 25 |

| Cambridge | East of England | 25 | 30 |

| Colchester | East of England | 25 | 27 |

| Copeland | North West | 25 | 32 |

| Methyr Tydfil | Wales | 25 | 31 |

| North East Derbyshire | East Midlands | 25 | 27 |

| Salford | North West | 25 | 22 |

rolling median time to sell, April to June 2023

Sale times slow where house prices rose sharply in 2022

Fast-moving housing markets tend to see above-average house price growth, as buyers compete for fewer houses.

But now mortgage rates are higher, many of last year’s fastest markets have slowed down. Buyers are increasingly unable to afford those places where homes sold the fastest and prices rose the most.

Southern locations are particularly affected due to the higher average house prices. Dartford, Exeter, Luton and Ipswich have all fallen off the list since last July.

The Midlands is seeing the same trend with homes selling more slowly in Rugby, Worcester, Coventry and Redditch.

And it’s a similar story in the North West, with buyers now turning away from the areas they were after last year, like central Manchester, Bury, Wigan and Chorley.

Properties selling fastest in new affordable locations

Different areas have risen to the top of our fastest-markets list as buyers find more value in new locations.

In the North West, buyers are moving the fastest in parts of Cumbria, with Eden, Carlisle, Allerdale and Copeland all appearing on our list for the first time.

Three parts of Newcastle make the list this year when nowhere in the North East featured a year ago. Homes in the city centre, North Tyneside and Gateshead are selling in 21, 23 and 24 days respectively.

In the West Midlands, homeowners are selling the quickest in Stoke-on-Trent, Birmingham and Newcastle-under-Lyme.

Cardiff and Merthyr Tydfil have sale times of 23 and 25 days, replacing last year’s Welsh entries of Neath Port Talbot and Bridgend.

Bexley and Waltham Forest - both in East London - offer relative affordability for Londoners, while the commutability of Woking, Basingstoke, Colchester and Cambridge is likely contributing to their fast sale times.

East Midlands and East of England see biggest slowdown in time to sell

When we look at regional trends, the East Midlands and the East of England have seen the biggest slowdown in time to sell. Homes now take 4 and 3 more days to sell respectively than they usually would have over the last 5 years.

Meanwhile, the North East, West Midlands and South West are the only 3 regions where homes are selling more quickly than the UK average.

It takes 27 days to sell a property in the North East - 5 days quicker than its 5-year average of 32 days.

Homes in the West Midlands have a 28-day sell time. This is a little slow for this region, as its average sell time over the last 5 years was 27 days.

The South West comes in at 29 days - quicker than the UK average, but a day slower than you’d expect in the region over the last 5 years.

At the bottom end of the table, homes in London and the South East are selling the slowest. It takes 35 and 34 days on average, although these are both only one day slower than their 5-year averages.

| Region | Average time to sell a home (days) | 5-year average time to sell a home (days) |

|---|---|---|

| North East | 27 | 32 |

| West Midlands | 28 | 27 |

| South West | 29 | 28 |

| North West | 30 | 29 |

| Wales | 30 | 31 |

| Yorkshire and the Humber | 30 | 28 |

| East Midlands | 34 | 30 |

| South East | 34 | 33 |

| East of England | 35 | 32 |

| London | 35 | 34 |

rolling median time to sell, April to June 2023

How long does it take to sell a house after you’ve agreed an offer?

Our data only looks at the time it takes between a property being listed for sale and being sold subject to contract.

After that, there’s still a lot that needs to happen before you can move.

The conveyancing and mortgage application process usually takes between 3 and 4 weeks, but it might be longer - especially if you’re in a chain.

Then you’ll exchange contracts, which is when you and the buyer are both legally locked into the sale.

The day you’re really waiting for is completion day, when you hand over the keys. This usually happens 1 to 3 weeks after exchange. But like a lot of things in the home moving process, it can be quicker or slower than that.

Key takeaways

- The average time to achieve a sale in the UK is 30 days, which was also the average speed over the last 5 years

- A year ago, UK homes were selling in an average of 19 days due to greater competition among buyers

- Only 8 of last year’s fastest areas remain in this year’s top 25 locations as buyers seek value for money in different places

- The major cities where properties sell the fastest are Newcastle, Bristol and Cardiff

- The North East of England is the fastest moving region in the country with homes selling in 27 days on average

The Best Upcoming Events in London in July 2023

The Best of London in July 2023: Your Ultimate Guide to Events and Things to Do.

July is a great time to be in London. The weather is warm and sunny, the city's parks are lush and green, and there are plenty of exciting events happening.

1. The BBC Proms is back with a whole load of classical treats

☆ Music, ☆ South Kensington, ☆

☆ Music, ☆ South Kensington, ☆

Another year, another spectacular line-up of classical music, kicking off with a series of Nordic music and a world premiere from Ukrainian composer, Bohdana Frolyak on July 14, and waving us off in the traditional flurry of Union Jacks and bow ties on September 9. In 2023 the BBC Proms will be treating us to a huge range of programming featuring composers and orchestras from Berlioz to Bollywood, large scale symphonic and choral work, as well as intimate chamber concerts and exciting debuts. Look out for big classical hitters like Sir Stephen Hough, Sir Simon Rattle and Chineke! orchestra as well as more off-the-wall editions like orchestral collaborations with non-classical artists, including Rufus Wainwright, Self Esteem and Jon Hopkins, the first Bollywood Prom, Northern Soul Prom and the first concert featuring fado with Portuguese singer Mariza. For little ones, the Horrible Histories present ‘Orrible Opera, while unusual experiences for young and old include a late night Moon and Stars Prom and the Fantasy, Myths and Legends Prom featuring music from film, TV and gaming. Booking ahead is recommended.

2. Head to London Zoo after dark" with "Embark on a unique adults-only adventure

☆ Zoo Nights are back for 2023!

A reincarnation of Zoo Lates (which ended in 2015), Zoo Nights brings ‘after hours’ fun to ZSL London Zoo. Explore the zoo without crowds or kids in the way (this is an adults only experience), hear the Birds and The Bees guided tour where expert guides reveal what animals get up to after dark, play animal-themed games, graze on delicious international street food (there’s plenty for herbivores and carnivores alike) or grab a drink at one of the bars. Time to unpack that elephant onsie?

Highlights

- See the zoo without the kids or the crowds!

- Animal-themed games

- Street food and bars also available

- Get tickets now for just £19.50

When and where?

Fridays, June 9 until July 28 from 6 pm at London Zoo

Need to know

- This is valid for a ticket to Zoo Nights at London Zoo.

- This event is restricted to those aged 18 and over.

- This booking is only valid for your selected date/time option.

- Arrival from 6 pm, last entry at 9 pm, event ends at 10 pm.

- Please note the majority of the animal exhibits will close at 9 pm, with some exceptions closing at 9.30 pm.

- *Additional charges apply for the Birds and The Bees guided tour.

- Please present your booking confirmation upon arrival.

- Location: Outer Circle, Regent’s Park, London NW1 4RY.

- This ticket cannot be cancelled, amended, exchanged, refunded or used in conjunction with any other offer.

3. Immerse yourself in the excitement of Wimbledon on a giant screen

☆ Things to do

Missed out on tickets in the Wimbledon Tennis Championships ballot? Can’t face camping out on the street for day tickets? No problem. London is a city that gives back and this summer it will be peppered with big screens showing all the Murray Mound (okay, Henman Hill) action in so much blown-up high-res glory that you might as well be court-side.

This year the tournament (which started in 1877!) runs from Monday 3rd July 2023 to Sunday 16th July 2023 and you’ll catch screens across the capital showing most matches on each day of the event, so there are plenty of opportunities to spend an afternoon or evening in a sweet viewing spot.

There will be more big screens announced nearer the time, many of which will also have extras such as special edition cocktails, food offers and even pop-up tennis coaching. Take that Centre Court.

4. Ballie Ballerson: The ultimate adult playground for kidults

Highlights

- Ticket includes all-night entry, two-hour ball pit session and a cocktail

- Ball pits, dance floor & more

- Just £6!

Need to know

- This voucher is valid for a two-hour ball pit session, all-night bar entry and 1 signature cocktail at Ballie Ballerson.

- Availability: Sunday, Tuesday, Wednesday and Thursday from 6 pm until close.

- Please present your Time Out booking confirmation to the door team upon arrival to claim your cocktail.

- To book your ball pit session, select your preferred time slot and enter the unique voucher code from your Time Out booking confirmation, here.

- Voucher must be purchased and ball pit session booked before entry to the venue.

- Voucher valid until 30 September 2023.

- This offer is restricted to those aged 18 and over. Valid ID is required for entry.

- Offer not valid on student nights.

- Ballie Ballerson reserves the right to offer another cocktail choice of the same value if necessary.

- Location: 97-113 Curtain Road, London EC2A 3BS.

- This voucher cannot be cancelled, amended, exchanged, refunded or used in conjunction with any other offer. For full terms and conditions, please see here.

5. Sit down and tuck into a grand Italian feast at the Museum of the Home

☆ Things to do, ☆ Food and drink events ☆ Hoxton, ☆

Think of your dream dinner party... then dial that vision up to 11 because mightly quaffable Italian beer Birrificio Angelo Poretti is offering Londoners a seat at it’s very own summer banquet and you can expect something straight out of your tablescaped dreams. Poretti has teamed up with Insta famous Mob Kitchen for the feast with recipe developer Jordon Ezra King creating an authentic three-course Italian menu that pairs perfectly with, you guessed it, ice-cold carafes of Poretti beer.

The beautiful Museum of the Home in Hackney will be hosting a huge banqueting table where 100 guests will sit down and tuck in over three sittings (12.30pm-2.30pm; 4pm-6pm; 7.30pm-9.30pm). Expect dishes you’ll want to photograph for posterity, the chance to chat to new people and decorations that’ll transport you straight to northern Italy. Bellissimo.

Buy Ticket

Which areas are experiencing an increase in house prices?

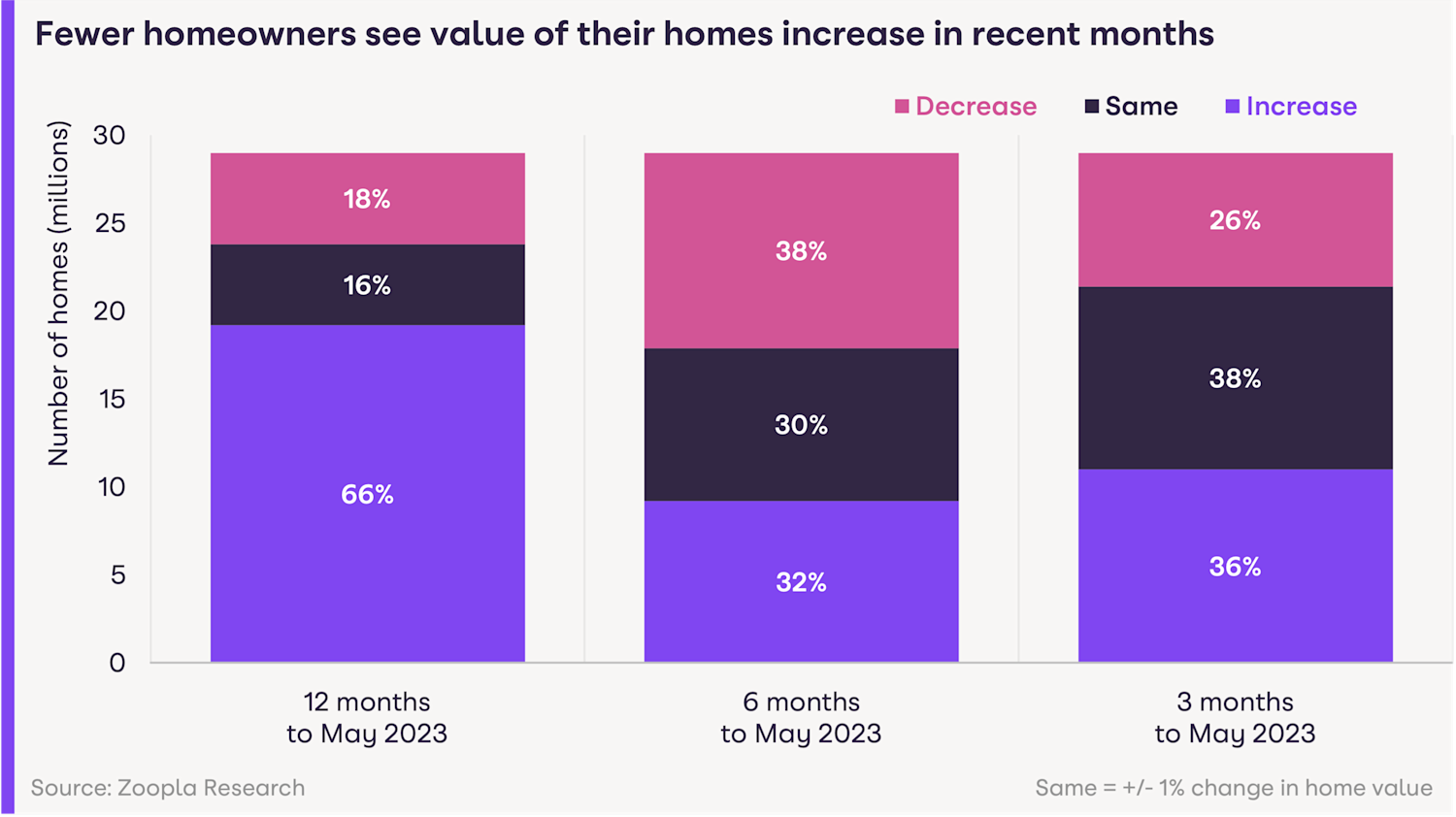

With two-thirds of homes experiencing a rise in value over the past year, is it possible that yours is among them?

we track the value of 30 million homes, updating our estimates every month.

Our latest analysis shows that the value of UK housing remains healthier than many may have anticipated.

In the last year, 2 out of every 3 homeowners saw the value of their home increase by at least 1%.

It’s a piece of positive news for many homeowners and sellers, who may have anticipated a different outcome.

However, house prices are now rising at a very slow pace - and some homes are posting small price falls.

Executive Director - Research, says: ‘Homeowners thinking about moving will be reading the news headlines but national averages can be dangerous when making decisions on your own home.

‘The reality is that market conditions can vary widely by local area and property type.’

Home values hold steady

From February 2020 to June 2022, the average UK home increased in value by an almost unprecedented £48 per day, adding around £36,000 to the overall value on average.

But the last 12 months tell a different story.

The average UK home has since increased by £19 per day, adding around £7,000 on average.

While our latest analysis shows 2 in every 3 homes increased in value by at least 1% over the last year, when looking at the last 6 months, this slows to just 1 in 3.

And falling values are increasing, with 1 in 4 homeowners experiencing a value loss of £7,700 (around 2.6%).

This shows that the impact of weaker demand is now affecting house prices.

Why aren’t house prices rising much any more?

Since the middle of last year, the economic backdrop has become more challenging, impacting housing value growth.

Tripling mortgage rates over the last 18 months and cost-of-living pressures are adding to the squeeze on household budgets, leading to weaker demand for homes.

That means the huge growth in house prices we saw over the pandemic years has now stalled and property prices are rising very slowly.

With anticipated price corrections, we expect more homeowners to see either more limited gains or modest decreases in their home values over the coming months.

Where are homes going up in value in the UK?

The impact of recent value changes will be felt differently across the country.

In northern England, the Midlands and Wales, 4 in 10 homeowners saw the value of their homes grow since November 2022.

Yorkshire and the Humber has four postal areas in the top 10 regions where values are up: Halifax (67%), Wakefield (65%), Huddersfield (59%) and Bradford (52%).

Top 10 regions where house prices are rising

| Postal area | Region | Proportion of homes with value increase since Nov 2022 | Number of homes increasing in value |

|---|---|---|---|

| Halifax | Yorkshire & The Humber | 67% | 40,000 |

| Derby | East Midlands | 65% | 1,734,000 |

| Wakefield | Yorkshire & The Humber | 65% | 126,000 |

| Huddersfield | Yorkshire & The Humber | 59% | 55,000 |

| Wolverhampton | West Midlands | 57% | 75,000 |

| Dorchester | South East | 56% | 46,000 |

| Chester | North West | 54% | 129,000 |

| Galashiels | Scotland | 53% | 16,000 |

| Hereford | West Midlands | 52% | 32,000 |

| Carlisle | North West | 52% | 62,000 |

| Bradford | Yorkshire & The Humber | 52% | 104,000 |

Zoopla

However it’s a different picture in southern England, Scotland and Northern Ireland, where only 1 in 4 homes has increased in value (3.1million).

In London, the South East and Eastern regions, 1 in 5 homes has increased in value.

That’s because property values in the south are higher, often exceeding £300,000, which means people need bigger mortgages to buy them.

With mortgage rates currently high buyers are wary, reducing demand for these more expensive homes.

From the South, only Dorchester makes our top 10, where 46,000 homes have increased in value since November 2022.

And homeowners holding off their next move until they grow more equity are unlikely to see meaningful additions in the coming months.

What types of homes are holding their value?

As cost-of-living pressures intensify, many buyers are looking for more affordable properties.

Smaller homes - terraced houses, semi-detached homes and apartments - are keeping their values better than the more expensive detached houses and bungalows.

But location is key.

Semis in Yorkshire, where 4 in every 5 homes have held or increased their value, are doing better than elsewhere in the UK.

In Scotland, only 50% of semi-detached homes have held or increased their value.

Flats are also holding up more than detached houses or bungalows, especially in the affordable markets that attract value-conscious buyers.

In Darlington, Lincoln and Wolverhampton, only 1 in 14 flats has lost any value.

Terraced homes are also holding their own, with more than 64% holding or gaining value since November 2022, especially in cities like Manchester, Leeds, Birmingham and Bristol.

However, the larger homes which became so popular during the pandemic: spacious detached houses, 4-bed homes and bungalows, are now less appealing to buyers, as they become more value-conscious in the face of rising mortgage rates and cost of living pressures.

And prices are adapting accordingly. More than 43% of detached houses and 42% of bungalows have lost 1% of their value in the last 6 months.

Coastal areas like Brighton, Norfolk and Southend-on-Sea are feeling the pinch, where 7 in 10 bungalows are losing value.

Sellers with bigger homes should be prepared for buyers wanting to negotiate harder on the prices.

That said, given the strong value gains these homes experienced during the pandemic, the growth in equity achieved may soften the impact of price reductions without limiting budgets for the next move.

Conclusion

What’s happening in the UK housing market is quite complex at the moment.

Home values are moving in different directions within different local contexts.

The state of the local economy, facilities in the area and differences in the types of homes available will continue to influence home values.

Key takeaways

- The average UK home has gone up £19 a day in value over the last 12 months, an annual increase of £7,000

- A third (9.2million) of UK homes saw their value increase in the last 6 months

- A further third of homes held their value

Properties Experiencing Significant Value Decline in June 2023

Introducing our "Value of Housing" report, which meticulously monitors the value fluctuations of 29 million homes across the UK. In the latest update for June 2023, we bring attention to the specific types of properties and locations that have experienced a decline in value.

More than a third of UK homes have lost value in the last 6 months, wiping £85 million from the housing market.

That’s 11.1 million properties that are less expensive than they were last November, each losing an average of £7,700.

But UK homes are split almost equally between those gaining value (32%), those seeing no real change (30%) and those losing value (38%) over the last six months.

So what types of properties are losing the most value? Are detached houses finally better value for money?

And where exactly should you look if you want to get a bargain?

We’ve got all the answers for you, whether you’re looking to buy your first house or your forever home.

After all, we track the value of 29 million homes in the UK - even if they’re not on the market.

So let’s see what type of property you should set your sights on - and which locations - to benefit from the latest shift in the UK housing market.

Which kinds of properties are losing value in June 2023?

The search for space has well and truly dwindled, and more larger homes are losing value than smaller ones in the UK.

Over the last 12 months, buyers have been scaling back their home requirements as the economics of buying a home have become more challenging.

It’s in stark contrast to 2020 to 2022, when extra space became the top need for buyers and high demand for larger properties boosted their value growth.

If you want to upsize from a smaller home, flat or terraced house, your current home should hold its value and you’re more likely to get money off a larger home.

43% of detached houses have fallen more than 1% value

Detached houses are losing value more than any other property type in the UK, with 43% losing at least 1% in the last 6 months.

Detached homes with falling values are most common in the St Albans, Perth and Worcester areas, where they make a 9 in 10 of such homes.

7 in 10 bungalows fall in value in the last 6 months

Bungalows account for 8% of all UK homes and 7 in 10 bungalows have recorded a fall in prices since November 2022.

Coastal areas such as Brighton, Norfolk and Southend-on-Sea are seeing the most hits to bungalow prices.

Homes losing value in the South of England, Northern Ireland and Scotland

In some respects, home values are more about where you want to buy a home, rather than what sort of house you want to live in.

The South of England, Northern Ireland or Scotland have the highest proportions of homes losing value, giving buyers the opportunity to buy at a lower price in these locations.

On the other hand, the most homes are rising in value in Northern England, Wales and the Midlands.

The top 10 locations where homes are losing value

While some regions are faring better than others, there’s a lot of complexity in the current UK housing market.

Home values move in different directions within different local contexts, such as the state of the local economy, local facilities and types of homes.

For example, West Central London is seeing a huge 68% of its homes lose value, with an average fall of £13,000 since November 2022.

One key trend we’re seeing is a fall in property values in coastal locations in the South of England.

| Postcode area | Region | Proportion of homes with value decrease since November 2022 | Number of homes decreasing in value |

|---|---|---|---|

| West Central London (WC) | London | 68% | 7,000 |

| Colchester (CO) | East of England | 67% | 109,000 |

| Canterbury (CT) | South East | 66% | 28,000 |

| Kilmarnock (KA) | Scotland | 65% | 19,000 |

| Norwich (NR) | East of England | 64% | 33,000 |

| Brighton (BN) | South East | 63% | 35,000 |

| Southend-on-Sea (SS) | East of England | 62% | 24,000 |

| Torquay (TQ) | South West | 59% | 25,000 |

| Truro (TR) | South West | 59% | 27,000 |

| Blackpool (FY) | North West | 58% | 21,000 |

Value of Housing Report - June 2023, Zoopla

67% of properties in Colchester (109,000 homes) have lost value by more than 1% in the last 6 months, while 66% have fallen in value in Canterbury.

Many homes in Norwich and Southend-on-Sea have also lost value - 64% and 62% respectively - while 63% of Brighton properties have lost value since November 2022.

Torquay and Truro in the South West also make the list, with 59% of homes in these areas declining in value over the last 6 months.

Buying a home that’s falling in value: what to think about

Your first thought when you see that home values are falling might be that it’s a good time to buy and get a bargain.

This is true to an extent, but you’ll also need to consider any potential for negative equity, as well as the fact that you’re likely to pay a higher mortgage rate now.

Negative equity unlikely with 5% house price falls this year

Our data suggests that house prices will fall by 5% over the course of 2023.

That means you’re unlikely to move into negative equity if you were to buy today - as long as your loan-to-value ratio is lower than 95%.

However, it’s worth knowing that the years of strong price growth are behind us.

It’s always best to buy your next home based on your personal needs and circumstances, rather than looking to make gains or play the market.

A high fixed rate might be worth a lower property price

Higher mortgage rates might be limiting your move right now, and understandably so.

Our recent analysis showed that buying power is hit by up to 20% with a 6% mortgage rate compared to a 4% one - which is putting a strain on home buyers despite falling house prices.

Our mortgage calculator can help you work out how your monthly repayments are impacted by a higher mortgage rate.

Adrian Anderson from property finance specialists Anderson Harris says a high fixed rate mortgage may be worth it now prices are falling, if you’re sure you can afford it.

“It’s usually better to purchase a property at a lower purchase price with a more expensive mortgage in the short term, than pay a higher price for a property and a cheaper mortgage in the short term.”

Always talk to a specialist mortgage advisor to understand the best option for you.

Look for value-adding potential to buck the trend

One way to offset potential price falls for a home you buy is to consider its value-adding potential.

By renovating a doer-upper, you can buy for a lower price and look to increase your return when you sell.

Key takeaways

- Over the last 6 months, 11.1 million or a third of UK homes have decreased in value by at least 1%

- Larger detached homes and bungalows are more likely to be falling in value than any other property type

- Some coastal areas in the South of England are seeing more than 65% of their homes lose value

- Across UK regions, home values are falling the most in the South of England, Scotland and Northern Ireland

- If you want to buy a home that’s dropping in value, think about the risk of negative equity and the impact of higher mortgage rates

The future of energy efficient homes

Our homes are the second-highest producers of carbon every year in the UK. New-build developers want to change that. Here's how.

From avoiding single-use plastic to upgrading to an all-electric car, as a nation we’re becoming increasing environmentally conscious – even when considering a house move.

Research continually shows that buyers are prioritising the energy performance of new homes, but what about carbon emissions?

All buildings in the UK are the second highest carbon emissions contributor, with residential properties making up a large proportion of this.

However, the country’s home builders are taking action to produce increasingly ‘green’ homes, powered by less energy to help reduce the UK’s carbon emissions and save household running costs.

Our Watt a Save July 2023 report finds the average new-build property consumes 55% less energy, cutting energy bills by £135 a month and reducing carbon emissions by an impressive 60%.

This is despite new-build homes being larger than older properties.

With 247,000 new-build homes issued with an EPC in the year to 31 March 2023, we can see that last year’s new-build homeowners helped to reduce emissions by a collective 500,000 tonnes, compared to if they had been built to the same standards as the average older property.

Why are new builds better for the environment?

New-builds have long offered a cheaper and more environmentally option for the running of a home.

Improved energy efficiency is embedded from the point of design through to construction, thanks to the use of modern building practices, technologies and materials.

Energy usage and carbon emissions: new-builds vs traditional homes

| Property type | Energy usage (kWh) | Bills | Carbon emissions (tonnes) |

|---|---|---|---|

| New-build | 9,400 | £1,320 | 1.4 |

| Existing | 21,000 | £2,950 | 3.6 |

| Saving | 11,600 | £1,630 | 2.2 |

| % Saving | 55% | 55% | 60% |

Home Builders Federation

Additionally, more rigorous building standards exist now than ever before.

Last year, changes to building regulations were introduced to set standards specifically related to the energy performance of buildings.

Our research has found that homes now built to these standards will emit 71% less carbon than the average older property.

And the energy savings and carbon reductions won’t stop there.

In 2025, the Future Homes Standard is due to come into force which will require new homes to reduce carbon emissions by a further 75% to 80% on current building regulations.

This will partly be achieved by moving away from the use of conventional gas boilers to modern heating systems, like heat pumps.

In other words, homes built from 2023 will emit 29% of the amount of carbon of the average existing property, and homes built from 2025 will emit just 10%.

If we assume that housing delivery levels in 2025 are around the same as current levels, under the Future Homes Standard, the changes to new homes will see carbon emissions reduced by a further 270,000 tonnes per year.

What does this mean for home buyers?

In recent years, a high EPC rating has crept up the lists of priorities for prospective buyers – particularly those purchasing their first home.

Amid the cost-of-living pressures and with energy bills still stubbornly high, potential customers are also driven by the running costs of a home.

Research we published earlier this year found that 53% of respondents agree that lower utility bills and running costs would encourage them to buy a new home.

The reduction in carbon emissions that new build homes offer come from consistent improvements to the energy efficiency of homes.

In the year to March 2023, 85% of new-build homes were rated A or B for energy performance, while just 4% of existing properties reached the same standards.

Unsurprisingly, this improved energy performance translates to significantly lower utility bills.

In the year to March 2023, the average older property saw monthly energy bills of around £245, while the average new-build energy costs were £110 – a 55% saving.

And as we move towards greener homes, these savings will only become greater. Under the Future Homes Standard mentioned above, a new-build property will use 12% of the amount of energy compared to an older home.

Despite future new homes being 100% electric – which is a more expensive source of energy than gas – it’s anticipated a new-build property built after 2025 will cost a little less than £900-a-year to power.

This is just 30% of the cost of the average existing property which, using a mix of electricity and gas, will cost £2,945 a year.

What next?

As you might know if you are in the process of applying for a mortgage, the affordability criteria are somewhat inflexible.

So, despite the enormous potential savings of high performing energy and thermal-efficient homes, affordability assessments are based on the same assumptions about monthly utility costs. That needs to change.

We’re trying to encourage lenders to develop mortgage products that offer tangible, financial incentives for home buyers to make environmentally conscious, energy-saving choices. Which will in turn support more people to get on that property ladder and become homeowners.

In the meantime, this year’s new homeowners can enjoy lower energy usage, reduced carbon emissions, cheaper energy bills and less eco-guilt so they can get on with living. Sounds ideal to me.

Key takeaways

- New homes built from 2023 will emit 29% of the amount of carbon of the average existing property

- Homes built from 2025 will emit just 10%

- From 2025, the energy bills for a new-build home are projected to be under £900-a-year, compared to £2,945-a-year for an older home

Interest Rates Soar to a 15-Year Peak of 5%

Bank of England's Latest Rate Hike Raises Monthly Repayments by £60 for Homeowners with a £200,000 Variable Mortgage.

The Bank of England has increased interest rates by 0.5% to 5% as it continues to battle high inflation.

It was the 13th consecutive meeting at which the Monetary Policy Committee (MPC) has hiked the official cost of borrowing, with the Bank Rate now standing at a new 15-year high.

The latest increase adds a further £60 a month to repayments for homeowners with a £200,000 variable mortgage.

People with variable rate mortgages have now seen their mortgage costs jump by £566 a month since the MPC first started to raise interest rates from their record low of 0.1% in December 2021.

An estimated 850,000 homeowners have a tracker mortgage, and 1.1 million are on their lender’s standard variable rate – both of which move up and down in line with changes made to the Bank Rate.

Meanwhile an estimated 1.4 million homeowners who have fixed rate deals that expire this year will also face significantly higher rates than when they previously remortgaged.

The MPC had been expected to increase the Bank Rate by 0.25% 22 June 2023, but figures released 21 June 2023 showed that core inflation was still rising surprised markets, prompting economists to predict it would impose a larger hike.

Why is this happening?

The MPC has been increasing interest rates since the end of 2021 in a bid to bring inflation back down to its 2% target.

But the most recent figures showed that core inflation, which excludes volatile categories such as food and energy, increased to 7.1% during May, while headline Consumer Prices Inflation stalled at 8.7%, after edging down the previous month.

The figures suggest inflation in the UK has now become entrenched and is being driven by internal factors, such as wage increases, rather than external factors, such as the conflict in Ukraine.

As a result, it will be harder to bring down and interest rates are expected to have to rise further than previously thought, with economists now predicting they could peak at 6%.

But there was some good news, with the MPC continuing to say it expects inflation to “fall significantly further” during the rest of the year, and markets expecting it to begin cutting interest rates by the middle of 2024.

While today’s higher than expected interest rate rise may have come as a shock, it is important to remember that if the Bank Rate does peak at 6%, this is only slightly higher than the 5.5% to 5.75% markets had previously pencilled in.

What does this mean for mortgages?

For those on variable rate mortgages, such as tracker deals and standard variable rates (SVR), today’s increase will mean their mortgage rate will also rise by 0.25%.

People on fixed rate deals will be protected from the latest hike until they come to remortgage, as fixed rates remain the same for the entire product term.

The mortgage market has already been responding to higher than expected inflation, with lenders withdrawing nearly 400 products for repricing during the past month.

This recent large-scale repricing means much of the bad news has already been factored in, with rates edging up only slightly more today, to stand at 6.19% for two-year fixed rate mortgages 5.81% for five-year ones.

Even so, people coming to the end of fixed rate deals are likely to face significant payment shock when they come to remortgage.

Rates averaged 2.59% and 2.92% when people coming to the end of two-year and five-year deals respectively took out their loan.

What should I do if I need to remortgage?

If you need to remortgage, it is probably worth considering using a mortgage broker to help you navigate the current market, which is changing very quickly.

While five-year fixed rate mortgages currently have lower interest rates than two-year ones, it might still be worth opting for the latter, as mortgage rates are currently elevated and interest rates are still expected to start falling next year.

If you take out a five-year deal, you will be locking into these higher rates for a five-year period, whereas if you opt for a two year one, you will have the opportunity to remortgage in two years’ time, by which point rates are expected to be lower.

Whatever rate you decide to go on to, with standard variable rates – the rate you are automatically moved to once your current mortgage deal expires – currently averaging 7.52%, you should try to line up your next deal before your current one ends.

What should I do if I’m struggling to pay my mortgage?

If you are struggling with your mortgage payments, there are two main ways you can make them more affordable.

The first is to increase your mortgage term.

For example, monthly repayments on a £200,000 mortgage on a fixed rate of 6% are £1,450 if you are repaying it over 20 years, but fall to £1,210 if you increase the term to 30 years.

They fall even further to £1,150 if you repay the mortgage over 35 years.

If you do decide to go down this route, it is important to understand that although it will reduce your monthly repayments in the short term, you will end up paying a lot more interest over the entire life of your mortgage.

The second option is to talk to your lender about being put on to an interest-only mortgage for a period of time.

Only paying interest significantly reduces your monthly payments, although it does mean that the amount you owe is not being reduced, so you will need to resume full repayments at some point.

For example, if you have a £200,000 mortgage on a fixed rate of 6%, monthly repayments would be £1,304 on a repayment basis, but £1,000 on an interest-only one.

If you are really struggling, you can ask your lender for a short-term payment holiday. This enables you to take a break from making repayments, with the interest portion of your monthly payment added to your outstanding mortgage debt.

If you think you may run into difficulties, it is important to contact your lender as soon as possible.

Chancellor Jeremy Hunt yesterday said he would ensure that banks were living up to the commitments they made to the government in December to help borrowers who got into difficulties.

At the time, lenders agreed to be more flexible in the way they approached borrowers impacted by the cost-of-living squeeze.

Alongside offering tailored support to those in difficulties, they also agreed to enable customers who were up to date with their payments to switch to a new mortgage deal without having to do another affordability test.

In addition, they pledged to ensure highly trained and experienced staff were on hand to help customers when needed.

Key takeaways

- The Bank of England has increased interest rates by 0.5% to 5% as it continues to battle high inflation

- It was the 13th consecutive meeting at which the Monetary Policy Committee (MPC) has hiked the official cost of borrowing

- The latest increase adds a further £60 a month to repayments for homeowners with a £200,000 variable mortgage

Mortgage Update: Current Trends and Developments in June 2023

Navigating the Mortgage Market Turmoil: Understanding the Causes and Exploring Options for Buyers and Homeowners

The latest inflation figures have spooked the financial markets, causing mortgage lenders to withdraw many of their deals for repricing.

Banks and building societies have pulled nearly 400 deals from the market in the past month, with some temporarily withdrawing their entire ranges.

We take a look at what’s happening in the mortgage market and what you should do if you need to remortgage.

Why are lenders withdrawing deals?

There are two different types of mortgage, fixed rate ones and variable rate ones.

The cost at which lenders borrow money for variable rate products is based on the Bank of England Bank Rate. When this goes up, so does the cost of variable rate mortgages, such as tracker deals.

Lenders’ borrowing costs for fixed rate mortgages are more complicated. These deals are based on so-called Swap rates – which is the rate at which lenders borrow money for a set period of time, such as two years or five years.

The cost of Swap rates are based on a number of different factors, including government borrowing costs and predictions on what the Bank Rate will be in future.

Swap rates shot up in the wake of the mini-Budget in September because government borrowing costs increased after financial markets lost confidence in the government’s plans for the economy.

This time around, Swap rates are increasing because inflation remains stubbornly high.

The Bank of England’s Monetary Policy Committee (MPC) has increased interest rates from a record low of 0.1% to 5% in a bid to lower inflation, but so far, these rate rises have had little impact.

The latest inflation figures, which showed that overall inflation was falling slower than expected and core inflation was actually increasing, has spooked markets.

Economists had previously predicted the Bank Rate would peak at 4.5%, but with inflation still remaining high, they now expect it to rise to 5.25% or 5.5%, with some predicting it could go as high as 6%.

These expectations have sent Swap rates higher, meaning lenders are withdrawing their fixed rate mortgage deals so that they can reprice them to reflect their own higher borrowing costs.

If you're looking to secure a new mortgage, the best thing you can do right now is to speak with a mortgage broker, who can help you to find the best deals out there.

What mortgage deals are being pulled in June 2023?

The number of different mortgage deals available has fallen by 387 products since the middle of May.

The majority of mortgages that have been withdrawn are fixed rate products, due to the recent increases in Swap rates.

In fact, the number of variable rate mortgages available has actually increased for some deposit bands.

Deals have been withdrawn across all deposit ranges, although products for people with smaller deposits have been less affected.

Lenders offer their most competitive deals to people with large deposits or equity stakes in their property and it is this part of the market that has borne the brunt of the withdrawals for repricing.

Around 100 fixed rate mortgages have been taken off the market in the past month for people with 40% to put down – the equivalent of 17% of all deals in this space.

A similar number of products have been withdrawn for both those looking to borrow 75% of their home’s value and those looking to borrow 80%.

Product withdrawals have been made by all types of lender, from large high street banks to smaller, regional building societies, as they all review the cost of their deals.

What mortgage deals are still available?

While headlines stating that mortgage choice has shrunk and some lenders have pulled their entire ranges may appear alarming, it is important to keep the situation in context.

There are still a total of nearly 5,000 different mortgage products available.

Unlike during the global financial crisis and the early stage of the Covid-19 pandemic, when lenders pulled products for people with only small deposits, mortgages remain available at all deposit levels – there is just a little less choice than previously.

The current round of withdrawals has been caused by lenders facing higher borrowing costs, so it is quite different to the liquidity issues seen during the global financial crisis and their reduced appetite for risk at the start of the pandemic.

As a result, lenders who have withdrawn their products are expected to return to the market, just charging slightly higher interest rates.

Are fixed rate deals still available?

While fixed rate deals have borne the brunt of the withdrawals, they are still very much available.

In fact, around two-thirds of all mortgages currently on the market are fixed rate ones.

The number of fixed rate mortgages on offer is expected to increase in the coming days as lenders who withdrew their products for repricing, relaunch them.

Can you still get a mortgage with a small deposit?

Mortgages for people with small deposits have been less impacted than other areas of the market.

There are currently 612 different products to choose from for people with only a 10% deposit, down from 682 a month earlier, and 218 for those with only 5%, compared with 242 in mid-May.

To put this into context, in the early stages of the pandemic, there were just 16 mortgages available for people with a 5% deposit and 75 for those with 10% to put down.

Although the latest data from the Bank of England signals that lenders are becoming more cautious, they seem to be cutting back on lending to people borrowing high multiples of their income, rather than those with smaller deposits.

It is also worth noting that the number of small deposit mortgages available has actually risen since the first week of June.

How much are mortgage rates rising by?

The average cost of a two-year fixed rate mortgage across all deposit levels is currently 6.01%, up from 5.3% at the beginning of May – an increase of 0.71%.

Five-year fixed rate mortgages have increased by broadly the same amount, rising to 5.67% from 4.97%.

The steepest increases have been seen for those borrowing 75% of their home’s value, with average two-year mortgage rates in this sector of the market rising by 0.89%.

But it is important to remember that these rates are averages and there are more competitive deals available if you shop around.

For example, there are still a number of two and five-year fixed rate products available with interest of around 4.5% or less.

Are mortgage rates likely to come down again soon?

The market is in a state of turmoil at the moment, and it is difficult to know how long this will last.

It is worth noting that when mortgage rates last shot up in the wake of the mini-Budget, it took a couple of months for the market to stabilise and rates to start falling again.

If the next set of inflation figures are more positive, markets may decide interest rates do not need to increase by as much as they previously thought, and mortgage rates could start to come down.

Even if the MPC does continue to increase the Bank Rate to combat inflation, most economists currently expect it to start cutting it again in 2024.

Can a lender withdraw an offer?

If you accepted a mortgage offer from a lender before the current turmoil started, you may be concerned they will now withdraw it.

While in theory lenders can withdraw mortgage offers, in practice this only tends to happen if the borrower’s circumstances change, or they cannot complete on the mortgage before the offer period expires, or issues with their property are uncovered.

Lenders tend not to withdraw fixed rate mortgage offers due to increased financing costs, as the offer is typically based on funding they already have in place.

What should I do if I need to remortgage?

If you need to remortgage in the near future, the current turmoil in the mortgage market is likely to be particularly stressful.

With things changing very quickly, it is probably worth considering using a mortgage broker to help you navigate the market.

Get an expert mortgage recommendation.

While five-year fixed rate mortgages currently have lower interest rates than two-year ones, it might still be worth opting for the latter.

Mortgage rates are currently elevated and interest rates are expected to start falling next year.

If you take out a five-year deal, you will be locking into these rates for a five-year period, whereas if you opt for a two year one, you will have the opportunity to remortgage in two years’ time, by which point rates are expected to have fallen again.

But with the average standard variable rate – the rate you are automatically moved to once your current mortgage deal expires – currently charging more than 7%, you should think about lining up your next mortgage before your existing one ends.

Key takeaways

- Lenders have withdrawn nearly 400 products since the middle of May. But to put this in perspective, there are still 5,000 deals available

- Deals have been withdrawn for repricing due to expectations that interest rates will rise more than previously thought

- However, there are still a number of two and five-year fixed rate products available with interest of around 4.5% or less

- Despite the situation, lenders are continuing to offer mortgages to people with only small deposits