The UK’s cheapest places to rent a home in 2024

Looking for a rental home that doesn’t cost an arm and a leg? Here’s your complete guide to the cheapest places to rent in the UK in 2024.

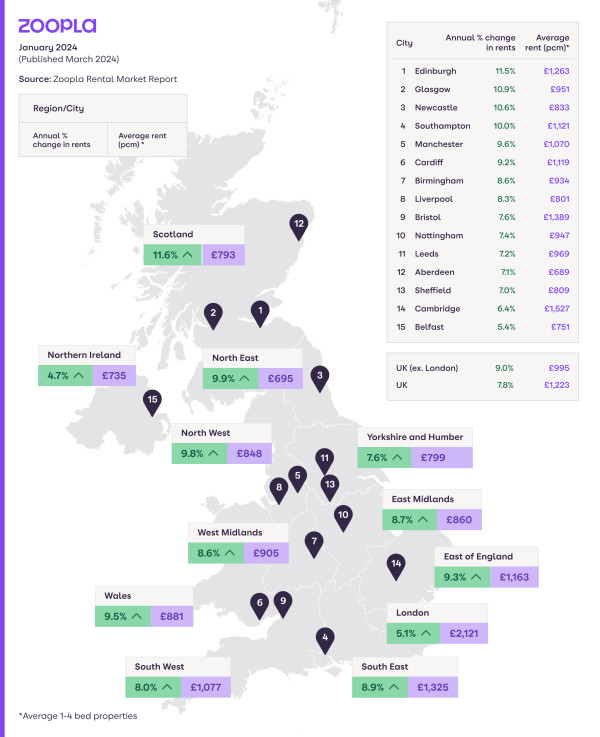

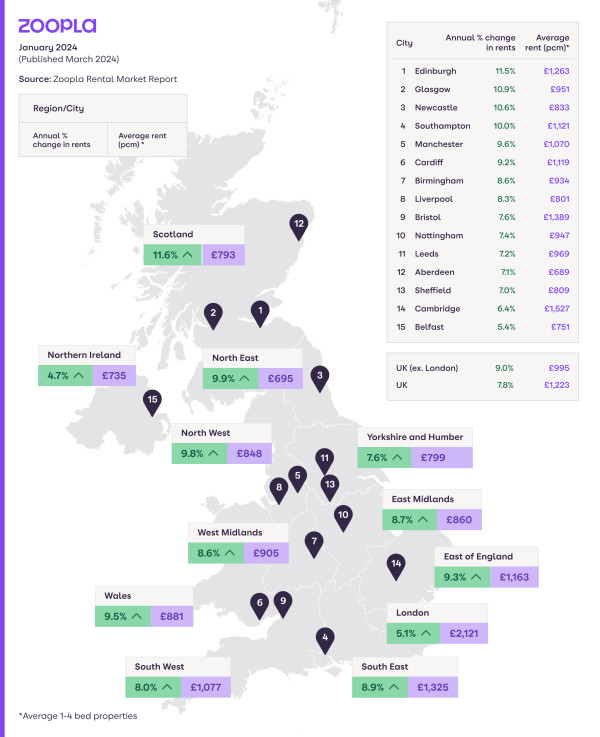

The UK’s average rent is now £1,223, a rise of +7.8% in the last year.

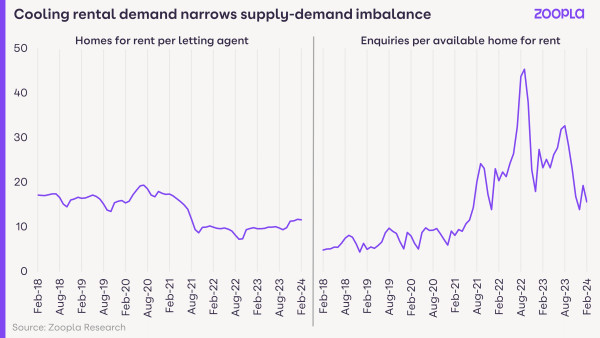

That’s the lowest level of rent rises for 2 years as the heat finally comes out of the rental market. Demand has dropped a fifth in a year and supply has risen by a fifth in the same period.

However, we still expect rents to rise in 2024, although a little more slowly. This is because rental demand is double the rate of before the pandemic, with 15 enquiries for every home to rent. At the same time, supply of rental homes remains 28% below the pre-pandemic average.

So with rents still rising and the cost-of-living squeeze pushing all our purses to the limit, you might be looking for a cheaper home to rent.

The good news is there are places where it’s much cheaper to rent a home than others. Let’s take a look at the regions, cities and local areas with the cheapest rents in the UK.

The cheapest places to rent in 2024: Regions

For the cheapest rents in the country, set your sights on the North East - you could expect to spend an average of £695 per month on rent here. It’s also the only region with no rental markets averaging more than £1,000 per month.

Northern Ireland, Scotland, Yorkshire and the Humber, and the North West all sit at the cheaper end of the scale too, with rents averaging less than £800 per month at the start of 2024.

As you may expect, rents across the South of England are much more expensive.

London’s average rent of £2,121 per month makes it almost twice as pricey as anywhere else. However, London renters will be glad to hear it has recorded the sharpest slowdown in rent rises, now at +5.1% compared to +15.3% a year ago.

The capital’s high rents are followed by the South East (£1,325), where nearly all private rental homes are now in areas with average rents higher than £1,000 per month. In 2020, that figure was less than 50%.

Then you’ve got the East of England (£1,163), where 70% of homes sit in £1,000-rent markets, and the South West (£1,077), with more than half now over that benchmark.

|

Region |

Average rent in 2024 |

Annual change in average rent (%) |

Annual change in average rent (£) |

|

North East |

£695 |

9.9% |

£60 |

|

Northern Ireland |

£735 |

4.7% |

£30 |

|

Scotland |

£793 |

11.6% |

£80 |

|

Yorkshire and the Humber |

£799 |

7.6% |

£60 |

|

North West |

£848 |

9.8% |

£80 |

|

East Midlands |

£860 |

8.7% |

£70 |

|

Wales |

£881 |

9.5% |

£80 |

|

West Midlands |

£905 |

8.6% |

£70 |

|

South West |

£1,077 |

8.0% |

£80 |

|

East of England |

£1,163 |

9.3% |

£100 |

|

South East |

£1,325 |

8.9% |

£110 |

|

London |

£2,121 |

5.1% |

£100 |

The cheapest places to rent in 2024: Cities

We’ve got rental data for every city in the UK, and you might be surprised when it comes to the cheapest (and most expensive) places.

The cost of rent varies a huge amount across UK cities, with the lowest in Burnley (£566), Grimsby (£608) and Hull (£612) and the highest in Brighton (£1,616), Oxford (£1,667) and London (£2,047).

Some of the UK’s most popular cities for students and young professionals are cheaper than you might think, too. Liverpool’s average rent comes in at £801 per month, closely followed by Sheffield (£809), Newcastle (£833), Swansea (£867) and Plymouth (£878).

When it comes to Scotland, you’ll find cheap city rents in Glasgow, where rents average £951 per month. Edinburgh is much pricier with an average rent of £1,263 per month.

|

City |

Average rent in 2024 |

Annual change in average rent (%) |

Annual change in average rent (£) |

|

Burnley |

£566 |

10.8% |

£60 |

|

Grimsby |

£608 |

7.8% |

£40 |

|

Hull |

£612 |

11.1% |

£60 |

|

Middlesbrough |

£613 |

8.0% |

£50 |

|

Sunderland |

£626 |

8.2% |

£50 |

|

Blackburn |

£661 |

9.8% |

£60 |

|

Doncaster |

£678 |

7.0% |

£40 |

|

Barnsley |

£684 |

11.3% |

£70 |

|

Aberdeen |

£689 |

7.1% |

£50 |

|

Blackpool |

£692 |

6.0% |

£40 |

|

Bradford |

£692 |

9.4% |

£60 |

|

Huddersfield |

£704 |

7.9% |

£50 |

|

Birkenhead |

£713 |

9.3% |

£60 |

|

Mansfield |

£732 |

9.3% |

£60 |

|

Stoke |

£735 |

11.1% |

£70 |

|

Wakefield |

£737 |

8.3% |

£60 |

|

Belfast |

£751 |

5.4% |

£40 |

|

Wigan |

£752 |

8.8% |

£60 |

|

Dundee |

£774 |

8.2% |

£60 |

|

Preston |

£784 |

7.7% |

£60 |

|

Bolton |

£790 |

13.7% |

£100 |

|

Derby |

£798 |

11.4% |

£80 |

|

Liverpool |

£801 |

8.3% |

£60 |

|

Sheffield |

£809 |

7.0% |

£50 |

|

Telford |

£809 |

7.8% |

£60 |

|

Rochdale |

£815 |

11.0% |

£80 |

|

Newcastle |

£833 |

10.6% |

£80 |

|

Warrington |

£863 |

12.3% |

£90 |

|

Swansea |

£867 |

9.1% |

£70 |

|

Plymouth |

£878 |

7.7% |

£60 |

|

Ipswich |

£879 |

9.7% |

£80 |

|

Newport |

£879 |

9.2% |

£70 |

|

Peterborough |

£907 |

8.0% |

£70 |

|

Leicester |

£924 |

10.2% |

£90 |

|

Birmingham |

£934 |

8.6% |

£70 |

|

Gloucester |

£945 |

10.9% |

£90 |

|

Nottingham |

£947 |

7.4% |

£60 |

|

Glasgow |

£951 |

10.9% |

£90 |

|

Leeds |

£969 |

7.2% |

£70 |

|

Swindon |

£969 |

11.0% |

£100 |

|

Northampton |

£977 |

7.1% |

£60 |

|

Coventry |

£1,015 |

9.3% |

£90 |

|

Hastings |

£1,016 |

7.6% |

£70 |

|

Norwich |

£1,065 |

7.4% |

£70 |

|

Manchester |

£1,070 |

9.6% |

£90 |

|

York |

£1,111 |

10.1% |

£100 |

|

Cardiff |

£1,119 |

9.2% |

£90 |

|

Southampton |

£1,121 |

10.0% |

£100 |

|

Luton |

£1,145 |

11.4% |

£120 |

|

Southend |

£1,152 |

9.9% |

£100 |

|

Portsmouth |

£1,161 |

7.1% |

£80 |

|

Worthing |

£1,171 |

7.3% |

£80 |

|

Medway |

£1,176 |

12.0% |

£130 |

|

Milton Keynes |

£1,202 |

8.5% |

£90 |

|

Bournemouth |

£1,243 |

6.7% |

£80 |

|

Edinburgh |

£1,263 |

11.5% |

£130 |

|

Aldershot |

£1,325 |

11.5% |

£140 |

|

Crawley |

£1,376 |

10.6% |

£130 |

|

Bristol |

£1,389 |

7.6% |

£100 |

|

Reading |

£1,412 |

7.7% |

£100 |

|

Cambridge |

£1,527 |

6.4% |

£90 |

|

Brighton |

£1,616 |

7.0% |

£110 |

|

Oxford |

£1,667 |

8.2% |

£130 |

|

London |

£2,047 |

5.4% |

£100 |

The cheapest places to rent in 2024: Local authority areas

Let’s go one step further and dive into the local authority areas with the cheapest rent in the UK.

At the top of the table we’ve got Hartlepool, with an average rent of £527 in 2024, along with East Ayrshire (£548), Burnley (£556) and Dumfries and Galloway (£557).

The North East dominates the list, with Country Durham (£575), Redcar and Cleveland (£588), North East Lincolnshire (£608) and Darlington (£611) all featuring.

The North West is also well-represented when it comes to cheap rental spots - including Pendle (£583), Allerdale (£591), Hyndburn (£594), Copeland (£598) and Carlisle (£602).

The rest of the spots are filled by Scottish areas, with North Ayrshire (£602) and Angus (£604) recording some of the lowest average rents in 2024.

|

Area Name |

Average rent in 2024 |

Annual change in average rent (%) |

Annual change in average rent (£) |

|

Hartlepool (B) |

£527 |

11.6% |

£50 |

|

East Ayrshire |

£548 |

8.4% |

£40 |

|

Burnley District (B) |

£556 |

12.0% |

£60 |

|

Dumfries and Galloway |

£557 |

11.9% |

£60 |

|

County Durham |

£575 |

8.5% |

£50 |

|

Pendle District (B) |

£583 |

8.8% |

£50 |

|

Redcar and Cleveland (B) |

£588 |

8.1% |

£40 |

|

Allerdale District (B) |

£591 |

6.8% |

£40 |

|

Hyndburn District (B) |

£594 |

12.4% |

£70 |

|

Copeland District (B) |

£598 |

7.3% |

£40 |

|

Carlisle District (B) |

£602 |

10.6% |

£60 |

|

North Ayrshire |

£602 |

7.4% |

£40 |

|

Angus |

£604 |

10.9% |

£60 |

|

North East Lincolnshire (B) |

£608 |

7.8% |

£40 |

|

Darlington (B) |

£611 |

10.5% |

£60 |

|

City of Kingston upon Hull (B) |

£612 |

11.1% |

£60 |

|

Stockton-on-Tees (B) |

£616 |

8.7% |

£50 |

|

Middlesbrough (B) |

£619 |

8.0% |

£50 |

|

South Tyneside District (B) |

£626 |

7.9% |

£50 |

|

Sunderland District (B) |

£626 |

8.2% |

£50 |

Bank Rate holds at 5.25%, so when will rates drop?

The Bank Rate has remained unchanged for the fourth time in a row since it was raised from 5% to 5.25% in August 2023. Rate cuts aren’t expected until later in the year but mortgage costs have still been falling.

Why has the Bank Rate stayed the same?

The Bank of England monetary policy committee voted by a majority of 6-3 to keep the Bank Rate unchanged this month, with two members voting to increase it by 0.25% and one to cut it by 0.25%.

Although energy prices have fallen, wage growth has eased and the prices of goods and services have been rising more slowly, there’s still a risk that overall inflation will increase again.

The conflict in the Middle East and the attacks on container ships in the Red Sea are two of the factors that could see prices rising faster again.

The committee forecasts that inflation will temporarily fall to its target of 2% in the second quarter of 2024 but that it will increase again over the rest of the year.

It then thinks it will be 2.3% in two years’ time and 1.9% in three. Because of this, there are no rate cuts for now, despite little economic growth.

The Bank of England is giving nothing away about how long it thinks rates should stay the same but experts are predicting that there could be a cut in May or June.

What’s happening to mortgage rates?

While borrowers on variable rates will be disappointed that the cost of their mortgages won’t be going down this month, lenders have been cutting the rates of new mortgage deals over the last six months.

This is good news for first-time buyers but anyone remortgaging is still likely to experience a shock increase in their mortgage repayments.

Mortgage costs – whether you’re taking out a new deal or reverting to your lender’s standard variable rate – remain much higher than they were two or five years ago, when most borrowers would have taken out their current deals.

How have higher mortgage costs affected house prices?

Higher mortgage rates led to fewer property purchases and less mortgage lending in 2023, according to industry body UK Finance. Despite this drop in demand, house prices didn’t follow for the majority of UK homeowners.

According to our latest data, more than half (56%) of homeowners saw the value of their homes stay the same or increase by at least 1% in 2023.

A quarter of homes increased in value by between 1% and 5% while a 10th increased by a sizeable 5% or more.

The average value increase was £7,800. Percentage price rises were larger in more affordable areas of the country, with the biggest increases in the North West and Scotland.

This is dramatically different to 2022, though, when 96% of homes saw their value staying the same or going up and the average increase was £19,700 where it did rise.

What’s the outlook for the mortgage market?

While mortgage costs have been going down, mortgage rates will continue to be relatively high compared to two or more years ago. Rate cuts are on the horizon, though, which will be welcome news for first-time buyers and homeowners alike.

Our Executive Director of Research, Richard Donnell, says: 'The debate about the timing and scale of base rate cuts is important for the mortgage rate outlook.

'The peak in base rates last year led financial markets to bet on lower rates in 2024 and into 2025, which have shaved almost 1% off fixed rate mortgages over the last 2 months.

'There is a sense these cuts to rates are close to bottoming out for now and unlikely to move any lower.

'Inflation is down but not out and central banks want to get it under control before cutting base rates.

'It looks likely mortgage rates will remain in the 4.5% to 5% range, which is still cheap by long run standards.

'Those looking to move or refinance should chat to a broker and seek advice about the rates available and the best strategy for them.'

Key takeaways

- The Bank Rate remained at 5.25% today, despite hopes it would come down

- Inflation has fallen significantly over the past year but it's still above the Bank of England’s target of 2%. It stood at 4% in December 2023, unexpectedly rising slightly from November’s figure of 3.9%

- World events are among the factors that could push inflation up again in the second half of this year

- But experts are predicting that there could be a cut in May or June

Rental Market Report: March 2024

The average UK rent is now £1,223 after a +7.8% rise in the last year. Rents for new lets will rise more slowly this year, but only a major supply boost will help with rental affordability.

The average rent for new lets in the UK is £1,223 as of January 2024 (published in March 2024).

Rents have risen +7.8% in the last year, the slowest rate of growth in two years.

Key figures

|

January 2024 |

December 2024 |

November 2023 |

|

|

Average rent (new lets only) |

£1,223 |

£1,219 |

£1,213 |

|

Annual rental growth |

+7.8% |

+8.2% |

+8.7% |

UK rental inflation lowest for 2 years

The heat is finally coming out of UK rent rises. Annual growth is now at the lowest rate for two years, down to +7.8% from +11% a year ago.

This is down to weakening demand and growing affordability pressures on renters, rather than a big boost in rental supply.

No major expansion in rental supply

New investment from private landlords remains low, with the average letting agent currently listing 12 homes for rent. This is a fifth higher than last year but 28% below the pre-pandemic average (16 homes).

Demand cools but still outweighs supply

Demand for rented homes has fallen by a fifth over the last year. One-off pandemic factors have receded, the labour market has cooled and settling mortgage rates have supported first-time buyers.

However, there are more than 15 enquiries for every home to rent. This is double the rate of before the pandemic, despite dropping from over 40 enquiries per property in 2021.

The supply and demand imbalance is narrowing but is far from closed. I expect rents to continue to rise in 2024, just at a slowing rate.

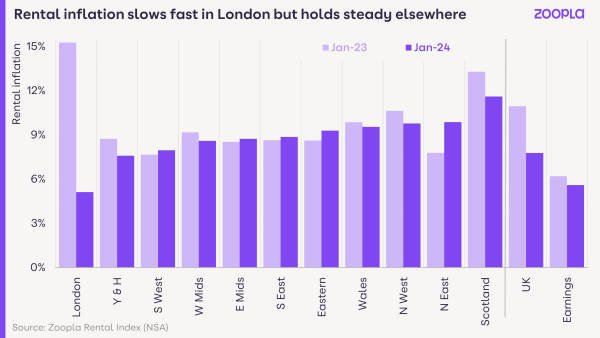

Rental inflation in line with a year ago across most of UK

Across most of the country, rental growth is broadly in line with a year ago despite weaker demand.

Rental inflation is starting to slow across all major cities, with London seeing the biggest slowdown.

Rents continue to rise the fastest in Scotland (+11.6%). In fact, it’s the only UK region or country with double-digit rental growth, although it’s seen a slight slowdown compared to a year ago.

Rental growth slows the most in London

London has recorded a sharp slowdown in annual rental inflation, with rents now rising at a rate of +5.1% compared to +15.3% a year ago.

The balance between supply and demand has narrowed the most in London, with demand -30% lower than a year ago while available supply has increased by the same amount.

This is down to London’s high rents combining with other cost-of-living pressures to hit the pockets of renters, making rising rents ever-less affordable.

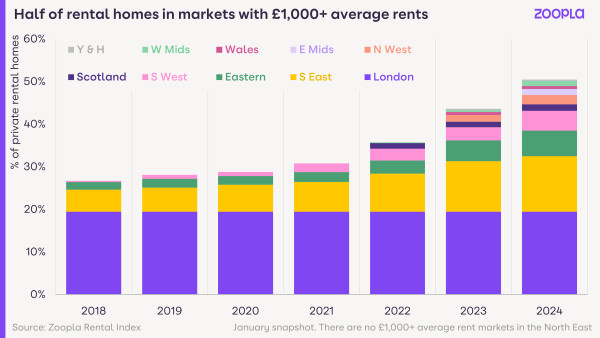

Pandemic price growth pushes half of rented homes into £1,000+ per month markets

Rents are 29% higher than pre-pandemic on average

The pandemic years have driven a step-change in rental growth, with the average UK rent jumping 29% since January 2020.

This has pushed many more properties into higher price brackets. Over half of rented homes in the UK (51%) are now in markets with average rents of more than £1,000 per month. This is almost double the number of rental homes in these pricey markets compared to five years ago.

More high-rent areas across Southern England

Rents in southern England have been close to, or above, £1,000 per calendar month for some time. The fast pandemic-fuelled rental growth has pushed many more over this threshold.

Nearly all private rental homes in the South East are now in areas with average rents higher than £1,000 per month compared to less than half in 2020.

In the East of England, it’s 70% today compared to only 24% in 2020. Over half of rented homes in the South West have also breached the £1,000 per month mark.

Rise in £1,000+ rents in affordable regions

A fifth of rented homes in Scotland, the North West, East Midlands and West Midlands are now in areas with average rents above £1,000 per month.

Just 3 years ago, nowhere outside of the South of England had an average rent higher than £1,000.

The North East remains the only region with no £1,000+ rental markets, while 4% of areas in Yorkshire and the Humber are over this price threshold.

Build-to-rent creates new city centre rental markets

There are now more of these £1,000 per month markets in regional markets, as new city centre rental markets emerge at the same time.

The rise of corporate and institutional investment in rented homes has led to the delivery of more than 90,000 new built-to-rent homes across the UK in recent years - with more to come. House builders are also starting to sell new-build homes to corporate landlords.

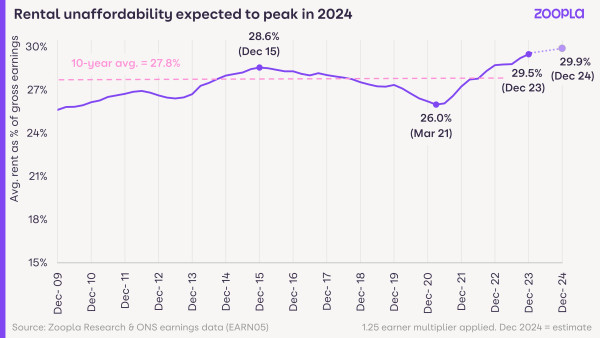

Rents to remain ‘unaffordable’ in 2024

We measure ‘rental affordability’ by looking at average rent as a percentage of average gross earnings, adjusted to reflect the estimated total income of renting households.

At the end of 2023, this measure of rental affordability reached a high of 29.5%. It came after rents for new lets rose faster than average earnings for more than 2 years (since October 2021).

Rental affordability improved between 2016 and 2021 as rents rose by only 4% in that time. This was a result of weaker demand post-Brexit, growth in rental supply, and easier access to home ownership thanks to low mortgage rates.

In contrast, recent years have been marked by strong demand, no increase in supply and high mortgage rates making it harder for first-time buyers to access home ownership.

This widened the supply and demand imbalance and pushed rents for new lets up faster than earnings. Ultimately, this has led to the deterioration in rental affordability.

The graph shows how rental affordability has tracked since December 2009 to today, with our projection for the rest of this year.

It highlights the difficulties faced by renters in the current climate, even with rents no longer rising as quickly.

Rent predictions for 2024: Rental supply must grow to improve rental affordability

We project that UK rental inflation will halve to +5% in 2024. Meanwhile, the consensus among economic forecasters is that average earnings growth will also slow, to just below +4%.

This means no immediate prospect that rental affordability will improve in 2024.

There must be a sustained expansion in rental supply to see a faster slowdown in rental inflation. It would even result in rents falling in some city centres.

However, any boost in supply this year is unlikely to be at a scale that impacts overall rental growth.

Continually low levels of net-new investment in rental properties means supply will remain below average, supporting further rent rises.

The clear conclusion is that the best way to improve affordability is to boost rental supply. This will continue to come from the new-build sector, but the big needle-mover would be more investment by private landlords.

This looks unlikely - and further rationalisation of landlord portfolios in the face of higher mortgage rates, alongside growing regulation, will offset any rise in new investment in rental supply.