What does the Spring Budget 2024 mean for the housing market?

It was a disappointing Budget for anyone hoping for measures to help home buyers and mortgage borrowers but tax changes announced could have a small impact.

Today’s Spring Budget was a chance for the Government to boost its popularity ahead of this year’s general election but there will be many younger and less wealthy voters left disappointed by the lack of measures to address the shortage of affordable housing in the UK and the challenges of getting a mortgage.

It was thought that a new 99% mortgage scheme could be announced but this idea has now been ditched.

It would have helped aspiring first-time buyers with small deposits get onto the property ladder, although critics pointed out that it would also expose them to greater risk of getting into negative equity if house prices were to fall.

There were also hopes that the early withdrawal penalty on Lifetime ISAs, which help people save for their first home or retirement, would be reduced and the limit on the value of home you can buy using the money you save in them would be increased.

However, there were some tax tweaks that could result in a modest boost to the housing market.

Capital gains tax cut

Currently, if you sell a residential property that isn’t your main home and you’re a higher rate tax payer, you pay 28% tax on the profits you make.

From April this will be cut to 24%, which could encourage more people to sell property and increase the supply of homes available.

On the other hand, wealthy property owners will get to keep more of the money they make when they sell it.

Holiday lettings tax breaks abolished

Owners of furnished holiday lets currently get more tax breaks than owners of buy-to-let properties but these will be scrapped from April, making holiday letting a less attractive option.

This could result in more longer-term rental property becoming available or more homes available to buy for local people.

Our Executive Director of Research, Richard Donnell, says: 'The furnished holiday let changes will see a mix of impacts split between more homes returning into the long let market or some of these homes being sold, benefitting from a reduction in capital gains tax.

'The impact will be felt in tourist hotspots, where most of these homes are to be found. But it's unlikely to have a big impact on the wider market in these areas. It is a further attempt to ensure investors can't outbid first time buyers.'

Stamp duty relief on multiple dwellings scrapped

There was one change to stamp duty announced, however.

From June, anyone buying more than one residential property at once will no longer pay less stamp duty than if they were buying them individually.

The Government says this is because there was no evidence that this relief was encouraging more people to invest in the private rented sector.

Our expert's view

'The Budget marks another missed opportunity to take action on boosting supply and mortgage availability in the housing market,' says Donnell.

'The consensus is that the country needs more new homes. Supply has increased but this has now stalled.

'There is a need for a widespread reform of the planning system to encourage more supply. More funding is needed for social and affordable homes, as well as investment in housing infrastructure to unlock more homes.

'The Government should also look to support the emergence of a long-term fixed rate mortgage market as a matter of urgency.

'This will help more young people with smaller deposits access home ownership – particularly in southern England, where deposit size is the biggest barrier to getting on the housing ladder.

'Another missed opportunity is the decision not to make the £625,000 threshold for first-time buyer relief permanent. This means 30% more first-time buyers will be liable to pay full stamp duty from March next year.'

Key takeaways

- The Chancellor has announced a cut in the rate of capital gains tax paid on property sales

- Tax breaks for those letting holiday homes are to be scrapped

- There are no plans to make the temporary higher stamp duty threshold permanent

Should I buy my first home in 2024?

How are first-time buyers coping with higher mortgage rates? We take a look out how buyers are stepping onto the property ladder as borrowing gets more expensive.

First-time buyers wait in the wings and save larger deposits

Despite higher borrowing costs, first-time buyers (FTBs) haven't changed what they’re looking for in a home.

Three-bed houses, below the average price for their local area, remain the most popular choice.

And most buyers are looking within a five-mile radius from where they’re already based.

First-time buyers were expected to adjust what they want from their first home in the face of higher mortgage costs, but many remain resolute in the criteria they want and need from their first home.

Those who have bought have managed to secure their first homes by putting more equity into their deposits and taking advantage of it being a buyers’ market where possible.

That said, many have parked the idea of buying until their financial situation improves or mortgage rates fall.

UK Finance data show that almost 80,000 (-20%) fewer first-time buyers bought their first home in 2023 compared to 2022.

First-time buyer deposits increase alongside mortgage payments

| Q4 2022 | Q4 2023 | % change | |

|---|---|---|---|

| Average FTB price paid | £241,300 | £244,100 | 1.2% |

| Average FTB deposit | £56,000 | £59,300 | 5.9% |

| Average FTB mortgage size | £185,300 | £184,800 | -0.3% |

| Average monthly mortgage payment | £777 | £990 | 27.4% |

Zoopla

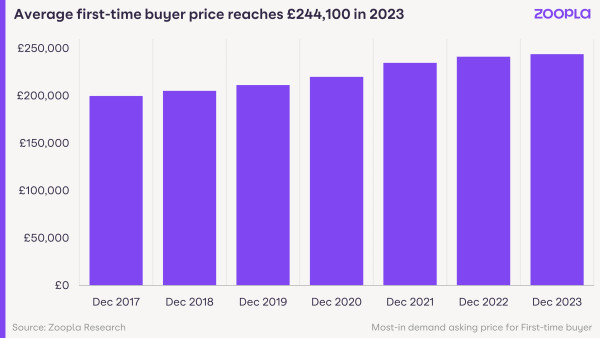

The average price of what first-time buyers are looking to buy on Zoopla increased by 1.2% over the course of 2023.

Most are now looking at properties costing an average of £244,100, that’s £2,800 higher than a year ago.

However, this small increase in first-time buyer prices does not necessarily mean paying larger mortgages.

UK Finance data shows that the average loan-to-value has declined slightly to just under 76%, meaning FTBs are using slightly larger deposits.

Based on the average price of a first-time buyer home on Zoopla, we estimate the average deposit size paid has increased by £3,300 (5.9%) over 2023.

This means that the typical first-time buyer mortgage is almost the same compared to a year ago (+£500).

Using slightly larger deposits did not, however, fully offset higher borrowing costs.

Higher mortgage rates mean that first-time buyers now need to pay mortgage bills that are 27% higher than they would be if they’d purchased their first home in the second half of 2022.

We estimate the monthly mortgage payment for a first-time buyer purchasing an average-priced home of £244,100 is now £990. That’s over £200 more than a year ago.

First-time buyers look for homes priced below market average

|

Region |

FTB house price (£) |

Price of all homes (£) |

Price difference (£) |

% discount |

|

London |

399,000 |

536,800 |

137,800 |

-26% |

|

South East |

321,400 |

386,400 |

65,000 |

-17% |

|

East of England |

316,700 |

337,700 |

21,000 |

-6% |

|

South West |

241,500 |

313,700 |

72,200 |

-23% |

|

East Midlands |

211,300 |

228,400 |

17,100 |

-7% |

|

West Midlands |

196,800 |

229,300 |

32,500 |

-14% |

|

Wales |

174,700 |

203,300 |

28,600 |

-14% |

|

North West |

164,100 |

194,800 |

30,700 |

-16% |

|

Scotland |

161,400 |

162,100 |

700 |

0% |

|

Yorkshire & the Humber |

153,800 |

185,900 |

32,100 |

-17% |

|

North East |

117,900 |

140,800 |

22,900 |

-16% |

|

UK |

244,100 |

264,400 |

20,300 |

-8% |

First-time buyers are looking for family homes at value-for-money prices.

Nationally, the average first-time buyer price is 8% below that of the UK average sold price. This translates to a saving of £20,300 on average.

First-time buyers in London, the South West and Yorkshire and the Humber are looking for the largest savings of 23% or more.

In the capital, first-time buyers typically look for homes that are £137,800 below the average price of £536,800, going up to £184,00 in West London (W).

This level of discounting is possible if first-time buyers choose apartments, which now attract nearly 70% of first-time buyer enquiries in London.

The South West is where first-time buyers are looking for some of the largest percentage discounts off the average local house price.

This is most evident in the areas that saw the largest value boosts during the pandemic. The typical discount being sought by a first-time buyer in Truro (TR), Cornwall and Dorchester (DO) in Dorset is 39%, the UK's largest discount for first-time buyers.

On the other hand, buyers in the East of England and Scotland are looking for homes that are closest to the regional average, with up to a 6% gap between market price and what first-time buyers are willing to pay.

In areas such as Glasgow, Motherwell and Paisley, first-time buyers are even looking for homes priced slightly above the average market price.

First-time buyers aren’t changing what they want from a home

Looking for a smaller home, to upsize further down the line, is one of the tactics that first-time buyers can use to get on the ladder in this higher mortgage rates environment.

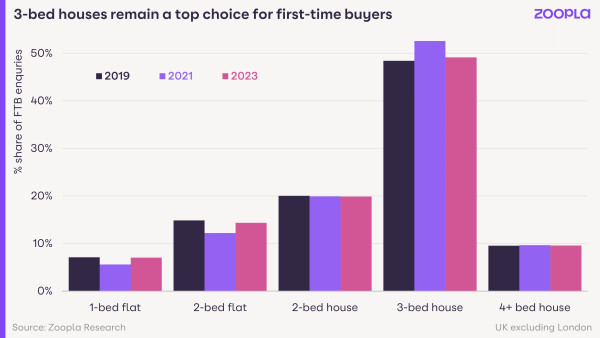

Today’s first-time home buyer prefers 3-bed houses, attracting close to half of FTB enquiries in 2023. This shows us that first-time buyers are taking a long-term view.

Terraced homes are one of the most affordable options for those looking to buy a family-sized home. And this is what first-time buyers are turning to in both expensive and cheaper markets.

In 2023, terraced homes were the most sought-after property type among those looking to buy for the first time in southern England.

This mirrors historical trends, despite the serious hit to the buying power that was amplified by higher prices in this part of the UK.

However, in 2023, first-time buyers in southern regions were looking to spend £3,400 less (-1.2%) on average on a terraced house compared to late 2022.

This tells us that first-time buyers may not be changing their preferences, but are definitely trying to make the most of cooling market conditions.

Terraced homes are also the most popular choice among first-time buyers in the North East, North West, Wales and Yorkshire and the Humber, where 4 in 10 first-time buyer enquiries relate to this property type.

The average price of terraced homes attracting first-time buyer interest in these areas has also cooled down. Yorkshire and the Humber is an exception, where prices increased 4.3% in 2023.

In the Midlands, classic 3-bed semi-detached homes are the most popular choice for first-time buyers. Here, the price of semis that first-time buyers are interested in remain in line with the later part of 2022.

In contrast, FTBs in London and Scotland prefer flats, which are both very common and historically popular amongst those looking to step on the property ladder in these areas.

Little appetite to relocate to boost buying chances

In the face of higher borrowing costs, first-time buyers have an option to move further afield to access more affordable markets.

But in reality today, fewer buyers are deciding to make a big move, compared to previous years.

Only 27% of first-time buyers are looking for their first home 10 miles or more from where they’re currently living, down from 29% a year ago.

This decrease goes hand-in-hand with an increase in the stock of homes for sale: more homes on the market means FTBs don’t have to look so far to find the home they want and need.

Over half (55%) of first-time buyers enquire about homes within a 5-mile radius from where they are based, which is a bigger proportion than other buyer groups (48%).

Having said that, FTBs in the less affordable markets of southern England are more likely to look for a home more than 10 miles away.

41% of enquiries in the East of England, 34% in the South East and 31% in London fall into this category. In northern England and Midlands, only half this number of first-time buyers look beyond 10 miles.

This highlights how affordability challenges in the South are a bigger trigger for first-time buyers to look further afield than in the North.

Why aren’t first-time buyers changing their requirements?

The average age of a first-time buyer in the UK today is currently 33, which means many will be buying with family needs in mind.

Nearly twice as many first-time buyers now have dependent children, compared to during the pre-2007 financial crisis period.

This, as well as more modest equity and wage growth than a few decades ago, is encouraging first-time buyers to look for more long-term homes, rather than traditional starter homes or flats.

This means that 3-bed houses attract nearly half (48%) of first-time buyer enquiries outside London in 2023. This is down from a 52% peak in 2021, but signals that first-time buyer needs remain the same as during pandemic.

What can first-time buyers expect in 2024?

We have seen some positive signals from mortgage markets last month, with lenders offering more deals to attract first-time buyers. This will lead to a small increase in buying power, which was a problem for many first-time buyers in 2023.

Meanwhile, earnings growth, alongside falls in house prices, is improving affordability. This, combined with lower borrowing costs, should encourage more first-time buyers to come to market in 2024, particularly in the second half of the year

Key takeaways

- Most first-time buyers are now looking at properties costing an average of £244,100, that’s £2,800 higher than a year ago

- However across the UK, the average first-time buyer price is 8% below that of the UK average sold price, a saving of £20,300

- The monthly mortgage payment for a first-time buyer purchasing an average-priced home of £244,100 is now £990. That’s over £200 more than a year ago

- 3-bed houses remain the top property choice on Zoopla for first-time buyers

- Recent falls in mortgage rates will support first-time buyers looking to buy in 2024

More homes come to market as house prices hold steady

Buyers have a lot more choice when it comes to securing a home in 2024. More sellers are coming to market as mortgage rates are expected to plateau at 4% to 5%.

The number of homes available for sale is up 20% on this time last year, meaning much more choice for home hunters.

Meanwhile, house price reductions are lower than a year ago but remain above average, as house price falls continue to slow.

Annual house price inflation is currently at -0.5% year-on-year, up from the recent low of -1.4% recorded in October 2023.

Where can buyers find the biggest price reductions right now?

The biggest cuts to house prices (5% or more) are currently underway in the UK’s more expensive regions: the South East and East of England.

Five English regions are registering annual price falls of up to -2.1%, led by the East.

However, house prices have moved into positive territory in the remaining 4 regions of England, alongside Wales, Scotland and Northern Ireland - where prices have risen 4.3% in the last year.

Will mortgage rates come down in 2024?

Mortgage rates have fallen back to where they were a year ago, but they remain above 4% and are likely to plateau at this point for the foreseeable.

Our Executive Director of Research, Richard Donnell, says: ‘Mortgage rates could move a little lower over the year, but this hinges on the timing of future base rate cuts, which may come later in the year.’

Falling mortgage rates are important when it comes to boosting housing market activity, but lenders have recently been pulling mortgage deals below 4%.

‘The cost of finance used to fund mortgages has increased modestly in recent weeks,’ says Donnell. ‘Rising incomes are helping to offset the impact of higher borrowing costs, but at a slow pace.

‘Buyers should anticipate 4-5% mortgage rates over much of 2024.’

A three-speed housing market

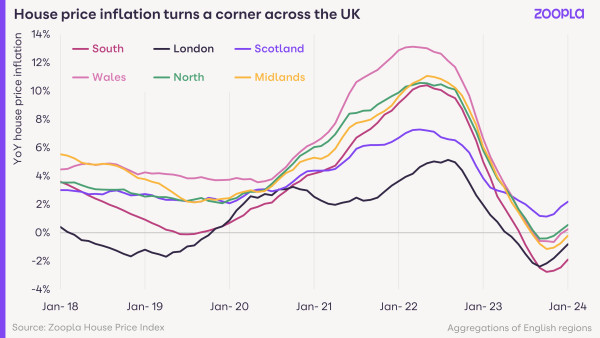

Across the UK over the last 18 months, there has been a rapid slowdown of house price inflation, largely due to higher mortgage rates and cost of living pressures.

These factors have mainly hit prices in the more expensive areas of the UK, such as London and the South, while areas with more affordable housing, such as the North, have been less impacted.

The housing market has now become divided into three groups:

1) Southern England is registering the largest price falls

The East, South East and South West regions have been hit hardest by rising mortgage rates and reduced household buying power. Largely because the average home price here is £344,000, which is 30% above the UK average.

2) London is seeing the lowest price inflation

‘While it is the most expensive housing market with an average price of £534,000, London is a market that has registered much lower levels of house price inflation over the last seven years,’ says Donnell.

‘Affordability has been improving slowly over this time, opening the market up to more potential buyers than before.’

London is now in hot demand as a location, yet fewer sellers are coming to market in the capital (+7% year on year), compared to the rest of the UK (+21% year on year).

This means demand is outstripping supply, so house prices are holding steady in the capital, rather than falling as they are in the rest of Southern England.

3) The rest of the UK is seeing firmer pricing

‘Over the last 12 months, annual price falls have been very limited across the rest of the UK, where house prices are at or below the UK average,’ says Donnell, ‘because the impact on buying power from higher mortgage rates has been less pronounced.’

In fact, Scottish house prices have been rising in the last 12 months, while Northern England, the West Midlands and Wales are registering firmer pricing because they are more affordable. Consequently more sales are being agreed here.

Will the Budget have anything in store for buyers?

‘We don’t expect the Budget to have any specific measures that will boost market activity in the very short term,’ says Donnell.

‘There is a case to make permanent stamp duty changes for first-time buyers from the 2022 autumn budget.

‘But any longer-term measures such as the Mortgage Guarantee Scheme or small deposit mortgages will take longer to impact market activity, with much depending on the scale of the proposals.’

Key takeaways

- 20% more homes available for sale as sellers return to market

- House prices not expected to rise quickly in 2024

- 15% more sales are being agreed, boosted by falling mortgage rates, which are now plateauing

- There is a 3-tier housing market split between southern England, London and the rest of the UK

Sales agreed up 15% as buyers return to market

Buyers are back in market and demand is now 11% up on this time last year. This is good news for sellers, as the number of sales agreed climbs 15%.

Sales market activity continues to improve

Pent up demand is returning to the housing market as mortgage rates return to 4-5%, which is good news for sellers.

More buyers are looking to secure homes, with demand up 11% compared to this time last year.

But even more importantly, the number of sales agreed is also up 15% compared to early 2023.

This shows both greater buyer confidence and more realism on pricing by sellers.

North East and London lead the way in sales

In the North East, the number of homes going under offer is up +17% on this time last year, while in London 16% more homes have sales agreed.

Across the UK as a whole, more properties are now coming to market, with 21% more sellers putting up their For Sale signs than this time last year.

This, in turn, is increasing the choice of homes available for buyers and supporting sales for sellers.

Our Executive Director of Research, Richard Donnell, says: ‘The housing market has proved very resilient to higher mortgage rates and cost of living pressures.

‘More sales and more sellers shows growing confidence among households and evidence that 4-5% mortgage rates are not a barrier to improving market conditions.’

Are sellers still reducing their prices?

‘While increased activity levels are welcome news, it’s important to note that a small proportion of sellers continue to reduce asking prices to attract buyer interest,’ says Donnell.

However, sellers will be pleased to learn that fewer price reductions are now taking place, compared with this time last year.

Reductions are still above average right now, as higher mortgage rates continue to make buyers price sensitive, but discounts of 5% or more are mainly taking place in the South East and East of England.

What will happen to house prices in 2024?

‘There is clear demand from homeowners and first-time buyers looking to move and buy their first home in 2024,’ says Donnell.

‘This is going to support higher sales volumes, but we don’t expect higher house price growth.

‘The reality is that the housing market is still adjusting to higher mortgage rates and the impact of reduced buying power, which has varied across the country.’

This means that sellers will need to remain realistic on pricing, but the fact that their home is likely to attract more interest is good news, as it increases the chances of agreeing a sale.

‘The average estate agent is agreeing 6 new sales a month, up from 5.2 a year ago, which proves that house prices don’t need to fall to support sales,’ says Donnell.

This is feeding through into our UK house price index, which continues to record a slowdown in the rate of price falls.

Annual house price inflation is currently -0.5%, up from the recent low of -1.4% recorded in October 2023. And house prices are now 1.5% below their peak of £268,000 in October 2022.

What’s going to happen to mortgage rates in 2024?

Mortgage rates have fallen back to where they were a year ago, but they remain above 4% and are likely to plateau at this point for the foreseeable.

‘Mortgage rates could move a little lower over the year, but this hinges on the timing of future base rate cuts, which may come later in the year,’ says Donnell.

Falling mortgage rates are important when it comes to boosting housing market activity, but lenders have recently been pulling mortgage deals below 4%.

‘The cost of finance used to fund mortgages has increased modestly in recent weeks,’ says Donnell. ‘Rising incomes are helping to offset the impact of higher borrowing cost, but at a slow pace.

‘Buyers should anticipate 4-5% mortgage rates over much of 2024. But our consistently held view is that 5% mortgage rates are the tipping point for annual house price falls.

‘Mortgage rates over 6% for a sustained period would lead to larger double-digit price falls. Mortgage rates in the 4-5% range are consistent with flat to low single digit price rises.’

Will the Budget have anything in store for sellers?

‘We don’t expect the Budget to have any specific measures that will boost market activity in the very short term,’ says Donnell.

‘There is a case to make permanent stamp duty changes for first-time buyers from the 2022 autumn budget.

‘But any longer-term measures such as the Mortgage Guarantee Scheme or small deposit mortgages will take longer to impact market activity, with much depending on the scale of the proposals.’

Key takeaways

- Demand rises 11% and sales agreed are 15% higher than a year ago

- Sellers make a return with 20% more homes for sale than this time last year

- Activity is being boosted by falling mortgage rates, which are now plateauing

- We expect to see more sales in 2024, rather than faster price growth