Bank Rate holds at 5.25%, so when will rates drop?

The Bank Rate has remained unchanged for the fourth time in a row since it was raised from 5% to 5.25% in August 2023. Rate cuts aren’t expected until later in the year but mortgage costs have still been falling.

Why has the Bank Rate stayed the same?

The Bank of England monetary policy committee voted by a majority of 6-3 to keep the Bank Rate unchanged this month, with two members voting to increase it by 0.25% and one to cut it by 0.25%.

Although energy prices have fallen, wage growth has eased and the prices of goods and services have been rising more slowly, there’s still a risk that overall inflation will increase again.

The conflict in the Middle East and the attacks on container ships in the Red Sea are two of the factors that could see prices rising faster again.

The committee forecasts that inflation will temporarily fall to its target of 2% in the second quarter of 2024 but that it will increase again over the rest of the year.

It then thinks it will be 2.3% in two years’ time and 1.9% in three. Because of this, there are no rate cuts for now, despite little economic growth.

The Bank of England is giving nothing away about how long it thinks rates should stay the same but experts are predicting that there could be a cut in May or June.

What’s happening to mortgage rates?

While borrowers on variable rates will be disappointed that the cost of their mortgages won’t be going down this month, lenders have been cutting the rates of new mortgage deals over the last six months.

This is good news for first-time buyers but anyone remortgaging is still likely to experience a shock increase in their mortgage repayments.

Mortgage costs – whether you’re taking out a new deal or reverting to your lender’s standard variable rate – remain much higher than they were two or five years ago, when most borrowers would have taken out their current deals.

How have higher mortgage costs affected house prices?

Higher mortgage rates led to fewer property purchases and less mortgage lending in 2023, according to industry body UK Finance. Despite this drop in demand, house prices didn’t follow for the majority of UK homeowners.

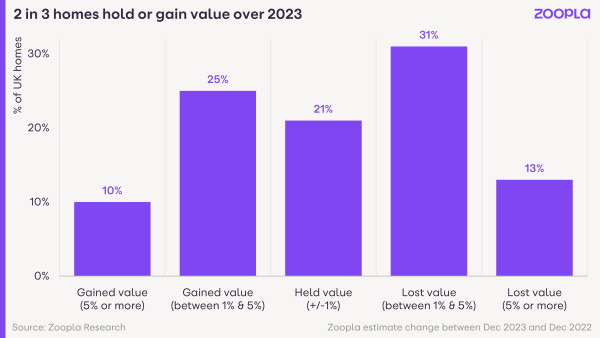

According to our latest data, more than half (56%) of homeowners saw the value of their homes stay the same or increase by at least 1% in 2023.

A quarter of homes increased in value by between 1% and 5% while a 10th increased by a sizeable 5% or more.

The average value increase was £7,800. Percentage price rises were larger in more affordable areas of the country, with the biggest increases in the North West and Scotland.

This is dramatically different to 2022, though, when 96% of homes saw their value staying the same or going up and the average increase was £19,700 where it did rise.

What’s the outlook for the mortgage market?

While mortgage costs have been going down, mortgage rates will continue to be relatively high compared to two or more years ago. Rate cuts are on the horizon, though, which will be welcome news for first-time buyers and homeowners alike.

Our Executive Director of Research, Richard Donnell, says: 'The debate about the timing and scale of base rate cuts is important for the mortgage rate outlook.

'The peak in base rates last year led financial markets to bet on lower rates in 2024 and into 2025, which have shaved almost 1% off fixed rate mortgages over the last 2 months.

'There is a sense these cuts to rates are close to bottoming out for now and unlikely to move any lower.

'Inflation is down but not out and central banks want to get it under control before cutting base rates.

'It looks likely mortgage rates will remain in the 4.5% to 5% range, which is still cheap by long run standards.

'Those looking to move or refinance should chat to a broker and seek advice about the rates available and the best strategy for them.'

Key takeaways

- The Bank Rate remained at 5.25% today, despite hopes it would come down

- Inflation has fallen significantly over the past year but it's still above the Bank of England’s target of 2%. It stood at 4% in December 2023, unexpectedly rising slightly from November’s figure of 3.9%

- World events are among the factors that could push inflation up again in the second half of this year

- But experts are predicting that there could be a cut in May or June

The home value winners and losers this year

Where did homeowners gain value in the last year? Do you fall into the not-to-lucky group who lost more than 5%? Let’s find out.

Just over a year ago, all the talk was around house prices dropping by up to 10% in 2023.

But things don’t seem quite so bad in hindsight.

And a huge 77% of home values remained within the +/-5% range, highlighting the more stable nature of house prices since stricter mortgage restrictions were introduced in 2015.

Although there are some winners: 1 in 10 UK homeowners gained 5%+ in value, gaining £17,200 on average.

And some losers: just over 13% of homes dropped more than 5% in value, each losing an average of £13,200

| Lost 5% or more in value | Value remained within +/-5% | Gained 5% or more | |

|---|---|---|---|

| Percentage of UK homes | 13% | 77% | 10% |

| Number of UK homes | 3.7 million | 23.1 million | 3.1 million |

January 2024

The winners: where the most homes gained 5%+ in value

| Local authority area, region | Percentage of homes that gained 5%+ in value |

|---|---|

| Rossendale, North West | 44.2% |

| Blackburn with Darwen, North West | 34.5% |

| Telford and Wrekin, West Midlands | 32.6% |

| Merthyr Tydfil, Wales | 32.3% |

| Burnley, North West | 32.3% |

| Bolton, North West | 31.1% |

| Inverclyde, Scotland | 30.0% |

| Glasgow, Scotland | 29.7% |

| Carlisle, North West | 28.9% |

| Knowsley, North West | 27.9% |

Zoopla, January 2024

A lucky 1 in 10 homeowners have seen gains of more than 5% in 2023. That’s 3 million of you across the UK who have gained £17,200 on average.

This year’s winners are largely based in the North West, where half a million homes (17%) gained more than 5% in value. In this region, the average value increase was a tidy £13,200.

An impressive 44% of homeowners in the borough of Rossendale saw a 5% jump in value this year, where reputable schools, stunning scenery and good commuter links are pushing values up.

Elsewhere in the North West, more than 30% of homeowners gained 5% in value in Blackburn, Burnley and Bolton. These up-and-coming commuter towns are affordable and increasingly popular alternatives to Manchester.

Beautiful Inverclyde on Scotland’s west coast and the buzzing city of Glasgow also make our winners list, with 30% of homeowners gaining 5%+ this year - compared to 16% across Scotland as a whole.

The charming Telford and Wrekin area in the West Midlands and Merthyr Tydfil near the Welsh valleys are also top 10 winners this year, with 32% of homeowners gaining 5%+.

The losers: where the most homes lost 5%+ in value

| Local authority area, region | Percentage of homes that lost 5%+ in value |

|---|---|

| Dover, South East | 52.4% |

| Hastings, South East | 50.7% |

| Aberdeen, Scotland | 45.1% |

| Canterbury, South East | 43.4% |

| Thanet, South East | 40.9% |

| Rother, South East | 38.6% |

| Folkestone & Hythe, South East | 35.8% |

| Tendring, East of England | 35.3% |

| Moray, Scotland | 32.1% |

| South Holland, East Midlands | 31.5% |

Zoopla, January 2024

While home values generally fared better than expected last year, there’s no denying that some places lost out - with home values falling by 5%+ over 2023.

The South East was the worst hit, with 18% of homeowners seeing their home’s value drop by 5%+. Of these, the average loss was £13,200 over the year.

These falls are clustered around the Kent and East Sussex coasts: half of all homes in both Dover and Hastings lost 5%+ in value, along with more than 35% of homes in Canterbury, Thanet, Rother, and Folkestone and Hythe.

The East of England saw 18% of properties lose value, although by a lesser average of £11,500. The proportion of homes losing value jumps to 35% in Tendring on the Essex coast, while it was above 27% in both Colchester and Great Yarmouth.

Rural and coastal areas within commuting distance of larger cities saw a large flow of buyers during the Covid-19 pandemic. Home values in these areas are adjusting back now that demand has cooled.

Who will win and lose in 2024?

We think this year will serve up more of the same for homeowners in the UK.

We’re expecting an average fall of around 2% across the country, although - like 2023 - this will differ depending on where you live and what sort of home you own.

How do we work out home values?

We only use data from regulated sources to create our home estimates. These sources include:

-

Data from HM Land Registry and Registers of Scotland

-

Official survey records from accredited surveyors

-

Energy Performance Certificates

We combine this data with live property listings in your area to take the latest local market trends into account.

Once we’ve created estimates for around 30 million homes in the UK, we can analyse the data as a whole and bring you reports like this.

But we don't claim to know everything. We provide confidence ratings to let you know if our data sources haven't updated or we don't have enough info.

And that's why we always recommend you get an estate agent valuation for the most accurate picture of what your home is worth.

Key takeaways

- 1 in 10 UK homeowners gained 5%+ in value in 2023

- The largest proportion of homeowners (77%) saw no significant change to their home’s value in 2023, contradicting predictions of major price falls

- But there are some losers - 13% saw their home’s value fall by 5%+ in the last year

3 in 5 homes rise in value over 2023

At the beginning of 2023, commentators predicted home values would plummet by as much as 10% over the course of the year. Here’s what actually happened.

In 2023, the press was filled with gloom and doom predictions of homes plummeting in value by as much as 10%.

However, our data reveals that in reality, more than half of UK homeowners (56%) saw their home values stay the same or increase by at least 1% over the course of the year.

Senior Property Researcher, Izabella Lubowiecka, says: ‘Where values went up, the average increase seen was £7,800. And 1 in 10 (or 3 million) UK homeowners even registered gains of more than 5% (or £17,200).’

It is a different picture to what happened the year before in 2022, when 96% of homes either held their value or saw an increase. Back then, the average value hike was £19,700.

However, we can clearly see that most homeowners didn’t see the hefty value falls that some initially predicted.

Where did homes rise in value in 2023?

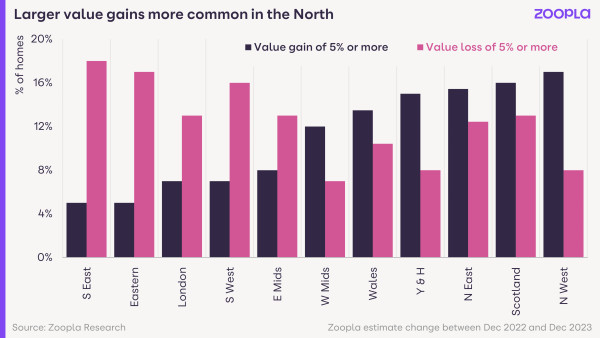

‘There is a clear north-south divide in the fortunes of homeowners during 2023,’ says Lubowiecka.

‘Areas with lower house prices were cushioned from the impact of higher mortgage rates, helping to support activity and sustain house prices in these regions.

‘So in the more affordable parts of the country, such as the north, home values increased.’

In fact, the North West led the way in value gains, with the highest proportion of homes registering value increases of 5% or more (£13,200 on average).

Here, terraced homes proved to be the hottest properties, with 19% of terraces rising by 5%+.

It was hotly followed by Scotland, where 16% of homes (400,000), increased in value by 5%.

Here, apartments proved to be the highest risers, with 19% registering a value increase of 5%+.

The North East and Yorkshire and the Humber take joint third place, with 1 in 7 homes going up in value by 5%+.

Flats were the winners in the North East, with 25% rising by 5%+ in value.

Meanwhile, in Yorkshire and the Humber, terraced homes came up trumps, with 16% rising by 5%+.

Which types of homes held their value in 2023?

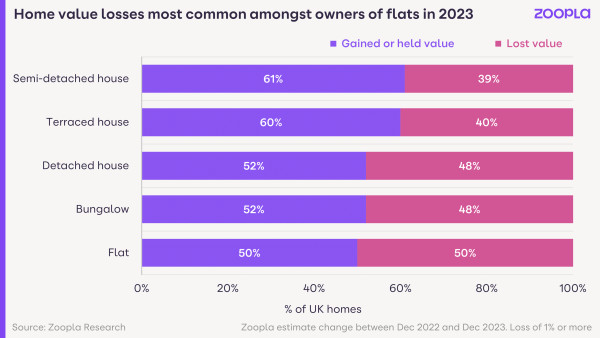

In 2023, the nation’s favourite property types: semi-detached homes and terraces, proved to be the best at holding their value.

‘Homes seen as good value for money continued to attract buyer interest, leading to stronger price performance,’ says Lubowiecka.

‘That said, the larger value gains of 5%+ were equally spread across different property types and enjoyed by 1 in every 10 UK properties.’

Where did home values fall in 2023?

While home values did better than expected, not all homeowners saw their homes increase in value in 2023.

44% of UK homes fell in value by at least 1% over the course of the year. Within that 44%, one third of homes lost 5%+ of their value from 2022.

Homeowners in the South, where house prices are less affordable, were most likely to see the falls.

Some 3 in 5 (or 4 million) homeowners in the East and the South East of England saw a value decrease of 1% or more.

And just over a million of these saw decreases of 5% or more.

‘In the East of England, the average loss was £11,500, while in the South East, it was £13,200,’ says Lubowiecka.

‘The coastal areas of Kent and East Sussex suffered the most in terms of value losses, with half of homeowners in Dover and Hastings experiencing value falls of 5% or more.’

During the pandemic, these rural and coastal areas within commuting distance of larger cities saw a large influx of buyers, boosting house price growth.

But now demand is starting to wane, leading to larger value falls here.

Which types of homes lost the most value in 2023?

Detached houses were most likely to lose value in the East of England (23%), while in the South East, apartments bore the brunt of the losses (25%).

Across the UK as a whole, value drops were more common for detached houses and bungalows, which are less common and often priced at a premium. 48% of these property types lost value in the last year.

Flats also suffered in 2023, despite some pick-up in buyer interest. Our data shows that exactly half of UK flats lost some value last year.

Larger flats fared better than smaller flats, with 52% of 3-bed flats holding or increasing in value. But in contrast, only 46% of 1-bed flats enjoyed the same benefits.

Why we didn’t see house prices plummet in 2023

New mortgage regulations introduced in 2015 helped to prevent homes from being ‘over-valued’, which can lead to property market crashes.

When agreeing to offer mortgages, lenders had to ensure their borrowers could still repay those mortgages at higher interest rates when they took out the loans.

So, if your mortgage rate was say, 2%, you had to prove you could still afford to repay it if it rose to 5%.

That, in turn, meant borrowers wouldn’t be forced to sell their homes if mortgage rates increased, because they had already proven they could meet those higher monthly payments.

Lots of forced sales negatively affect property values, so these regulations helped to protect house prices from a major downturn.

Will home values rise or fall in 2024?

‘Zoopla predicts modest house price falls of 2% in 2024 across the UK,’ says Lubowiecka.

‘This signals a repetition of the last year in terms of pricing as well as key themes influencing the market.

‘How this is going to impact your home value depends on where you are in the country and what property type you own. But we expect those who saw home value growth in 2023 to see similar increases in 2024.’

Higher mortgage rates will continue to limit many peoples’ buying power, and this impact will be most felt in the high-value regions in the South.

‘We anticipate further value drops in the south, especially in areas where values shot up during the pandemic.

‘Flats and detached homes here are most likely to register further value falls, so if you’re planning to sell a home like this in 2024, it’s important to set your price at a realistic level right from the start,’ advises Lubowiecka.

Meanwhile, popular property types such as terraces or 3-bed houses that offer good value for money are likely to hold or increase in value.

Thinking of selling? It’s always a good idea to speak to a local agent to get a valuation for your home.

Estate agents will be on top of all of the local market trends in your area, while taking into account your property’s unique characteristics and all of the improvements you’ve made to it to set the best possible price for a sale.

How we calculate our home values

Monthly estimates for every home in the UK, to show homeowners how much their home is worth.

Our data source, Hometrack's market-leading Automated Valuation Model, is reliably used by mortgage lenders across the UK to assess a home’s value.

And while not as conclusive as an agent valuation, which takes in all of the recent work you might have done to your property, our estimates provide a good initial indication of your home’s worth to help you unlock your next move.

How current estimates differ from sold house price data

Every month, we and many other organisations publish a house price index.

House price indices are a useful guide to the overall direction of travel in national house prices.

But homeowners really want to understand how the value of their own home is moving over time, which could be different to what’s reported in a national index.

In 2023, most house price indices registered modest annual price falls as higher mortgage rates hit buying power.

Many places experienced price falls for the first time since the Global Financial Crisis in 2007.

But while the overall average UK house price moved lower over 2023, the nation’s 30 million homes are spread across thousands of housing markets.

And our data reveals not every home fell in value last year: 3 in every 5 homeowners can testify to that.

Key takeaways

- 3 in 5 homeowners saw their homes hold their value or rise by an average of £7,800 in 2023

- 1 in 10 saw their home’s value increase by 5% or more

- Greater gains were seen in affordable areas like the North West, whereas homes in the South were more likely to see values drop

Two-thirds of first-time buyers team up to step on the property ladder

First-time buyers accounted for more than half of all home loans in 2023 - and more than two-thirds teamed up to secure their own homes.

Almost two thirds of first-time buyers teamed up last year in a bid to get onto the housing ladder.

Against a challenging economic backdrop, 63% of first-time buyer mortgage completions in 2023 were in joint names, with two or more people. Just 37% were sole applications, according to the latest research from Halifax.

First-time buyers accounted for just over half (53%) of all home loans last year, the highest proportion since 1995.

But the overall number of buyers that stepped onto the housing ladder last year stood at 293,339 – a 21% drop compared with 2022.

The number of first-time buyers fell in all regions across the UK in 2023, with the greatest drops in East Anglia and the south east.

What was the average deposit paid by first-time buyers in 2023?

Halifax said it was ‘unsurprising’ that the bulk of first-time buyer mortgage applications were joint, given the increase in deposits over the last decade.

First-time buyers forked out an average deposit of £53,414 last year, around 19% of the purchase price. That’s £9,057 (15%) less than in 2022 but £21,000 (67%) more than 10 years ago.

And even though the typical salary is higher than 10 years ago, first-time buyers have to save more than a year’s average pay for a deposit large enough to buy a first home, according to the lender.

Terraced homes most popular among first-time buyers

In a glimmer of hope for aspiring homeowners, the average price tag of a home for a first-time buyer fell 5% from its peak in 2022 to £288,136.

But house prices for first-time buyers remain over £132,000 (86%) more expensive than a decade ago.

Halifax’s research also revealed that terraced homes were the most sought-after type of property for first-time buyers in 2023, making up 30% of all first-time buyer mortgages.

But their popularity has faded over the last decade, with the number of first-time buyers snapping up a terraced home dropping by 7% compared with 2013.

Flats, on the other hand, have risen in popularity. The number of first-time buyers purchasing a flat over the last 10 years has climbed by 6%, increasing in every region and nation in the UK.

Where are the most affordable places to step onto the housing ladder?

First-time buyers should look to Scotland to boost their chances of homeownership. Many of the most affordable places to buy a first home are in Scotland, said the lender.

Inverclyde was crowned the most affordable area last year, where properties were around 2.6 times the average salary (£41,598).

At the other end of the spectrum, London was home to some of the least affordable places to get onto the housing ladder. Properties in Islington, north London, were a whopping 10.6 times the average salary (£57,548).

To put these figures into wider context, average property values for first-time buyers are around 6.7 times the average UK salary (£43,257), according to Halifax.

Kim Kinnaird, director, Halifax Mortgages said: ‘Following a record year in 2021, unsurprisingly in view of the wider economic environment, the number of first-time buyers joining the property market fell again in 2023 to around 293,000.

‘Despite this drop, new buyers made up over half of all home loans. However, to get a foot on the ladder most people are now buying for the first time in joint names.

‘The overall fall in house prices we saw in 2023 will go some way to helping people get on the ladder for the first time – but these buyers are still dependent on a steady supply of properties in their price range, while they are faced with the continued pressure of saving for a deposit, when rent and living costs are high.'

Key takeaways

- Almost two thirds of first-time buyers teamed up to buy a home last year, with 63% of mortgage completions in joint names, says Halifax

- The average deposit paid was £53,414, around 19% of the purchase price

- Inverclyde in Scotland has been crowned the most affordable place in the UK to step onto the housing ladder, while Islington in London is the least

‘First-time buyers have been hit especially hard by rising mortgage rates. The sub-4% deals we increasingly hear about are typically for those with equity levels of 40% or more,’ explained Tom Bill, head of UK residential research at Knight Frank.

‘The government is likely to offer first-time buyers more financial support ahead of the election this year given that housing is a key political battleground and based on the belief that homeowners are more likely to vote Conservative.’