Will house prices rise in 2024?

If you’re planning to buy or sell a home in 2024, what should you do? Our Executive Director of Research, Richard Donnell, shares his UK house prices forecast.

The first weeks of January have been full of reports about improving conditions in the housing sales market. Some are now projecting that UK house prices might even rise in 2024.

There has been a bounce-back in activity, which has followed the usual seasonal pattern. This is positive news but home buyers and sellers shouldn’t get too carried away with the hype.

Our data shows we are still locked in a buyers market, so it’s unlikely that we will see prices rise in 2024 at a national level. But at the same time, they haven’t fallen much over the last 12 months, despite mortgage rates more than trebling since 2021.

We believe that house prices still need to adjust to higher mortgage rates, even though these are now falling and appear to be on track to get into the 4%-4.5% range later this year.

This means sellers have to remain realistic on what someone will pay for their home and seek advice from an estate agent on how best to get their home ready to sell.

Return of pent-up demand after weak 2023

Demand for homes has certainly jumped out of the blocks in the first weeks of January as pent-up demand from 2023 returns to the market, encouraged by falling mortgage rates.

More than 75% of all homes currently for sale are featured on Zoopla and we can see that buyer demand is 10-15% higher than the pre-pandemic years of 2017-2019 - and also higher than at the start of 2023.

However, demand levels are still more than a third lower than they were at the start of the hotter pandemic years of 2020-2022.

Plenty of choice for buyers will keep price rises in check

While we have a return of buyers into the housing market, there are also many more homes for sale. This greater choice of homes available is likely to limit the scope for price rises in 2024.

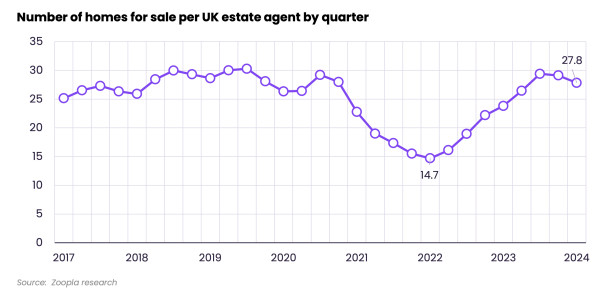

One feature of the pandemic years was a chronic shortage of homes for sale, which drove faster price rises. The low point was just 14 homes per estate agent in late 2022.

Supply is now more than double these lows and back up to an average of 30 homes for sale per agent, closer to the pre-pandemic average.

There are also more larger, 4+ bed family homes for sale, as some sellers re-list homes that might have been on the market in 2023 and struggled to attract interest.

More supply and weaker demand led to a drawn out re-pricing of homes listed for sale over 2023, as sellers adjusted asking prices lower in order to attract demand.

This accelerated in the second half of 2023 as higher mortgage rates hit buying power.

Asking price reductions for homes listed for sale have picked up again in January 2024, which is a sign that house prices are still adjusting to higher borrowing costs.

They aren’t as high as this time last year but are higher than those seen in previous years, as sellers speak to their agents about how to pitch their home at the right price level to attract renewed interest.

Half of owners with a mortgage still need to move onto higher mortgage rates

Buyers remain price sensitive and many with mortgages are still yet to remortgage onto higher rates.

The Bank of England estimates that around 55% of mortgage accounts (around 5 million), have remortgaged since rates started to rise in late 2021.

Higher mortgage rates are expected to affect around a further 5 million households by 2026.

For the typical owner-occupier mortgagor rolling off a fixed rate between 2023 Q2 and the end of 2026, their monthly mortgage repayments are projected to increase by around £240, or around 39%.

The good news is that the more mortgage rates decline, the smaller the jump in repayments.

However, for those looking to buy a home and trade-up for more space or a nicer area, this means spending more and taking on a larger loan, adding to monthly mortgage payments.

With inflation not falling as fast as economists expected, the decline in mortgage rates is set to moderate, despite intense competition between banks.

The cost of mortgages is set to keep buyers focused on value for money, even as mortgage rates fall, keeping prices in check.

It's still a buyers market and sellers need to price carefully

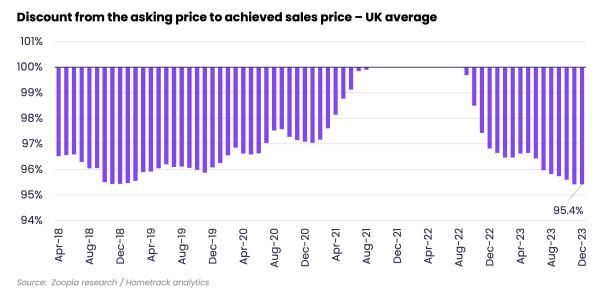

The average UK seller is having to accept offers below the asking price and the typical discount from the asking price to the agreed sale price is around 5%.

This is slightly below the long run average and well down on the hot market conditions seen over the pandemic years.

This proportion is not growing, which means larger price falls are unlikely. But it shows sellers will need to price carefully to ensure they attract demand.

The proportion of sellers achieving their asking prices varies across the UK, with slightly larger discounts happening in southern England.

Here, prices are higher than the national average and for that reason, the impact of higher mortgage rates on pricing levels has been greater than in other regions.

How should sellers and buyers respond to the positive start to 2024?

The positive news at the start of 2024 should boost market confidence and encourage more buyers and sellers into the market.

But it’s important sellers don’t get too carried away and shift expectations on what their home is worth in 2024 versus 2023.

It all depends on what you are looking to sell and how closely this matches to who is in the market looking to buy in your area and price range.

For example, we expect first time buyers to remain a very important group in 2024. However, this group is not focused on buying larger homes, where there is more supply.

Larger homes will mainly appeal to upsizers, who are likely to need bigger borrowings to buy at higher mortgage rates than 2-3 years ago.

We don’t expect house prices to suddenly start rising in 2024, but more demand and sensible pricing of homes for sale is likely to boost housing sales and overall levels of activity.

Key takeaways

- We are still locked in a buyers market, so it’s unlikely we'll see prices rise in 2024 at a national level

- House price falls were modest in 2023, despite mortgage rates more than trebling since 2021

- But buyers remain price sensitive and 45% of those with mortgages are yet to remortgage onto higher rates

- Inflation appears sticky, meaning there is only so far mortgage rates are likely to fall

- The average UK seller is having to accept offers and is getting around 95% of the asking price, so sellers must remain realistic on pricing

Renters paying an extra month's rent per year after latest rises

Rents jumped 9% in the last year, adding £1,200 - a month’s worth of rent - to the average annual bill.

2023 was another tough year for renters, with average rents for new lets reaching £1,200 in November - 9% higher than a year ago.

It means renters have seen an extra £1,200 - or a month’s worth of rent - added to their annual bill.

The table shows how much rents for new lets have increased across the UK in the last year.

| Region | Annual rental increase (%) | Annual rental increase (£) | Average monthly rent |

|---|---|---|---|

| Scotland | 12.1% | £84 | £780 |

| North West | 10.8% | £81 | £831 |

| Wales | 10.1% | £78 | £852 |

| North East | 9.7% | £60 | £672 |

| East Midlands | 9.7% | £75 | £846 |

| East of England | 9.5% | £99 | £1,145 |

| South East | 9.3% | £110 | £1,294 |

| West Midlands | 8.8% | £72 | £883 |

| South West | 8.6% | £83 | £1,061 |

| London | 8.0% | £157 | £2,128 |

| Yorkshire | 7.7% | £56 | £782 |

| Northern Ireland | 4.9% | £35 | £750 |

Zoopla Rental Index, data to November 2023 published in January 2024

Rental inflation in Scotland boosted by rent controls

In September 2022, the Scottish Parliament introduced a rent cap of 3% on annual rises to existing tenancies.

While intended to reduce cost-of-living pressures for renters, it means landlords are now going higher at the start of a tenancy to cover their costs and the limited increases during the contract.

In fact, Scotland has registered the highest level of annual rental inflation in the UK at +12.1%. The average monthly rent in Scotland stands at £780, £84 more than a year ago.

This is a slower rate of growth than the highs of +13.7% back in February 2023, but we still expect Scotland to see faster rental growth than anywhere else in the UK in 2024.

In turn, Scottish cities continue to register some of the largest rent increases in the country. Over the last 12 months, the average monthly rent in Edinburgh increased by £150 and in Glasgow by £100.

Rental inflation is much less dramatic in rural parts of Scotland, with Ayrshire, Moray and the Highlands all recording growth below +7%.

London leads the slowdown in rental growth

Rental inflation has slowed down in southern cities in the last 12 months, giving some relief to renters in the expensive South of England.

The largest moderation is in London, where rental inflation has dropped from +15.9% a year ago to +8.1% today.

Rental growth has slowed the most in Inner London boroughs. A year ago, we were seeing rises of +14.9% in Hammersmith and Fulham and up to +21.1% in Tower Hamlets. Today, no inner borough is seeing growth of more than +9.5%.

However, outer boroughs are a different story, seeing some of the highest rent increases in England right now. Rents have risen by more than +13.5% in boroughs like Hillingdon, Redbridge and Barking and Dagenham.

The second and third largest slowdowns are recorded in Bristol and Newport, where rental inflation has fallen to +7.9% and +8.8% respectively.

These reductions suggest landlords are becoming more realistic in pricing their rentals and may be taking cost-of-living struggles into consideration when setting new rates, which tend to be exacerbated for those in the rental market.

What are renters doing to minimise the impact of higher rents?

Some renters have escaped the steepest rises by staying in their existing homes.

Year-on-year rises for established tenancies rose at the slower rate of 6.2% according to the Index of Rental Prices from the Office for National Statistics.

When renters move and are faced with higher rents and a limited supply of homes on the market, they're more commonly considering renting smaller homes, moving to cheaper areas or house-sharing to reduce costs.

House-sharing reduces the cost of housing per person but it comes at the personal expense of privacy and space. Data from the Resolution Foundation found private renters have experienced a 16% reduction in floor space per person over the last 20 years.

What’s next for the rental market?

We believe that the rental market is now past peak rental growth after starting to cool in the final months of 2023.

We expect a further slowdown in rental growth in 2024 as worsening affordability keeps demand in check and supply improves slowly. There are already signs asking rents have overshot in some markets that are showing resistance to higher rents.

Slower increases will be welcome news to renters who have often faced steep hikes in the last two years.

Key takeaways

- A 9% rise in average monthly rent has added £1,200 to the average annual bill since this time last year

- Renters are now paying £1,200 per month on average, ranging from £672 in the North East to £2,128 in London

- Rental growth slowing to single digits is a sign we're past peak growth after nearly two years of 10%+ increases

- Scotland continues to register the highest rental growth despite rent controls

- London and the South of England are seeing rent growth slow the most as rents hit an affordability ceiling

- We expect a further slowdown in rental growth in 2024 as worsening affordability keeps demand in check

Buyers return amid falling mortgage rates

The first full week back after the new year has seen buyer interest jump out of the blocks faster than last year as mortgage rates drop. Get the latest with Richard Donnell.

The start of 2024 has seen a slew of more positive news on the housing market.

Over the last month, we’ve seen further signs that house price falls are slowing, alongside a further drop in average mortgage rates for new borrowers with some very competitive deals at 60% loan to value.

This reflects what we reported in our most recent house price index: a 17% increase in new sales agreed as buyers sought to lock down new deals at the end of 2023.

This improvement in market activity looks to be rolling over into the start of 2024, driven by improving mortgage rates.

London and South East lead fast start to 2024

The first full week back after the new year has seen buyer interest jump out of the blocks faster than last year and the pre-pandemic period in 2019.

It’s early days but our data shows demand at the end of the first week of January was more than 10% ahead of the same period a year ago.

Demand has jumped most in London and the South East, where house price gains over recent years have been much lower than the rest of the UK, which has helped improve housing affordability.

Modest house price falls over 2023

Our UK house price index shows that prices are 1.1% lower than a year ago, with signs that the scale of price falls is slowing.

Sales volumes are now starting to improve with buyers returning to the market.

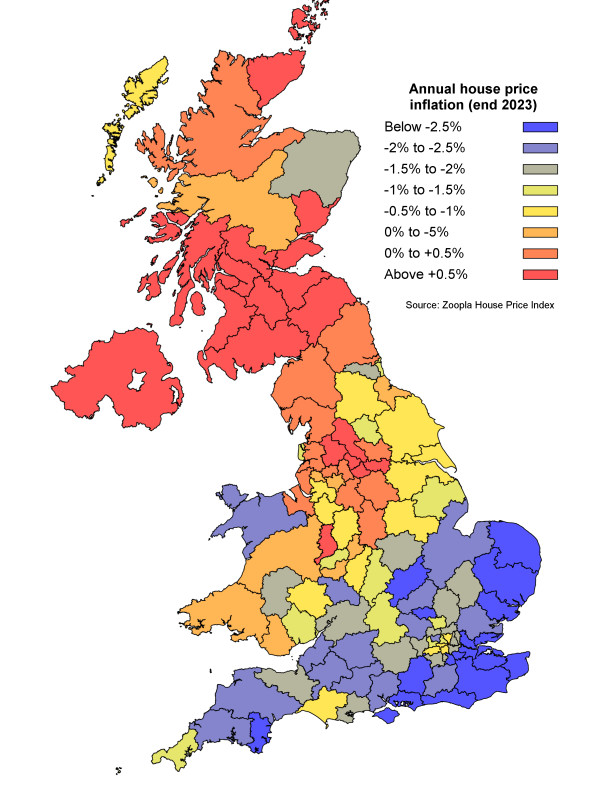

While the Zoopla house price index has recorded a modest fall in UK house prices over the last 12 months, the profile of price changes varies widely across the UK.

The largest price falls are up to 4% and concentrated across southern England in markets which saw the greatest demand over the pandemic, including those in the East of England and Kent.

Prices are also falling in areas where there has been strong demand for second homes, such as North Wales and the South West.

In contrast, house price inflation remains positive in many areas across northern England and Scotland. The rate of price gains has slowed quickly from double digit growth at the end of 2022 to close to 0% now but prices aren’t falling everywhere.

The greatest downward pressure on prices has been in southern England, where higher house prices mean a greater impact from higher mortgage rates.

This is where sellers are having to accept larger discounts to the asking price to achieve a sale, averaging around 6%.

While house prices are highest in London, they aren’t leading the fall. That's because the London market has lagged behind the rest of the country in terms of price growth over the last 6 years, making homes slightly less expensive and more accessible to buyers.

Annual house price inflation by postcode area November 2023

Nearly all homeowners are sitting on gains vs the start of the pandemic

House price falls have been modest, despite higher mortgage rates, because of the mortgage regulations introduced in 2015 by the Bank of England.

These regulations stopped the development of a bubble in house prices and are a key reason why price falls have been small over 2023.

The net result is that most areas have house prices still well above the levels they were before the pandemic hit the market, which created a boom in demand for housing.

The average UK home is now worth 18% (or £41,000) more than it was at the start of the pandemic in March 2020.

The map below shows the difference in house prices between March 2020 and November 2023.

It shows that the Northern regions, Wales and the South West are where house prices pushed highest during the pandemic - and that average prices in these regions are still over 24% higher than their pre pandemic levels.

Price gains have been more modest in and around London, where affordability pressures and mortgage regulations have limited the scope for price gains.

So for those looking to sell and move in 2024, the vast majority of homeowners are sitting on price gains compared to the pre-pandemic period.

It’s a much better position than many people predicted we would be in a year ago, although not us however.

House price growth since the start of the pandemic March 2020

What does this mean for buyers and sellers?

We certainly expect news of lower mortgage rates to boost buyer demand and bring more interest into the market over the coming months.

Buyers understand that there is more room to negotiate on pricing with sellers but many will also still need to sell a home to unlock their next move.

Sellers will need to remain realistic over the value they expect to achieve from their property and be prepared to negotiate on price.

We saw a steady reduction in asking prices over 2023, as sellers worked with their estate agents to get the pricing right to attract demand and increase the chances of securing a sale.

Much depends on the type of property you're selling and its location, so it’s essential to speak to your local agent to get a view of demand for a home like yours in the current market.

Key takeaways

- The number of buyers out home hunting has shot up 10% compared to this time last year

- House price falls are starting to slow as sales agreed rise by 17%

- The average UK home is worth 18% (or £41,000) more than it was in March 2020

- Mortgage rates drop further with some very competitive rates for borrowers with a 60% LTV