House Price Index: December 2023

House price inflation running at -1.1% as market sentiment improves with demand up and more sales agreed. Get the latest in our December House Price Index with Richard Donnell.

Sales hold up in Q4 2023, providing support for prices

The final weeks of 2023 have recorded above average levels of new sales, 17% higher than a year ago.

Market sentiment is improving due to rising incomes and an initial decline in mortgage rates. Demand is also 19% higher than a year ago.

An increase in available supply, up a quarter on last year, is also boosting choice and supporting sales. Buyers and sellers are becoming more aligned on pricing, reducing the downward pressure on values.

Our headline UK house price index has recorded a slower pace of annual price decline at -1.1% in November 2023, down from +7.2% a year ago.

And price falls have now moderated across all regions and countries of the UK.

House price indices can show varied trends when the market turns

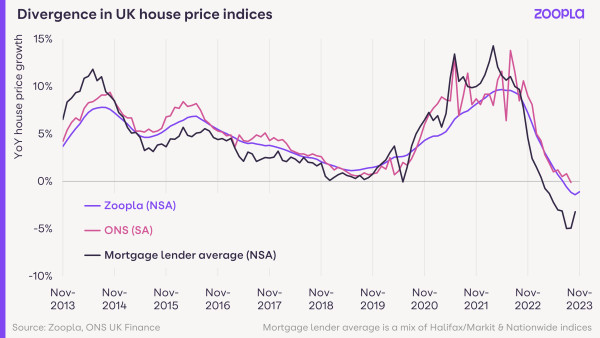

UK house price indices track well over time, but they tend to separate at key moments as the volume and mix of sales changes.

The Zoopla house price index is based on the largest dataset of any UK house price index.

It has performed inline with the ONS house price index, with both series including cash and mortgaged sales.

In 2023, cash purchases look set to account for a third of all sales and are therefore an important source of pricing evidence.

The average price of a cash purchase is 10% lower than the average mortgage funded sale. This makes cash purchases slightly more affordable, especially since there is no mortgage process or valuation required to enable a sale.

Mortgaged sales are on track to be 30% lower over 2023 as higher mortgage rates hit demand. Because of this, mortgage lenders’ house price indices responded quickly to weaker demand, recording steeper price falls over 2022 Q4 and 2023 H1.

However, the annual growth rate in house prices recorded by lenders has improved in recent months as market activity and pricing stabilises, bringing it back towards the Zoopla/ONS series.

Why haven’t house prices fallen more in 2023?

History suggests that mortgage rates rising from 2% to over 5% would have led to larger price falls than what has been recorded over 2023.

There are several reasons why prices have defied the predictions of larger falls:

1. The strength of the labour market has been an important factor along with high growth in average earnings.

2. Lenders have also pursued forbearance policies to support households struggling with repayments, which has limited the number of forced sellers.

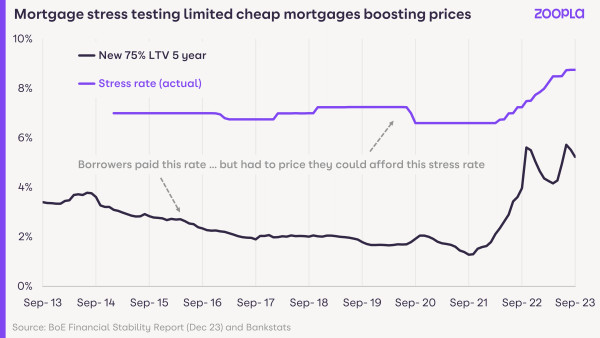

3. And perhaps the most important factor of all: the introduction of tougher mortgage affordability testing for new borrowers since 2015.

These regulations were designed to stop households taking on excessive debts at a time of low mortgage rates.

They have stopped a major housing overvaluation and built resilience for many households to manage the transition to higher mortgage rates.

While mortgage rates got as low as 1.3% in late 2021, all new mortgage borrowers had to prove to their bank that they could afford a 6-7% stressed mortgage rate to get the loan (see chart below).

Banks were also limited to 15% of new business at high loan to income ratios over 4.5x.

These regulations have effectively capped buying power for home buyers.

They require the borrower to have a higher income to buy and put down a larger deposit, which is especially true in higher value housing markets.

ONS data shows that first-time buyers in London put down an average deposit of £145,000 in 2022, compared to £26,000 for those buying in the North East.

Today, lenders are stress testing new borrowers at close to 9% despite mortgage rates starting to fall.

This regulatory constraint on buying power is one reason we believe house prices are unlikely to rise in 2024, even as base rates start to fall later in the year.

First-time buyers to remain largest buyer group in 2024

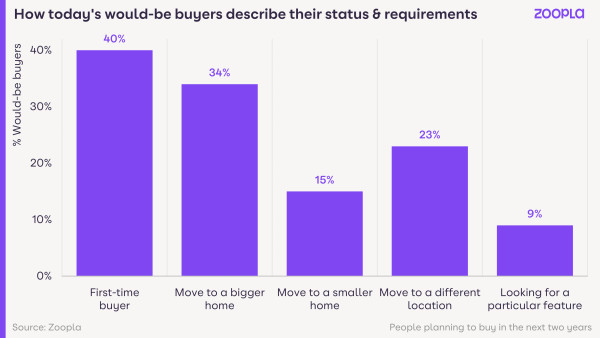

Despite the affordability challenges facing first-time buyers, they will be the largest group of would-be buyers in the next 2 years.

Our latest consumer survey of home moving intentions found that 40% of people looking to buy a home in the next 2 years are first-time buyers.

The rapid growth in rents continues to motivate this group - average rents have risen faster than average mortgage repayments over the last 3 years - despite the need for higher deposit levels.

Upsizers account for a third of would-be buyers in the next 2 years, who will typically be buying a larger home that will require a larger mortgage.

This group has been biding their time in 2023, waiting for the outlook on the economy and mortgage rates to become clearer. The trajectory for mortgage rates and getting better value for money will be key considerations for upsizers in 2024.

Buyers look further afield for better value

Almost a quarter of would-be home movers say they are looking to move to a different location.

A high proportion of home moves tend to be limited to within local areas - the average distance buyers are looking to move when searching on Zoopla is 4.3 miles.

However, in the face of higher borrowing costs and the search for value, one of the key trends for 2024 will be buyers continuing to look further afield in search of better value.

This is particularly the case in high value housing markets where upsizing is expensive.

Our data shows that almost half of would-be movers currently living in southern regions are looking to move more than 10 miles. The proportion looking longer distances in other parts of the UK is lower.

This is important for home builders and estate agents who tend to focus on demand and needs in local areas whereas there is the need to capture and nurture demand coming from further afield, especially as these buyers may well have more money to spend.

Outlook for 2024

We expect the steady momentum in new sales that has developed over the final quarter part of 2023 to continue into early 2024, with the usual seasonal rebound in demand over Q1 as pent-up demand returns to the market.

While mortgage rates are edging lower, affordability remains a key challenge for mortgage reliant households who are making home moving decisions.

The impact of higher mortgage rates continues to feed through with half of mortgagees yet to move onto higher rates from cheaper fixed rate deals agreed before 2022.

The modest decline in house prices over the year means UK housing still looks 10-15% overvalued at the end of 2023. We expect this position to improve over 2024 as incomes rise and house prices drift 2% lower over the year. Sales volumes are expected to hold steady at 1 million sales completions over 2024.

Key takeaways

- Annual UK house price inflation running at -1.1% (compared with +7.2% in Nov-22)

- Market sentiment improving with new sales agreed running 17% higher than a year ago, demand is also 19% higher as buyer sentiment improves

- House price falls starting to moderate as sales volumes improve

- Mortgage regulations a key reason for only modest price falls in 2023 along with strong labour market and rapid earnings growth

- First-time buyers are largest group of would-be movers in next 2 years (40%) followed by upsizers (34%)

- Almost half of buyers living in southern England looking to move more than 10 miles, in search of better value for money

- House prices to fall 2% over 2024 with 1m sales

Are UK house prices falling in December 2023?

UK house prices have fallen -1.1% in the last year, bringing the average house price to £264,500. So where’s faring worst, and is anywhere escaping the price falls so far? Let’s find out what’s happening with house prices in December 2023.

The average UK house price is now £264,500. That’s £2,990 lower than a year ago and £100 lower than last month.

However, the rate of house price falls has moderated across all regions and countries of the UK. Buyers and sellers are becoming more aligned on pricing, reducing the downward pressure on values.

Our UK House Price Index has recorded a slower pace of annual price decline at -1.1% in the last year (versus +7.2% a year ago). Prices fell -1.1% in the year to November 2023, -1.4% in the year to October and -1.2% in the year to September.

Where are UK house prices falling in December 2023?

Regions

Homeowners in Southern England are seeing the biggest fall in house prices. The East of England (-2.7%), the South East (-2.4%) and the South West (-2.2%) are the worst hit, as higher mortgage rates reduce demand the most in more expensive regions.

On the other hand, property prices are now +2.1% and +1.3% higher than a year ago in Northern Ireland and Scotland respectively.

Lower average house prices here means many people can still afford to buy a home with a higher mortgage interest rate. This keeps the housing market moving and gives less need for sellers to reduce their prices.

Cities

Cities in the South of England are seeing the biggest house price falls, with Southampton (-2.8%) hit harder than any other UK city.

Fellow south coast cities Portsmouth (-2.4%) and Bournemouth (-2.1%) are among the larger price falls, along with Cambridge (-2.6%) in the East, Leicester (-2.0%) in the East Midlands and Bristol (-1.9%) in the South West.

These Southern cities enjoyed strong buyer demand and significant price growth during the pandemic. But now demand is falling and supply is growing, there is downward pressure on local property prices.

On the other hand, house prices are still rising slowly in more affordable cities in Scotland, Northern Ireland and the North of England. This includes Belfast (+3.2%), Glasgow (+1.3%), Edinburgh (+0.9%) and Newcastle (+0.5%).

Local authority areas

Parts of Kent and Norfolk are seeing the biggest house price falls in the country. Many of these popular areas saw prices rise sharply during the pandemic due to strong demand in the ‘race for space’ or lifestyle influences.

But now they’re seeing demand fall and supply grow due to higher mortgage rates, putting the negotiating power in buyers’ hands.

| Local authority area and county | Annual house price change (%) | Annual house price change (£) | Average house price |

|---|---|---|---|

| Dover, Kent | -4.5% | -£13,960 | £297,900 |

| Canterbury, Kent | -4.5% | -£15,790 | £343,800 |

| Thanet, Kent | -4.3% | -£13,180 | £293,300 |

| Broadland, Norfolk | -4.1% | -£13,460 | £318,000 |

| North Norfolk, Norfolk | -4.1% | -£13,230 | £313,100 |

| South Norfolk, Norfolk | -4.1% | -£13,640 | £322,600 |

| Breckland, Norfolk | -4.0% | -£11,510 | £273,300 |

| Great Yarmouth, Norfolk | -4.0% | -£8,060 | £193,200 |

| Norwich, Norfolk | -4.0% | -£9,480 | £226,200 |

| Waveney, Suffolk | -4.0% | -£10,120 | £241,900 |

Zoopla House Price Index, December 2023

Why are UK house prices falling?

Higher interest rates on mortgages have made it harder for people to buy a home, which reduces demand for property. At the same time, there are many more homes on the market than in recent years.

These factors together create a buyers’ market - when buyers have more choice so sellers are under pressure to price more competitively in order to sell.

However, the market is in a much better condition than this time last year, when the fall-out from the mini budget was still fresh. Buyer demand is up +19% on a year ago which is helping +17% more new sales agreed. There is also an increase in available supply, up a quarter on last year, which is boosting choice and supporting sales.

Why haven’t house prices fallen further in 2023?

History suggests that mortgage rates rising from 2% to 5%+ would have led to larger house price falls than those we’ve recorded in 2023.

But there are several reasons to explain the more modest falls.

The strength of the labour market and high growth in average earnings are important factors.

Lenders’ forbearance policies are supporting households struggling with repayments, which has limited the number of forced sellers.

Perhaps most important is the tougher mortgage affordability testing for new borrowers since 2015. New regulations were designed to stop households taking on excessive debt and artificially inflating house prices.

This has prevented a major housing overvaluation and made sure that most households can manage the transition to higher mortgage rates.

While mortgage rates dropped as low as 1.3% in late 2021, new mortgage borrowers had to prove they could afford a 6% to 7% rate. At the same time, banks were only allowed to lend 15% of new customers more than 4.5 times a salary.

These regulations mean mortgage borrowers must have a higher income and put down a larger deposit. The higher the house prices, the more they need.

The chart shows the rate at which lenders have stress-tested over the last 10 years versus the mortgage rate borrowers have paid.

Will house prices keep falling in 2024?

Yes, our data suggests that house prices will keep falling slowly next year.

After three years of strong price growth up until 2022, higher mortgage rates are resetting the price people can afford to buy at.

Despite a modest decline in house prices over 2023, UK housing still looks 10-15% overvalued at the end of the year. We expect this position to improve during 2024 as incomes rise and house prices drift 2% lower. Sales volumes are expected to hold steady at 1 million sales completions over 2024.

Lenders are stress-testing new borrowers at close to 9%, despite actual mortgage rates starting to fall. This regulatory constraint on buying power is one reason we believe house prices are unlikely to rise in 2024 even if the Bank Rate starts to fall later in the year.

Mortgage rates need to drop further to improve affordability and encourage people to move.

How far house prices will fall hinges on the trajectory for mortgage rates and how mortgage lenders assess affordability. Some economists forecast that the Bank of England will start cutting rates around summer 2024. This would see mortgage rates falling and mean an uplift in housing market activity towards the end of next year.

Key takeaways

- House prices are falling in all property price bands and areas of England and Wales

- The biggest annual falls are in the East of England (-2.7%), the South East (-2.4%) and the South West (-2.2%)

- Southampton, Aberdeen, Cambridge and Portsmouth are worst hit in terms of UK cities

- Parts of Kent and Norfolk are seeing the largest house price falls as they feel the impact of high mortgage rates and low demand

- Northern Ireland (+2.1%) and Scotland (+1.3%) are the only UK regions where house prices are rising, while the North East has seen no annual change

- Property prices remain well above what they were before the pandemic, even in the places with the biggest house price falls

House price falls start to slow

Buyers and sellers are becoming more aligned on pricing, reducing the downward pressure on house prices and falls are starting to moderate.

The housing market is looking more buoyant than it did this time last year following the mini budget.

New sales agreed are running 17% higher than in November 2022, while buyer demand is up 19%.

However, housing market confidence was badly knocked in November 2022 following Kwasi Karteng’s Autumn Statement. The Bank Rate jumped to 3% and the average mortgage rate for a five-year fixed deal pushed northwards of 6%.

Today, we’re seeing an initial decline in mortgage rates, with the average five-year fixed deal now sitting at 4.74% for those with a 25% deposit.

This, along with rising incomes, is helping to boost buyer confidence.

Meanwhile, an increase in the number of homes available for sale - up 25% on last year - is boosting choice and supporting sales.

Buyers and sellers are also now also becoming more aligned on pricing, reducing the downward pressure on house prices and falls are beginning to moderate.

Thinking of selling?

Get the ball rolling with an in-person valuation of your home. It’s free and there’s no obligation to sell if you change your mind.

Property sales supported by cash buyers in 2023

This year, cash buyers are on track to account for 30% of all house sales. Conversely, the number of mortgaged sales fell by 30%, as higher mortgage rates hit demand.

Yet house prices didn’t tumble despite the hit to buying power. Why?

1: The labour market has remained strong throughout 2023 and wages have continued to rise.

2: Lenders have support measures in place to help those who are struggling to pay their mortgages - and this has limited the number of forced sales from homeowners.

3: Finally, and perhaps most importantly of all, lenders have had strict affordability testing measures in place since 2015, preventing buyers from taking on excessive debts at a time of low mortgage rates.

Even when mortgage rates were sitting at 1.3% back in 2021, mortgagees had to prove that they could still repay their debts if those rates increased to 6-7%.

Banks were also restricted in their ability to lend 4.5x or more of a borrower’s salary. Only 15% of their loans were allowed to be this large.

Today, lenders are stress testing new borrowers at close to 9%, even though mortgage rates are starting to fall.

Our Executive Director of Research, Richard Donnell, says: ‘This regulatory constraint on buying power is one reason we believe house prices are unlikely to rise in 2024, even as base rates start to fall later in the year.’

Who will be the big movers in 2024?

Our latest consumer survey reveals first-time buyers are set to be the biggest group of buyers next year, accounting for 40% of all sales.

Average rents have risen faster than average mortgage repayments over the last three years, which is a key motivator for this buying group.

They’ll be hotly followed by upsizers (34%), who have been biding their time this year amid mortgage rate uncertainties.

Buyers in expensive regions set sights on homes further afield

To help mitigate higher mortgage rates, we’re expecting to see buyers looking further afield in 2024.

Currently, the average distance buyers are looking to move when searching on Zoopla is 4.3 miles.

Yet our data shows that buyers in the south, where homes are more expensive and need bigger mortgages, are looking to move more than 10 miles at the moment to secure a good value home.

What’s going to happen in the housing market next year?

‘We expect the steady momentum in new sales that has developed over the final part of 2023 to continue into early 2024,’ says Donnell.

‘While mortgage rates are edging lower, affordability remains a key challenge for mortgage-reliant households who are making home moving decisions.’

In fact, half of mortgagees are yet to move onto higher rates from the cheaper fixed rate deals they agreed before 2022.

‘The modest decline in house prices over the year means UK housing still looks 10-15% overvalued at the end of 2023,’ says Donnell.

‘We expect this position to improve over 2024 as incomes rise and house prices drift 2% lower over the year.

‘Sales volumes are expected to hold steady at 1 million sales completions over 2024.’

Key takeaways

- Market sentiment is improving and house prices are holding steady

- The number of new sales agreed is currently 17% higher than in November 2022 and buyer demand is up 19% on this time last year

- Sellers in the south are likely to attract buyers from further afield in 2024 as they search out new areas to secure good value homes