Buyers and sellers are becoming more aligned on pricing, reducing the downward pressure on house prices and falls are starting to moderate.

The housing market is looking more buoyant than it did this time last year following the mini budget.

New sales agreed are running 17% higher than in November 2022, while buyer demand is up 19%.

However, housing market confidence was badly knocked in November 2022 following Kwasi Karteng’s Autumn Statement. The Bank Rate jumped to 3% and the average mortgage rate for a five-year fixed deal pushed northwards of 6%.

Today, we’re seeing an initial decline in mortgage rates, with the average five-year fixed deal now sitting at 4.74% for those with a 25% deposit.

This, along with rising incomes, is helping to boost buyer confidence.

Meanwhile, an increase in the number of homes available for sale – up 25% on last year – is boosting choice and supporting sales.

Buyers and sellers are also now also becoming more aligned on pricing, reducing the downward pressure on house prices and falls are beginning to moderate.

Thinking of selling?

Get the ball rolling with an in-person valuation of your home. It’s free and there’s no obligation to sell if you change your mind.

Property sales supported by cash buyers in 2023

This year, cash buyers are on track to account for 30% of all house sales. Conversely, the number of mortgaged sales fell by 30%, as higher mortgage rates hit demand.

Yet house prices didn’t tumble despite the hit to buying power. Why?

1: The labour market has remained strong throughout 2023 and wages have continued to rise.

2: Lenders have support measures in place to help those who are struggling to pay their mortgages – and this has limited the number of forced sales from homeowners.

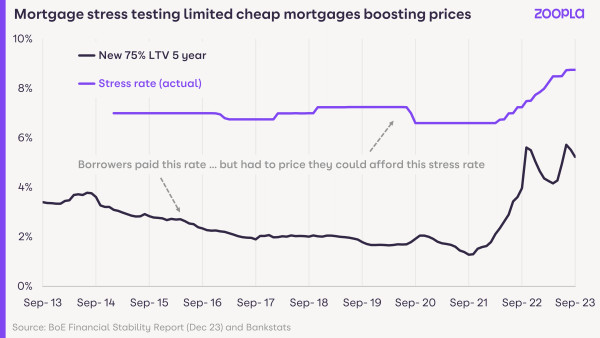

3: Finally, and perhaps most importantly of all, lenders have had strict affordability testing measures in place since 2015, preventing buyers from taking on excessive debts at a time of low mortgage rates.

Even when mortgage rates were sitting at 1.3% back in 2021, mortgagees had to prove that they could still repay their debts if those rates increased to 6-7%.

Banks were also restricted in their ability to lend 4.5x or more of a borrower’s salary. Only 15% of their loans were allowed to be this large.

Today, lenders are stress testing new borrowers at close to 9%, even though mortgage rates are starting to fall.

Our Executive Director of Research, Richard Donnell, says: ‘This regulatory constraint on buying power is one reason we believe house prices are unlikely to rise in 2024, even as base rates start to fall later in the year.’

Who will be the big movers in 2024?

Our latest consumer survey reveals first-time buyers are set to be the biggest group of buyers next year, accounting for 40% of all sales.

Average rents have risen faster than average mortgage repayments over the last three years, which is a key motivator for this buying group.

They’ll be hotly followed by upsizers (34%), who have been biding their time this year amid mortgage rate uncertainties.

Buyers in expensive regions set sights on homes further afield

To help mitigate higher mortgage rates, we’re expecting to see buyers looking further afield in 2024.

Currently, the average distance buyers are looking to move when searching on Zoopla is 4.3 miles.

Yet our data shows that buyers in the south, where homes are more expensive and need bigger mortgages, are looking to move more than 10 miles at the moment to secure a good value home.

What’s going to happen in the housing market next year?

‘We expect the steady momentum in new sales that has developed over the final part of 2023 to continue into early 2024,’ says Donnell.

‘While mortgage rates are edging lower, affordability remains a key challenge for mortgage-reliant households who are making home moving decisions.’

In fact, half of mortgagees are yet to move onto higher rates from the cheaper fixed rate deals they agreed before 2022.

‘The modest decline in house prices over the year means UK housing still looks 10-15% overvalued at the end of 2023,’ says Donnell.

‘We expect this position to improve over 2024 as incomes rise and house prices drift 2% lower over the year.

‘Sales volumes are expected to hold steady at 1 million sales completions over 2024.’

Key takeaways

- Market sentiment is improving and house prices are holding steady

- The number of new sales agreed is currently 17% higher than in November 2022 and buyer demand is up 19% on this time last year

- Sellers in the south are likely to attract buyers from further afield in 2024 as they search out new areas to secure good value homes