Selling this year? Then we’ve got some good news

If you're looking to sell a home that represents good value, then you're in demand. Homes that offer more bang for their buck are just what buyers are looking for right now.

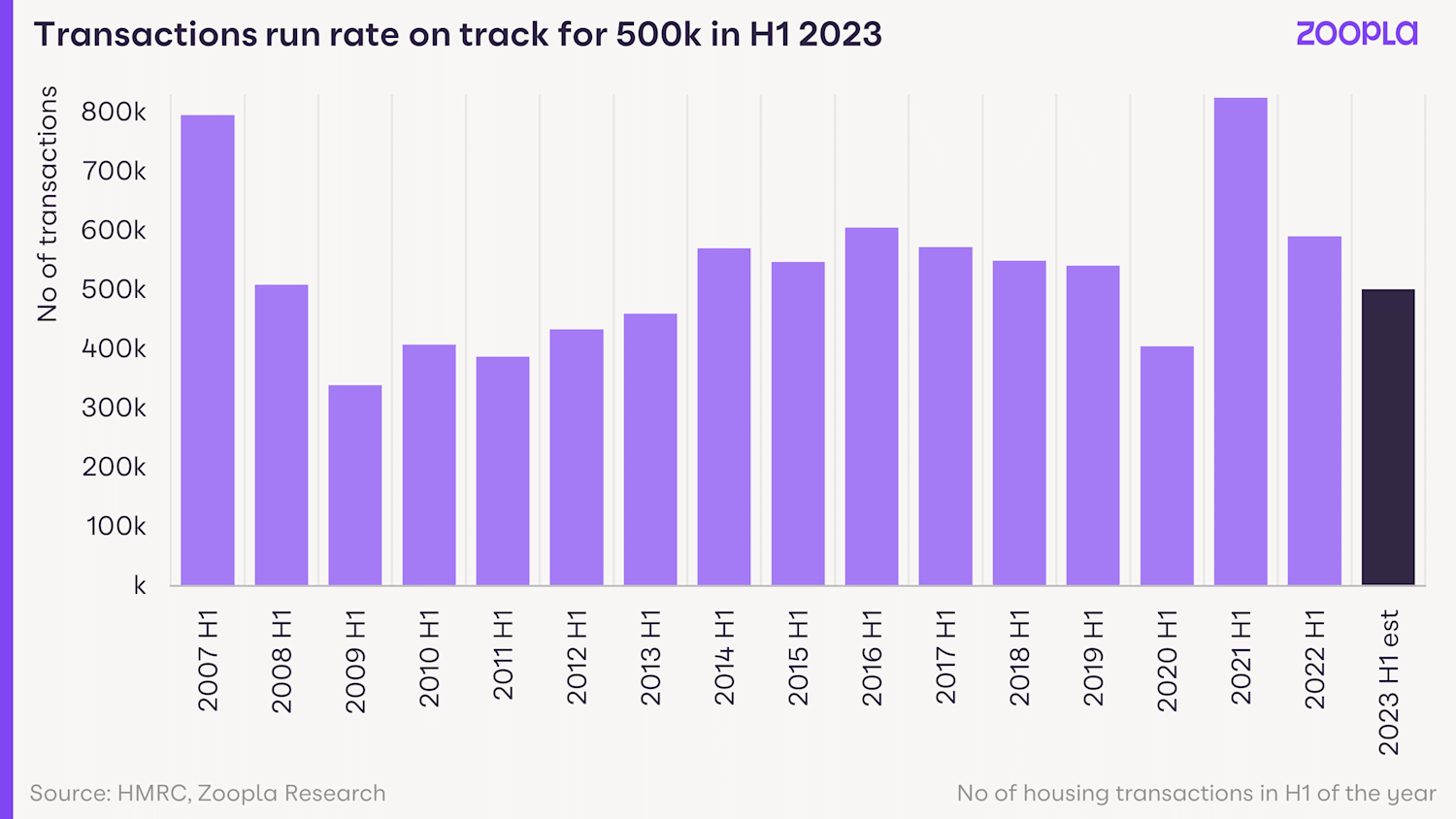

House prices are still up 4% year on year and we’re expecting 500,000 home sales to go through in the first half of 2023.

The number of sales agreed is 11% higher than the number agreed in spring 2019 - and sales are on an upward trajectory.

Prices are down 1% from what they were in October 2022, but the housing market is faring much better than many predicted and the number of sales going through is starting to pick up.

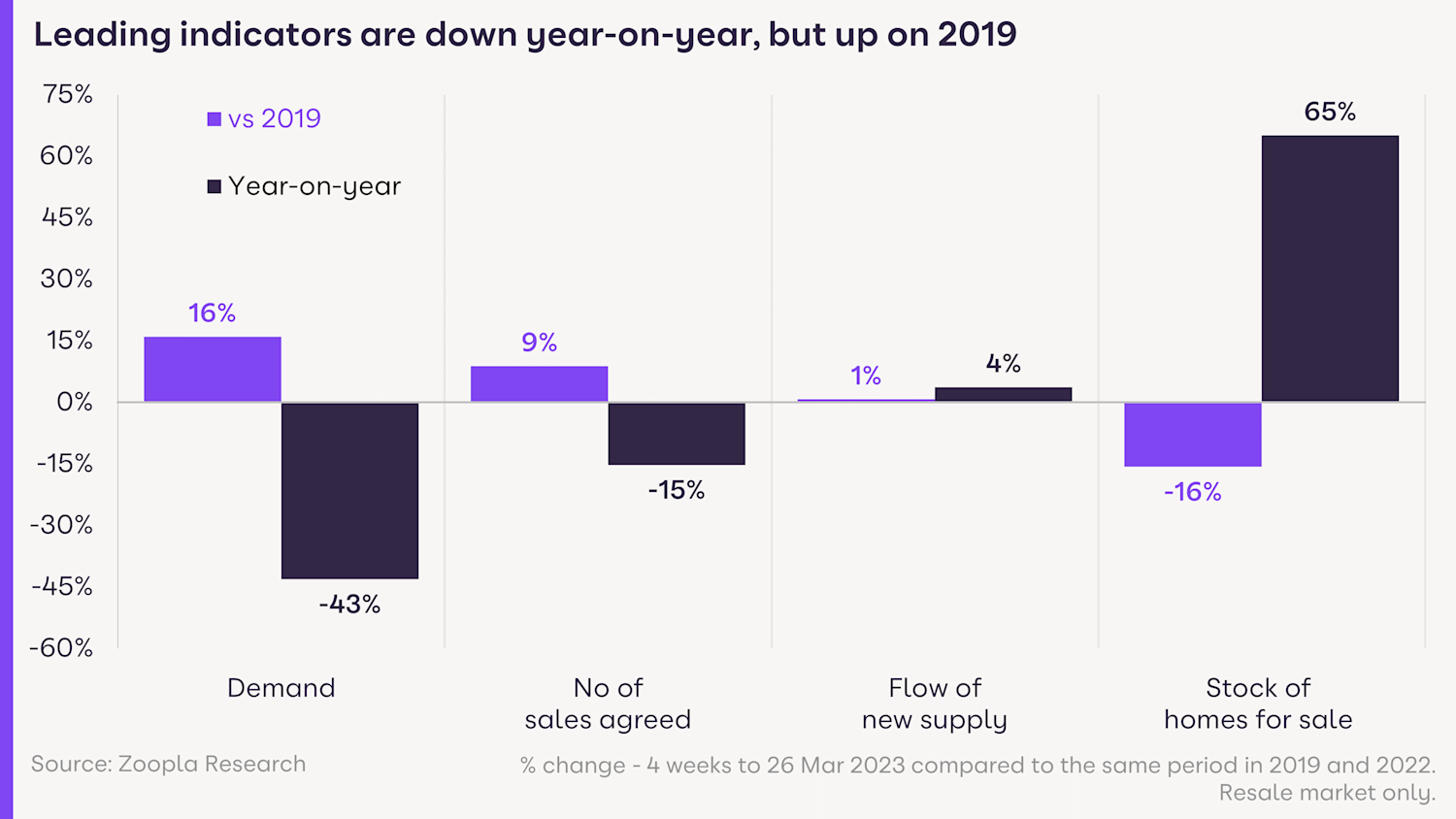

There are now 65% more homes available for sale than there were this time last year. The average estate agent now has 25 homes available, compared to a low of 14 homes in spring 2022.

This means there’s much more choice for buyers - and we’re expecting at least a million home sales to go through in 2023.

If your home represents good value for money, then you’re in demand

Buyers with less spending power are looking for homes that offer more bang for their buck.

That means homes in the more affordable areas like Scotland, Wales, the North East of England and London are seeing plenty of demand.

And we’re expecting the popularity of inner London flats to see a resurgence this year - because of price stagnation since 2016 - they’re now representing good value for money.

Across all regions and countries of the UK, we’re seeing a 5% increase in the share of sales at the lower end of the market and a 4% decrease at the top end, clearly showing that buyers are currently more interested in homes at the more affordable end of the spectrum.

The top end of the London market is the only area bucking this national trend, with an increase in the share of sales in the top 20%.

If you live in an area that saw big gains during the pandemic (we’re talking the South West, South East and Midlands) then you may find it takes longer to sell, as these homes now need bigger mortgages from would-be buyers.

And 4% mortgage rates are currently reducing buying power by 20%, hence buyers are looking for cheaper properties.

How much are sellers cutting their asking prices by?

Sellers are making modest downward adjustments to their asking prices to ensure their pricing matches what buyers are prepared to pay.

The average seller discount at the moment is 4% or £14,000.

That said, the scale of price gains over the pandemic (where the average home value increased by £42,000) is giving sellers room for manoeuvre to make these adjustments so that they can continue with their moving plans.

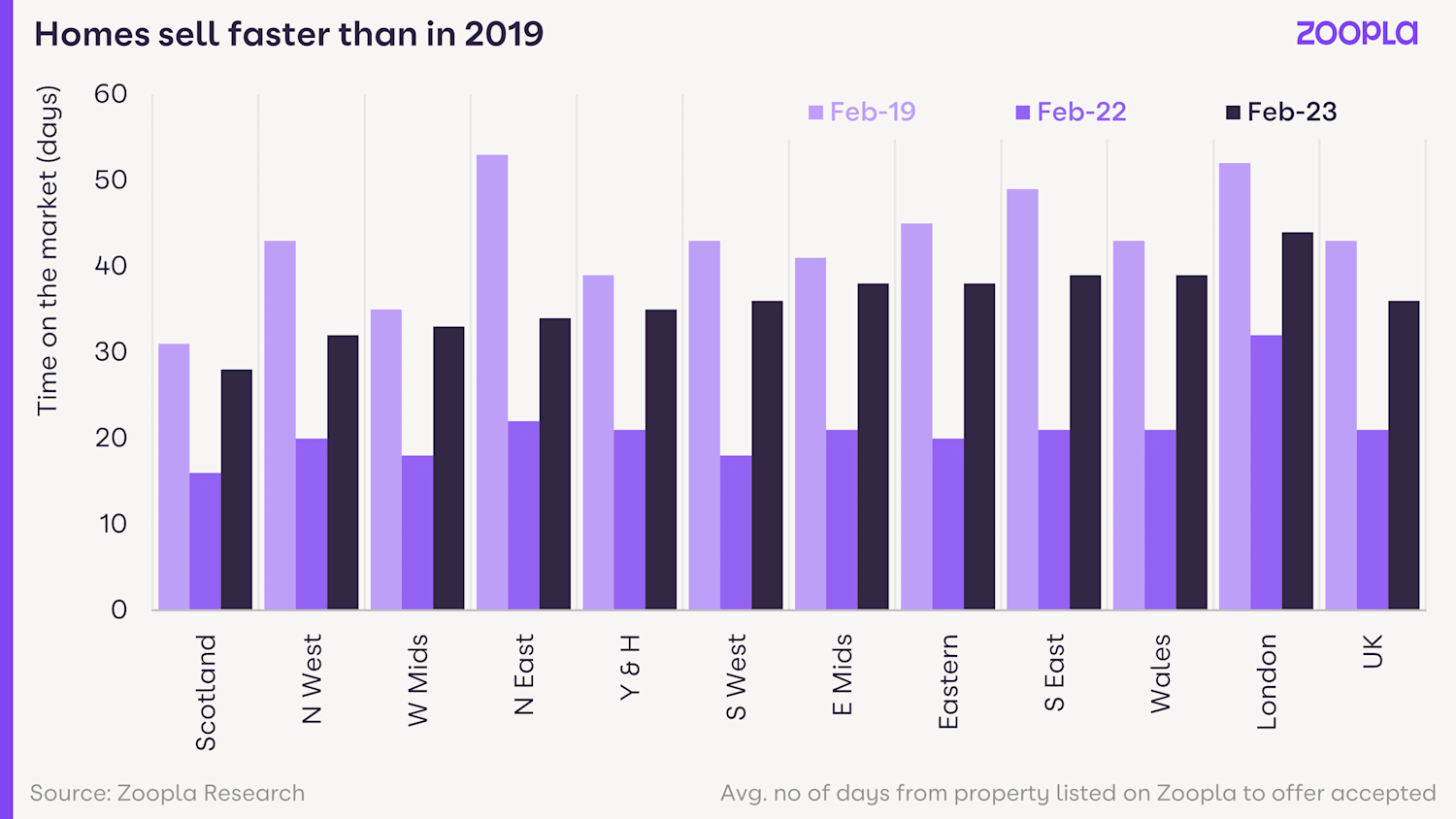

How long does it take to sell a home in March 2023?

The average home is now taking 15 days longer to sell than in spring 2022, when we were in a red hot housing market.

However, homes in most areas are still selling faster right now than they did in spring 2019.

Scotland has the shortest sales period at 28 days (where homes are marketed with a survey and valuation in place), and London has the longest time to sell at 44 days.

Why buyers are still motivated to move in 2023

Hybrid working between the home and office is becoming the norm for many office workers.

And that freedom is still opening up the buying landscape for many, allowing them to look further afield for a home that’s better value for money.

A spike in retirement caused by the pandemic is also continuing to be a trigger for home moves.

Meanwhile, increasingly high rents are pushing some renters to become first-time buyers.

And finally, cost-of-living pressures will encourage some movers to down-trade from larger homes that are expensive to run to more affordable properties.

How is the rest of 2023 looking for the housing market?

The market is going through a soft repricing process with modest quarter-on-quarter price falls across all regions and countries of the UK.

But the good news is that buyers and sellers are continuing to agree deals and there’s little evidence to suggest house prices and transaction volumes are going to suddenly drop lower.

The most affordable markets will continue to attract demand and see above-average levels of sales.

The onus on all sellers is to make sure pricing aligns with buyers' expectations. If you are serious about moving, you simply cannot afford to over-price your home.

Mortgage rates are set to remain around 4% over much of 2023 and could move lower towards the end of the year.

Key takeaways

- Demand for homes has reached its highest level since October 2022 and is 16% higher than spring 2019

- Demand from buyers is also above average in the most affordable areas, led by Scotland, Wales, the North East of England and London

- Mortgage rates are set to remain at around 4% for most of 2023 - and could move lower towards the end of the year

- Prices are adjusting lower but most homeowners looking to sell will still be making more from their home than 1-2 years ago

Where are house prices falling in the UK?

Seven local authority areas in the UK have seen an annual fall in house prices.

Houses across the UK are now selling at an average price of £259,700, 1% less than in October 2022.

UK-wide annual house price growth has dropped to 4.1%, but a few locations are already seeing annual price falls: expensive London boroughs and the east coast of Scotland.

We’ll reveal the locations in the UK where house prices are falling and rising, plus the cheapest and most expensive places to buy a home on average right now.

Having said that, we know averages aren’t going to cut it when it comes to your home.

The UK locations where house prices are falling

Four parts of London have registered a fall in average house prices since this time last year.

Homes in Westminster are selling for £12,170 less than a year ago on average (-1.2%), while properties in Kensington and Chelsea have lost an average of £6,220 (-0.5%).

House prices have fallen slightly in Hammersmith and Fulham (-0.1%) and Tower Hamlets (-0.1%), taking £550 and £350 off the average sale price respectively.

Meanwhile, Islington, Camden and Wandsworth have seen house prices rise less than 1% in the last year.

London is feeling the impact of increased mortgage rates due to its higher house prices, which is impacting buyer demand and causing price growth to stagnate or fall into reverse.

The only other places in the country where house prices are already falling year-on-year are on the east coast of Scotland: Aberdeen (-1.1%), Aberdeenshire (-0.2%) and Moray (-0.2%).

A lack of investment in the North Sea’s oil industry in recent years is having a knock-on effect on local employment and reducing demand for property on the Scottish east coast.

Here are the sevens places where house prices are falling, along with the locations seeing the lowest annual house price growth.

| Local authority area | Average house price | Annual price change (%) | Annual price change (£) |

|---|---|---|---|

| City of Westminster | £962,600 | -1.2% | -£12,170 |

| Aberdeen | £140,000 | -1.1% | -£1,590 |

| Kensington and Chelsea | £1,189,400 | -0.5% | -£6,220 |

| Moray | £168,700 | -0.3% | -£560 |

| Aberdeenshire | £186,600 | -0.2% | -£350 |

| Hammersmith and Fulham | £731,100 | -0.1% | -£550 |

| Tower Hamlets | £482,100 | -0.1% | -£350 |

| Islington | £628,000 | 0.4% | £2,260 |

| Camden | £750,900 | 0.6% | £4,560 |

| Wandsworth | £655,500 | 0.7% | £4,660 |

Zoopla House Price Index, March 2023

The UK locations where house prices are rising the most

Areas in the North West and Wales are recording the strongest house price growth in the UK, with homeowners gaining more than 6% in sale prices year-on-year.

House prices have risen the most in four towns near Manchester - Oldham (+7.4%), Rochdale (+7.3%), Wigan (+7.1%) and Calderdale (+6.9%) - as buyers seek value for money and connections to large employment centres.

Homeowners in these areas can expect to see at least £10,000 added to their home’s sale price since February 2022.

Areas in South and West Wales have also enjoyed strong house price growth in the last year, with the biggest gains seen in Carmarthenshire (+6.8%), Neath Port Talbot (+6.7%) and Bridgend (+6.6%).

The Vale of Glamorgan has seen the biggest monetary gains with homeowners adding £17,360 (+6.3%) to their home’s sale price, while those in Pembrokeshire have seen a £13,920 rise (+6.5%) since February 2022.

| Local authority area | Average house price | Annual price change (%) | Annual price change (£) |

|---|---|---|---|

| Oldham | £171,900 | 7.4% | £11,820 |

| Rochdale | £163,700 | 7.3% | £11,070 |

| Wigan | £163,900 | 7.1% | £10,860 |

| Calderdale | £169,200 | 6.9% | £10,900 |

| Carmarthenshire | £199,000 | 6.8% | £12,650 |

| Neath Port Talbot | £151,000 | 6.7% | £9,480 |

| Bridgend | £192,100 | 6.6% | £11,870 |

| Pembrokeshire | £228,300 | 6.5% | £13,920 |

| Caerphilly | £174,100 | 6.4% | £10,410 |

| Vale of Glamorgan | £293,300 | 6.3% | £17,360 |

House Price Index, March 2023

The UK locations with the cheapest house prices

The cheapest areas to buy a home in the UK right now are all located in Scotland and the North of England.

The cheapest houses for sale in the UK are in rural areas to the east of Glasgow - Inverclyde, East Ayrshire and West Dunbartonshire - where house prices average less than £110,000.

In the North East, you can find cheap houses for less than £120,000 in Hartlepool, Hull, Middlesbrough and Sunderland.

And in the North West, the cheapest properties for sale are in Burnley, where the average home costs £116,600.

The prominence of Scottish regions is down to a greater balance between property and wage growth than the rest of the UK.

"Scotland dominates the most affordable areas list, with modest pricing and stronger relative earnings making a home move more accessible for many,” says Izabella Lubowiecka, Researcher at Zoopla.

"For home movers on average salaries, mortgages are more affordable in these lower-value locations, especially if they have built up some equity in their current property.”

| Local authority area | Average house price | Annual price change (%) | Annual price change (£) |

|---|---|---|---|

| Inverclyde | £101,200 | 3.3% | £3,190 |

| East Ayrshire | £102,600 | 3.3% | £3,300 |

| West Dunbartonshire | £108,700 | 2.7% | £2,810 |

| Hartlepool | £110,500 | 3.7% | £3,930 |

| North Ayrshire | £111,200 | 3.0% | £3,220 |

| Hull | £112,000 | 2.5% | £2,750 |

| Middlesbrough | £113,900 | 3.7% | £4,110 |

| Burnley | £116,600 | 3.3% | £3,720 |

| North Lanarkshire | £117,600 | 3.9% | £4,380 |

| Sunderland | £117,700 | 2.4% | £2,810 |

House Price Index, March 2023

Where are the most expensive house prices in the UK?

When it comes to the most expensive places to buy a home, it’s all about London and the South East.

Kensington and Chelsea is the only place where the average house price pips the £1 million mark, but houses are selling for £6,220 less than a year ago on average.

The City of Westminster is a clear second place at £962,600 despite a £12,170 annual drop in sold prices.

House prices in Richmond, Camden, Hammersmith and Fulham, and Elmbridge all sit above £700,000 but price growth is low or negative.

Stretched affordability in London is limiting the scope for price growth and we’re expecting price falls of around 5% to 8% by the end of 2023. This will improve affordability and support a future rebound in inner London markets.

| Local authority area | Average house price | Annual price change (%) | Annual price change (£) |

|---|---|---|---|

| Kensington and Chelsea | £1,189,400 | -0.5% | -£6,220 |

| City of Westminster | £962,600 | -1.2% | -£12,170 |

| Richmond upon Thames | £764,600 | 1.2% | £9,430 |

| Camden | £750,900 | 0.6% | £4,560 |

| Hammersmith and Fulham | £731,100 | -0.1% | -£550 |

| Elmbridge | £720,200 | 1.8% | £12,710 |

| South Buckinghamshire | £680,100 | 2.4% | £15,620 |

| Wandsworth | £655,500 | 0.7% | £4,660 |

| Chiltern | £654,300 | 2.3% | £14,640 |

| Islington | £628,000 | 0.4% | £2,260 |

House Price Index, March 2023

Key takeaways

- The UK’s average house price is now £259,700 as house prices fall 1% since October and annual price growth drops to 4.1%

- There are seven local authority areas in the country where house prices are already falling year-on-year - four London boroughs and three areas on the east coast of Scotland

- All other areas in the UK continue to see low annual house price growth, with towns on the outskirts of Manchester and areas in Wales faring the best

Property sales rise as buyers regain confidence

With steadying mortgage rates and 65% more homes for sale than this time last year, buyers are back in the market and agreeing 11% more sales than in 2019.

Increasing sales volumes indicate recovering market health

The housing market is continuing to see cautious improvements in conditions since the mini budget in October 2022.

Sales volumes are on an upward trajectory while the demand for homes has reached the highest level since last October in recent weeks.

The number of agreed sales is now 11% higher than in 2019, while demand from buyers sits 16% and homes are selling more quickly across most regions of the UK.

While these measures are tracking lower than this time last year, the return of more ‘normal’ market conditions in recent months makes 2019 a more relevant benchmark of activity than the pandemic housing boom of 2020 to mid-2022.

Second-steppers in favourable position to upsize

Homeowners looking to upsize are enjoying a favourable position thanks to greater demand at the lower end of the market along with more choice of their next property and repricing at the upper end of the market.

There’s been a clear shift in the proportion of homes selling across the UK, with properties in the cheapest 40% of the market agreeing 5% more sales. Meanwhile, houses in the most expensive 40% have seen a 4% drop in agreed sales.

There are 65% more homes for sale than a year ago with the average estate agent listing 25 available homes for sale compared to the low of 14 last year.

This is seeing sales agreed at 4% lower than asking price - or £14,000 on average - which equates to the greatest savings on higher-priced properties.

What’s more, the rapid 11% rise in rental rates in the last year is continuing to support demand from first time buyers, who accounted for 1 in 3 sales last year.

These trends are coming together to give homeowners at the lower end of the market confidence in the sale of their current home, along with more choice, time and bargaining power in their next purchase.

However, upsizing will come with the consideration of higher mortgage costs. We expect more people to proceed with their move as the economic outlook becomes clearer and UK-wide house prices start to register small annual falls this summer.

First time buyers look to escape rising rents

The rapid pace of rental inflation - up 11% in the last year - is encouraging an increasing number of renters to become owners, despite the challenge of getting a deposit together.

We expect this to hold up this year as rental growth shows no sign of slowing and mortgage rates remain below rental costs in many regions - even with current 4% mortgage rates limiting buyer power by up to 20% compared to last year.

Buyers finding value in affordable regions and some pockets of London

More affordable areas are seeing the highest demand as the market adjusts to higher mortgage rates.

The highest levels of demand are from buyers in Scotland, Wales, the North East of England and London.

Buyers are generally less keen to move in regions where prices increased the most during the pandemic and where higher mortgage rates therefore have the biggest impact - across the South of England and the Midlands.

Rebalancing of house prices set to support activity across the housing market in 2023

Rising house prices are often associated with market health but we believe the current repricing will support activity from all segments of the housing market as we look to the end of 2023 and into 2024.

The highest prices we saw in mid-2022 simply aren’t sustainable with the mortgage rates now available, so the natural tip back towards what buyers can realistically afford with a 4% mortgage rate will encourage more back into the market.

We expect 1 million sales in 2023 with 5% house price falls in localised areas, but sellers’ concerns will be somewhat alleviated by an average gain of £19,000 to their home’s value in 2022.

Key takeaways

- Increasing sales volumes indicate recovering market health with 11% more agreed sales than in 2019

- Second-steppers in favourable position with highest demand at cheaper end of the market plus more choice, time and bargaining power with their next purchase

- Widespread repricing of homes set to tempt more buyers this summer while sellers’ concerns are alleviated by an average £19,000 gain in home values in 2022