Competition investigation launched into the housing sector

The Competition and Markets Authority is looking into the cost and availability of housing and the experience of renters.

The Competition and Markets Authority (CMA) has launched an investigation into the cost and availability of housing in England, Scotland and Wales.

The market study will look into whether housebuilders are failing to deliver the homes people need at sufficient scale and speed.

The CMA will also start a consumer protection project looking at the experience of those living in rented accommodation and whether more could be done to help landlords and intermediaries understand their obligations.

Sarah Cardell, chief executive of the CMA, said: “The quality and cost of housing is one of the biggest issues facing the country.

“If there are competition issues holding back housebuilding in Britain then we need to find them. But we also need to be realistic that more competition alone won’t unlock a housebuilding boom.”

What will the CMA look at in the housebuilding sector?

The CMA’s market study into housebuilding will focus on four key areas.

The first area is housing quality, such as whether builders are delivering the sort of homes that buyers and communities need, as well as looking at the fairness of estate management fees charged for unadopted roads and other amenities.

It will also look at land management and whether developers’ practice of ‘banking’ land, either before or after receiving planning permission, is anti-competitive.

Other areas include the extent to which local authorities oversee the delivery of homes, and the requirements for builders to include affordable homes.

Finally, it will consider innovation and whether there are circumstances holding back housebuilders from adopting new building techniques or moving towards more sustainable, net zero homes.

What will the CMA focus on in the rented sector?

The consumer enforcement work in the rented sector will focus on the end-to-end experience from a tenant’s perspective, including finding somewhere to live, renting a property, and moving between homes.

It will also identify any consumer protection issues that may arise, looking at the relationship between tenants and landlords, as well as the role of intermediaries, such as letting agents.

What happens next?

The CMA is able to use compulsory information-gathering powers to examine the housing market to see why it may not be working well for consumers.

The process will enable it to develop a deeper understanding of how housebuilders decide to deliver new homes and their interaction with local authority housing targets.

The study will also consider the issues faced by smaller, regional house-building firms.

Market studies can lead to a range of outcomes, including making recommendations to the government to change regulations or public policy, encouraging businesses to self-regulate, taking consumer or competition law enforcement action against firms, or conducting a more in-depth study.

The CMA must publish its report into the market setting out its findings and any action it plans to take within 12 months.

For the rented sector, the CMA will report on its initial findings and proposed next steps this summer.

Key takeaways

- The Competition and Markets Authority (CMA) has launched an investigation into the cost and availability of housing

- It will look into whether housebuilders are failing to deliver the homes people need at sufficient scale and speed

- It will also look at the experience of people living in rented accommodation

Sellers accept average discounts of £14,100

However, homes grew by £42,000 in pandemic, suggesting sellers are having to forgo around 33% of their pandemic gains in order to achieve a sale.

On the surface, the picture for those looking to sell a home this year might look a bit bleak when compared with the flurry of buying activity that happened over 2021 and 2022.

But it’s possible to take two opposing views on the sales market right now.

Glass half-full or half-empty?

The glass-half-empty view is to look at trends on a year-on-year basis, comparing this year to the red-hot market conditions of last year.

The glass-half-full view compares the current market to the pre-pandemic years of 2017 to 2019, when activity levels and house price growth were steadier.

However, when comparing this year’s sales activity to last year’s, the number of sales taking place is around half of what was seen in 2022, because it was an exceptionally buoyant year.

The reality is that current market conditions are now simply more aligned with those of the pre-pandemic years.

Sellers accept average discounts of £14,100 from asking prices

The difference between a seller’s initial asking price and what they actually end up selling for is now widening to the largest gap seen for five years.

While the number of sales taking place is recovering, sellers are having to accept larger discounts to their asking prices in order to secure those sales.

That said, negotiating down from the asking price was normal practice before the pandemic boom.

Our latest data shows that the average seller is offering a 4.5% - or £14,100 discount.

That’s currently larger than the average discount seen in pre-pandemic years.

It reflects the rapid transition from a red hot sellers' market - where most buyers had to pay the full asking price over much of 2021 and 2022 - to a buyers' market, where there’s more room for negotiation on price.

Putting this into context, the average UK home grew by £42,000 in value during the pandemic, suggesting sellers are having to forgo around 33% of their pandemic gains in order to achieve a sale.

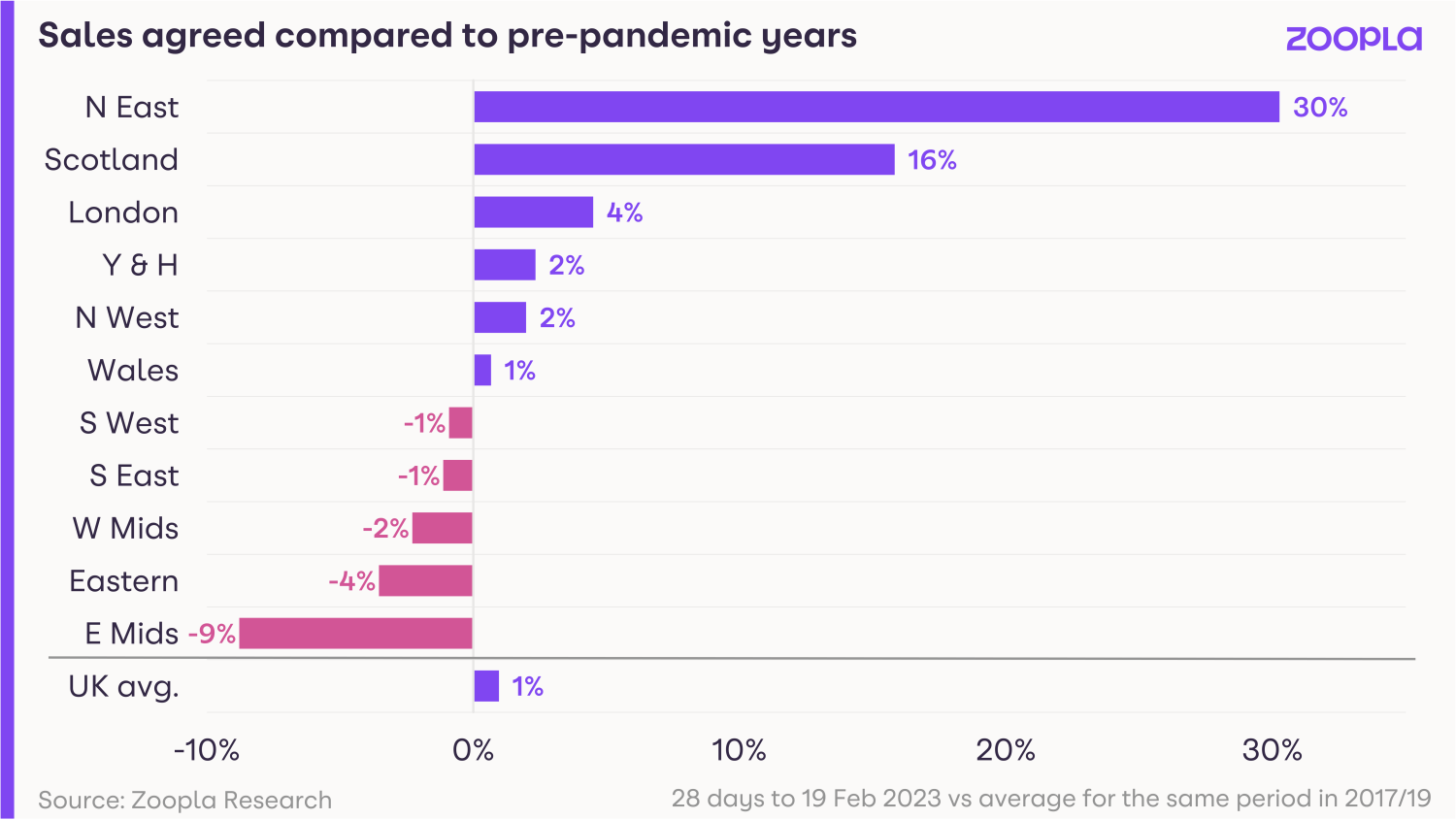

Sales going well in affordable markets

Overall, sales volumes are lower year-on-year across most of the UK.

But in the more affordable markets, such as the North East and Scotland, the number of sales taking place is up on pre-pandemic levels.

That’s because higher mortgage rates have less of an impact on demand in lower-value markets.

In London sales are also 4% higher than their pre-2020 levels.

But that’s not because it’s an affordable market, rather it’s down to the fact that house prices in the capital have risen at a much slower rate than the rest of the country since 2016.

This makes it appear better value for money to buyers, which is supporting sales.

Meanwhile, in the Midlands and southern England, sales volumes are going down to 9% lower than the levels seen in the pre-pandemic period.

What’s going to happen in the rest of 2023?

Sellers of every property type across the UK will need to be realistic when pricing their homes in order to secure a sale.

However, homes gained so much value in the last two years that it will provide a buffer for those who need to drop their asking price.

Working from home, increased retirement and high immigration will continue to stimulate the demand to move home, while cost-of-living pressures will exacerbate the need for some.

We expect 1.1m homes to sell this year and the market is still on track for a soft landing with modest price falls of up to 5%.

Key takeaways

- Sellers are now having to accept an average 4.5% discount to their asking price to achieve a sale, the highest for 5 years

- The average discount to asking price is £14,100, meaning sellers are having to forgo a third of their pandemic house price gains

- We’re now returning to a buyers’ market where negotiation on asking price is to be expected

Average energy bills set to start to falling later this year

Ofgem has reduced the energy price cap by nearly £1,000, from £4,279 to an average of £3,280 a year, following steep increases in 2022.

The average cost of heating and lighting a home could fall later in the year following a near £1,000 reduction in the energy price cap.

Energy regulator Ofgem has cut the price cap for gas and electricity customers on their providers’ default and variable tariffs from £4,279 to an average of £3,280 a year from 1 April.

But the move, which follows recent falls in wholesale energy prices, will not have an immediate impact on customers’ bills due to the government’s Energy Price Guarantee (EPG).

Under the guarantee, the government stepped in to limit the average household’s combined energy bill to £2,500 until the end of March, rising to £3,000 from 1 April.

As a result, customers will still see an increase in their energy bills of around £500 a year from April.

But the reduction to the energy price cap means the average consumer can expect to have lower energy bills in the months ahead, once the energy price cap falls below the level of the EPG.

Why is this happening?

Ofgem said its cut to the energy price cap, which limits the amount suppliers can charge per unit of energy, was due to a significant reduction in the cost that companies faced in buying and providing energy to customers.

Energy prices have soared following the start of the conflict in Ukraine in February 2022.

The military action led to the UK, EU and US putting restrictions on oil and gas imports from Russia, which had previously accounted for 43% of the EU’s natural gas imports.

The fall in supply coincided with a rise in demand for energy as economic activity resumed following Covid-19 lockdowns, combined with a cold winter in Europe and a hot summer in Asia, where electricity is used to power air conditioning units.

The resulting mismatch between supply and demand pushed gas and electricity prices higher.

Who does it affect?

Unfortunately, the reduction in the energy price cap will not lead to an immediate reduction in gas and electricity bills for consumers.

This is partly because suppliers purchase their energy months in advance, and partly because of the increase to the level of the EPG.

Ofgem CEO Jonathan Brearley said: “Although wholesale prices have fallen, the price cap has not yet fallen below the planned level of the Energy Price Guarantee.

“This means, that on current policy, bills will rise again in April. I know that for many households this news will be deeply concerning.”

But he added that the reduction in the energy price cap reflected a fundamental shift in the cost of wholesale energy for the first time since the gas crisis began, suggesting the pressure seen in the energy market was starting to ease.

“If the reduction in wholesale prices we’re currently seeing continues, the signs are positive that the price cap will fall again in the summer, potentially bringing bills significantly lower.”

What to do if you're worried about your energy bills

If you’re worried about being able to afford your energy bills, or you’re already struggling, make sure you claim any support that’s available to you.

Cost-of-living: help with energy bills

Check that you have claimed any cost-of-living or cold weather payments you are entitled to from the government, as well as the warm home discount from suppliers.

A number of the major energy companies offer grants to help people struggling with their fuel bills. For example, British Gas offers up to £1,500 for individuals and families who are in energy debt, regardless of who their supplier is.

If you’re already facing difficulties, contact your supplier as soon as possible.

Ofgem has rules that they must help you if you’re falling behind. They should work with you to create an affordable payment plan.

You can also take steps to reduce your gas and electricity consumption. Try turning your thermostat down, taking shorter showers, draft-proofing your windows and doors, not using a tumble drier and turning off appliances left on standby mode.

Key takeaways

- The average cost of heating and lighting a home could fall later in the year following a near £1,000 reduction in the energy price cap

- But the move will not have an immediate impact on bills due to the government’s Energy Price Guarantee

- Instead, customers will still see their energy bills increase by around £500 a year from April

The true cost of upgrading an older home to new build energy standards

New research reveals how much it costs to retrofit an older home to match the energy efficiency standards of new-build homes.

The cost of running a home has become one of the most widely discussed topics in recent months, with Google searches for the term ‘energy bill’ increasing by more than 800% in the last year.

So it’s unsurprising that improving the energy efficiency of our homes and reducing bills has become an increasing priority for homeowners and those looking to buy their first property.

Buying a new home vs upgrading an old one

The UK has one of the oldest and most inefficient housing stocks in the world, with nearly three quarters of our homes built before 1980.

Much of the conversation around ways to reduce energy usage has been dominated by quick wins and fast fixes.

This could be using draught excluders, swapping out baths for showers and switching off electrical appliances rather than leaving them on standby.

While these measures can help cut your energy bills, it takes a lot more to bring older homes up to modern energy efficient standards.

It generally requires retrofit works, which can’t be done overnight.

They can be disruptive, costly and time-consuming, so aren’t a reasonable option for everyone.

Our Get on with living report has found that the average three bedroom semi-detached home would cost £61,500 to upgrade to the current standards new builds are built to.

This figure rises to more than £73,000 when including exterior rendering and guttering.

New-build homes have energy efficiency built in, as they’re designed and delivered according to updated and evolving building regulations.

They also use new technologies and materials, and are built with environmentally-conscious practices to support and encourage natural biodiversity.

How much can you save on your energy bills with a new-build home?

As a result of this improved efficiency, new-build homes use significantly less energy than their older counterparts.

So new build homeowners see much lower utility bills, on top of the money saved by not forking out for expensive retrofit works.

Our analysis of government data found 85% of new-build homes were awarded an A or B Energy Performance Certificate (EPC) rating last year.

Meanwhile, only 4% of existing dwellings reached the same energy efficiency standard. The most common energy performance certificate rating in the UK is D.

So what does it all mean for your energy bills?

A new-build home will save you an average of £2,600 on energy bills per year.

And our research shows new-build homeowners will save even more when the government’s Energy Price Guarantee increases on 1 April 2023.

From then, we expect new-build owners to save more than £3,100 per year in England and, due to an older housing stock, £3,300 per year in Wales.

Thinking that saving may be due to new builds being smaller than their older counterparts?

Our Watt a Save report explored this theory and found that new builds use significantly less energy per square metre over the course of a year.

We also found the new-build homes are larger, with an average floorspace of 90.7 square metres compared to existing dwellings at 84.4 square metres.

What do lower energy bills mean for getting a mortgage?

When considering you for a mortgage, banks take your monthly income and outgoings into account.

With new-build buyers seeing monthly savings of £260 on energy bills, they’re likely to be in a better position to afford monthly mortgage payments than those buying older homes.

However, mortgage lenders don’t currently factor in the energy performance of a home when looking at affordability calculations. A national average energy bill is used instead.

At the Home Builders Federation, we’re encouraging lenders and the government to make changes that’ll support and encourage more people to buy energy efficient new builds.

But in the meantime, choosing a new-build home could still open up your buying options.

House developers offer incentives, like contributing to your deposit or energy bills, and low-deposit mortgage schemes to increase your borrowing options.

Plus, the Welsh government has confirmed an extension of the Help to Buy scheme for buyers of new homes with a minimum EPC rating of B.

Given the cost-conscious and time-precious time we’re living in, it’s no surprise that many homebuyers are opting for the benefits of buying a new-build home so they can get on with living.

Key takeaways

- It could cost £70,000 to upgrade the average three bedroom semi-detached home to match the energy efficiency level of new builds

- 85% of new-build homes were awarded an A or B Energy Performance Certificate (EPC) rating last year, compared to only 4% of older homes

- New-build homeowners can expect to save more than £3,100 per year in England after the Energy Price Guarantee rise in April 2023