However, homes grew by £42,000 in pandemic, suggesting sellers are having to forgo around 33% of their pandemic gains in order to achieve a sale.

On the surface, the picture for those looking to sell a home this year might look a bit bleak when compared with the flurry of buying activity that happened over 2021 and 2022.

But it’s possible to take two opposing views on the sales market right now.

Glass half-full or half-empty?

The glass-half-empty view is to look at trends on a year-on-year basis, comparing this year to the red-hot market conditions of last year.

The glass-half-full view compares the current market to the pre-pandemic years of 2017 to 2019, when activity levels and house price growth were steadier.

However, when comparing this year’s sales activity to last year’s, the number of sales taking place is around half of what was seen in 2022, because it was an exceptionally buoyant year.

The reality is that current market conditions are now simply more aligned with those of the pre-pandemic years.

Sellers accept average discounts of £14,100 from asking prices

The difference between a seller’s initial asking price and what they actually end up selling for is now widening to the largest gap seen for five years.

While the number of sales taking place is recovering, sellers are having to accept larger discounts to their asking prices in order to secure those sales.

That said, negotiating down from the asking price was normal practice before the pandemic boom.

Our latest data shows that the average seller is offering a 4.5% – or £14,100 discount.

That’s currently larger than the average discount seen in pre-pandemic years.

It reflects the rapid transition from a red hot sellers’ market – where most buyers had to pay the full asking price over much of 2021 and 2022 – to a buyers’ market, where there’s more room for negotiation on price.

Putting this into context, the average UK home grew by £42,000 in value during the pandemic, suggesting sellers are having to forgo around 33% of their pandemic gains in order to achieve a sale.

Sales going well in affordable markets

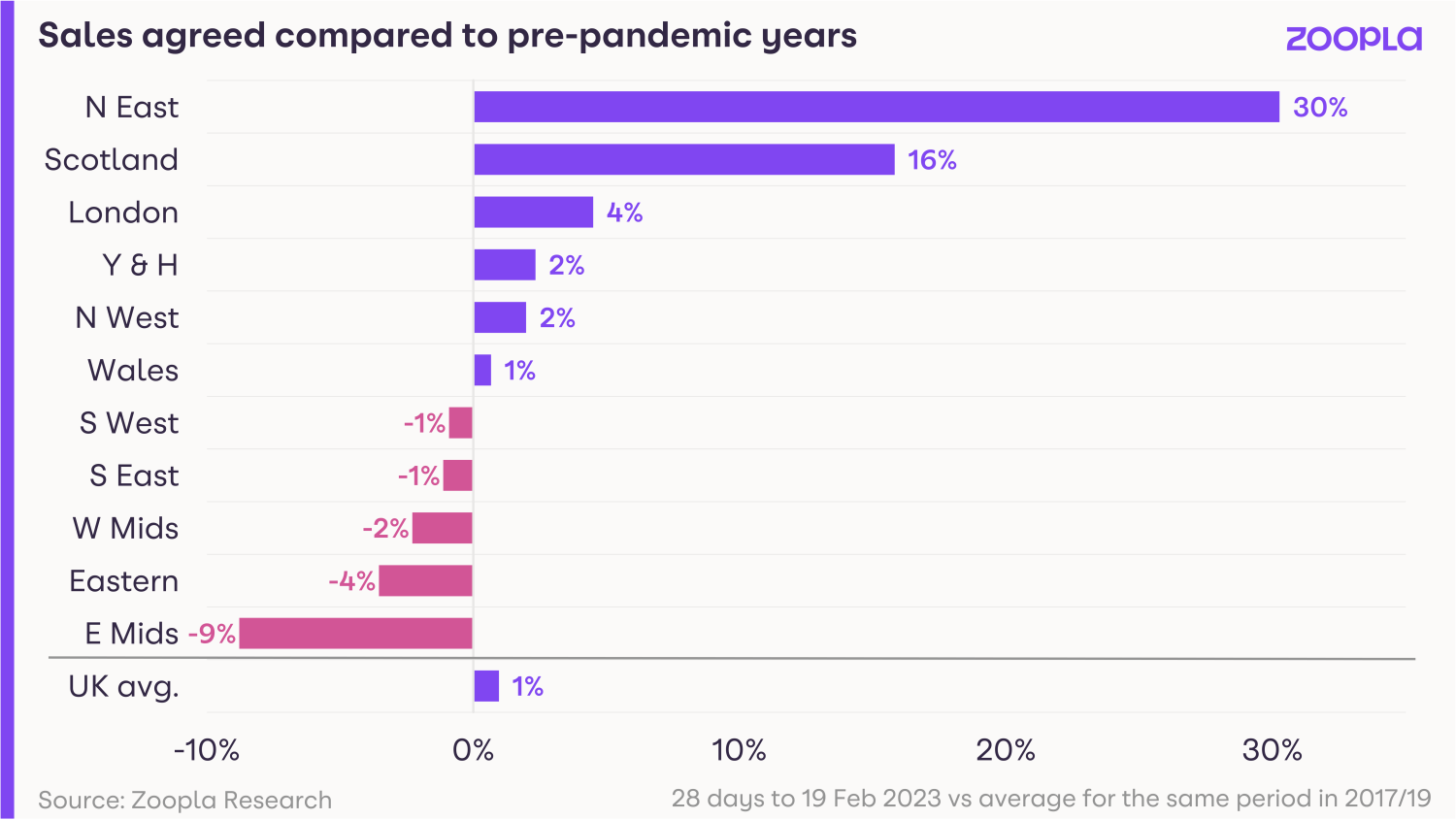

Overall, sales volumes are lower year-on-year across most of the UK.

But in the more affordable markets, such as the North East and Scotland, the number of sales taking place is up on pre-pandemic levels.

That’s because higher mortgage rates have less of an impact on demand in lower-value markets.

In London sales are also 4% higher than their pre-2020 levels.

But that’s not because it’s an affordable market, rather it’s down to the fact that house prices in the capital have risen at a much slower rate than the rest of the country since 2016.

This makes it appear better value for money to buyers, which is supporting sales.

Meanwhile, in the Midlands and southern England, sales volumes are going down to 9% lower than the levels seen in the pre-pandemic period.

What’s going to happen in the rest of 2023?

Sellers of every property type across the UK will need to be realistic when pricing their homes in order to secure a sale.

However, homes gained so much value in the last two years that it will provide a buffer for those who need to drop their asking price.

Working from home, increased retirement and high immigration will continue to stimulate the demand to move home, while cost-of-living pressures will exacerbate the need for some.

We expect 1.1m homes to sell this year and the market is still on track for a soft landing with modest price falls of up to 5%.

Key takeaways

- Sellers are now having to accept an average 4.5% discount to their asking price to achieve a sale, the highest for 5 years

- The average discount to asking price is £14,100, meaning sellers are having to forgo a third of their pandemic house price gains

- We’re now returning to a buyers’ market where negotiation on asking price is to be expected