What’s hot in the housing market right now

The search for space means houses are more popular than flats, while good affordability is also driving buyer interest in northern regions.

What’s selling the fastest?

Houses are selling three weeks faster than flats as the lockdown-led search for space continues.

It currently takes an average of just 42 days from being listed for sale for houses to reach the 'sale agreed' stage, compared with 62 days for flats.

Homes in the north east and Yorkshire and the Humber are selling the fastest, with sales agreed in an average of just 38 days in both regions.

Meanwhile, homes in the north east and north west have seen the biggest reductions in the time it takes to sell, with the length of time they are listed for before receiving an offer dropping by 17 days and 12 days respectively.

What’s the most sought-after type of property?

Family homes are the most coveted type of property across the UK, with demand for three-bedroom homes jumping by 30% in the week following the Budget.

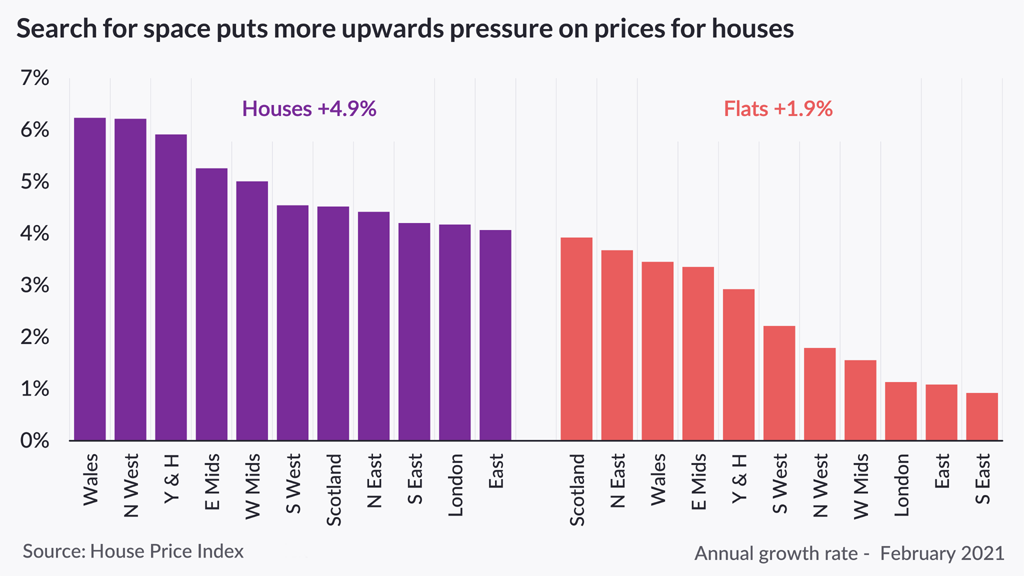

Unsurprisingly, the popularity of houses is pushing their prices higher, with values rising by an average of 4.9% in the past year, compared with an increase of 1.9% for flats.

But there are pockets of the country where flats are popular, with demand for one and two-bedroom flats in London and the south east rising after the Budget, likely reflecting increased interest from first-time buyers.

Where are the hot markets?

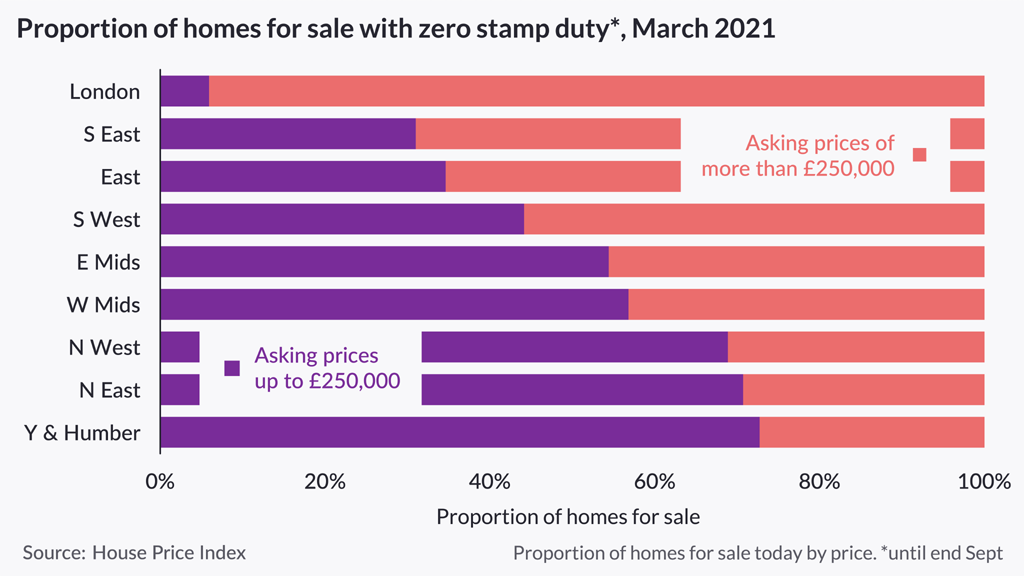

More than two-thirds of homes currently for sale in the north east, north west and Yorkshire and the Humber are listed for less than £250,000, meaning buyers in these regions have more opportunity than anywhere else in the country to secure the stamp duty holiday saving before 30 September.

High demand in these regions is driving strong house price growth. At a city level, Manchester and Liverpool posted annual gains of more than 6%, while prices have risen by more than 5% Leeds and Sheffield, with values in Nottingham and Leicester in the East Midlands on a similar trajectory.

And house price growth in the Midlands, north of England, Wales and Scotland is at an almost 10-year high, fuelled by the relative affordability in these areas.

Why is this happening?

The current trends in the property market are being driven by a combination of factors.

Successive lockdowns have prompted many people to reevaluate their homes and lifestyles, leading to a search for space.

And the extension of the stamp duty holiday is driving demand for homes costing up to £500,000, as well as those in the £125,000 to £250,000 price bracket, which will benefit from being stamp duty-free until 30 September.

Meanwhile, a mismatch between the supply of homes for sale and buyer appetite is putting upward pressure on house prices. Average demand is 13% higher this year than last year, while the number of sellers has fallen by 13%, likely as a result of people being unwilling to open up their homes for viewings during lockdown.

Finally, more first-time buyers are expected to enter the market from 1 April once the government’s new 95% mortgage guarantee scheme is launched.

News of the scheme is thought to be behind the recent increase in interest in flats in London and the south east.

What’s the outlook?

The housing market in general is expected to remain busy as lockdown measures are eased. But despite the stamp duty holiday extension boosting housing sales, house price growth is expected to moderate later in the year as government support measures are withdrawn.

Head of research, explained: “The search for space is driving continued demand for family homes, which means prices for houses are rising faster than flats, and houses are also selling more quickly.

“The prospects for the housing market over the next year have improved on the back of Budget. The continued search for space, the stamp duty extension and mortgage guarantees will support activity levels and headline house price growth up to the end of June.

“Yet the pathway out of the lockdown, and the route to a full re-opening of the economy and unwinding of support measures, is unlikely to be simple or smooth.

“We still expect house price growth to moderate later in the year, but overall transactions are set to benefit from an additional boost following the stamp duty extension and tapering.”

Top three takeaways

- Houses are selling three weeks faster than flats as the lockdown-led search for space continues

- The north east and Yorkshire and the Humber are the fastest-moving markets in the UK, with sales agreed in an average of just 38 days in both regions

- Family homes are the most coveted type of property across the UK, with demand for three-bedroom homes jumping by 30% following the Budget

The 20 locations where homes sell the fastest

With the stamp duty holiday extension galvanising the housing market in England and Wales, our research reveals where homes sell like hot cakes.

Wigan has been crowned the fastest-moving property market in England and Wales, with homes listed for sale in the town taking an average of just 26 days to sell.

The most popular property type in the town is a three-bedroom semi-detached house, while the price band that is selling the quickest is £100,00 to £150,000.

Redditch in the West Midlands, Knowsley and Salford in the north west, Sheffield, and Medway in the south east, all tied for second place, with homes spending an average of 27 days on the market before being sold subject to contract.

The top 20 hottest housing markets were dominated by northern regions, with the Isle of Wight and Bristol joining Medway to be the only locations in the south to make it on to the list, according to our research.

What does this mean for you?

The fastest-moving price band in all of the 20 markets, apart from Bristol, is £250,000 or less. This means both buyers and sellers in these areas will be well placed to complete their purchase – in other words, legally transfer ownership –before the end of the stamp duty holiday and make a saving.

What’s driving sales?

The pandemic and its subsequent lockdowns have led many people to carry out a once-in-a-lifetime reevaluation of their home and lifestyle, stimulating home moves and driving a search for space.

And the stamp duty holiday means that many first-time buyers and homeowners looking to move are keen to buy a new home in time to benefit from the tax break.

The fastest-moving markets fall into three main groups: coastal areas, traditionally fast-moving markets within cities, and demand-driven regional markets.

Coastal areas

Reflecting increased appetite for homes on the coast, several seaside locations feature in the top 20. Medway in Kent is the fastest-moving coastal market in England and Wales, with homes taking an average of 27 days to go under offer.

And properties on the Isle of Wight are taking 32 days to sell – 29 days faster than the same time last year – while the most popular property type is a three-bedroom semi detached house.

The coastal areas of Neath Port Talbot and Bridgend in Wales also made the cut. Three-bedroom semi-detached houses are the most popular property type, while the time to sell is 31 and 32 days respectively.

Traditionally fast-moving markets within cities

Traditionally fast-moving urban markets, such as Liverpool, Sheffield, Leeds, Bristol and Manchester, continue to enjoy quick sales, with times averaging less than 34 days.

High levels of demand in these locations have been met with constrained supply of homes for sale during the past three months, leading to increased competition among buyers.

Demand-driven regional markets

Meanwhile, demand has also grown in areas adjacent to these fast city markets, as successive lockdowns have caused buyers to shift their focus to less urban areas.

Wigan, Knowsley and Salford around Liverpool and Manchester, Redditch near Birmingham, and Barnsley and Rotherham close to Sheffield have all benefited from this trend.

Head of research at said: “We have observed the time taken to sell a home changing in many areas during Covid-19 pandemic.

“While the number of days it takes between listing a property to agreeing a sale in one of the traditionally fastest-moving moving markets such as Manchester, Liverpool or Sheffield has stayed the same, sellers in some adjacent areas may now see their properties selling just as quickly.

“Buyers will have to move fast but the speed at which this stage of the buying process is moving also means that those looking to take advantage of the stamp duty holiday extension will be giving themselves the best chance of doing so.”

Which areas have seen the time to sell reduce the most?

South Tyneside in the north east has seen the largest improvement in the time it takes to sell a home during the past year, with the average number of days between a property being listed for sale and an offer accepted dropping from 74 days in February last year to just 41 days now.

The Isle of Wight came in second place, with the time taken to sell a home falling by 29 days, followed by Swale in Kent, which has seen a 28-day reduction.

The historical city of Canterbury, Tonbridge and Malling, and Medway, also all made it into the top 10 ranking of areas that have seen the largest improvement in the time it takes to sell a home, showing that there's been a dramatic change in parts of the south east of England.

All of the locations in the ranking have recorded a drop of more than three weeks, largely due to the surge in buyer demand seem during the past year.

What are the fastest-moving housing markets in London?

Waltham Forest in north east London is the fastest-moving market in the capital, with homes taking 35 days from being listed to sold subject to contract. That’s 30 days quicker than the London average.

In line with London house prices, the fastest-moving price band in this corner of the city is £400,000 to £450,000, noticeably higher than other parts of the country, while the most popular property type is a two-bedroom terraced house.

The outer London authorities of Barking and Dagenham and Bexley took second place at 39 days and third place at 41 days respectively, reflecting an appetite for affordable property and more space.

Two-bedroom terraced houses were the fastest-moving property type in the capital, along with homes in the £300,000 to £350,000 price band.

What’s happening across the different regions?

Wigan is not only the fastest-moving property market in England and Wales, but also for the north west, with Gateshead taking the title for the north east and Sheffield for Yorkshire and the Humber.

Three-bedroom semi-detached homes were the most popular property type in all of these markets.

Mansfield took the top spot in the East Midlands, with homes taking an average of 10 days less to sell than across the region as a whole, while in Redditch in the West Midlands, sales are agreed 17 days faster than the regional average.

Neath Port Talbot is the fastest-moving market in Wales.

Medway in the south east is the hottest market in a southern region, with homes taking an average of 28 days to sell, while Bristol is the fastest market in the south west.

Rochford in Essex is the fastest-market in the east, but with homes taking an average of 38 days to sell, it is slower than the hottest markets in other regions.

What are the fastest-selling property types?

Overall, three-bedroom semi-detached houses remain the fastest-selling property type, while properties with asking prices of between £150,000 and £200,000 are being snapped up quickest.

Meanwhile, houses are selling an average of three weeks quicker than flats, as home movers continue to search for more space.

Our analysis looks at the average number of days between a property being listed for sale on Zoopla to offer accepted (marked as sold subject to contract), with days on the market rounded to the nearest whole number.

Data referring to the fastest-moving markets are ranked on the median number of days until an offer is achieved, while the markets with largest improvement to time to sell is ranked on the reduction in the number of days from listing from offer (in days).

The fastest-selling properties and fastest-moving price bands have been calculated separately.

Scotland is excluded from this analysis as the stamp duty holiday does not apply.

Top three takeaways

- Wigan is the fastest-moving property market in England and Wales, with homes listed in the town taking an average of just 26 days to sell

- The top 20 hottest housing markets were dominated by northern regions, with the Isle of Wight and Bristol joining Medway to be the only locations in the south to make it onto the list

- Three-bedroom semi-detached homes remain the fastest-moving property type, while properties in the £150,000 to £200,000 price bracket are being snapped up quickest