The search for space means houses are more popular than flats, while good affordability is also driving buyer interest in northern regions.

What’s selling the fastest?

Houses are selling three weeks faster than flats as the lockdown-led search for space continues.

It currently takes an average of just 42 days from being listed for sale for houses to reach the ‘sale agreed’ stage, compared with 62 days for flats.

Homes in the north east and Yorkshire and the Humber are selling the fastest, with sales agreed in an average of just 38 days in both regions.

Meanwhile, homes in the north east and north west have seen the biggest reductions in the time it takes to sell, with the length of time they are listed for before receiving an offer dropping by 17 days and 12 days respectively.

What’s the most sought-after type of property?

Family homes are the most coveted type of property across the UK, with demand for three-bedroom homes jumping by 30% in the week following the Budget.

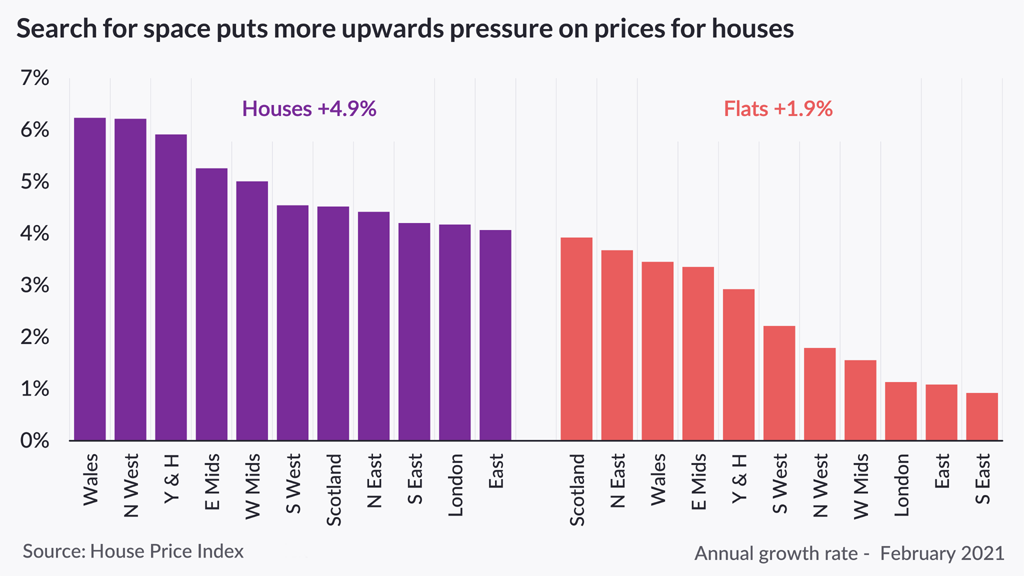

Unsurprisingly, the popularity of houses is pushing their prices higher, with values rising by an average of 4.9% in the past year, compared with an increase of 1.9% for flats.

But there are pockets of the country where flats are popular, with demand for one and two-bedroom flats in London and the south east rising after the Budget, likely reflecting increased interest from first-time buyers.

Where are the hot markets?

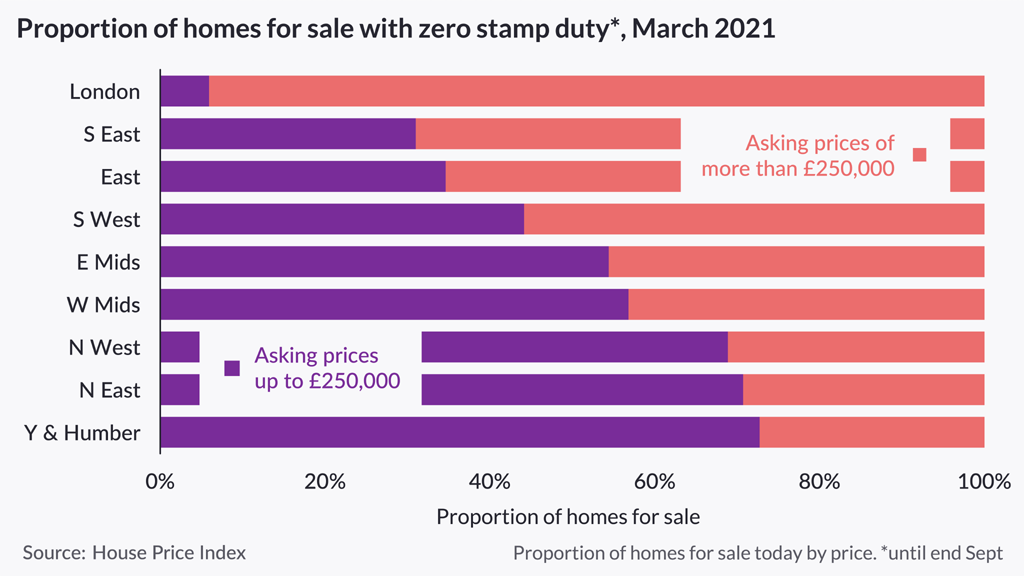

More than two-thirds of homes currently for sale in the north east, north west and Yorkshire and the Humber are listed for less than £250,000, meaning buyers in these regions have more opportunity than anywhere else in the country to secure the stamp duty holiday saving before 30 September.

High demand in these regions is driving strong house price growth. At a city level, Manchester and Liverpool posted annual gains of more than 6%, while prices have risen by more than 5% Leeds and Sheffield, with values in Nottingham and Leicester in the East Midlands on a similar trajectory.

And house price growth in the Midlands, north of England, Wales and Scotland is at an almost 10-year high, fuelled by the relative affordability in these areas.

Why is this happening?

The current trends in the property market are being driven by a combination of factors.

Successive lockdowns have prompted many people to reevaluate their homes and lifestyles, leading to a search for space.

And the extension of the stamp duty holiday is driving demand for homes costing up to £500,000, as well as those in the £125,000 to £250,000 price bracket, which will benefit from being stamp duty-free until 30 September.

Meanwhile, a mismatch between the supply of homes for sale and buyer appetite is putting upward pressure on house prices. Average demand is 13% higher this year than last year, while the number of sellers has fallen by 13%, likely as a result of people being unwilling to open up their homes for viewings during lockdown.

Finally, more first-time buyers are expected to enter the market from 1 April once the government’s new 95% mortgage guarantee scheme is launched.

News of the scheme is thought to be behind the recent increase in interest in flats in London and the south east.

What’s the outlook?

The housing market in general is expected to remain busy as lockdown measures are eased. But despite the stamp duty holiday extension boosting housing sales, house price growth is expected to moderate later in the year as government support measures are withdrawn.

Head of research, explained: “The search for space is driving continued demand for family homes, which means prices for houses are rising faster than flats, and houses are also selling more quickly.

“The prospects for the housing market over the next year have improved on the back of Budget. The continued search for space, the stamp duty extension and mortgage guarantees will support activity levels and headline house price growth up to the end of June.

“Yet the pathway out of the lockdown, and the route to a full re-opening of the economy and unwinding of support measures, is unlikely to be simple or smooth.

“We still expect house price growth to moderate later in the year, but overall transactions are set to benefit from an additional boost following the stamp duty extension and tapering.”

Top three takeaways

- Houses are selling three weeks faster than flats as the lockdown-led search for space continues

- The north east and Yorkshire and the Humber are the fastest-moving markets in the UK, with sales agreed in an average of just 38 days in both regions

- Family homes are the most coveted type of property across the UK, with demand for three-bedroom homes jumping by 30% following the Budget