Three different prime ministers within the space of three months, a mini-Budget and a mini-Budget reversal.

The political turmoil in recent weeks has compounded the rise in borrowing costs, resulting in mortgage rates spiking above 6% and growing uncertainty over the UK’s economic outlook.

The health of the housing market is inextricably linked to the health of the economy and, in particular, the cost of borrowing.

Higher mortgage rates squeeze out new buyers

The sudden increase in mortgage rates represents the largest interest rate shock for new buyers since the late 1980s.

The immediate impact has been felt by the households who don’t have mortgages arranged at the cheaper rates that were available prior to – and during – the pandemic.

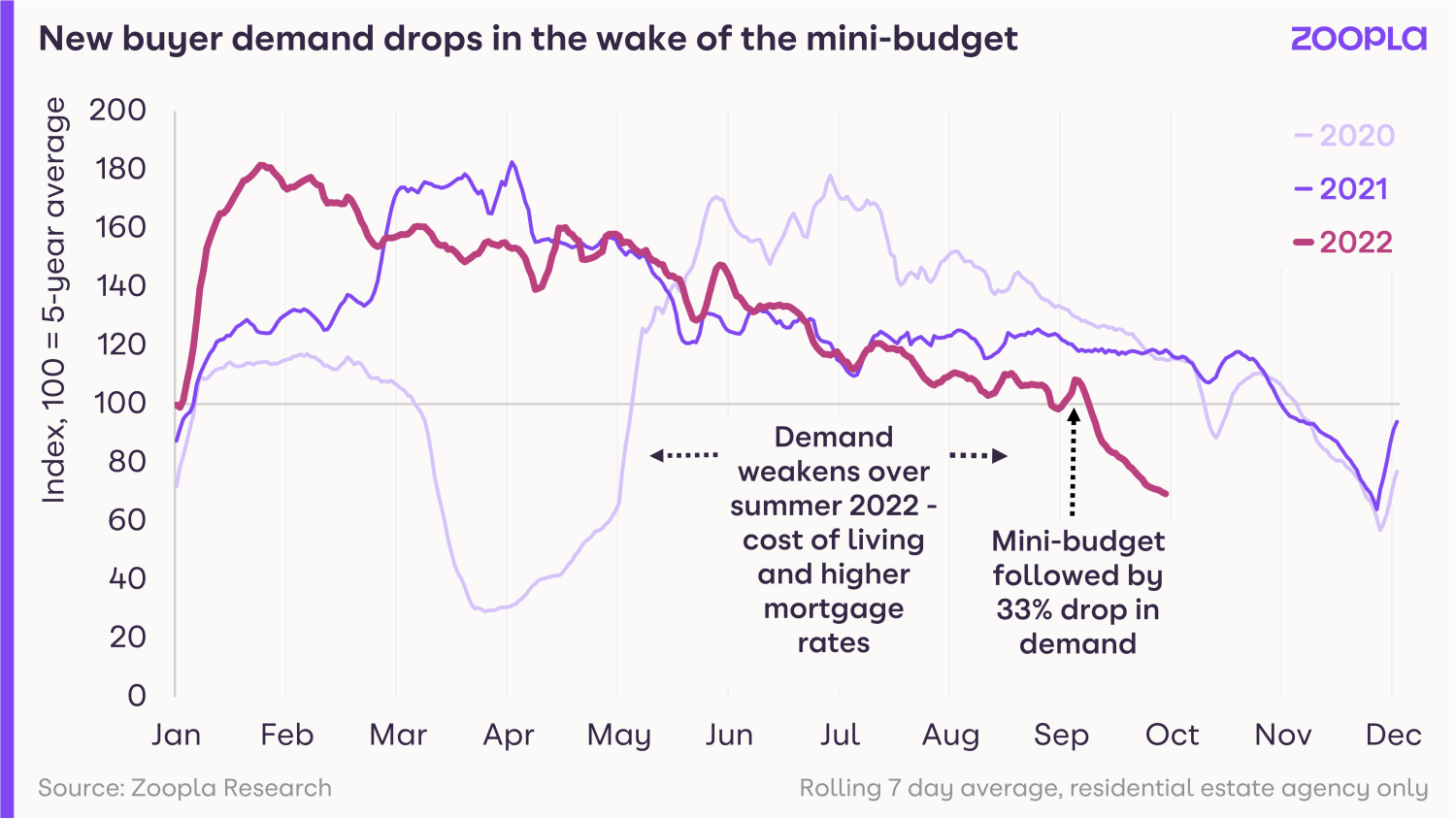

It explains why new buyer demand has fallen by a third since the mini budget.

That drop in buyer interest has been spread across all UK markets, as the pool of buyers with cheap mortgage offers dwindles.

The South East has seen the biggest drop, with demand down 40%, followed by the West Midlands, where demand is down 38%.

What we’re seeing right now is very similar to what we typically see in late November ahead of the Christmas slowdown.

However, those with cheap loans secured, as well as cash buyers, are continuing to make offers and agree sales, albeit at a slower rate than this time last year.

Dwindling pool of interested buyers with cheap mortgages

The pent-up demand to move remains.

In fact, many households rushed to secure low-cost mortgages over the summer as the rates started to rise.

The Bank of England data for mortgage approvals in August showed an unseasonal jump of 17%.

This demonstrates an underlying desire to move among a proportion of households, largely driven by the pandemic-led search for space and cost-of-living factors.

Large pipeline of sales remains

All that being said, 2022 was a strong year for the housing market and there are still around 293,000 sales still going through in the pipeline, most of which we expect to complete.

The number of sales falling through is beginning to increase, mainly as a result of a lack of affordable finance, but in total, we are still on track for nearly 1.3m sales this year.

Large scale price reductions not expected this year

We don’t expect any pricing impact to materialise until the first quarter of 2023.

Typically, it takes several months for pricing to adjust in the face of weaker demand.

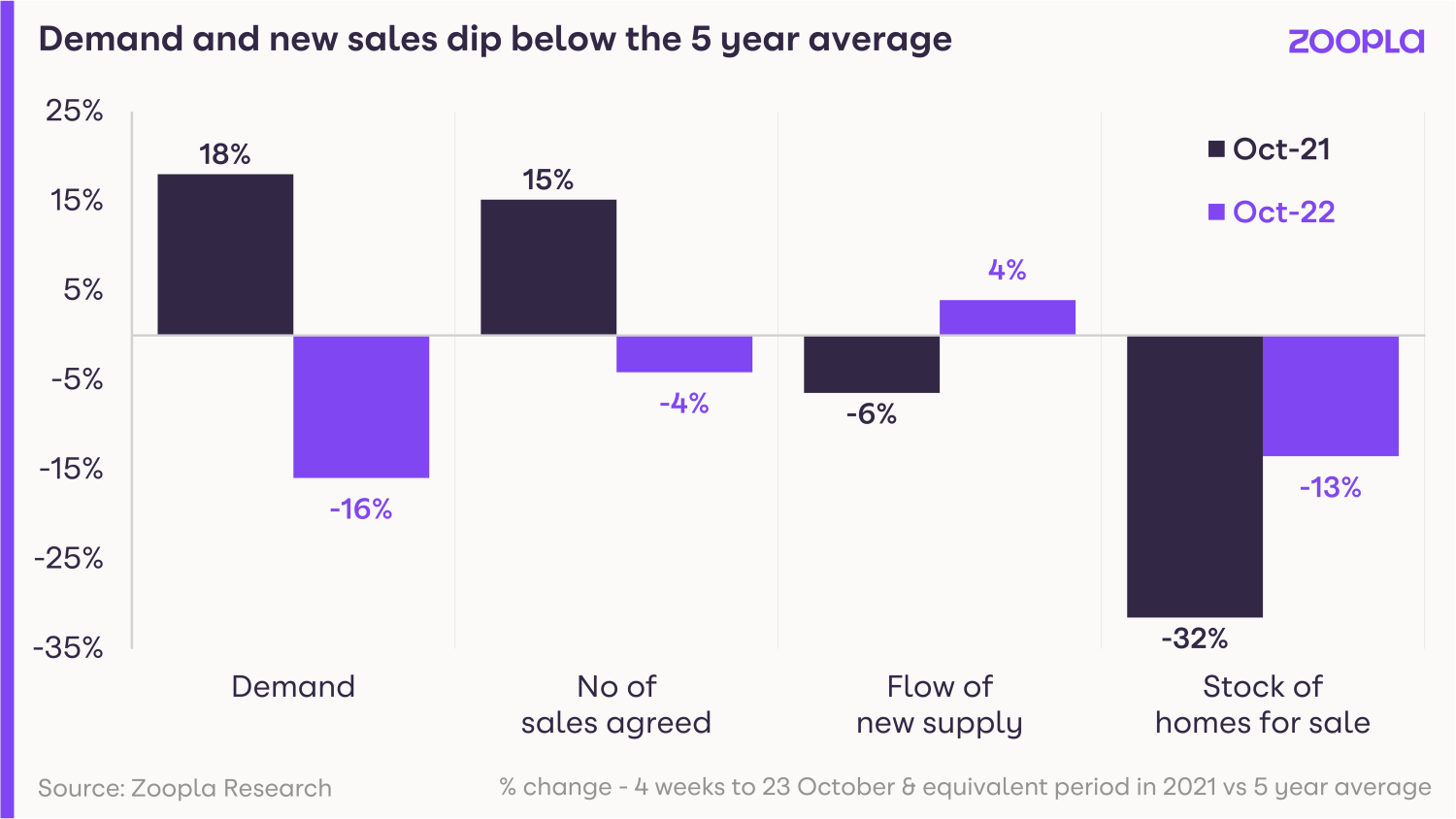

There has been a short-lived surge in the number of homes coming to the market, although the number of homes for sale still remains below average, which is supporting pricing.

At the same time, around 7% of homes for sale have seen their asking price reduced by more than 5% – an increase on recent months but still below 2018 levels.

Average house prices have increased by 8.1% over the last year, thanks to the strength of demand and the number of sales agreed over the last six months.

This demand, combined with an ongoing shortage of homes available for sale, will continue to push prices higher for the rest of 2022.

But the annual rate of growth is starting to slow across all areas, and this will accelerate further into 2023.

Key takeaways

- Buyer demand has dropped by a third since the mini-Budget, across all UK markets

- That said, 2022 was a strong year for property – and nearly 300,000 sales are still going through this autumn, taking the year’s total sales to 1.3m

- A shortage of supply means prices will remain buoyant for the rest of the year and we don’t anticipate any impact on house prices to be felt until 2023