Homeowners saw thousands added to the value of their homes this year with the entire UK housing stock now estimated to be worth £9.5trn, our latest House Price Index reveals.

UK house prices hit an all-time high in 2021 with the average home rising in value by £16,000.

The increase has left the typical property costing £240,800.

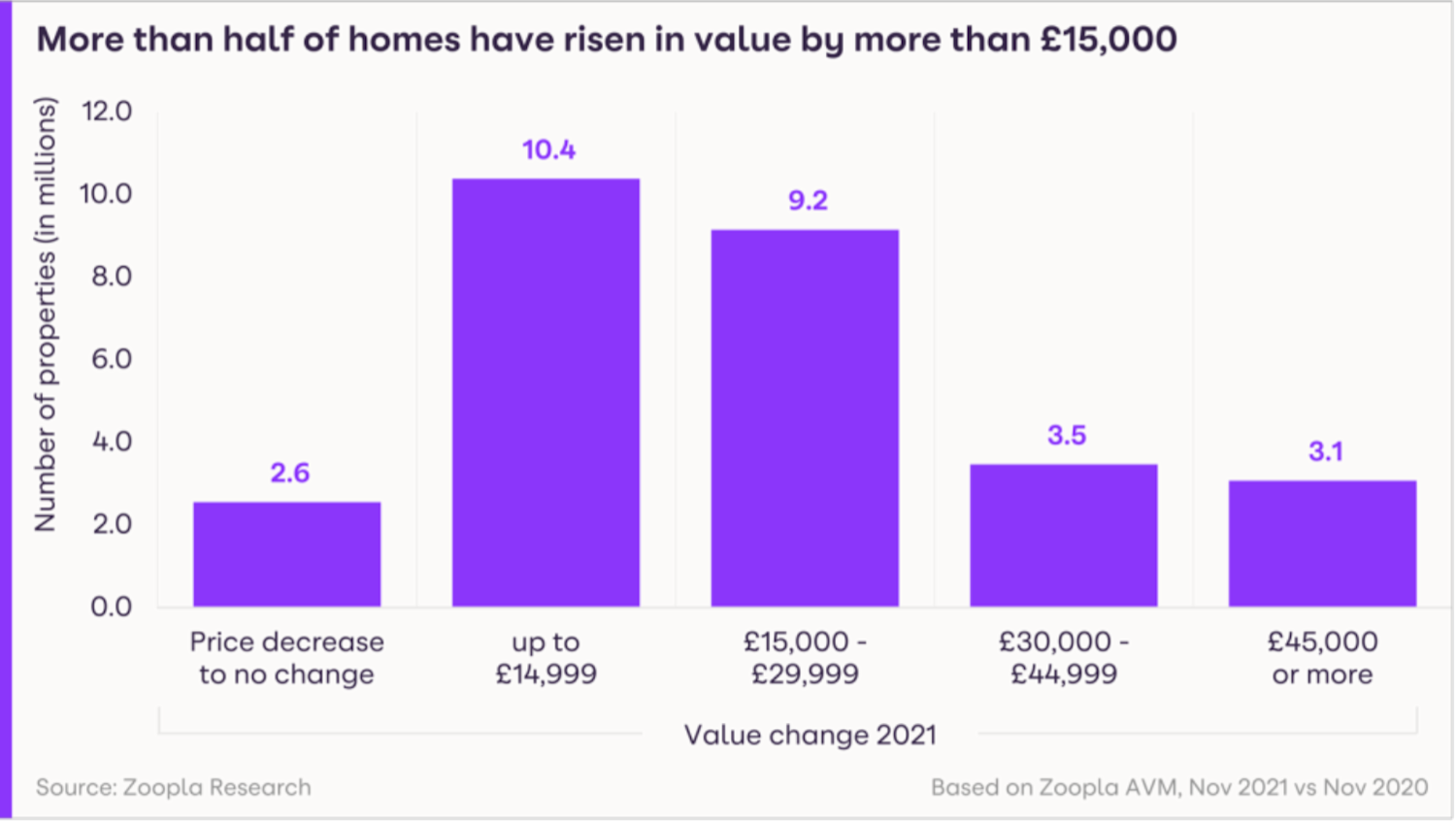

More than half of UK homes have risen in value by more than £15,000.

A whopping 3.5m homeowners will have seen a £30,000 to £44,999 increase in their property’s value.

And, 3.1m homes have soared by more than £45,000.

A surge in home sales in 2021 has resulted in the market value of homes soaring by £670bn collectively.

The entire UK housing stock is now estimated to be worth £9.5trn.

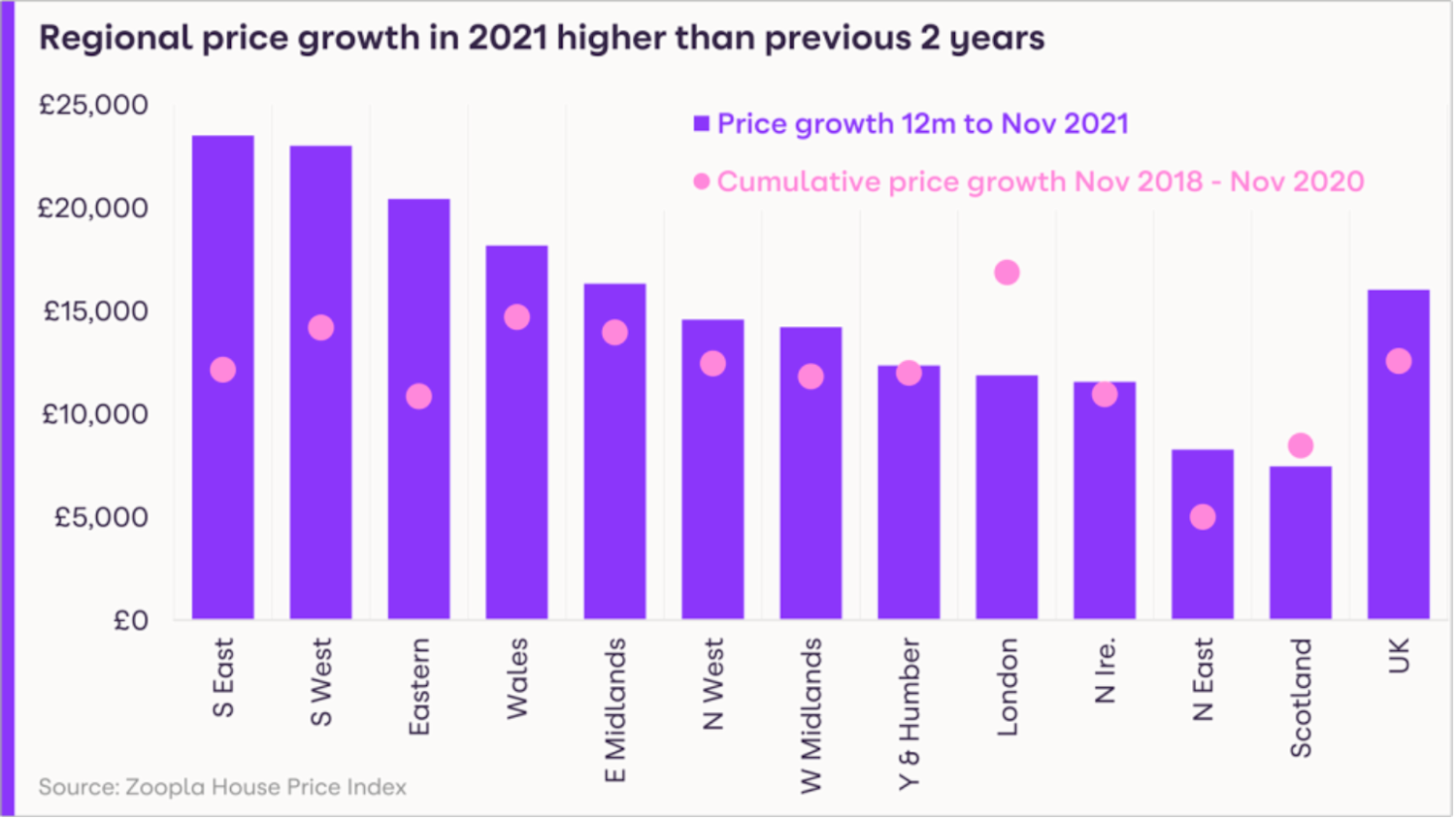

House prices in nearly every region of the country have risen by more this year than in 2019 and 2020 combined.

But, the rate at which property values are increasing is expected to slow next year amid economic headwinds, and a rise in the number of homes being put up for sale – from record low levels

What’s happening to house prices?

House prices rose at an annual rate of 7.1% in November.

The strongest growth was in Wales, where house prices went up 11.1%.

This was followed by the North West at 9.1% and the South West at 8.7%.

By contrast, prices in London edged ahead by just 2.4%.

Northern cities continued to see the highest growth.

Liverpool led the way with growth of 10.7%, followed by Manchester at 8.5% and Nottingham at 8.1%.

In monetary rather than percentage terms, homeowners in the South East saw the biggest gains.

Homes in the South East went up by an average of £23,500.

While those in the South West typically gained £23,000 and the East of England gained £20,400.

How busy is the housing market?

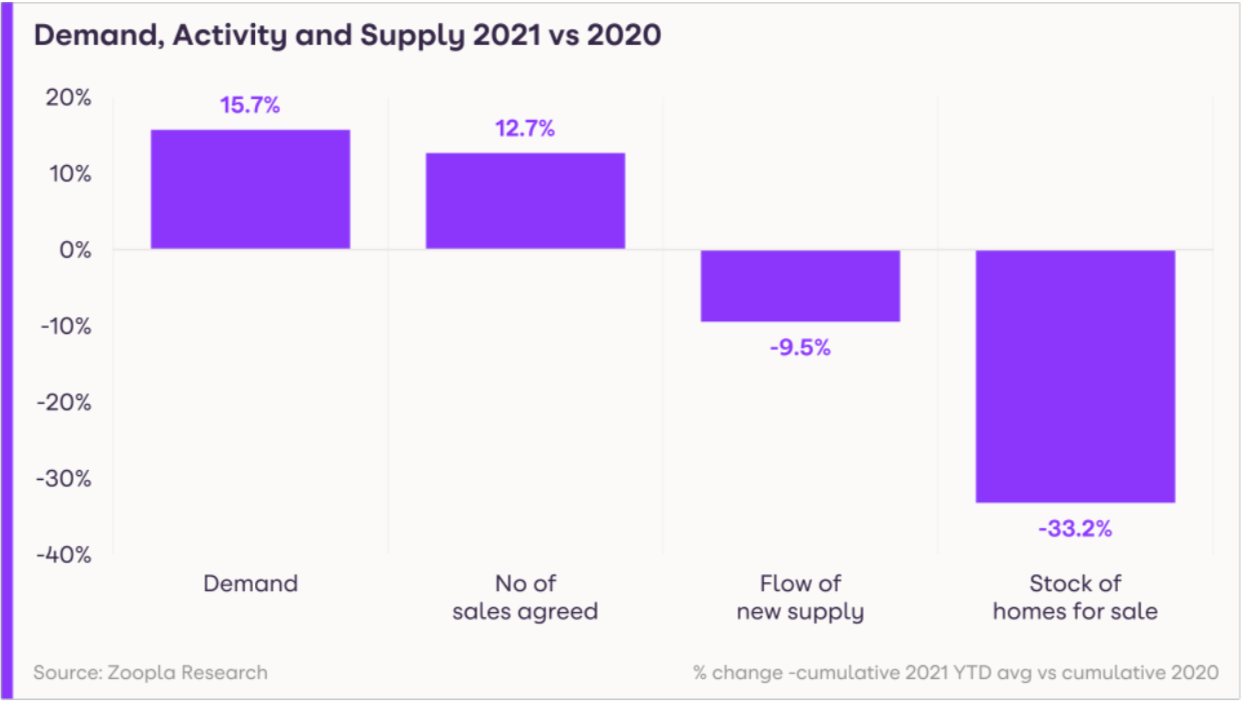

Buyer demand has remained strong throughout the year, running at an average of 15.7% higher than in 2020.

The number of people looking to move is currently highest in the East Midlands at 42% above last year’s level.

The West Midlands and Yorkshire and the Humber are not far behind at 35% and 28% respectively.

Buyer activity peaked in June 2021, when more people moved home than in any month since our records began in 2005.

But, the number of homes for sale has failed to keep pace with soaring demand.

The number of properties on the market is around a third lower than it was in 2020.

Strong demand and limited supply has accelerated house price growth in 2021.

What could this mean for you?

First-time buyers

Big jumps in property prices are bad news if you are a first-time buyer, as it makes getting a first home harder.

The good news is that the increase is only an average and the price of houses has increased significantly more than flats.

In fact, the typical price of a flat in London is broadly unchanged since last year.

As a result, if you are struggling to afford your first home, it may be worth looking at flats.

Home-movers

Strong house price gains mean that if you’re an existing homeowner wanting you could be sitting on significant equity.

The shortage of homes on the market also means you are likely to be able to sell your current home quickly, putting you in a strong position to buy.

On the downside, you can expect to face significant competition from other buyers. But this should ease somewhat next year.

What will happen in the housing market in 2022?

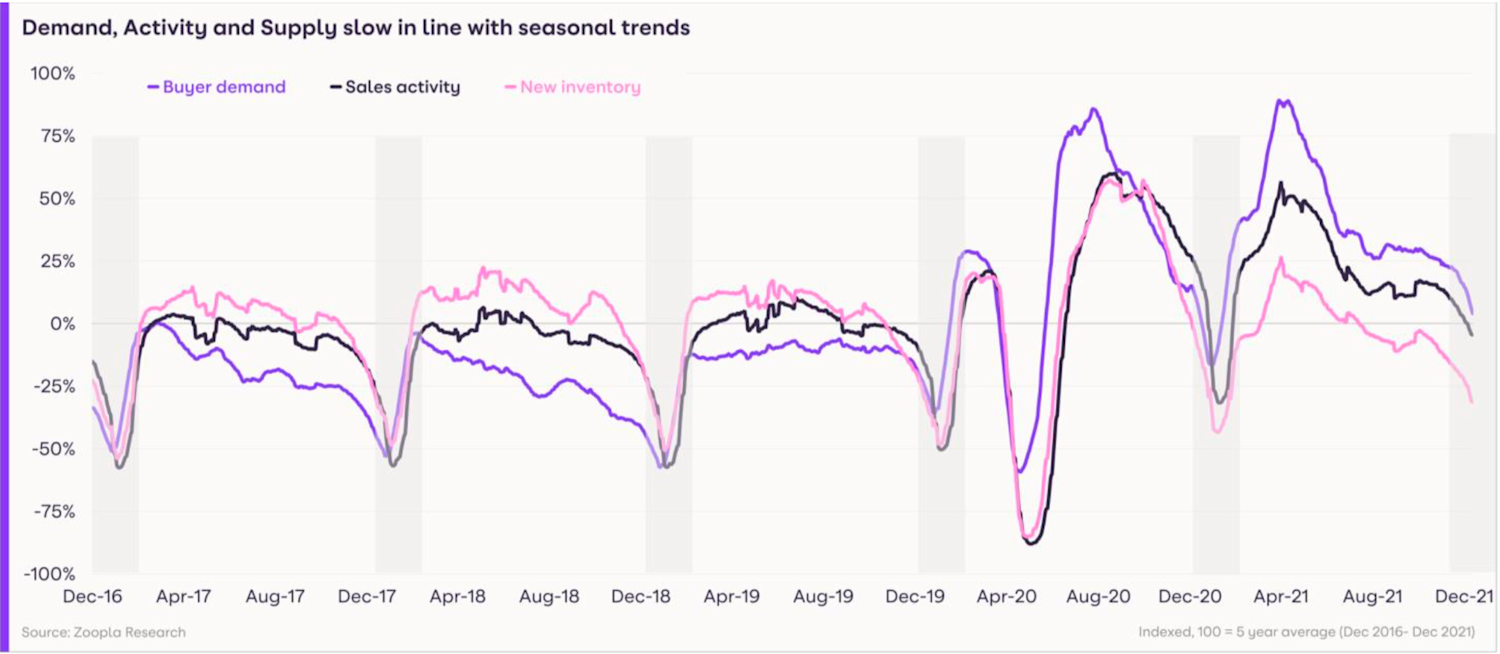

The property market is currently in a seasonal dip, as people put buying plans on hold while they celebrate Christmas.

But, we expect a massive bounce back in activity after the festive season as the pandemic-induced search for space continues.

Our Head of research, said: “This year has been a record year for the market.

“The stamp duty holiday and the pandemic-led ‘search for space’ has resulted in the highest number of sales since before the financial crisis, with 1.5m transactions.”

She expects the strong price growth seen during the past year to prompt some homeowners to cash in and move in the new year.

As a result, more properties are expected to come on to the market in the first quarter of 2021.

As more homes come onto the market, the imbalance between supply and demand should begin to ease.

It currently takes fewer than 30 days on average from a property being listed to a sale being agreed subject to contract.

Sales times are expected to fall back to a pre-pandemic level of 50 days during 2022.

Even so, demand is likely to continue to outpace supply, leading to predicted house price growth of 3% during 2022.

In 2022, we estimate 1.2m homes will be sold, compared with 1.5m in 2021.