The number of rental homes available could face additional pressure as nearly a third of landlords are being affected by higher mortgage rates.

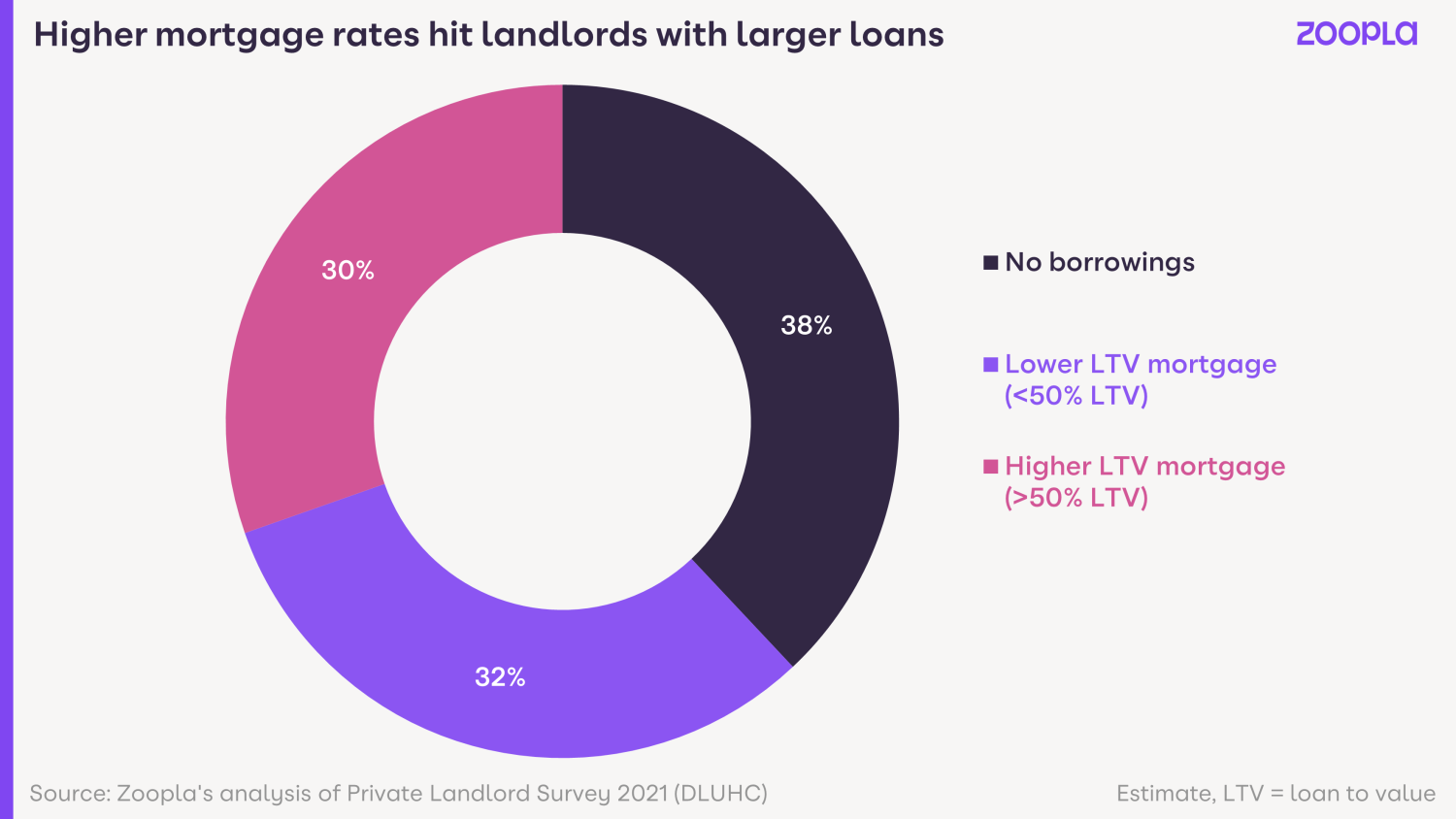

More than a third of landlords own their properties outright, while another third have loan to value mortgages of less than 50%.

But for the remaining 20-30% of landlords, whose mortgages have a loan to value of 50-75%, higher mortgage rates are hitting hard.

As mortgage rates creep up, landlords are forced to use more of their rental income paying back lenders, which in turn reduces their own income and creates a squeeze on cashflow.

The net result is the increased likelihood of a sale as landlords approach refinancing.

Higher mortgage rates are unwelcome but more manageable for landlords at lower LTVs as there is greater free rental cashflow to absorb higher mortgage rates.

In London and the South East, the two most expensive property regions in the UK, so many landlords are selling that these two regions account for 51% of all landlord sales.

Because homes in these areas are expensive to buy – and therefore offer low rental yields (or profit) once the monthly mortgage is paid, the economics of being a landlord here are tougher than other areas.

Rising mortgage rates are hitting profitability hardest in these regions, especially for higher rate taxpayers.

How can I keep my buy-to-let property in the face of rising mortgage rates?

The main option for landlords facing a big increase in mortgage interest payments is to inject equity at refinancing.

However, this will be an unattractive option for many with concerns over low yields and the risk of further price falls.

Is there a mass exodus of landlords selling up?

While some landlords are selling up, talk of an exodus is probably overdoing it.

Our sales data continues to show a steady, constant flow of private landlords selling up but this has been the case since 2018. And the level of landlords’ sales isn’t accelerating.

Corporate and institutional landlords are continuing to invest in homes and for this reason the number of private rented homes available has remained at the same level since 2016.

We don’t expect to see a worsening of supply. However, the market does need significant investment from more private and corporate landlords to help with the demand for rental homes.

Right now, there are 33% less homes available to rent than the five year average, yet demand is currently running at 50-85% above average.

Key takeaways

- Higher mortgage rates are hitting landlords who have loan to value mortgages of 50-75% hard. And that accounts for 20-30% of landlords

- 51% of all landlord sales are taking place in London and the South East, the two most expensive property regions in the UK

- While some landlords are selling up, talk of an exodus is probably overdoing it