If you’re looking to sell a home that represents good value, then you’re in demand. Homes that offer more bang for their buck are just what buyers are looking for right now.

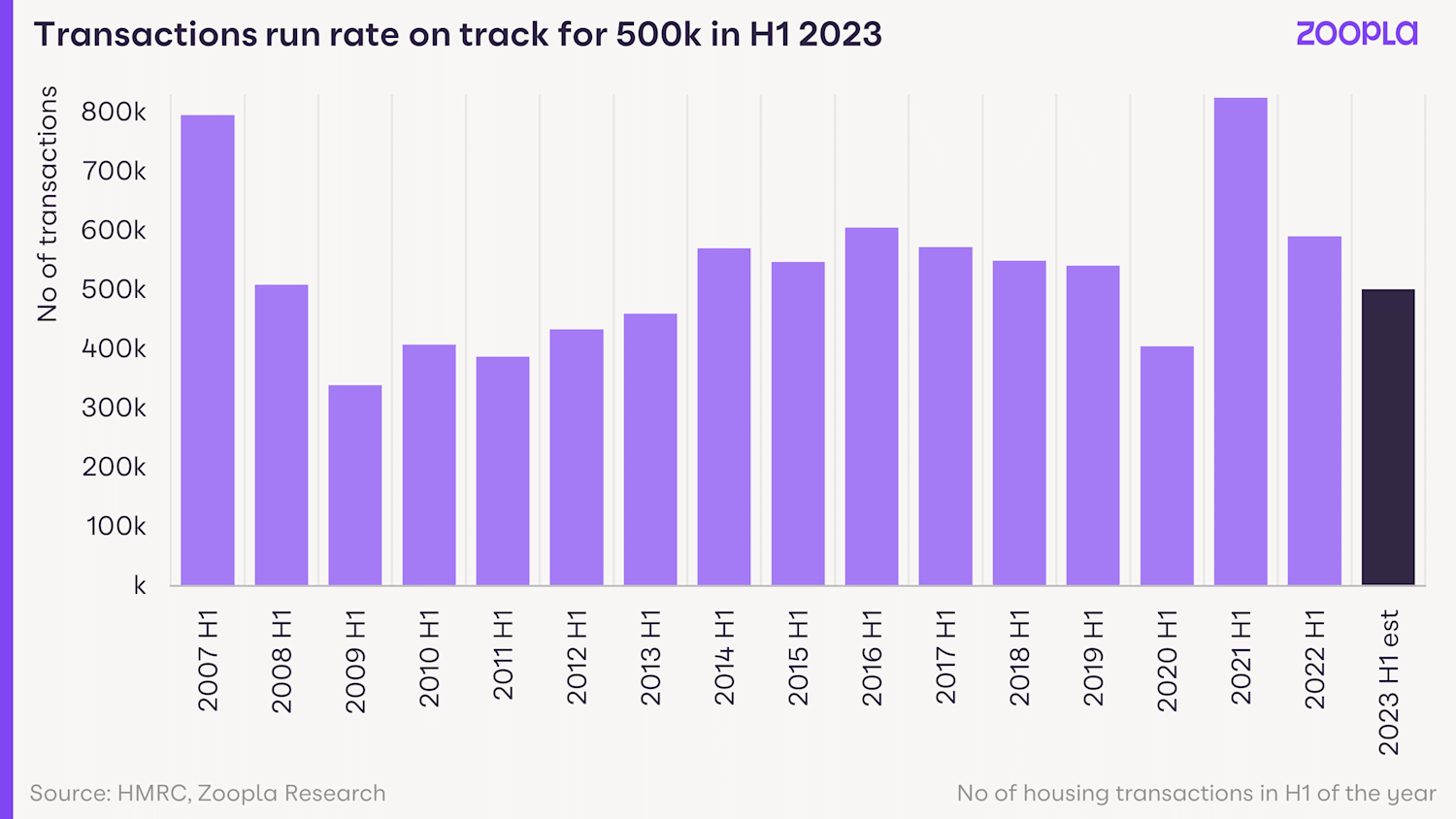

House prices are still up 4% year on year and we’re expecting 500,000 home sales to go through in the first half of 2023.

The number of sales agreed is 11% higher than the number agreed in spring 2019 – and sales are on an upward trajectory.

Prices are down 1% from what they were in October 2022, but the housing market is faring much better than many predicted and the number of sales going through is starting to pick up.

There are now 65% more homes available for sale than there were this time last year. The average estate agent now has 25 homes available, compared to a low of 14 homes in spring 2022.

This means there’s much more choice for buyers – and we’re expecting at least a million home sales to go through in 2023.

If your home represents good value for money, then you’re in demand

Buyers with less spending power are looking for homes that offer more bang for their buck.

That means homes in the more affordable areas like Scotland, Wales, the North East of England and London are seeing plenty of demand.

And we’re expecting the popularity of inner London flats to see a resurgence this year – because of price stagnation since 2016 – they’re now representing good value for money.

Across all regions and countries of the UK, we’re seeing a 5% increase in the share of sales at the lower end of the market and a 4% decrease at the top end, clearly showing that buyers are currently more interested in homes at the more affordable end of the spectrum.

The top end of the London market is the only area bucking this national trend, with an increase in the share of sales in the top 20%.

If you live in an area that saw big gains during the pandemic (we’re talking the South West, South East and Midlands) then you may find it takes longer to sell, as these homes now need bigger mortgages from would-be buyers.

And 4% mortgage rates are currently reducing buying power by 20%, hence buyers are looking for cheaper properties.

How much are sellers cutting their asking prices by?

Sellers are making modest downward adjustments to their asking prices to ensure their pricing matches what buyers are prepared to pay.

The average seller discount at the moment is 4% or £14,000.

That said, the scale of price gains over the pandemic (where the average home value increased by £42,000) is giving sellers room for manoeuvre to make these adjustments so that they can continue with their moving plans.

How long does it take to sell a home in March 2023?

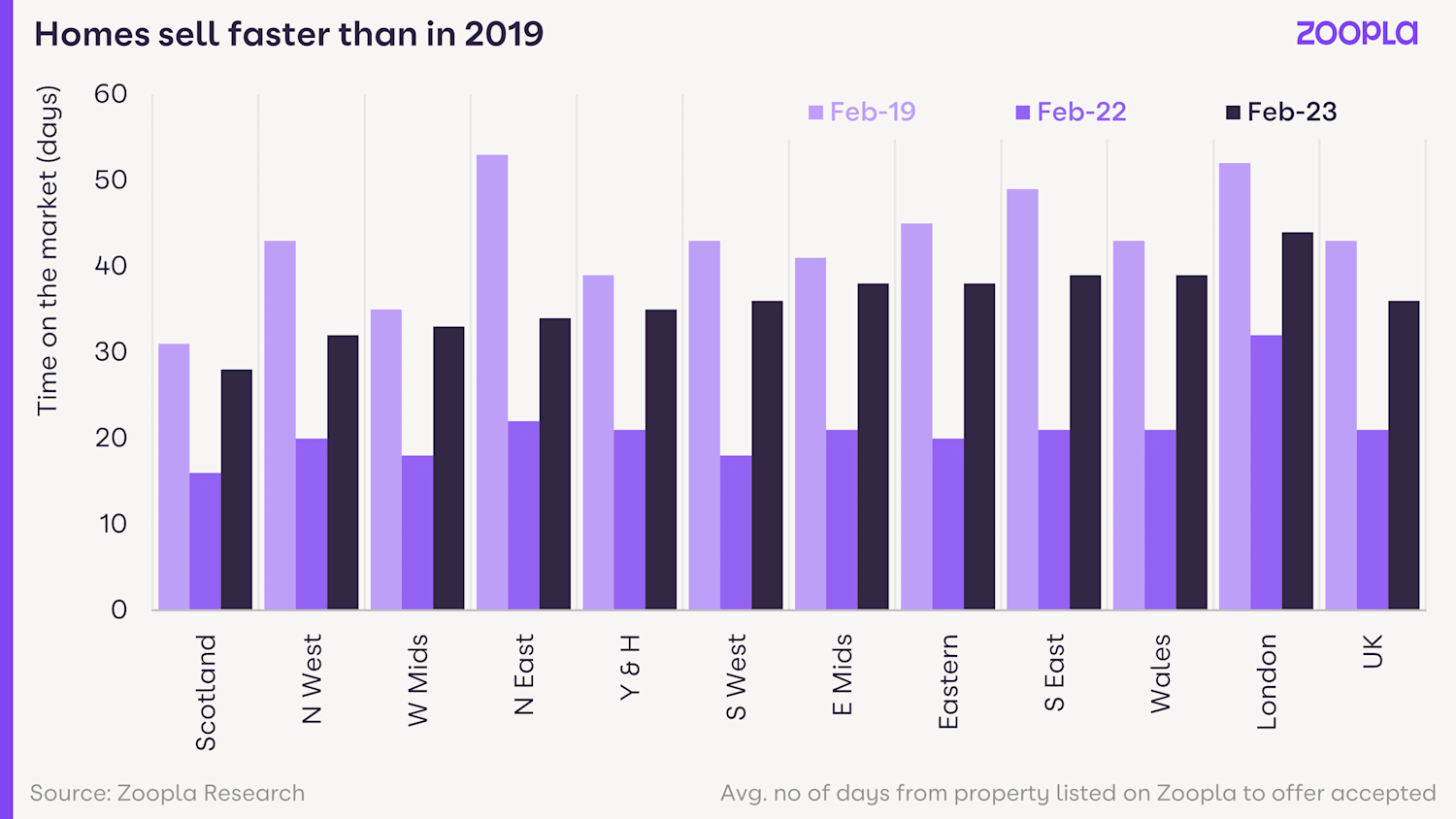

The average home is now taking 15 days longer to sell than in spring 2022, when we were in a red hot housing market.

However, homes in most areas are still selling faster right now than they did in spring 2019.

Scotland has the shortest sales period at 28 days (where homes are marketed with a survey and valuation in place), and London has the longest time to sell at 44 days.

Why buyers are still motivated to move in 2023

Hybrid working between the home and office is becoming the norm for many office workers.

And that freedom is still opening up the buying landscape for many, allowing them to look further afield for a home that’s better value for money.

A spike in retirement caused by the pandemic is also continuing to be a trigger for home moves.

Meanwhile, increasingly high rents are pushing some renters to become first-time buyers.

And finally, cost-of-living pressures will encourage some movers to down-trade from larger homes that are expensive to run to more affordable properties.

How is the rest of 2023 looking for the housing market?

The market is going through a soft repricing process with modest quarter-on-quarter price falls across all regions and countries of the UK.

But the good news is that buyers and sellers are continuing to agree deals and there’s little evidence to suggest house prices and transaction volumes are going to suddenly drop lower.

The most affordable markets will continue to attract demand and see above-average levels of sales.

The onus on all sellers is to make sure pricing aligns with buyers’ expectations. If you are serious about moving, you simply cannot afford to over-price your home.

Mortgage rates are set to remain around 4% over much of 2023 and could move lower towards the end of the year.

Key takeaways

- Demand for homes has reached its highest level since October 2022 and is 16% higher than spring 2019

- Demand from buyers is also above average in the most affordable areas, led by Scotland, Wales, the North East of England and London

- Mortgage rates are set to remain at around 4% for most of 2023 – and could move lower towards the end of the year

- Prices are adjusting lower but most homeowners looking to sell will still be making more from their home than 1-2 years ago