The UK rental market is roaring ahead, with properties letting almost a week faster than in 2020, our research shows.

Rents outside London are rising at their fastest rate since 2008 as people return to city centres.

The typical price of renting a home in the UK, excluding the capital, now stands at £790 a month, costing tenants an additional £456 a year, according to our latest Rental Market Report.

The steep increase has been driven by renters returning to cities. But the surge in tenant demand has not been met by an increase in the number of homes to rent, forcing rents higher.

Our head of research, said: “There has been a sharp rise in demand for rental properties in recent months, especially in central city markets, signalling the return of city life as offices and other leisure and cultural venues continue to open up more fully.”

What’s happening to rents?

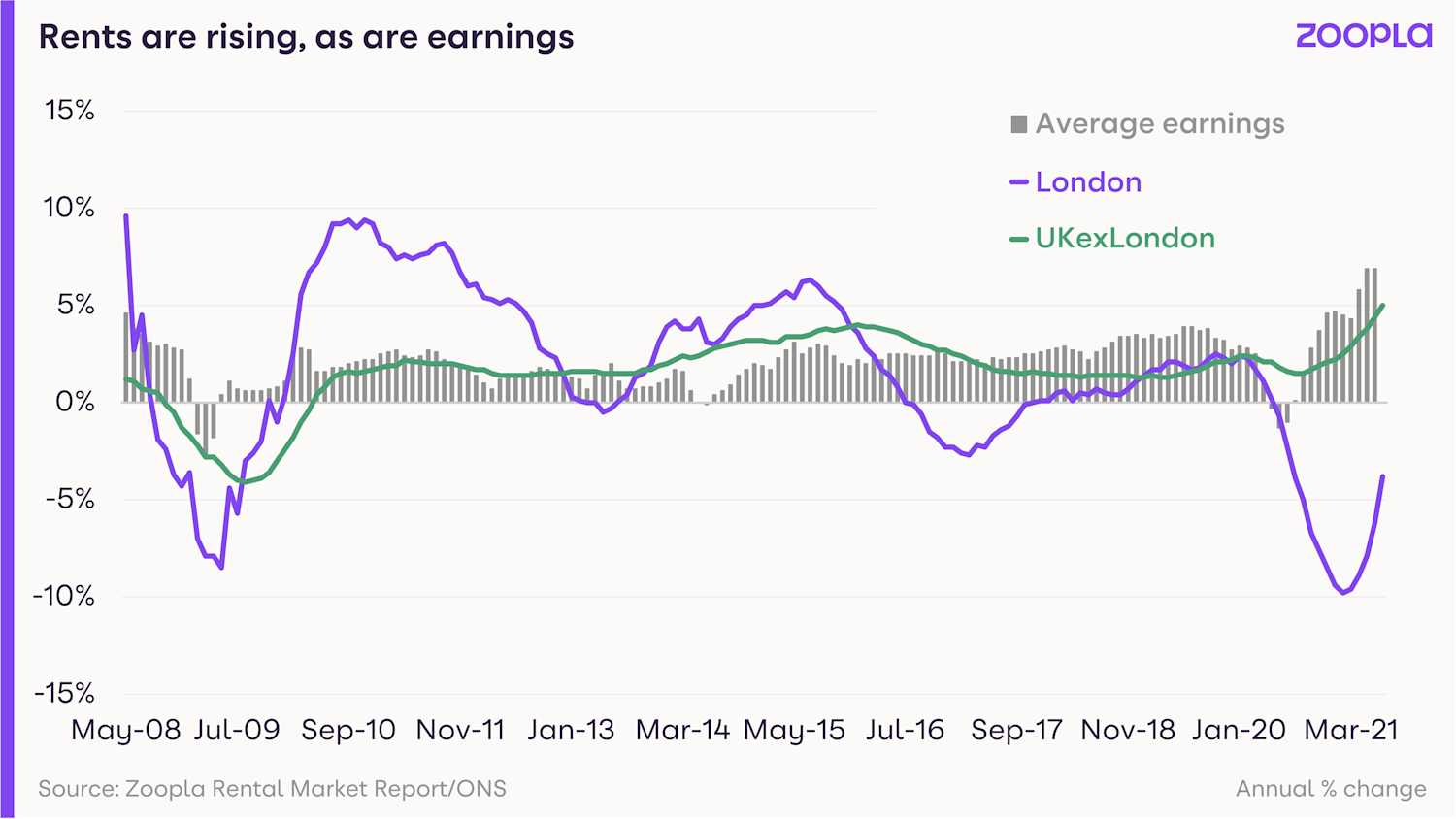

Rents across the UK, excluding London, have risen by 5% in the last year, the highest level since our index began in 2008 and more than double the 2.2% rise recorded in January.

The south-west saw the biggest hike, with the cost of being a tenant jumping by 7.6% year-on-year. It was followed closely by the East Midlands at 6.8% and the north-east at 6.5%.

Rent increases were particularly strong in some towns and cities, with Wigan and Mansfield seeing hikes of 10.5% and 10% respectively.

Meanwhile, rents in Hastings, Blackburn, Barnsley and Norwich all grew by 9.4% or more.

Despite the rise, these places remain some of the most affordable in which to be a tenant. A single earner has to spend an average of 21% of their income on rent, compared with a UK average of 32%.

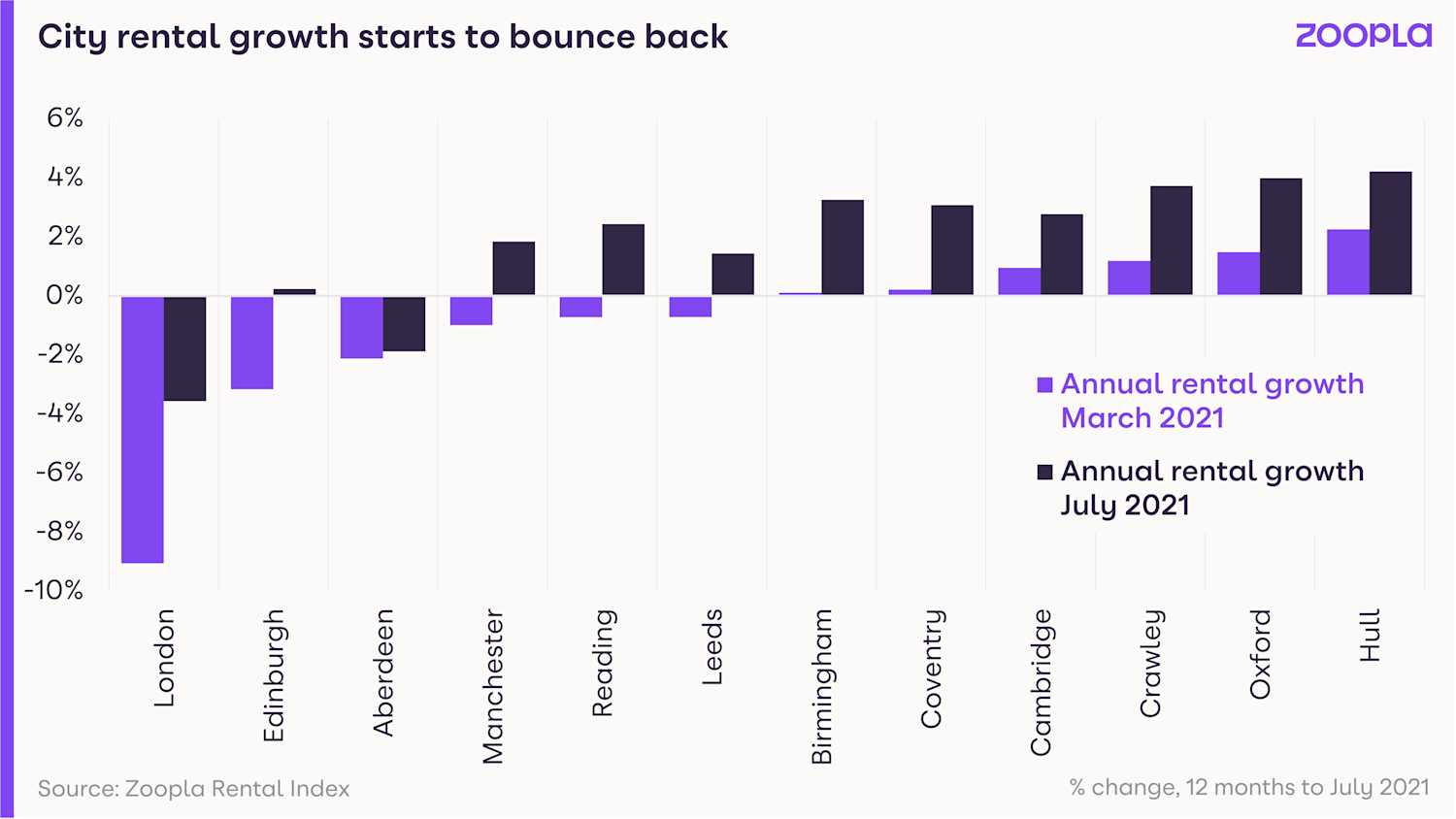

At the other end of the scale, rents in London have dropped by 3.8% year-on-year.

Even so, the rate at which rents in the capital are falling is showing signs of bottoming out, as tenants return to the city.

Across the whole of the UK, including the capital, the average rent stands at £943 a month, 2.1% more than a year earlier.

But with average earnings rising faster than rents, rental affordability is holding steady for tenants who are employed.

Kate Eales, head of regional residential agency at Strutt & Parker, said:

“Rents are recording healthy growth in cities, but in the most desirable areas, there’s evidence of growth up to 25%. We recently let a home in the Cotswolds for £3,750 a month when it was previously let out at £2,200 and another was let for £5,500, up from £4,100.”

What’s demand for rental homes like?

Tenant demand is soaring. It was nearly 80% higher in August than average levels between 2017 and 2019.

It’s being driven by a resurgence in city centre life, with people being drawn back as offices, bars, restaurants and other leisure facilities reopen.

There are also seasonal factors at play, such as university students looking for accommodation ahead of the new academic year, graduates starting jobs and families moving before the school term starts.

The bounce back has been particularly marked in London, leading to rents in the 12 inner boroughs rising by an average of 2.3% between May and July.

Similar spikes have been seen in Birmingham, Edinburgh, Leeds and Manchester.

It’s reversing the decline seen during the earlier stages of the pandemic, when renters moved back in with families or relocated to more rural areas.

Is there a good supply of homes available to rent?

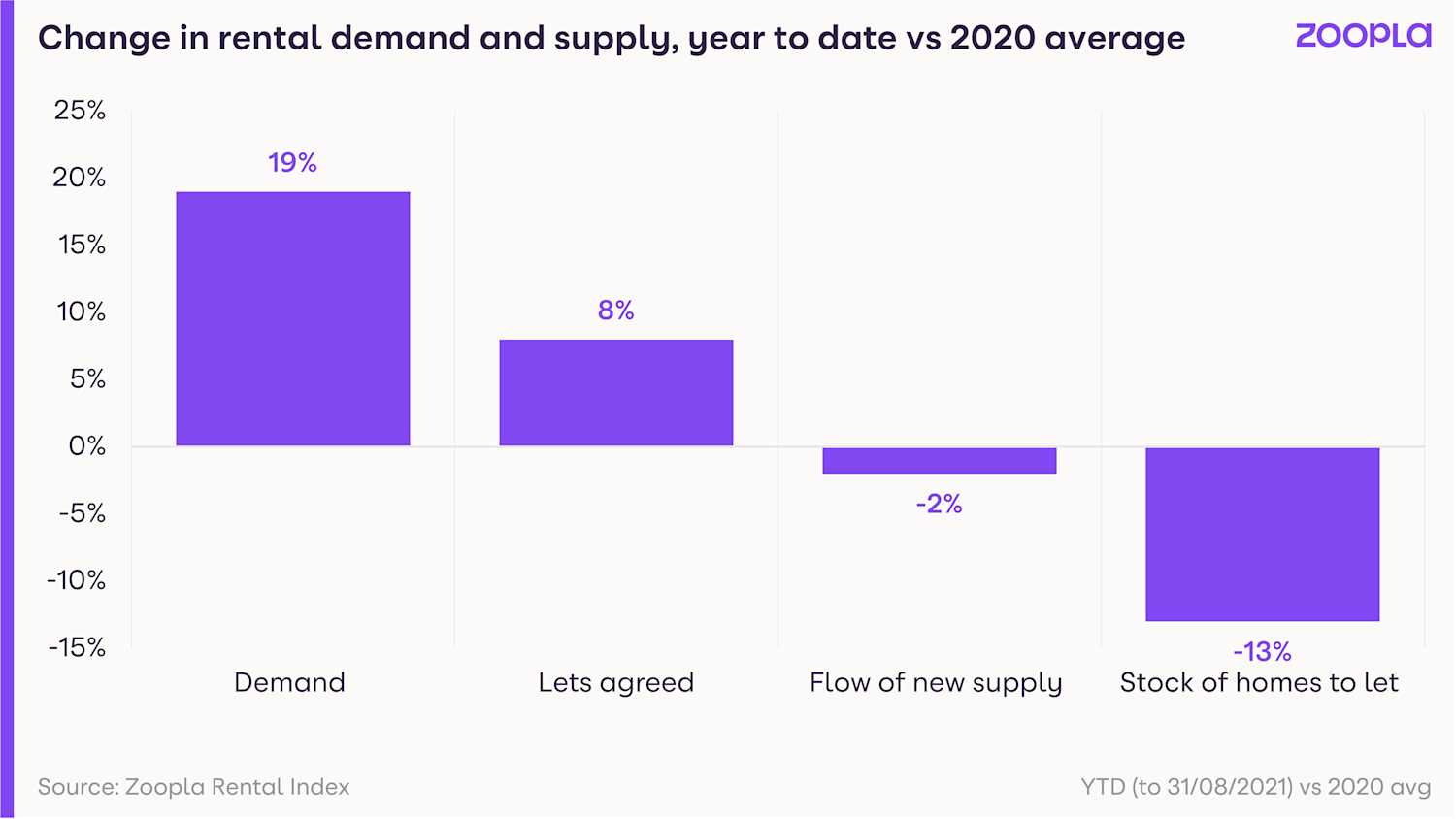

While demand so far this year has increased by 19%, the level of rental homes available has fallen by 13%.

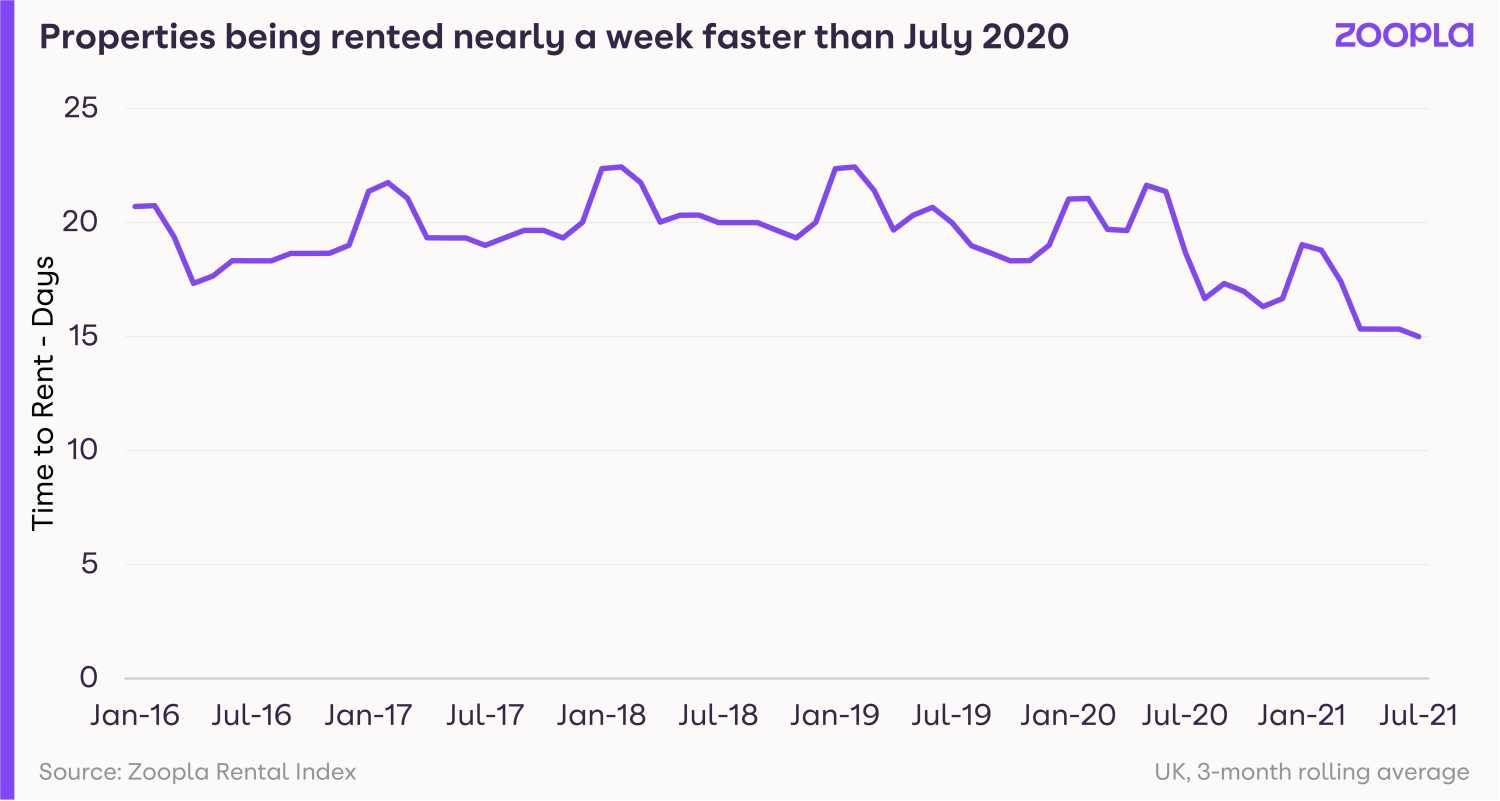

This mismatch is not only forcing rents up, it is also leading to the rental market moving at its fastest pace since 2016.

The average time between marketing a property for rent and agreeing a tenancy is now just 15 days, compared with 20 in July last year.

Coastal locations, such as Hastings, Worthing, Bournemouth and Plymouth, have the fastest-moving markets, with properties taking just over a week to let.

Rental homes in many large cities, including Liverpool, Cardiff, York, Bristol and Newcastle, are also coming off the market quickly, with the time to rent averaging just under two weeks.

Eales added:

“The recovery in the rental market has, in many ways, mirrored the boom in the sales market, with people looking for homes that accommodate a different set of needs shaped by their lockdown experience.

“Lack of stock and high demand are inevitably driving price growth. This stock depletion is a result in part of many accidental landlords having now sold their properties – benefiting from the soaring demand in the sales market.”

What could this mean for you?

Landlords

If you are a landlord with a property to rent, the current surge in tenant demand is good news.

It not only means you are likely to be able to find a tenant quickly, but you are also likely to be able to achieve the rent you want.

It is worth noting the swing back to city life, compared with the earlier stages of the pandemic when people were looking for homes in rural locations and ones with outdoor space.

Tenants

With demand rising and the level of homes to rent falling, you can expect to face significant competition from other tenants to secure a home.

The imbalance is also pushing rents higher, so you may have to pay more than you did a year ago.

If you are finding it hard to find somewhere, consider looking outside of town and city centres.

What’s the outlook?

The high number of people looking for a home to rent during August will ease off in line with seasonal trends.

But demand is expected to remain high in the coming months as the return to city life continues.

Gilmore explained: “As ever, much will be dependent on the extent to which the current rules around Covid-19 continue as they are.

“But given no deviation from the current landscape, the demand for rental property, coupled with lower levels of supply, will continue to put upward pressure on rents.

“In London, this will translate into rental growth returning to positive territory late 2021 or early 2022.”