Mortgage rates are on track to drop below 5% this autumn, boosting buyer confidence as more return to market.

What’s happening with mortgage rates right now?

Mortgage rates are on track to fall below 5% this year.

The latest pause in the Bank of England’s base rate rises, amid better than expected inflation news, is good news for buyers, mortgagees and sellers.

The amount banks need to pay for borrowing money has now fallen, giving them wiggle room to reduce mortgage rates – and they are starting to creep downwards.

What 4% mortgage rates mean for the housing market

The closer mortgage rates get to 4%, the more buyers will come back to market.

That’s good news for sellers, as it will support both house sales and house prices.

Our Executive Director of Research, Richard Donnell, says: ‘Our consistently held view is that mortgage rates over 5% mean lower sales and year-on-year price falls.

‘We expect mortgage rates to start falling slowly in the coming weeks into the high 4% range.’

Right now, across the UK’s biggest lenders, the average cost of a 5-year 75% LTV fixed-rate mortgage is 5.1%.

Back in spring 2023 it fell to 4.2%, which boosted buyer demand and the number of sales agreed.

There is still some uncertainty over the outlook for inflation and how quickly it will fall back to the Bank of England’s 2% target, but it is ultimately lower mortgage rates that will increase buying power over the next 12-18 months.

More buyers will come to market once mortgage rates get below 4.5%

House prices have fallen at a modest rate this year, despite the 20% hit to buying power triggered by mortgage rates increasing since early 2022.

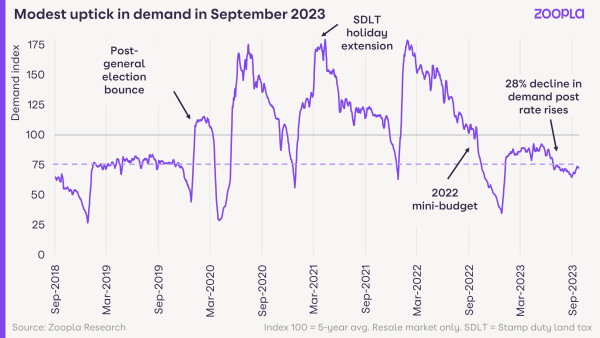

However, a silver lining is beginning to emerge in the housing market: this September saw more buyers coming back to the market.

And enquiries to estate agents are up 12% since the August bank-holiday weekend.

While this improvement comes from a low base (demand remains 33% down on what it was a year ago), it means the housing market is now tracking more closely to where it was in 2019.

And while this uptick is partly seasonal, it also reflects improving consumer confidence, which is now at a two-year high, amid expectations of lower mortgage rates.

Donnell adds: ‘It’s clear that some buyers are returning to the market this autumn, having delayed home moving decisions as base rates moved ever higher.

‘Many others are waiting on the outlook for mortgage rates and holding their requirements for their next purchase.

‘The quicker average mortgage rates (for 5-year 75% LTV fixed-rates) move towards 4.5% or lower, the sooner we will see buyers return to the market.

‘This doesn’t mean prices will start to rise but it will support sales volumes.’

Why house prices aren’t tumbling in 2023

Stricter lending regulations, where mortgagees are stress-tested to prove they can still pay their mortgages at up to 8% rates, have prevented larger house price falls this year.

That’s because we’re not seeing high numbers of forced sales, where mortgagees can no longer afford their repayments.

Instead, homeowners are using alternative routes, like extending their mortgages over a longer period of time, to lower their monthly repayments amid higher borrowing costs.

A buoyant jobs market is also helping mortgagees to keep up with those repayments.

But it remains a buyers’ market right now, with the average seller offering a £12,125 discount to sell their home.

Key takeaways

- Lenders reduce mortgage rates as bank rate holds

- Buyer confidence increases as borrowing rates edge closer to sub 5%

- Estate agents report 12% increase in enquiries