Buyers have a lot more choice when it comes to securing a home in 2024. More sellers are coming to market as mortgage rates are expected to plateau at 4% to 5%.

The number of homes available for sale is up 20% on this time last year, meaning much more choice for home hunters.

Meanwhile, house price reductions are lower than a year ago but remain above average, as house price falls continue to slow.

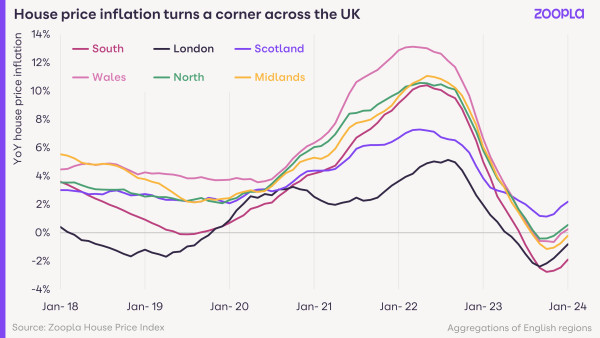

Annual house price inflation is currently at -0.5% year-on-year, up from the recent low of -1.4% recorded in October 2023.

Where can buyers find the biggest price reductions right now?

The biggest cuts to house prices (5% or more) are currently underway in the UK’s more expensive regions: the South East and East of England.

Five English regions are registering annual price falls of up to -2.1%, led by the East.

However, house prices have moved into positive territory in the remaining 4 regions of England, alongside Wales, Scotland and Northern Ireland – where prices have risen 4.3% in the last year.

Will mortgage rates come down in 2024?

Mortgage rates have fallen back to where they were a year ago, but they remain above 4% and are likely to plateau at this point for the foreseeable.

Our Executive Director of Research, Richard Donnell, says: ‘Mortgage rates could move a little lower over the year, but this hinges on the timing of future base rate cuts, which may come later in the year.’

Falling mortgage rates are important when it comes to boosting housing market activity, but lenders have recently been pulling mortgage deals below 4%.

‘The cost of finance used to fund mortgages has increased modestly in recent weeks,’ says Donnell. ‘Rising incomes are helping to offset the impact of higher borrowing costs, but at a slow pace.

‘Buyers should anticipate 4-5% mortgage rates over much of 2024.’

A three-speed housing market

Across the UK over the last 18 months, there has been a rapid slowdown of house price inflation, largely due to higher mortgage rates and cost of living pressures.

These factors have mainly hit prices in the more expensive areas of the UK, such as London and the South, while areas with more affordable housing, such as the North, have been less impacted.

The housing market has now become divided into three groups:

1) Southern England is registering the largest price falls

The East, South East and South West regions have been hit hardest by rising mortgage rates and reduced household buying power. Largely because the average home price here is £344,000, which is 30% above the UK average.

2) London is seeing the lowest price inflation

‘While it is the most expensive housing market with an average price of £534,000, London is a market that has registered much lower levels of house price inflation over the last seven years,’ says Donnell.

‘Affordability has been improving slowly over this time, opening the market up to more potential buyers than before.’

London is now in hot demand as a location, yet fewer sellers are coming to market in the capital (+7% year on year), compared to the rest of the UK (+21% year on year).

This means demand is outstripping supply, so house prices are holding steady in the capital, rather than falling as they are in the rest of Southern England.

3) The rest of the UK is seeing firmer pricing

‘Over the last 12 months, annual price falls have been very limited across the rest of the UK, where house prices are at or below the UK average,’ says Donnell, ‘because the impact on buying power from higher mortgage rates has been less pronounced.’

In fact, Scottish house prices have been rising in the last 12 months, while Northern England, the West Midlands and Wales are registering firmer pricing because they are more affordable. Consequently more sales are being agreed here.

Will the Budget have anything in store for buyers?

‘We don’t expect the Budget to have any specific measures that will boost market activity in the very short term,’ says Donnell.

‘There is a case to make permanent stamp duty changes for first-time buyers from the 2022 autumn budget.

‘But any longer-term measures such as the Mortgage Guarantee Scheme or small deposit mortgages will take longer to impact market activity, with much depending on the scale of the proposals.’

Key takeaways

- 20% more homes available for sale as sellers return to market

- House prices not expected to rise quickly in 2024

- 15% more sales are being agreed, boosted by falling mortgage rates, which are now plateauing

- There is a 3-tier housing market split between southern England, London and the rest of the UK