Sellers are offering their biggest discounts in five years, with one in four offering 10% off the asking price right now, putting buyers in a strong negotiating position.

Jeremy Hunt’s Autumn Statement last week revealed that inflation has now fallen from a high of 11.1% to 4.6%.

The government anticipates it will fall to 2.8% by the end of 2024 and to 2% by the end of 2025.

‘Financial markets expect the Bank of England to start cutting rates around the summer of 2024,’ says our Director of Research, Richard Donnell.

‘If mortgage rates start to fall further, this will support an improvement in demand, but prices will remain under modest downward pressure.’

The news couldn’t be better for buyers right now, who have been held back by higher mortgage rates in 2023.

Sellers are currently offering the biggest discounts in five years, with one in four offering 10% off the asking price.

The average discount being offered is 5.5%, the equivalent of £18,000.

In London and the South East, that rises to 6.1%, or £25,000, off the asking price.

Across the rest of the UK, the reduction is smaller at 4.8%, or £11,000, but it’s still the highest level of discounting we’ve seen in recent years.

Much more choice of homes, including popular 3-bed properties

The supply of the UK’s most in demand property type: three and four bedroom houses, is increasing.

And we’re now seeing record numbers of properties for sale.

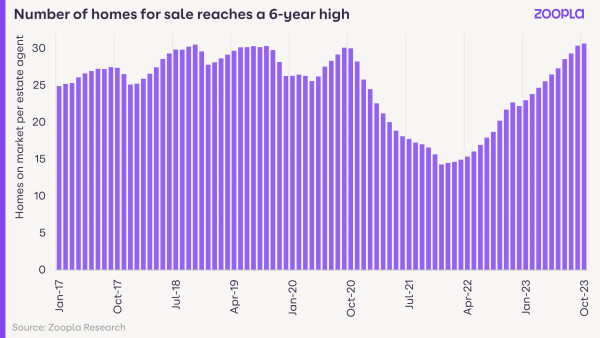

During the pandemic years a chronic scarcity of homes on the market pushed up prices.

But this position has now fully reversed, with the highest number of homes for sale per estate agent in six years.

‘The average estate agency branch has 31 homes for sale, compared to a low of just 14 in the middle of the pandemic boom,’ says Donnell.

‘This is boosting choice amongst would-be buyers and providing them with much greater negotiating power with sellers as they agree pricing.’

Buyers have room to negotiate on price

During the pandemic years, buyers had to pay the full asking price to secure a property, but not any more.

‘Over the course of 2023, sellers have been accepting ever larger discounts to the asking price to agree a sale,’ says Donnell.

In the first six months of 2023, those discounts averaged out at 3.4% off the asking price.

This month, the average discount recorded is 5.5%, or £18,000. That’s the largest level of discounting seen since 2018.

And buyers in southern England now have the greatest negotiating power of all. It’s where the biggest discounts are going on, with 6.1% reductions on average asking prices.

‘These discounts reflect the fact that sellers haven’t been cutting asking prices very quickly,’ says Donnell. ‘As more sellers adjust asking prices lower, we expect these discounts will start to return to normal levels of 3-4%.’

There couldn’t be a better time to buy in London

London has seen slow price growth over the last seven years of just 8%, while for the rest of the UK, house prices have risen 28%.

Homes in the capital are now seen as better value for money, while a steady return to office working is supporting sales volumes and pricing levels here.

In fact, new sales have rebounded more in London than any other part of the UK over the last 2 months, leading to a slight firming in prices.

What’s going to happen to house prices in 2024?

As we edge towards Christmas, the number of homes for sale will start declining as some sellers take their properties off the market with a view to relaunching in the new year.

But it will remain a buyers’ market in 2024, with no rise in house prices anticipated any time soon.

‘The current repricing of homes has further to run in 2024,’ says Donnell.

‘While 5-year fixed mortgage rates have been falling below 5%, they need to fall further to bring more buyers back into the market.’

Key takeaways

- Sellers are accepting an average discount of £18,000 in November 2023

- In London and the South East, that rises to £25,000

- Buyers are now in a strong negotiation position, particularly in southern England