The rapid rise in house prices over the last three years means first-time buyers now need to earn more to buy a home. Let’s look at the options.

Higher mortgage rates have a major impact on first-time buyers.

But many first-time buyers come from the rental market, where there have been steep increases in rental costs over the last year, with rents up £1,120.

This, combined with a chronic shortage of supply, which is currently down by a third, is now pushing more first-time buyers towards home ownership.

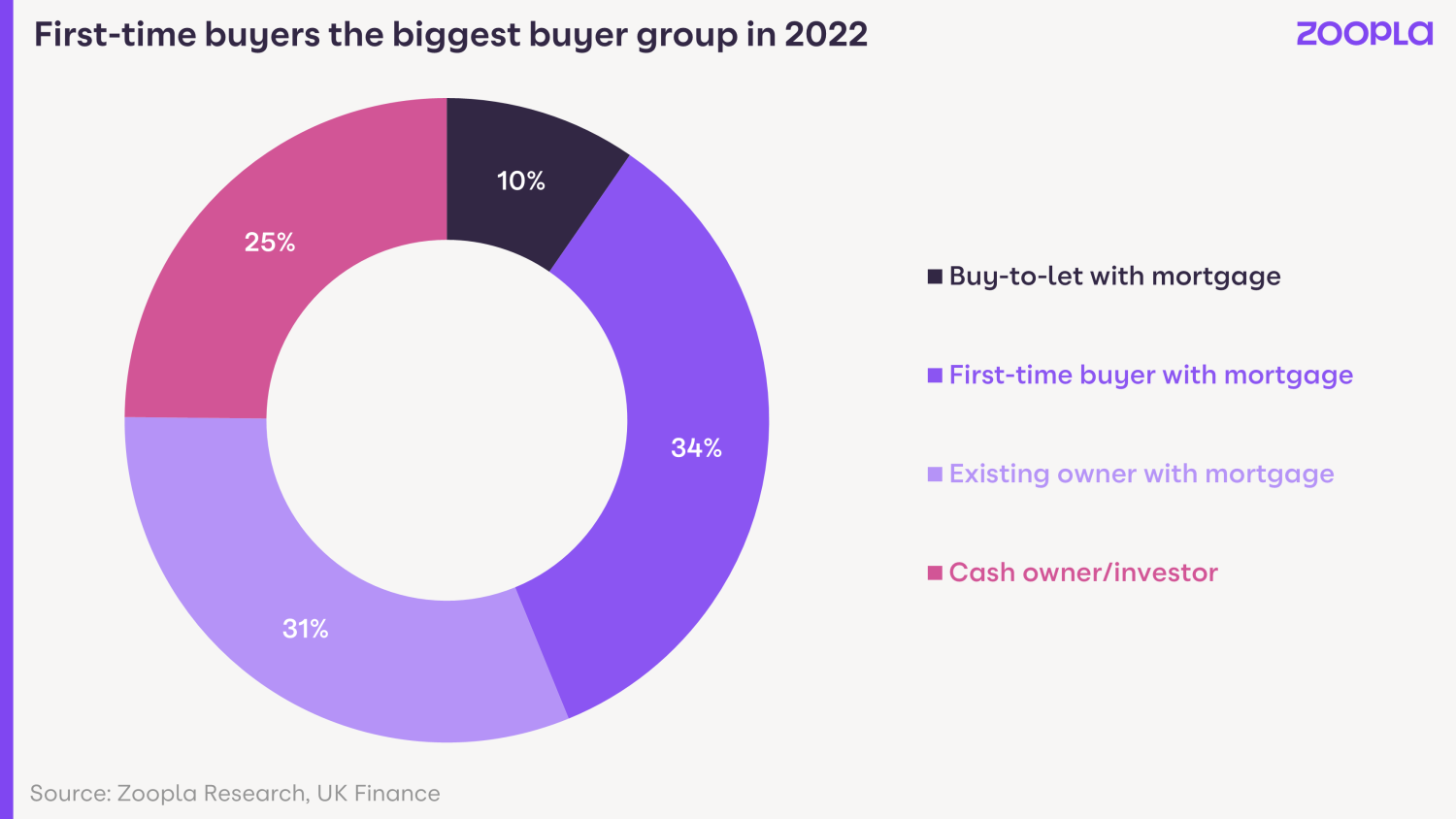

In fact in 2022, first-time buyers have proven to be highly resilient. We estimate that first-time buyers using a mortgage accounted for over 1 in 3 sales last year (34%).

This made them the largest group of home buyers, followed by existing owners using a mortgage (31%) and cash buyers (25%).

The main constraints to stepping onto the property ladder for first-time buyers are access to a suitable deposit and the right level of income to afford a mortgage.

While the jump in house prices over the last 3 years has increased the amount of income and deposit needed to buy a first home.

How much money do first-time buyers need?

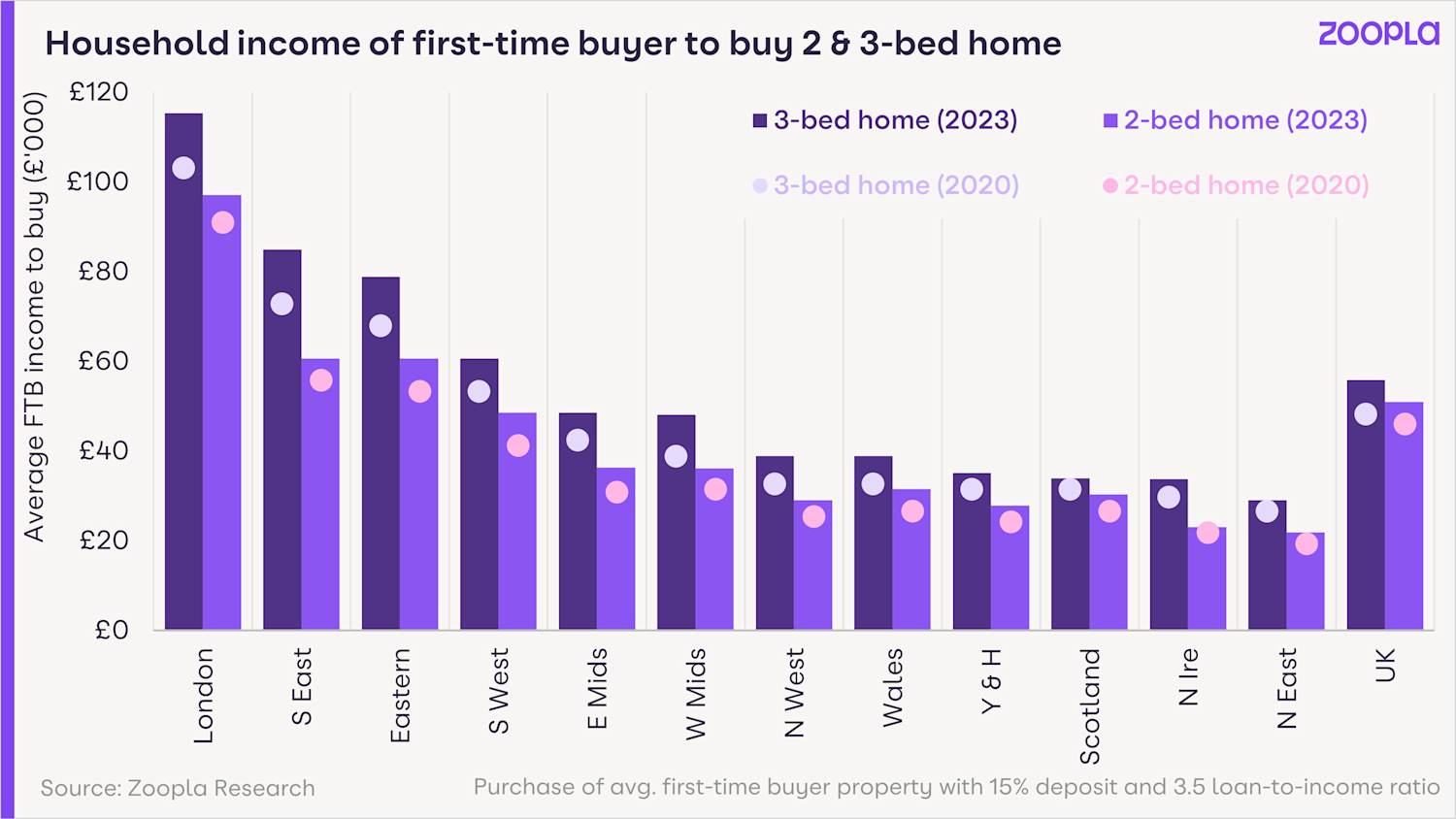

First-time buyers now need to earn nearly £7.5K more to buy a home than they did in 2020.

That means you’ll need to earn a household income of £55,900 for a 3 bed home, or £51,000 for a 2 bed home (an increase of £4,900) .

In London and the South East, the income needed to buy a home has now increased by over £12,000 to buy a 3-bed home and £7,300 to buy a 2-bed home.

Yet wages have only risen by £4,800 since 2020, according to the Office for National Statistics.

The average amount needed for a house deposit has also risen.

For the average three-bed home costing £230,000, a first-time buyer would need to have a deposit of £34,500 (an increase of nearly £5,000).

For a two-bed home costing £210,000, you would need a deposit of £31,500 (an increase of £3,000).

Traditionally, 3-bed houses have been the most popular choice for first-time buyers, but we are seeing clear evidence of first-time buyers seeking better value for money with one and two-bed flats.

The ability to work from home has also enabled first-time buyers to look further afield to secure the home they need at the right price.

So what can first-time buyers do in 2023?

A quick checklist:

1: Save for a larger deposit

One option is to try and save for a larger deposit, which may be challenging when rental costs are taking up a larger portion of people’s earnings.

2: Borrow from the bank of mum and dad

Another might be to borrow from the ‘bank of mum and dad’ if that’s a possibility.

3: Look to buy a more affordable home

We’re seeing that some first-time buyers are looking to purchase cheaper and lower-cost homes.

Lower mortgage rates in recent years have enabled first-time buyers to purchase larger, typically 3-bed homes.

But higher mortgage rates and prices are now pushing some to adjust their requirements, particularly in the areas where prices have increased the most since 2020.

Three-bed homes are still the most in-demand property type but buyer interest has fallen back to 40% in Q1 2023, while demand for 1 and 2-bed flats increases.

Outside of London, the average asking price for a 2-bed flat (£200,000) is 29% lower than a 3-bed house (£280,000).

4: Take out a longer term mortgage

Finally, you might consider taking out a longer term mortgage.

In the past, mortgage terms have usually been around 25 years.

But there has been a steady increase in the number of mortgages with terms of over 30 years.

Taking out a 35-year loan gives buyers an extra 20% boost to buying power, compared to a 25 year loan.

But it’s important to be aware that this comes at the cost of an extra 48% in mortgage interest payments over the longer term.

Key takeaways

- Rising rents and a shortage of rental properties are pushing more renters to become first-time buyers

- In 2023, first-time buyers need to earn a household income of £55,900 to buy a 3-bed home, or £51,000 to buy a 2-bed home

- There are options available for first-time buyers, including saving for larger deposits, extending the mortgage term or looking for more affordable housing in less expensive areas