Government exclusive: 'Why we've launched our 95% mortgage guarantee scheme'

The minister of state for housing reveals why applications opened for a new mortgage guarantee scheme this week.

The Rt Hon Christopher Pincher MP, minister of state for housing, explains how the government is determined to do everything it can to support first-time buyers and the housing market.

In a year that has tested us like no other, we have never felt more of a connection to the place we call home and the sense of security and comfort that comes with it.

Recent polling has revealed that the desire for home ownership has increased during the pandemic with many people looking to take their first step onto the housing ladder.

We recognise the challenges facing prospective first-time buyers and for many that dream of home ownership feels out of reach.

That is why this week applications have opened for our 95% mortgage guarantee scheme – just one of a range of flexible home ownership schemes introduced by this government.

Polling has revealed that 69% of private renters and 63% of people living at their family home struggle to find many mortgages with a low deposit.

This will enable more households to access mortgages on both new-build and existing homes, without the need for large deposits.

First-time buyers will be able to purchase a home with only a 5% deposit – meaning they can purchase their home having saved a smaller amount upfront.

As we build back better from the pandemic, we are determined to do everything we can to support first-time buyers and the housing market.

We are building more homes – in 2019 a pledge to build 300,000 new and attractive homes a year was announced with an investment of over £12bn in affordable housing over the next five years – the largest investment in a decade.

Extending the aspiration of home ownership is a central mission of this government. The 95% mortgage guarantee scheme is another step in levelling up the country and bridging the home ownership divide.

How much hidden equity is in your home?

Daydreaming of selling up and buying a bigger home? It could become a reality, with 45% of homeowners undervaluing their home by an average of £46,300, our research shows.

Almost half of UK homeowners are undervaluing their home, with their properties worth nearly £50,000 more than they realised.

Only three out of 10 people have an accurate idea of how much their home is worth, with 45% undervaluing and a quarter overvaluing their property, according to our inaugural Hidden Equity Survey.

Those who underestimated the value of their home discovered it was worth £46,305 more than they thought, which equates to roughly 1.5 times the average UK salary. Meanwhile, those who overvalued it were out by around £44,313.

Nearly one in 10 homeowners whose property was worth more than they expected found that it was valued at over £100,000 more, with 40% of these located in London and the south east.

At a national level, this means that more than one million UK properties could be carrying six figures of hidden equity – unbeknown to their owners.

When all the survey results were taken into account, the net result was that the average home is worth £9,470 more than its owner realised, meaning UK homeowners are collectively sitting on a staggering £237bn of hidden equity.

What does the picture look like in London?

Some 35% of London homeowners found their property to be worth more than they expected, by an average of £117,000.

Conversely, a similar amount – 37% – said their home was worth less than they thought, by an average of £49,000. Meanwhile, 28% of homeowners said the value was in line with what they expected.

When all the survey results were taken into consideration, the average home in the capital is worth £22,846 more than its owner anticipated. To put this into context, that’s more than double the £9,470 national average.

What impact did hidden equity have on homeowners?

The research, which was based on homeowners who had their home valued via an estate agent or sold it in the past three years, highlights the significant gap between how much people think their home is worth and what it really is.

Nearly a third of people whose home was worth more than they realised said they were overjoyed, while 6% described it as feeling like they had won the lottery.

Among those who went on to sell their home and benefit from the hidden equity, the unexpected windfall had a significant impact, with 81% saying the additional money had enabled them to improve their lifestyle.

Exactly half said they were able to move to a better property than they had expected, such as one with more bedrooms or in a nicer area, while 18% of those aged 55 to 64 said they could retire earlier. For those able to retire earlier than expected, it was on average by more than three years.

Around 13% said it had enabled them to upgrade their car, with the same proportion going on more holidays and 8% using the money to help their children get onto the property ladder.

For the seven in 10 homeowners who did not know the true value of their home until they got it valued by an estate agent, 45% said they would have made different financial decisions in previous years if they had been aware of their hidden equity.

Nearly half of those again – 21% of respondents – said they would have made ‘significantly’ different decisions.

Some 31% of homeowners whose home was worth less than they expected said they would have worked harder to build up their savings if they had known the true value of their property, while 12% said they would have put more money into their pension. Others said they would have spent less on holidays, cars and luxury items.

What could this research mean for you?

Our survey shows that many homeowners may be in for a nice surprise if they check the current value of their home.

There are significant benefits to knowing exactly how much your home is worth, particularly if you are thinking of selling it, as its value could impact the type of property or location you look to move to.

The supply of homes for sale is tight, so if you list your home now it will not only stand out, but you will also be in a good position to take advantage of the stamp duty holiday on your next step on the housing ladder.

Head of research at, explained: "The effects of the pandemic over the last 12 months have been felt in the housing market, with many households reassessing how and where they want to live.

"There is soaring buyer demand but this is not currently being matched by homes being listed for sale. Homeowners considering a move could be in pole position in their local market if they offer their property for sale, and could be set to unlock hidden equity."

Top three takeaways

- More than half of homeowners undervalue their home, with their properties worth nearly £50,000 more than they realise

- Only three out of 10 people have an accurate idea of how much their home is worth, with 45% undervaluing and a quarter overvaluing their property

- Nearly one in 10 homeowners found their home was worth more than £100,000 more than they thought, with 40% of these properties located in London and the south east

How the latest easing of lockdown restrictions could affect you

The housing market remains open for business but you still need to take precautions. Here’s how to move home safely as England enters stage two on the roadmap out of lockdown.

The government has updated its guidance on moving home as lockdown restrictions ease further in England.

The housing market remains open and people are able to both continue with planned moves and view properties.

But precautions still need to be taken and the government has warned it may become necessary to pause all home moves locally or nationally at some point to manage the spread of Covid-19.

Remember that you will be required to follow social distancing measures at all stages of the moving process.

If you have any symptoms of Covid-19 or test positive for the virus, you should immediately self-isolate at home for at least 10 days.

Here’s how to move safely under the latest guidelines.

Preparing to move home

You can put your home on the market and look for properties to buy or rent, but the process is likely to be different compared with pre-Covid-19 times.

Estate agents may require you to make an appointment ahead of time, rather than just walking into their offices. When visiting an estate agent’s office, you should also wear a suitable face covering.

Estate agents can visit your property to take photographs or videos, but when looking for a property yourself it is recommended that you carry out initial searches online.

As well as finding properties for sale and rent on blackstones, you can search new-build homes from leading developers.

Viewings

Initial viewings should be done virtually wherever possible, and you should only visit in person if you are seriously considering making an offer on the property.

Viewing occupied homes should be done by appointment, and ‘open house’ viewings cannot take place.

If you are interested in a new-build home, you should contact the developer to make an appointment to view the show home or a particular plot you are interested in.

When viewing a property in-person, you should wear a face covering, avoid touching surfaces wherever possible, and wash your hands or use hand sanitiser regularly.

If you need to stay somewhere overnight in order to view properties, you can do so in self-contained accommodation, but you must only stay within your own household or support bubble.

If people are viewing your property, you should open all internal doors, ensure surfaces, such as door handles, are cleaned after each viewing, and allow access to handwashing facilities, ideally with separate towels or paper towels.

It is recommended that you wait outside the property while viewings are taking place.

Making offers or reservations

You can make or accept an offer, or reserve a property as normal, but you should be aware that there is a greater risk that home moves may need to be delayed if someone involved has Covid-19 symptoms, so contracts and agreements should be as flexible as possible.

You can visit a property again after having an offer accepted but you should follow the same measures as with an initial viewing.

Tradespeople can also visit the property to carry out inspections but only one person should visit the property at a time and social distancing and hand hygiene measures should be followed.

Property searches and surveys

Your legal representative should be able to carry out searches on your property online, while surveyors can also undertake surveys on it.

Where possible, inspections should take place by appointment only, with only one person visiting the property at a time, and social distancing measures should be followed.

If your home is being surveyed, make sure the surveyor has access to all parts of the property they need to inspect, so that you can minimise contact with them, such as by staying in another room.

Finalising your move

Once you have exchanged contracts or signed a tenancy agreement, you have entered into a legal agreement to purchase or rent a property.

Even so, you should be prepared to delay the move if necessary, such as if someone involved in the transaction develops Covid-19 symptoms.

Your legal advisor should help to ensure that any contract you enter into has sufficient flexibility to allow the purchase to be delayed if one of the parties develops Covid-19 or has to self-isolate.

Moving your belongings

Removal firms are able to carry on working and you should contact them as early as possible in advance of your moving date.

If removal firms are unavailable, another household can help you move but you must follow social distancing and hand hygiene measures where possible.

It is recommended that you and others in your household try to do as much of the packing yourself as you can, and that you clean your belongings where possible.

While removers are in your house, you should keep internal doors open and try to minimise contact with them, maintaining a distance of at least two metres where possible.

You should not provide refreshments but should give access to handwashing facilities with separate towels or paper towels.

All parties should wash their hands regularly or use hand sanitiser and avoid touching surfaces where possible.

What’s hot in the housing market right now

The search for space means houses are more popular than flats, while good affordability is also driving buyer interest in northern regions.

What’s selling the fastest?

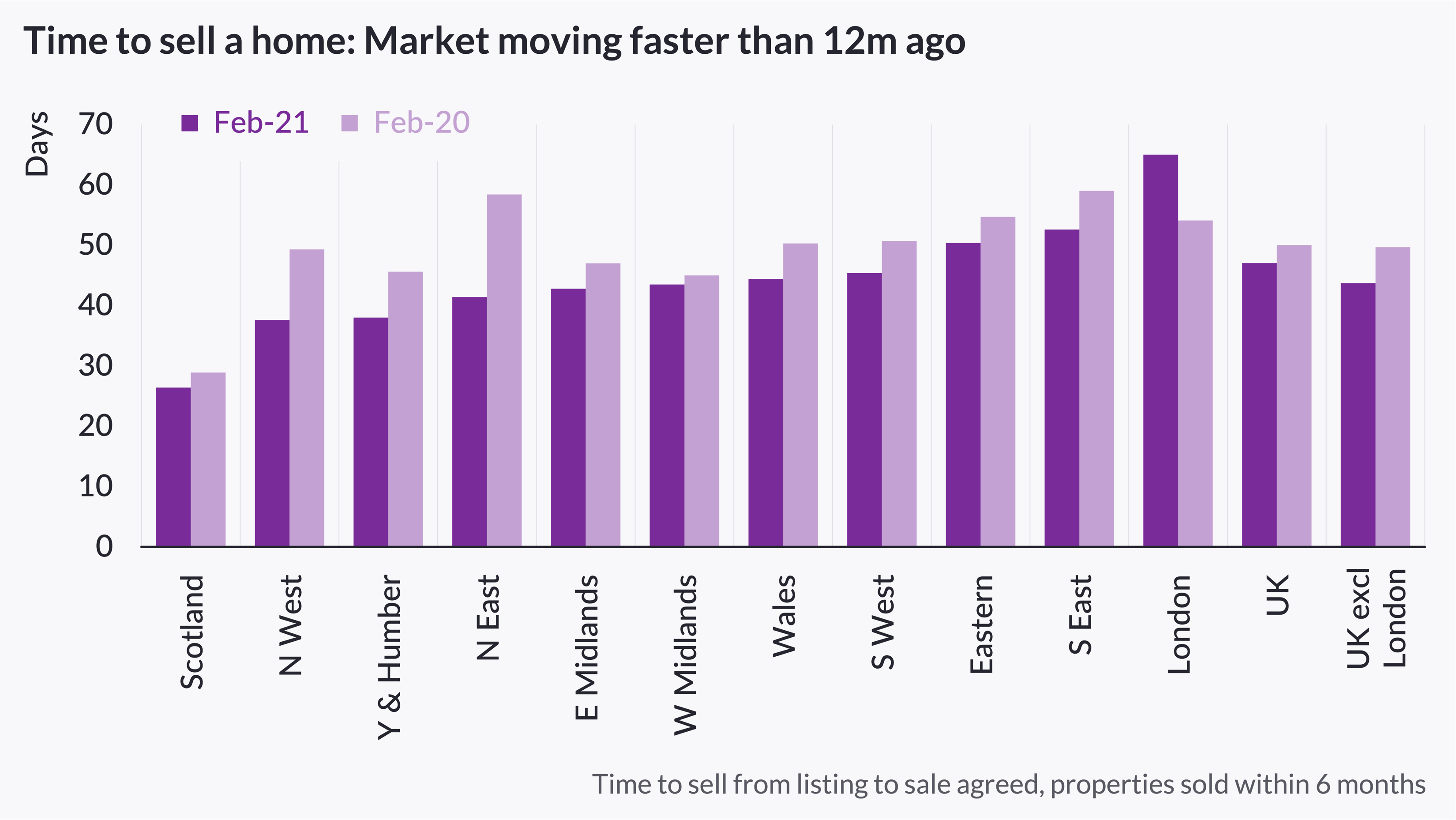

Houses are selling three weeks faster than flats as the lockdown-led search for space continues.

It currently takes an average of just 42 days from being listed for sale for houses to reach the 'sale agreed' stage, compared with 62 days for flats.

Homes in the north east and Yorkshire and the Humber are selling the fastest, with sales agreed in an average of just 38 days in both regions.

Meanwhile, homes in the north east and north west have seen the biggest reductions in the time it takes to sell, with the length of time they are listed for before receiving an offer dropping by 17 days and 12 days respectively.

What’s the most sought-after type of property?

Family homes are the most coveted type of property across the UK, with demand for three-bedroom homes jumping by 30% in the week following the Budget.

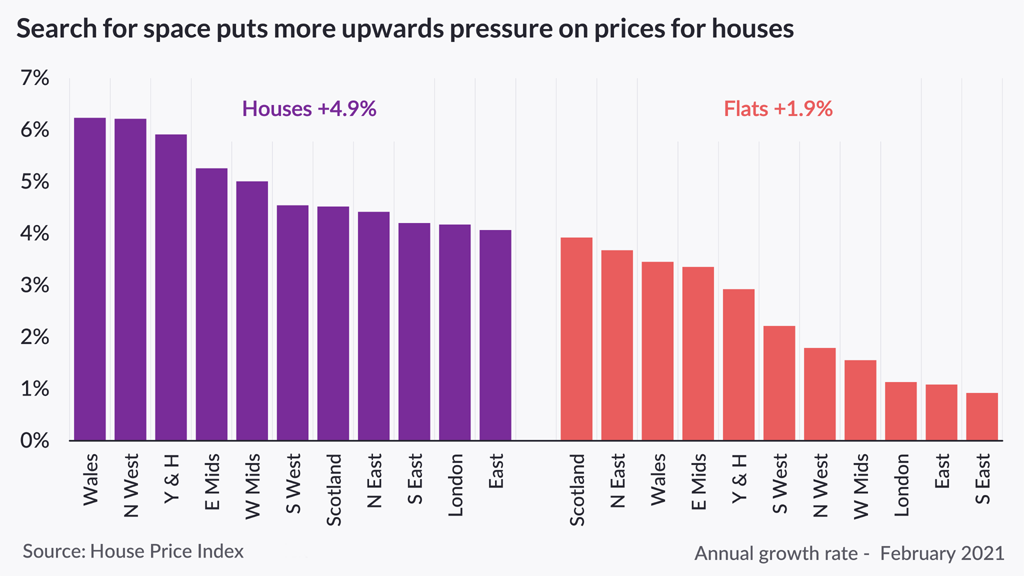

Unsurprisingly, the popularity of houses is pushing their prices higher, with values rising by an average of 4.9% in the past year, compared with an increase of 1.9% for flats.

But there are pockets of the country where flats are popular, with demand for one and two-bedroom flats in London and the south east rising after the Budget, likely reflecting increased interest from first-time buyers.

Where are the hot markets?

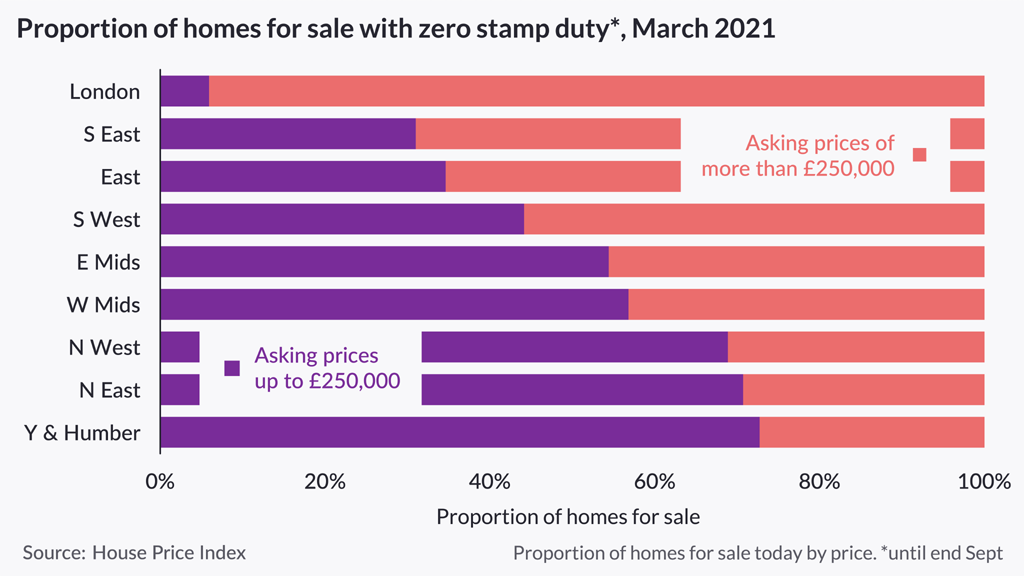

More than two-thirds of homes currently for sale in the north east, north west and Yorkshire and the Humber are listed for less than £250,000, meaning buyers in these regions have more opportunity than anywhere else in the country to secure the stamp duty holiday saving before 30 September.

High demand in these regions is driving strong house price growth. At a city level, Manchester and Liverpool posted annual gains of more than 6%, while prices have risen by more than 5% Leeds and Sheffield, with values in Nottingham and Leicester in the East Midlands on a similar trajectory.

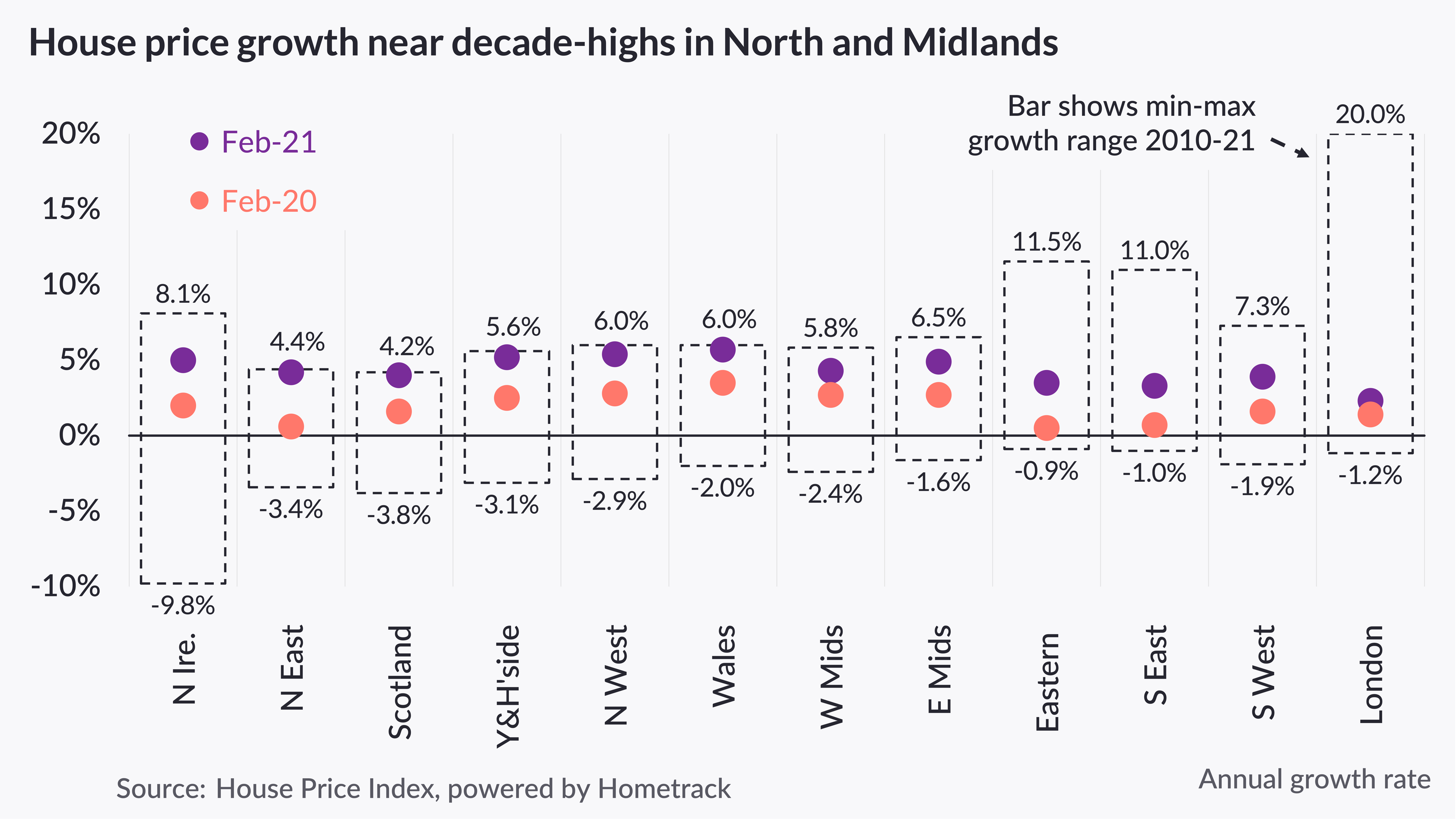

And house price growth in the Midlands, north of England, Wales and Scotland is at an almost 10-year high, fuelled by the relative affordability in these areas.

Why is this happening?

The current trends in the property market are being driven by a combination of factors.

Successive lockdowns have prompted many people to reevaluate their homes and lifestyles, leading to a search for space.

And the extension of the stamp duty holiday is driving demand for homes costing up to £500,000, as well as those in the £125,000 to £250,000 price bracket, which will benefit from being stamp duty-free until 30 September.

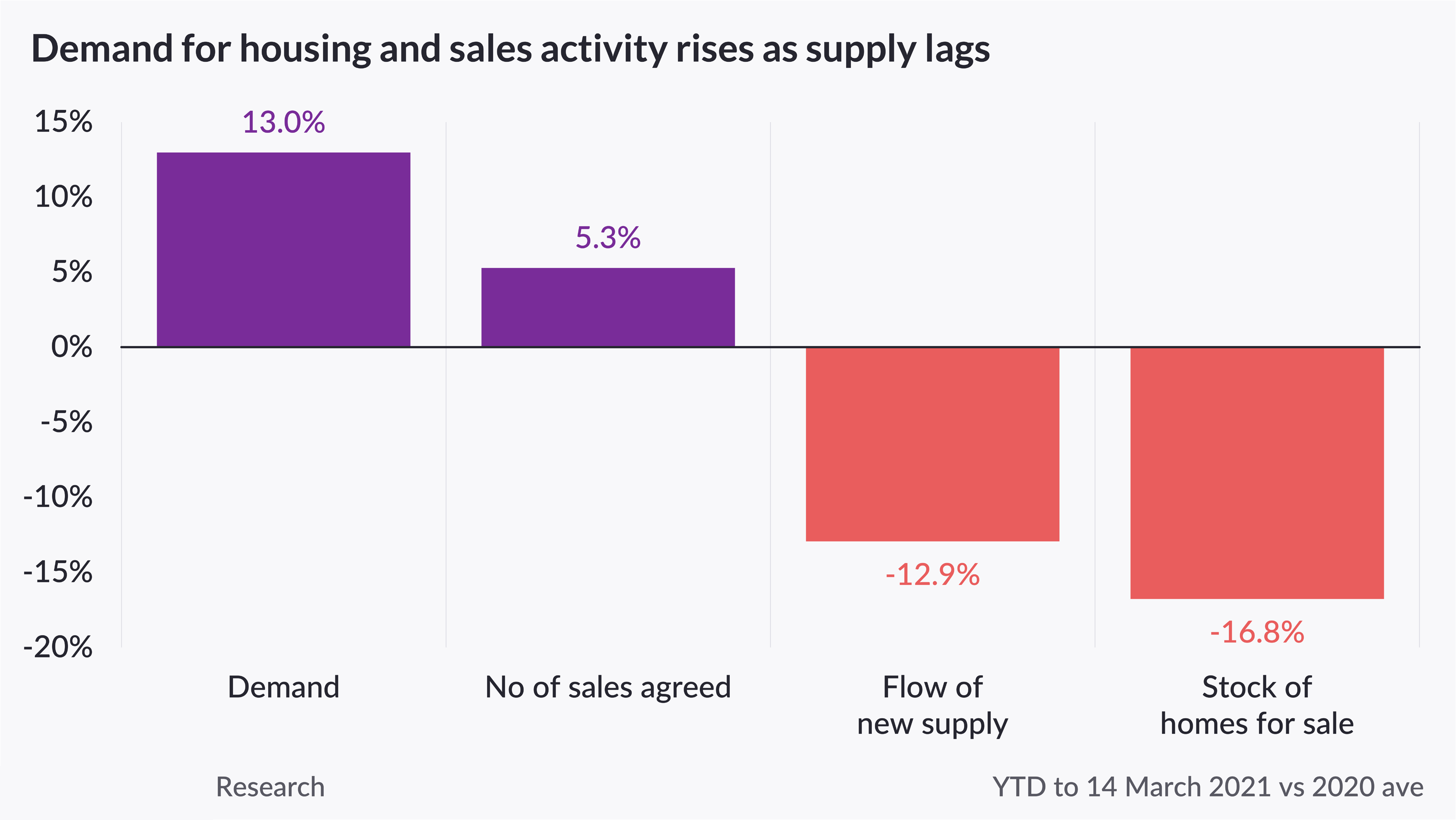

Meanwhile, a mismatch between the supply of homes for sale and buyer appetite is putting upward pressure on house prices. Average demand is 13% higher this year than last year, while the number of sellers has fallen by 13%, likely as a result of people being unwilling to open up their homes for viewings during lockdown.

Finally, more first-time buyers are expected to enter the market from 1 April once the government’s new 95% mortgage guarantee scheme is launched.

News of the scheme is thought to be behind the recent increase in interest in flats in London and the south east.

What’s the outlook?

The housing market in general is expected to remain busy as lockdown measures are eased. But despite the stamp duty holiday extension boosting housing sales, house price growth is expected to moderate later in the year as government support measures are withdrawn.

Head of research, explained: “The search for space is driving continued demand for family homes, which means prices for houses are rising faster than flats, and houses are also selling more quickly.

“The prospects for the housing market over the next year have improved on the back of Budget. The continued search for space, the stamp duty extension and mortgage guarantees will support activity levels and headline house price growth up to the end of June.

“Yet the pathway out of the lockdown, and the route to a full re-opening of the economy and unwinding of support measures, is unlikely to be simple or smooth.

“We still expect house price growth to moderate later in the year, but overall transactions are set to benefit from an additional boost following the stamp duty extension and tapering.”

Top three takeaways

- Houses are selling three weeks faster than flats as the lockdown-led search for space continues

- The north east and Yorkshire and the Humber are the fastest-moving markets in the UK, with sales agreed in an average of just 38 days in both regions

- Family homes are the most coveted type of property across the UK, with demand for three-bedroom homes jumping by 30% following the Budget

The 20 locations where homes sell the fastest

With the stamp duty holiday extension galvanising the housing market in England and Wales, our research reveals where homes sell like hot cakes.

Wigan has been crowned the fastest-moving property market in England and Wales, with homes listed for sale in the town taking an average of just 26 days to sell.

The most popular property type in the town is a three-bedroom semi-detached house, while the price band that is selling the quickest is £100,00 to £150,000.

Redditch in the West Midlands, Knowsley and Salford in the north west, Sheffield, and Medway in the south east, all tied for second place, with homes spending an average of 27 days on the market before being sold subject to contract.

The top 20 hottest housing markets were dominated by northern regions, with the Isle of Wight and Bristol joining Medway to be the only locations in the south to make it on to the list, according to our research.

What does this mean for you?

The fastest-moving price band in all of the 20 markets, apart from Bristol, is £250,000 or less. This means both buyers and sellers in these areas will be well placed to complete their purchase – in other words, legally transfer ownership –before the end of the stamp duty holiday and make a saving.

What’s driving sales?

The pandemic and its subsequent lockdowns have led many people to carry out a once-in-a-lifetime reevaluation of their home and lifestyle, stimulating home moves and driving a search for space.

And the stamp duty holiday means that many first-time buyers and homeowners looking to move are keen to buy a new home in time to benefit from the tax break.

The fastest-moving markets fall into three main groups: coastal areas, traditionally fast-moving markets within cities, and demand-driven regional markets.

Coastal areas

Reflecting increased appetite for homes on the coast, several seaside locations feature in the top 20. Medway in Kent is the fastest-moving coastal market in England and Wales, with homes taking an average of 27 days to go under offer.

And properties on the Isle of Wight are taking 32 days to sell – 29 days faster than the same time last year – while the most popular property type is a three-bedroom semi detached house.

The coastal areas of Neath Port Talbot and Bridgend in Wales also made the cut. Three-bedroom semi-detached houses are the most popular property type, while the time to sell is 31 and 32 days respectively.

Traditionally fast-moving markets within cities

Traditionally fast-moving urban markets, such as Liverpool, Sheffield, Leeds, Bristol and Manchester, continue to enjoy quick sales, with times averaging less than 34 days.

High levels of demand in these locations have been met with constrained supply of homes for sale during the past three months, leading to increased competition among buyers.

Demand-driven regional markets

Meanwhile, demand has also grown in areas adjacent to these fast city markets, as successive lockdowns have caused buyers to shift their focus to less urban areas.

Wigan, Knowsley and Salford around Liverpool and Manchester, Redditch near Birmingham, and Barnsley and Rotherham close to Sheffield have all benefited from this trend.

Head of research at said: “We have observed the time taken to sell a home changing in many areas during Covid-19 pandemic.

“While the number of days it takes between listing a property to agreeing a sale in one of the traditionally fastest-moving moving markets such as Manchester, Liverpool or Sheffield has stayed the same, sellers in some adjacent areas may now see their properties selling just as quickly.

“Buyers will have to move fast but the speed at which this stage of the buying process is moving also means that those looking to take advantage of the stamp duty holiday extension will be giving themselves the best chance of doing so.”

Which areas have seen the time to sell reduce the most?

South Tyneside in the north east has seen the largest improvement in the time it takes to sell a home during the past year, with the average number of days between a property being listed for sale and an offer accepted dropping from 74 days in February last year to just 41 days now.

The Isle of Wight came in second place, with the time taken to sell a home falling by 29 days, followed by Swale in Kent, which has seen a 28-day reduction.

The historical city of Canterbury, Tonbridge and Malling, and Medway, also all made it into the top 10 ranking of areas that have seen the largest improvement in the time it takes to sell a home, showing that there's been a dramatic change in parts of the south east of England.

All of the locations in the ranking have recorded a drop of more than three weeks, largely due to the surge in buyer demand seem during the past year.

What are the fastest-moving housing markets in London?

Waltham Forest in north east London is the fastest-moving market in the capital, with homes taking 35 days from being listed to sold subject to contract. That’s 30 days quicker than the London average.

In line with London house prices, the fastest-moving price band in this corner of the city is £400,000 to £450,000, noticeably higher than other parts of the country, while the most popular property type is a two-bedroom terraced house.

The outer London authorities of Barking and Dagenham and Bexley took second place at 39 days and third place at 41 days respectively, reflecting an appetite for affordable property and more space.

Two-bedroom terraced houses were the fastest-moving property type in the capital, along with homes in the £300,000 to £350,000 price band.

What’s happening across the different regions?

Wigan is not only the fastest-moving property market in England and Wales, but also for the north west, with Gateshead taking the title for the north east and Sheffield for Yorkshire and the Humber.

Three-bedroom semi-detached homes were the most popular property type in all of these markets.

Mansfield took the top spot in the East Midlands, with homes taking an average of 10 days less to sell than across the region as a whole, while in Redditch in the West Midlands, sales are agreed 17 days faster than the regional average.

Neath Port Talbot is the fastest-moving market in Wales.

Medway in the south east is the hottest market in a southern region, with homes taking an average of 28 days to sell, while Bristol is the fastest market in the south west.

Rochford in Essex is the fastest-market in the east, but with homes taking an average of 38 days to sell, it is slower than the hottest markets in other regions.

What are the fastest-selling property types?

Overall, three-bedroom semi-detached houses remain the fastest-selling property type, while properties with asking prices of between £150,000 and £200,000 are being snapped up quickest.

Meanwhile, houses are selling an average of three weeks quicker than flats, as home movers continue to search for more space.

Our analysis looks at the average number of days between a property being listed for sale on Zoopla to offer accepted (marked as sold subject to contract), with days on the market rounded to the nearest whole number.

Data referring to the fastest-moving markets are ranked on the median number of days until an offer is achieved, while the markets with largest improvement to time to sell is ranked on the reduction in the number of days from listing from offer (in days).

The fastest-selling properties and fastest-moving price bands have been calculated separately.

Scotland is excluded from this analysis as the stamp duty holiday does not apply.

Top three takeaways

- Wigan is the fastest-moving property market in England and Wales, with homes listed in the town taking an average of just 26 days to sell

- The top 20 hottest housing markets were dominated by northern regions, with the Isle of Wight and Bristol joining Medway to be the only locations in the south to make it onto the list

- Three-bedroom semi-detached homes remain the fastest-moving property type, while properties in the £150,000 to £200,000 price bracket are being snapped up quickest

Tax loophole on second homes set to be closed

The Government is looking to clampdown on people who claim ‘holiday let’ tax breaks on their second home.

People with second homes will soon no longer be able to claim tax breaks on the properties by stating they are holiday lets.

Under current rules, owners who declare they rent out second properties as holiday lets are charged business rates on the homes, rather than council tax.

Many of the properties qualify for Small Business Rate Relief, meaning if the property has a rateable value of £12,000 or less, they do not have to pay any tax at all, representing a significant saving compared with the council tax bill they would have faced.

But the Treasury is concerned that many people may be stating they let out their second home in order to claim the tax break, while making little effort to actually do so.

As a result, it plans to tighten the rules, forcing people who claim to be operating a holiday let to prove the property is actually let out for at least 140 days each year.

The move was included in the Government’s Tax policies and consultations publication.

Who does it affect?

Government figures show there are 60,000 self-catering premises in England that are registered for business rates, 96% of which have a rateable value that means they are likely to qualify for Small Business Rates relief. It is not clear how many of these are second homes and how many are genuine holiday lets.

Second-home owners who have been claiming business rates will now face the choice of either opting to pay council tax on their property instead, or ensuring it is let out for at least 140 days a year to continue benefiting from the tax break.

What other property-related taxes were in the publication?

While the change to the tax treatment of holiday lets was the most eye-catching change in the tax policy document, there were a number of other changes relating to property.

A new residential property developer tax

The Government announced plans to launch a consultation on introducing a new tax on the largest residential property developers in 2022.

The money raised will be used to cover the cost of replacing unsafe cladding for leaseholders in residential buildings that are more than 18 metres (the equivalent of six storeys) high.

Further details on how developers will be taxed have not yet been released, but the Government has previously said it plans to raise £2 billion over the coming decade through the levy.

Simplified inheritance tax reporting

Plans to simplify inheritance tax reporting requirements were also announced by the Government, which is good news for property owners, as their family home is most people’s most valuable asset.

Under the move, more than 90% of estates that are not liable for the tax will no longer have to complete inheritance tax forms when probate is required from January next year.

It is estimated the change will reduce red tape for more than 200,000 estates every year.

Land and property VAT simplification

The Government is looking for ways to make rules on land and property VAT exemptions clearer.

Transactions involving certain types of land and property, such as the sale of a freehold, are liable for VAT.

Certain transactions are exempt, for example if a landowner converts a commercial building into a residential one. But the current rules are complex.

The Government plans to publish a call for evidence on the issue of simplifying exemptions shortly.

Financial Secretary to the Treasury Jesse Norman said: "We are making these announcements in order to increase the transparency, discipline and accessibility of tax policymaking.

"These measures will help us to upgrade and digitise the UK tax system, tackle tax avoidance and fraud, among other things.

"By grouping them together, we want to give Members of Parliament, tax professionals and other stakeholders a better opportunity to scrutinise them."

Q&A: 'The strength of the housing market later in the year depends on the transition from an economy in lockdown towards normality'

Head of research, explores the latest housing trends – and looks at what's in store for home movers in the months ahead.

Q. First things first, what’s happening to house prices? What are the hottest markets?

A. House prices edged up by 0.3% in January. It means that annual house price growth now stands at 4.3%, the highest rate since April 2017.

The hottest markets in terms of house price growth are Wales and the north of England. At a country and regional level, annual house price growth ranges from 5.6% in Wales and 5.5% in the north west of England, through to 2.8% in London.

Breaking it down to a city level, Manchester and Liverpool continue to lead the way with the strongest house price rises, with annual growth at 6.3% and 6.8% respectively.

Q. What’s the level of demand like from people wanting to buy a home at the moment?

A. It’s been a really strong start to the year. A lot of buyers have been motivated by the stamp duty holiday, with savings of up to £15,000 on offer. There’s also a cohort of buyers who, driven by the experience of successive lockdowns and restrictions, are searching for homes with more space.

As a result, the level of interest from buyers looking for a new home is up 12.4% on last year.

And this buyer demand is translating into transactions, with the number of housing sales agreed also up 10.1% year-on-year.

.png)

Q. And how has the current lockdown impacted sellers?

A. Although the housing market remains open for business, the current lockdown has stifled the supply of homes for sale. The number of homes on the market in the first six weeks of 2021 is down 13.8% year-on-year. And the level of homes being listed for sale is also 14.5% down compared with the same period last year.

Our data also points to increasing interest from first-time buyers, who have no property to sell when they move.

This mismatch between the level of interest from buyers and the supply of homes for sale is apparent in most regions across the country. In the north east, buyer demand is running more than 40% higher than the same period last year – yet the level of new supply has shrunk.

The one exception to this trend is London. It’s important to note that while buyer demand is down 17% year-on-year, it’s still well ahead of the average based on previous years.

Q. How are these trends impacting different people in the housing market?

A. Our data suggests that first-time buyers are returning to the housing market. The level of interest from people looking to step onto the housing ladder was up 5% in the first six weeks of this year compared with the last three months of 2020.

We’ve also seen a 18% increase in the number of sales agreed on homes worth between £100,000 and £250,000, a price band typically associated with first-time buyers, in the first seven weeks of this year.

We expect this trend to continue beyond the newly-extended stamp duty holiday as most first-time buyers are not affected by the tax break.

This comes as the availability of mortgages for buyers with a 5% or 10% deposit gradually picks up. While mortgage lending to buyers with small deposits have not returned to the levels seen in early 2020, it is on an upward trajectory.

Existing homeowners continue to be motivated by a once-in-a-lifetime reassessment of their homes and lifestyles after successive lockdowns.

However, some have been reluctant to list their homes for sale, possibly deterred by social distancing measures. We expect homeowners to press the green light on marketing their homes as lockdown eases and further progress is made on the vaccine roll-out.

Our research also points to a growing number of previously rented properties being listed for sale. This is particularly noticeable in London, where 13% of homes marketed in the last three months of 2020 were previously rented.

There’s several possible reasons for landlords reassessing their portfolios. Firstly, landlords may be looking to crystallise capital gains amid speculation that capital gains tax changes could be on the way.

Secondly, they may also be eager to take advantage of momentum in the housing market, with house prices close to a four-year high.

And thirdly, they may be reacting to the changing dynamics of the rental market, with negative pressure on some city centre rents.

It’s an interesting trend, but it’s worth noting that the rented homes being put up for sale account for less than 1% of private rented sector stock.

Q. The Chancellor made some important announcements in the Budget. How will they affect the housing market over the coming weeks and months?

- The Chancellor’s announcements at the Budget, which included the extension of the stamp duty holiday and the launch of a 95% mortgage guarantee scheme, has already prompted a spike in interest from people looking to buy a home.

This demand jumped 23% in the days immediately following the Budget. To put the figure into context, that’s 47% higher than this time last year.

We expect the housing announcements unveiled by the Chancellor to fuel buyer demand for the next three to four months.

Meanwhile, the flow of homes being listed for sale is gradually improving as lockdown restrictions begin to ease. However, the number of homes being actively marketed remains almost 25% down on last year.

The Budget announcements mean that there will be less of a drop-off in housing sales than we had initially thought for the months ahead, with the tapering of the stamp duty holiday preventing a ‘cliff edge’. However, we do expect housing market activity in general to slow down through the summer.

The strength of the housing market later in the year depends on the transition from an economy in lockdown towards normality. Current trends suggest that house prices will continue to rise and there’ll be a modest uplift in the number of homes that are sold in 2021.

Q. What impact will the stamp duty extension have on people looking to move home?

- The stamp duty holiday extension is great news for all buyers who agreed a sale over the last two months with little or no expectation of completing their purchase in time to secure the stamp duty savings.

Tens of thousands of buyers who are currently in the process of agreeing a sale may save up to £15,000. We estimate that a further 280,000 buyers will benefit from savings of up to £2,500 as a result of the tapered extension, as long as they complete their purchase by the end of September.

Our research shows how the savings vary across the country. Buyers in London are set to save £8,000 in stamp duty, the highest figure in England. Some 22,000 buyers who have already agreed a sale in the city are set to benefit from £174m in savings in total.

Meanwhile, 46,000 buyers who have already agreed a sale in the south east of England will collectively save £271m, more than anywhere else in the country. The average buyer in the region will save nearly £6,000.

Thank you.

Buyer demand soars as stamp duty holiday is extended

But the supply of homes for sale remains tight, pushing prices higher.

Buyer demand spiked by 24% in the week following the Budget as people scrambled to take advantage of the stamp duty holiday extension.

Overall demand was also 80% higher in that same week compared to the same time period over the previous four years, due to a combination of the tax break and the ‘search for space’ triggered by the Covid-19 pandemic.

But the supply of new homes coming on to the market remains constrained, putting further upward pressure on prices, according to our latest House Price Index.

These factors contributed to annual house price inflation of 4.1% in February, more than double the rate of 1.8% recorded in the same month of 2020.

How busy is the housing market?

The Budget announcement that the stamp duty holiday on homes costing up to £500,000 will be extended until 30 June, with a tax-free threshold of £250,000 in place for a further three months, has triggered a fresh wave of interest among potential buyers.

The number of sales agreed is 5.3% higher than it was a year ago, while the average time it takes to sell a property, excluding London, has fallen by nearly a week to just 44 days.

But while buyer demand is 80% higher than the long-run average, the supply of homes being put on the market has actually fallen by 13%, compared with the same period of 2020.

That said, the volume of homes for sale is expected to start to recover as the Covid-19 vaccine programme continues to gather pace and lockdown restrictions are lifted.

What’s happening to house prices?

Unsurprisingly, the mismatch between supply and demand is continuing to drive house prices higher.

The typical value of a home is now 4.1% higher than at the start of the first national lockdown in 2020, with prices rising by an average of £8,907 during the past year or £750 a month.

February marked the fourth consecutive month during which house price growth was above 4%, matching levels last seen in the summer of 2017.

Wales has seen the strongest gains during the past year at 5.7%, followed by the North West at 5.4% and Yorkshire and Humber at 5.2%.

Meanwhile, house price growth in the Midlands, North of England, Wales and Scotland is at an almost 10-year high, fuelled by the relative affordability of these markets.

Growth is slowest in southern regions, where affordability has become increasingly stretched, with prices rising by only 2.3% in London, 3.3% in the South East and 3.5% in the East of England.

Northern cities also continued to outperform their southern counterparts.

Manchester led the way with year-on-year price increases of 6.6%, followed by Liverpool at 6.4% and Leeds at 5.4%.

At the other end of the scale, prices edged ahead by just over 2% in Cambridge, Oxford and Southampton, while Aberdeen, where the property market has been struggling for some time due to the low oil price, saw property values drop by 1.3%.

What could this mean for you?

The jump in demand, which is feeding through into faster selling times, is good news for anyone with a property to sell.

But sellers who are also looking to move up the property ladder are likely to find themselves facing increased competition for their next home.

This is likely to particularly be the case for people in northern regions, where the property market is hottest, and those looking for houses, rather than flats.

Our data also points to an increase in demand among first-time buyers following the Budget announcement about the new 95% mortgage guarantee scheme, which launches on 1 April.

The share of mortgages taken out by first-time buyers fell in 2020 as lenders withdrew loans for people with small deposits, so if you are planning to take your first step on the property ladder this year, you can expect to face more competition for entry level properties.

What’s the outlook?

People’s reassessment of their homes in the light of the pandemic looks set to continue, as homeowners look for more space both inside and outside of their property.

As lockdowns start to ease, more homes should come on to the market, as sellers feel more comfortable about inviting potential buyers into their home, further driving market activity.

Head of research said: “The prospects for the housing market over the next year have improved on the back of the Budget. The continued search for space, the stamp duty extension and mortgage guarantees will support activity levels and headline house price growth up to the end of Q2 2021.

“Yet the pathway out of the lockdown, and the route to a full re-opening of the economy and unwinding of support measures, is unlikely to be simple or smooth.

“We still expect house price growth to moderate later in the year, but overall transactions are set to benefit from an additional boost following the stamp duty extension and tapering.”

Top three takeaways

-

Buyer demand spiked by 24% in the week following the Budget as people scrambled to take advantage of the stamp duty holiday extension

-

But the supply of new homes being put up for sale remains constrained putting further upward pressure on prices

-

At a national level, house price growth stood at 4.1% in February, more than double the rate of 1.8% recorded in the same month of 2020

Eviction ban extended again in England

With the country still in lockdown, the government has extended the ban on evicting tenants from their homes until the end of May.

A ban on landlords evicting their tenants has been extended until 31 May for people living in England.

Under the ban, bailiff-enforced evictions will not be allowed except in the most serious circumstances, such as cases of fraud or domestic abuse.

The requirement for landlords to give their tenants a six-month notice period before they can evict them has also been extended until the end of May.

The government said the extension would ensure tenants in both the private and social rental sectors could stay in their homes and have enough time to find alternative accommodation as the UK comes out of lockdown.

The eviction ban was first introduced last March as part of emergency legislation to help people whose finances had been impacted by the coronavirus pandemic. The ban has been extended several times, and the current one was due to expire on 31 March.

The government said it would consider the best approach to moving away from emergency protections at the beginning of June.

Who does it affect?

The move is good news for tenants who are struggling to pay their rent as a result of the pandemic and its associated lockdown measures.

Many workers from sectors that have been hit hardest by the pandemic rent their home, with 49% of hospitality workers and 36% of retail ones living in rental homes, according to government figures.

A free mediation service has also been set up to help landlords and tenants resolve disputes without having to go to court, in a bid to help more people stay in their homes.

Despite these measures, the ban on tenant evictions has been criticised as being less generous for tenants than the mortgage payment holiday is for homeowners.

The mortgage payment holiday enables homeowners to suspend payments for up to six months. While the eviction ban means tenants do not lose their home, it does not offer them any breathing space on their rent.

What should you do if you can’t pay your rent?

If you are struggling to pay your rent, it is important to contact your landlord as soon as possible.

Landlords with buy-to-let mortgages are included in the mortgage payment holiday scheme, on the understanding that they will pass on the benefit to tenants.

But people who have not yet applied for a payment holiday must do so soon as the scheme ends on 31 July.

It is worth checking to see if you are eligible for any government benefits, such as the universal credit, if your income has fallen.

You may also be able to get a Discretionary Housing Payment from your local authority, after the government made £180m available to councils to support renters with housing costs.

If you can still afford to pay some of your rent, it is worth asking your landlord if they would accept a reduced payment for a set period of time, particularly if you think you will be able to make up the shortfall once lockdown is lifted.

What are your rights as a tenant?

It is illegal for your landlord to evict you without giving you written notice or obtaining a court order.

If you are in an assured shorthold tenancy, the most common type of tenancy, they can start the eviction procedure through giving you either a section 21 or section 8 notice.

Your landlord does not need to give a reason to evict you under a section 21 notice, but they must give you a warning period. This period was previously two months, but it has been extended to six months because of the pandemic.

If you do not leave the property at the end of this period, your landlord must go to court to evict you legally.

You cannot be issued with a section 21 notice during the first four months of your original contract.

Landlords can only issue a section 8 notice if they have legal grounds to end your tenancy, for example if you are in rent arrears. They must apply to a court for a possession order to evict you.

Prior to the eviction ban, the notice period varied, depending on the grounds for possession.

Landlords are not allowed to harass you or lock you out of your home, even temporarily, while they are waiting to evict you.

Read our guide for more on your rights as a tenant.

What measures are in place in Wales, Scotland and Northern Ireland?

Wales

Landlords in Wales currently have to give their tenants six months’ notice if they are going to evict them, up from a normal notice period of two months.

Scotland

Scotland has also passed an emergency law due to coronavirus under which tenants must be given six months’ notice, except under certain circumstances, such as cases of criminal or anti-social behaviour or if the landlord or their family need to move into the property.

Northern Ireland

In Northern Ireland, landlords must give tenants 12 weeks’ notice, up from 28 days’ notice under normal circumstances, before applying for a court order to have them evicted.

Explore a wide range of properties for rent . Take our Advanced Search tool - it allows you to search for homes with specific features, such as 'garden'.

Top three takeaways

- A ban on landlords evicting their tenants has been extended until 31 May for people living in England

- Under the ban, bailiff-enforced evictions will not be allowed except in the most serious circumstances

- The requirement for landlords to give their tenants a six-month notice period before they can evict them has also been extended until the end of May

Why are some landlords selling up?

Latest House Price Index explores why the proportion of previously rented properties being listed for sale is starting to rise.

A number of landlords are exiting the private rental sector in response to changing market dynamics.

The proportion of homes for sale that were previously rented has been on a steady upward trajectory in all regions of England and Wales during the past year.

The trend has been most pronounced in London, where 13% of homes being marketed for sale in the last three months of 2020 were previously rented, while it is also strong in the south east.

Why is this happening?

On the one hand, landlords may simply be selling properties to crystallise gains following recent strong house price growth.

At the same time, some may have been prompted to sell up following speculation that capital gains tax rates were set to be increased in the Budget, although when the Chancellor delivered his statement he only announced that the threshold at which the tax kicks in would be frozen until April 2026.

Landlords’ decision could also be in response to changes to demand in the rental sector as a result of the pandemic, with renters favouring the suburbs and more rural locations.

Finally, buy-to-let investors have been hit by a raft of tax and regulatory changes in recent years, which may have acted as a catalyst for many to sell their less profitable properties.

Gráinne Gilmore, head of research, said: "One area of the market where there is more supply coming is among landlords who are bringing their investment properties forward for sale.

"The share of homes listed for sale which were previously rented has risen in nearly every region during 2020, as landlords reassess their portfolios in light of current rental trends, or ahead of possible tax changes for investment property.

"While the homes for sale account for a very small proportion (less than 1%) of rented stock, it is a noticeable trend emerging in the market."

What’s the background?

The pandemic, with its associated lockdowns and shift to working from home, has driven a significant change in demand in the rental market.

There has been a fall in tenants looking for homes to rent in cities, leading to a slight softening in rents in these locations, with London particularly impacted.

By contrast, demand for homes to rent has risen in commuter zones and well-connected towns, pushing rents higher.

Tenants are also looking for more space, and while overall demand has risen by 21% during the past year, houses are letting 30% quicker than they were 12 months ago.

Top three takeaways

- A number of landlords are exiting the private rental sector in response to changing market dynamics

- The proportion of homes for sale that were previously rented has been on a steady upward trajectory in all regions of England and Wales during the past year

- The trend has been most pronounced in London, where 13% of homes being marketed for sale in the past three months of 2020 were previously rented