1.8m homes pushed into higher stamp duty bands

Some buyers are set to fork out thousands of pounds more in stamp duty once the tax break draws to a complete close at the end of September. Could you be one of them?

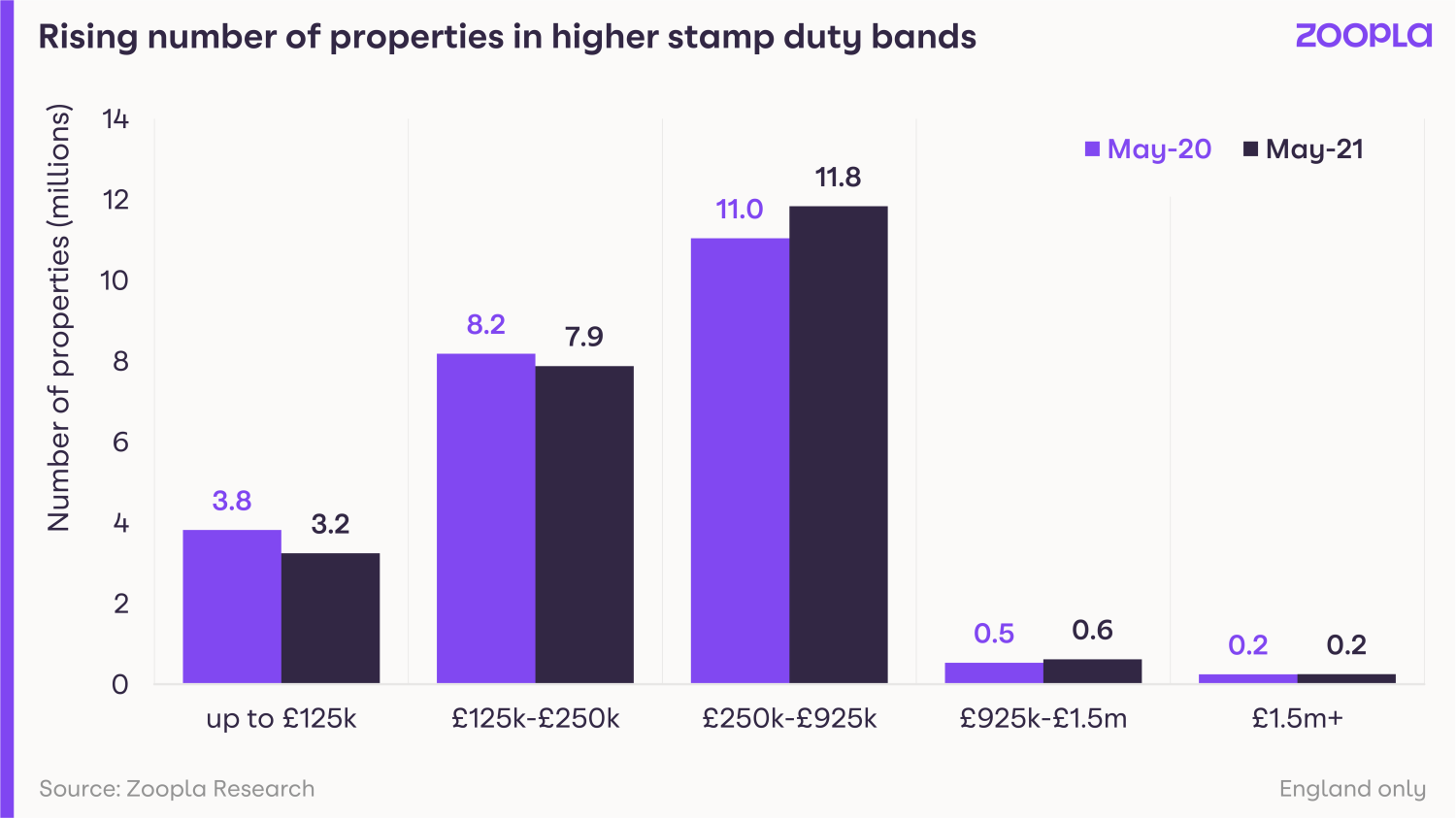

Soaring house price growth has pushed more than 1.8m homes in England into higher stamp duty bands.

House prices have jumped by more than £10,000 during the past year as the scramble for homes continues.

And this house price growth is having a knock-on effect on stamp duty bills because the tax is based on a property’s price. It is charged on a tiered basis so buyers only pay the higher rates on the slice above any threshold – the same as income tax.

An estimated 940,000 properties have moved into the 5% stamp duty band, while 130,000 have moved into the 10% one.

At the same time, the number of homes in the lower stamp duty bands is falling.

Find out more about how stamp duty works further down this article.

What could this mean for you?

Put simply, some buyers face a bigger stamp duty bill.

Buyers purchasing a home that has moved into the 5% band face an additional cost of £725 on average once the tapered stamp duty holiday ends on 30 September.

Meanwhile those buying a property that has moved into the 10% band could expect to pay £6,100 more.

The situation should have less impact on first-time buyers, as they do not pay the tax on the first £300,000 of a property purchase, as long as the home they are buying does not cost more than £500,000.

But the strong house price rises seen during the past year could still make it harder for first-time buyers to get onto the property ladder, as affordability may be more stretched, and they will need a bigger deposit.

Why is this happening?

The housing market has been booming during the past year due to a combination of the stamp duty holiday and successive lockdowns causing people to re-evaluate the type of home they want to live in.

Our latest House Price Index shows that annual house price growth was running at 4.7% in May, more than double the rate of 2.2% seen in the same month last year.

The strong price growth has added £10,246 to the value of the typical home, enough to push many properties into a higher stamp duty band.

The lowdown on stamp duty

Buyers pay stamp duty when purchasing a property in England or Northern Ireland.

Last year, the Chancellor introduced a stamp duty holiday on properties costing up to £500,000. Although this has now ended, the threshold at which the tax kicks in will remain at £250,001 until 30 September 2021.

After this date, no stamp duty will be charged on the first £125,000 of a purchase, with the tax charged at:

- 2% on the portion from £125,001 to £250,000

- 5% on the portion from £250,001 to £925,000

- 10% on the portion from £925,000 to £1.5m

- 12% on the portion above £1.5m

It's worth remembering that stamp duty rates in England and Northern Ireland are different for first-time buyers and people buying additional property.

Top three takeaways

- Strong house price growth has pushed more than 1.8m homes in England into a higher stamp duty bracket during the past year

- Buyers purchasing a home that has moved into the 5% band face an additional cost of £725 on average once the tapered stamp duty holiday ends on 30 September.

- Meanwhile those buying a property that has moved into the 10% band could expect to pay £6,100 more.

Stamp duty holiday extension: everything you need to know

You can still save up to £2,500 in stamp duty if you buy a home before the end of September. Our guide has all the details.

The full stamp duty holiday has now drawn to a close but there’s still a tax break available on the first £250,000 of a property purchase until the end of September.

Chancellor Rishi Sunak extended the stamp duty holiday earlier this year. It meant that buyers in England and Northern Ireland would not have to pay stamp duty on the first £500,000 of property if they complete – in other words, legally transfer ownership – before 30 June 2021.

To avoid a ‘cliff edge’ at the end of this period, the threshold at which stamp duty kicks in then dropped from £500,001 to £250,001 until 30 September 2021.

Normal stamp duty rates will apply from 1 October 2021.

It’s worth remembering that there’s stamp duty relief available for first-time buyers beyond the current stamp duty holiday.

So is there still time to take advantage of the stamp duty holiday?

Yes, there’s still a window of opportunity to secure a stamp duty saving. But if you're looking to complete on your property purchase by the end of September, when the tax break is wound down completely, you'll need to have your ducks in a row well beforehand.

In a normal year, it would take on average three months from a sale being agreed to completion. But given the uptick in activity over the past year, the average time it takes for a sale to cross the line is now four months.

There's a number of ways to boost your chances of buying in time, from staying in close contact with your conveyancer, to buying a property via an auctioneer.

As the full stamp duty holiday on the first £500,000 of a property’s purchase price drew to a close at the end of June, We calculated that over 50,000 buyers in England could have been at risk of missing out on the maximum savings due to extreme pressure on and delays to the transaction pipeline.

Head of research, explained: "The busy market is being driven by a once-in-a-generation re-assessment of home as a result of the pandemic.

"This has led hundreds of thousands of households to reflect on how and where they want to live – and they are making a move as a result, with family houses most in demand.

"This trend has been certainly boosted by the stamp duty savings on offer due to the stamp duty holiday, but levels of sales activity in recent months have remained high, with many of these buyers now only expecting the lower, tapered, stamp duty exemption of up to £2,500 because of the longer timeframe to complete a sale."

The Chancellor originally announced the stamp duty holiday in July 2020 to help kickstart the housing market in England and Northern Ireland following the first national lockdown.

The tax break, combined with many people carrying out a ‘once-in-a-lifetime’ re-assessment of their housing needs in the face of the pandemic, triggered a mini home buying boom.

But the steep spike in housing transactions led to a congested sales pipeline and the home buying process taking longer than usual.

We estimated that around 70,000 people who agreed sales in 2020 were in danger of missing the 31 March deadline.

And a petition calling for the stamp duty holiday to be extended received more than 100,000 signatures, triggering a debate to be held in Parliament in February.

What are the stamp duty rates from 1 October 2021?

The former stamp duty rules will apply from 1 October 2021. This means buyers can be charged between 2% and 12% tax (or up to 17% if they are a foreign investor) on their property purchase, depending on the value of the home they are buying and if they own more than one property.

Stamp duty is calculated as a percentage of the property you are buying. It applies to freehold and leasehold properties, whether you’re buying outright or with a mortgage.

For existing homeowners, the rates are:

- 0% up to £125,000

- 2% on £125,001 - £250,000

- 5% on £250,001 - £925,000

- 10% on £925,001 - £1.5m

- 12% on any value above £1.5m

For example, if you buy a flat for £275,000, the stamp duty you owe would be:

- 0% on the first £125,000 = £0

- 2% on the next £125,000 = £2,500

- 5% on the final £25,000 = £1,250

Total stamp duty = £3,750

Read our guide to find out more about stamp duty and how it's calculated.

Landlords and second-home owners

For owners of more than one property, a surcharge of 3% on top of the standard stamp duty rates apply.

However, if you sell a home within three years of purchasing a second property, you can apply for a refund of that 3%.

It is also possible under some circumstances to claim multiple dwellings relief.

Dig into the detail in our Q&A on the 3% surcharge.

Non-UK residents

There’s been an additional 2% stamp duty levy on non-UK residents who buy property in England and Northern Ireland since April 2021.

It means that international buyers of second homes could pay up to 17% tax on expensive properties.

The 2% is on top of standard rates and in addition to the 3% surcharge for any investors who own property elsewhere.

First-time buyers

First-time buyers are exempt from paying regular stamp duty on properties costing up to £300,000 and pay 5% on the value of a property between £300,000 and £500,000.

A first-time buyer will pay:

- 0% on the first £300,000

- 5% on the remainder up to £500,000

So a first-time buyer purchasing a £275,000 flat would pay no stamp duty.

For a house costing £475,000, a first-time buyer would pay:

- 0% on the first £300,000 = £0

- 5% on the final £175,000 = £8,750

Total stamp duty = £8,750

However, if the purchase price is more than £500,000, first-time buyers cannot claim the relief and must pay the standard rates.

For example, a property purchased at £700,000 would result in a stamp duty bill totalling £25,000 even for a first-time buyer.

Stamp duty relief was introduced in November 2017 to help people step onto the property ladder.

Our guide on the first-time buyer exemption has more detail.

When do you pay stamp duty?

You must pay stamp duty within 14 days of completing your property purchase. Your solicitor or conveyancer will usually file this return and transfer the money on your behalf.

What other government support is available?

The government has a number of schemes available to help buyers. They include:

- First Homes, which offers local first-time buyers and key workers a 30% to 50% discount on the purchase of their first home

- Mortgage guarantee, under which buyers can take out a 95% mortgage, with the government acting as guarantor

- Help to Buy, which offers an equity loan to buyers with a 5% deposit

- Shared Ownership, a part-buy, part-rent scheme.

It's also a good idea to check out the initiatives and allowances you could benefit from this tax year.

What about stamp duty in Scotland and Wales?

Housing is a devolved issue in Britain so stamp duty only applies in England and Northern Ireland.

Scotland and Wales have equivalent taxes. Similar breaks were introduced but have now ended.

Scotland

In April 2015, stamp duty was replaced by Land and Buildings Transaction Tax (LBTT).

In Scotland, the LBTT rates are:

- 0% up to £145,000

- 2% on £145,001-£250,000

- 5% on £250,001-£325,000

- 10% on £325,001-£750,000

- 12% on any value above £750,000

First-time buyers pay no LBTT up to £175,000.

Wales

Property owners in Wales have paid Land Transaction Tax (LTT) since April 2018.

LTT rates are:

- 0% up to £180,000

- 3.5% on £180,001-£250,000

- 5% on £250,001-£400,000

- 7.5% on £400,001-£750,000

- 10% on £750,001-£1.5m

- 12% on any value above £1.5m

The Welsh government introduced an additional charge for second-home owners.

Second home-owners now pay a 4% levy when they buy homes up to £180,000, rising to 16% for homes worth £1.6m or above.

Stamp duty holiday explainer

The full stamp duty holiday on the first £500,000 of a property’s purchase price may now be over but you could still benefit from the tax cut. Our guide explains how.

Stamp duty rates have now changed as the Chancellor’s tax holiday starts to be wound down.

The threshold at which stamp duty kicks in has dropped from £500,001 to £250,001 until 30 September 2021.

It will then fall back to its usual level of £125,001 on 1 October 2021.

Here’s our guide with more detail on what exactly the stamp duty holiday is – and how you could still benefit from it.

First of all, what is stamp duty?

Under normal circumstances, buyers must pay stamp duty when buying a home or a piece of land worth £125,001 or more in England and Northern Ireland.

It is charged on a tiered basis (so you only pay the higher rates on the slice above any threshold – the same as income tax).

These are the rates:

- Up to £125,000: 0%

- On the portion from £125,001 to £250,000: 2%

- On the portion from £250,001 to £925,000: 5%

- On the portion from £925,000 to £1.5m: 10%

- Above £1.5m: 12%

There are exemptions available for first-time buyers beyond the current stamp duty holiday. They don’t have to pay stamp duty on the first £300,000, so long as the home doesn’t cost more than £500,000.

Meanwhile, people buying additional property for £40,000 or more, such as second homes, pay an extra 3% of stamp duty on top of regular stamp duty rates. The surcharge effectively works as a slab tax. In other words, the 3% loading applies to the entire purchase price of the property.

There’s also been an additional 2% stamp duty levy on non-UK residents who buy property in England and Northern Ireland since April 2021.

Find out more in our guide on stamp duty and how to calculate it.

So how does the stamp duty holiday work?

The Chancellor, Rishi Sunak, unveiled a stamp duty holiday last July in a bid to boost the housing market after the first national lockdown.

He raised the threshold at which buyers start paying stamp duty with immediate effect, from £125,001 to £500,001, in England and Northern Ireland.

It meant that nearly nine out of 10 transactions were no longer subject to stamp duty, with the average bill falling by £4,500.

These are the full stamp duty holiday rates:

- Up to £500,000: 0%

- On the portion from £500,001 to £925,000: 5%

- On the portion from £925,001 to £1.5m: 10%

- Above £1.5m: 12%

And here's our handy interactive table revealing the savings on offer under the stamp duty holiday on the first £500,000 of property.

The stamp duty holiday was set to run until 31 March 2021. But in the Budget earlier this year, Sunak moved the deadline until the end of June 2021.

And to avoid a ‘cliff edge’ when this period ended, the threshold at which stamp duty kicks in then dropped from £500,001 to £250,001 until 30 September 2021.

The 3% stamp duty surcharge applies on top of the stamp duty holiday rates. This still results in a saving, because the 3% rate is normally applied on the first £125,000, with higher rates above that.

Similar ‘holidays’ were introduced last year in Scotland and Wales, where the property tax is different. But both have now ended.

The Scottish government increased the threshold of its Land and Buildings Transaction Tax (LBTT) from £145,000 to £250,000.

And the Welsh government raised the threshold of its Land Transaction Tax (LTT) from £180,000 also to £250,000.

Why was the stamp duty holiday extended?

The stamp duty holiday, combined with many people reassessing their homes and lifestyles during the pandemic, prompted a jump in housing transactions.

It led to a congested sales pipeline and the home buying process taking longer than usual.

As a result, around 70,000 people who agreed sales in 2020 were in danger of missing the 31 March deadline, according to our research.

And a petition calling for the stamp duty holiday to be extended received more than 100,000 signatures, triggering a debate to be held in Parliament in February.

Can you still take advantage of the stamp duty holiday?

Yes, there’s still scope to save up to £2,500 if you complete before the end of September, when the stamp duty holiday is wound down completely.

It’s worth noting that in a normal year, it would take on average three months from a sale being agreed to completion. But given the uptick in activity over the past year, the average time for a sale to cross the line is now four months.

The good news is that there’s a number of ways to boost your chances of meeting the final deadline, from staying in close contact with your conveyancer, to buying a property via an auctioneer.

Head of research explained: "The busy market is being driven by a once-in-a-generation re-assessment of home as a result of the pandemic.

"This has led hundreds of thousands of households to reflect on how and where they want to live – and they are making a move as a result, with family houses most in demand. "This trend has been certainly boosted by the stamp duty savings on offer due to the stamp duty holiday, but levels of sales activity in recent months have remained high, with many of these buyers now only expecting the lower, tapered, stamp duty exemption of up to £2,500 because of the longer timeframe to complete a sale."

Tell me a bit about the background of stamp duty

The government introduced historic reforms to stamp duty in 2014. It saw the method of calculating the tax change - as well as the rates (Scotland followed with changes in 2015).

This effectively cut the tax bill on homes worth up to £940,000 (which account for more than 95% of households) but cranked up the charges for more expensive properties.

In 2009, the most expensive stamp duty band was 4%. This is now 12%, rising to 17% for overseas buyers purchasing in England from April.

New-build home development hits 21-year high

The number of new homes being built in England hit a 21-year high in the first quarter of this year. And 81% of them are houses.

The new homes industry got off to a flying start this year as it continued to recover from Covid-19 disruption.

A total of 49,470 properties were completed between January and March, the highest level since figures were first collected in their current format in 2000.

Meanwhile, the number of houses in development accounted for 81% of all new builds, the highest proportion since 2000/01.

There was also a steep jump in the number of new-build starts, with the first phase of construction hitting a near-15 year high, according to the Ministry of Housing, Communities and Local Government.

Why is this happening?

The housebuilding industry was hit hard in the early stages of the pandemic, when construction sites were forced to close during lockdowns.

But the Government has since introduced a range of measures to enable building to continue, while also keeping workers safe, including allowing builders to negotiate flexible working hours on construction sites with their local council.

The measures have led to a steady increase in the number of new homes being completed, since a low point in the second quarter of last year.

Who does it affect?

The Covid-19 pandemic has seen people undertake a once-in-a-lifetime reassessment of their housing needs, as they search for more space following successive lockdowns.

The good news for potential buyers who want to purchase a new-build property is that 81% of homes completed during the first quarter were houses, rather than flats, the highest level since 2000/01.

In regional terms, the proportion of new homes being completed was highest in the South East, East Midlands and East of England, while new-build starts were highest in the South West and East of England.

The jump in new properties being built particularly benefits first-time buyers, who can use the Help to Buy scheme to purchase a new-build home with just a 5% deposit.

What’s the background?

It has previously been estimated that the UK needs between 240,000 and 340,000 new homes a year to keep pace with rising demand.

Only 155,960 new homes were completed in the year to the end of March, 11% fewer than in the previous 12 months, as Covid-19-related disruption continued to impact figures.

Before the pandemic struck, the number of new homes being built had been on a steady upward trend since 2014.

But building new homes is only one way in which properties are added to the available housing stock.

Residential properties are also created through the conversion of existing buildings, such as factories, offices and farm buildings into homes, or dividing large houses into flats.

In the year to the end of March, applications for Energy Performance Certificates on new dwellings totalled 220,730, suggesting the overall increase in homes in England was significantly higher than just the new-build figures suggest.

Top three takeaways

- The number of new homes being built in England hit a 21-year high during the first quarter as the industry continued to recover from Covid-19 disruption

- A total of 49,470 properties were completed during the three months to the end of March, the highest level since the figures began being collected in their current form in 2000

- Houses accounted for 81% of all new properties built, the highest proportion since 2000/01

House prices jump by £10,000 in a year

High demand from potential buyers and a shortage of homes for sale makes it the fastest-moving housing market for five years, our latest House Price Index report shows.

House prices have soared by more than £10,000 during the past year as the scramble for homes continues.

The increase, which is the largest rise in value recorded since October 2016, left the average home costing £229,300 in May, according to our latest monthly House Price I report.

This house price growth has pushed 1.8 million properties into a higher stamp duty bracket.

High demand from potential buyers has also led to the average time it takes to sell a home nearly halving to just 22 days, down from 42 days in May 2019. It makes it the fastest-moving housing market for five years.

But there are signs that the market is beginning to cool as the stamp duty holiday on homes costing up to £500,000 comes to an end.

What’s happening to house prices?

Annual house price growth was 4.7% in May – more than double the 2.2% it was running at in the same month of 2020.

House prices are rising fastest in the most affordable markets, with growth in Wales hitting a 10-year high of 7.1%, while property values rose by 6.8% in Northern Ireland and 6.2% in Yorkshire & the Humber.

Meanwhile, in London house prices rose by just 2.2% – the seventh month running during which the capital recorded the lowest gains in the UK.

In terms of individual cities, Liverpool and Manchester continued to record the highest price growth at 7.9% and 7.2% respectively.

Buyer demand is down 28% from its pandemic peak, moderated by the end of the full stamp duty holiday on the first £500,000 of property this month. But to put this into context, it remains 55% higher than in the more ‘normal’ market of 2019.

Demand is being driven by a combination of greater mortgage availability for first-time buyers, the stamp duty holiday (which draws to a complete close at the end of September) and a pandemic-led once-in-a-lifetime reassessment of housing needs, which has seen many people search for more space.

Demand is highest for homes costing up to £250,000, which are exempt from stamp duty until the end of September.

While the number of buyers looking for properties below £250,000 is down 24% from April’s highs in England, it remains 75% higher than the average recorded in the ‘normal’ market of 2019.

At the same time, demand for homes worth more than £250,000 has dipped by a third since April, but it remains up 86% compared to average levels in 2019.

Meanwhile, the number of homes for sale is 24% lower in the first half of this year compared to 2020.

One of the reasons for this is that first-time buyers are flocking to the housing market and buying a home without having one to sell - in other words, they are not replenishing stock levels. Aspiring homeowners are being spurred on in part by the first-time buyer stamp duty exemption that extends beyond the June deadline as well as having a wider range of mortgages to choose from.

What could this mean for you?

First-time buyers and home-movers

Activity levels remain high among first-time buyers and home-movers, and the supply of homes for sale is not keeping pace with demand.

As a result, you can expect to face stiff competition for those homes that are on the market, particularly if you are looking for somewhere costing up to £250,000.

You should try to get your ducks in a row, such as lining up a mortgage offer in principle or having a clear idea of exactly how much you can borrow, so that you can move quickly and put in an offer when you do see somewhere you like.

Sellers

With demand remaining strong and a shortage of homes for sale, now is a great time to list your property if you are thinking of selling, particularly if your home is worth less than £250,000.

Things are likely to be trickier if you are also looking to purchase a home as well, as while your current property is likely to sell quickly, it may take longer to find a home to buy, given the current shortage of listings. As a result, do your homework before you list your property.

Co-ordinating your sale and purchase could be tricky in the current market due to the mismatch between supply and demand, so it may be worth considering doing it in stages if you have somewhere you could stay in the interim.

What’s the outlook?

While the stamp duty holiday boosted activity, demand from potential buyers remains high despite the first phase of the holiday ending, suggesting the once-in-a-generation reassessment of housing needs still has further to run.

Meanwhile, although demand may ease as the economy continues to reopen, enabling people travel more widely and enjoy leisure activities that have previously not been allowed, many workers are likely to receive clarification on whether they are going to be expected back in the office full time.

Those who are not, may decide to go ahead with a move they had been putting off until they had received clarification on this issue.

Head of research said: “The total stock of homes for sale continues to run well below historical norms, and this will underpin pricing.

“At the same time, it may also constrain potential activity, especially for buyers looking for family houses. Even so, we forecast that this year will be one of the busiest for the housing market since the global financial crisis - with 1.5 million residential transactions.”

Garage conversions on the up: we reveal the most popular home improvements in the UK

If successive lockdowns have had you reassessing your home and lifestyle, you’re not alone. We look at the home improvements that are in hot demand.

Homeowners focused on increasing their space and improving their gardens during 2020 as successive lockdowns forced people to spend more time at home.

With the housing market closed for business in the early part of the year, many people looked to improve their existing space instead of trading up the property ladder.

Successive lockdowns also led to a significant desire among homeowners to have a better property, particularly as working from home looks likely to become the new normal for many.

Meanwhile, as people spent less money on holidays, entertainment and eating out, they had more spare cash to invest in their property, with the Bank of England estimating households collectively set aside £125bn of extra savings between March and November 2020.

The net result was a 25% jump in the number of planning applications for home improvements submitted in 2020, compared with the five-year average.

Which home improvements are on the up?

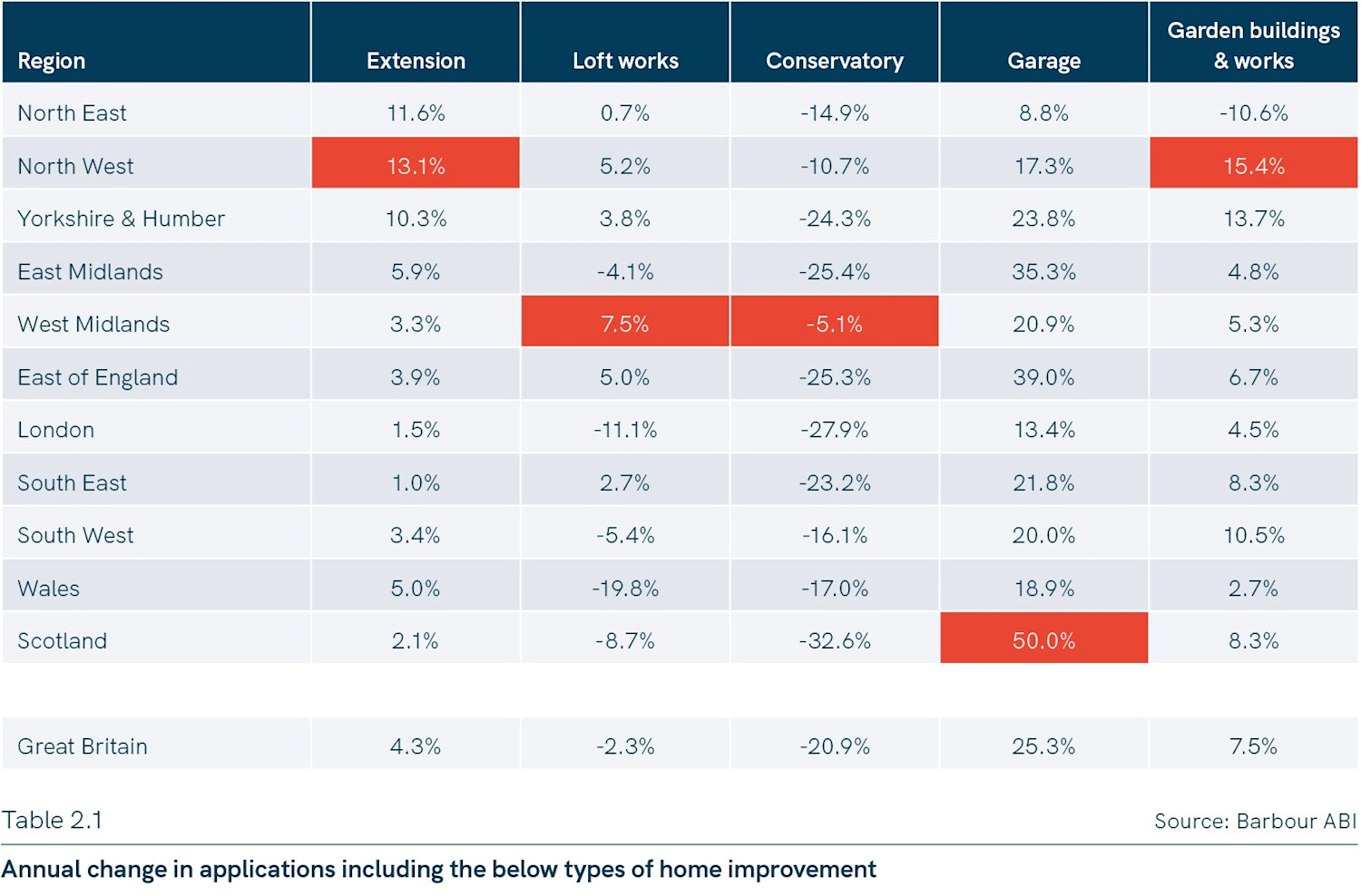

Planning applications to develop garages soared by 25.3% during the year, while there was a 7.5% rise in people seeking permission for garden buildings and works.

Meanwhile, planning applications for an extension were up 4.3%, according to research by Barbour ABI.

By contrast, planning applications submitted for conservatories dived by 20.9% year-on-year, while the number of people looking to do a loft conversion fell by 2.3%.

The group said the trends showed that people were not only looking for more space during 2020, but they were also keen to make the best use of the space they had.

Another notable trend was a significant increase in homeowners seeking to install solar panels towards the end of the year, which Barbour ABI attributed to people becoming more conscious of environmental issues during the pandemic, as well as an increased desire to be self-sufficient.

Why is this happening?

Successive lockdowns have led to people spending more time at home, with many people working from home for the first time.

As a result, homeowners have become very focused on making better use of the space they have.

Rather than seeing garages as a place for cars, people were instead viewing them as somewhere to store things to free up space in their home, a place to transform into a home office or even as an extension of their property, according to Barbour ABI.

Lockdowns have also prompted people to reconnect with their gardens, particularly due to the good weather during the first national lockdown.

What are the most popular home improvements?

House prices, population density and outside space all greatly influenced the type of home improvements that were undertaken in different regions of the country.

Extensions

Building an extension continued to be the most popular type of home improvement, accounting for 81.7% of all planning applications for homes across the UK.

They were most popular in northern regions, many of which saw double-digit increases in planning applications.

This trend is likely to have been driven by the strong house price growth the northern regions have seen in recent years, making building an extension more attractive financially than moving home.

Garages

Extensions were followed by garages in the popularity stakes, as people looked to build or convert a garage as a way of expanding their home.

The steep increase in planning applications for garages reversed the previous declining trend. It is likely that in many cases, garages were doubling as a home office or workspace.

While applications for garages rose most in Scotland, big increases were also recorded in the East of England and East Midlands.

Loft conversions

Loft conversions were most popular in London and the south east, where they accounted for nearly one in five of all improvement applications.

The group said this is likely to reflect the shortage of garden space homeowners in London may have in which to build an extension, with loft conversions tending to be popular in areas where garden space is at a premium.

At the same time, the higher cost of having a loft conversion done compared with an extension meant house prices needed to be correspondingly higher to justify the work.

Conservatories and garden buildings

Conservatories and garden buildings were most popular in the south west and Wales, possibly reflecting the more rural nature of these regions and the larger gardens of those living there, as well as the popularity of conservatories with retirees.

That said, it should be noted that most conservatory providers offer products with dimensions that do not require planning permission to be installed, so the figures may not reflect the true popularity of conservatories.

The important role played by gardens last year across the whole of Great Britain is reflected by the fact that applications for outside-the-house improvements saw a sizable jump in all regions of the country apart from the north east.

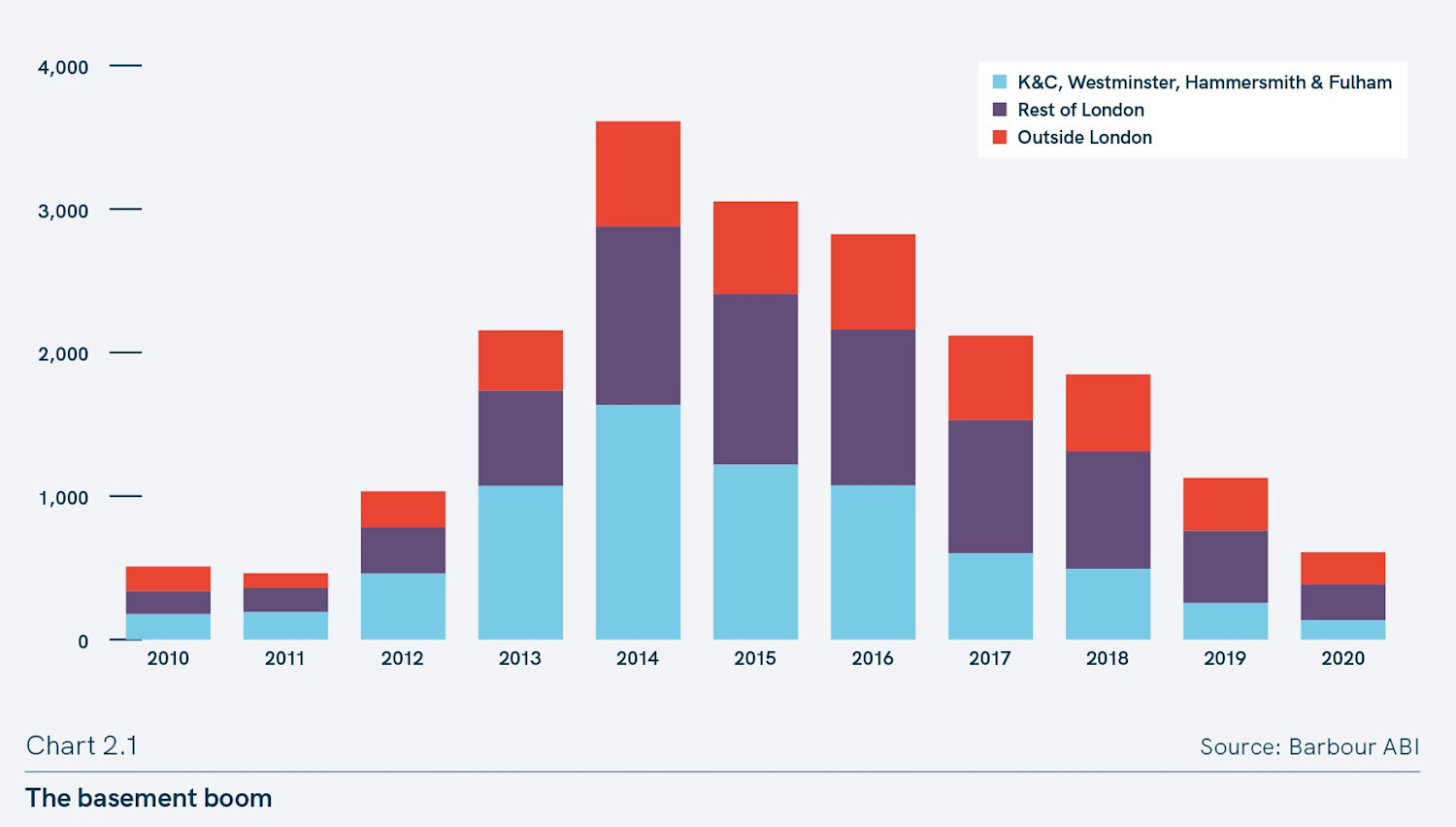

Basements

After a steep rise in the popularity of basement developments in London between 2013 and 2016, applications for this improvement have been in steady decline.

ABI Barbour explains that economically, basements only tend to work in locations with high land prices, so that the high cost of having the work done translates into a sufficiently large increase in the value of the property to make it worthwhile.

As money flooded into the London market, basement applications boomed, but once the market started to lose its heat around 2016, demand for basement developments fell back again.

Who are the big spenders?

During the past 15 to 20 years baby boomers have had the biggest impact on home improvements, as this generation not only benefited from high levels of housing wealth, but they also appreciated the value home improvements could add to their property and aspired to live in a home tailored to their own needs.

While those aged between 57 and 75 are still significant home improvement spenders, it is people aged between 30 and 49, an even split of younger generation X and older Millennials, who are now spending the most.

In terms of household type, families with two adults and children are the biggest spenders on home improvements, followed by homes occupied by two retired adults, and those with three or more adults and no children, possibly reflecting the trend for adult children to return to their parent’s home.

Home improvement need-to-knows

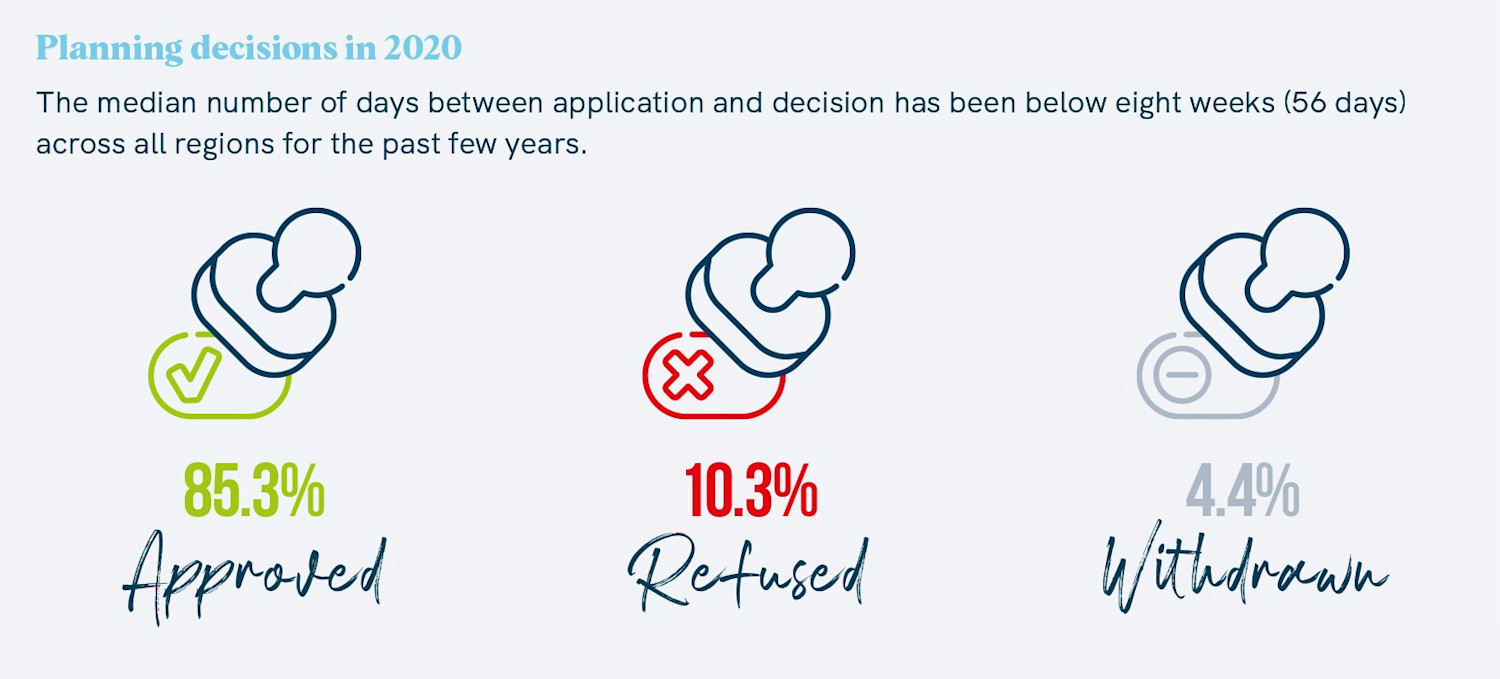

It took an average of 55 days to receive a decision on a planning application across all regions of Great Britain in 2020, slightly up on the 54 days taken in 2018 and 2019.

More than 85% of applications were approved, with just 10% refused, while just over 4% were withdrawn.

London had the lowest level of approvals with 75% of applications given the go-ahead. In the south east and east of England approvals were also slightly below the national average.

But in other regions of the country, around nine out of 10 applications were approved.

London’s lower approval rate is likely to be due to a combination of higher housing density in the capital, meaning neighbours may be more likely to object to applications, as well as higher house prices, which may incentivise applicants to submit more ambitious improvement plans, as the potential gains of adding to their home are proportionately greater.

Top three takeaways

- Homeowners focused on increasing their space and improving their gardens during 2020 as successive lockdowns forced people to spend more time at home

- Building an extension continued to be the most popular type of home improvement

- There was a steep increase in applications for garages and garden buildings. By contrast, planning applications for conservatories and loft conversions fell

Q&A: ‘We think the housing market is on track for its busiest year since the global financial crisis’

Our head of research, looks at what has triggered the recent boom in housing market activity – and what the outlook is as the stamp duty holiday ends.

Q. Despite the global pandemic, the UK housing market is on course for the busiest year since the financial crisis. What’s behind this record-breaking prediction?

The pandemic has actually triggered a lot of the activity in the housing market. Buyer demand has been strong since the end of the first lockdown last year, as households reassess where and how they are living.

The Government has also introduced the 95% mortgage guarantee, which means there’s a wider range of home loans for first-time buyers with a small deposit to choose from.

Many people feel they need more space, particularly families and those for whom working from home is likely to become the norm.

At the same time, many older homeowners are also re-evaluating their housing needs and moving for the first time in many years.

This demand for more space has led buyers to focus on houses and family homes, meaning more expensive properties are changing hands.

Government initiatives are also boosting activity, with the stamp duty holiday encouraging people to bring forward purchases, while the 95% mortgage guarantee has increased mortgage availability for first-time buyers. The government’s recent announcement about First Homes is also likely to have a positive impact on transactions.

We expect activity to remain elevated in the second half of the year, with total sale completions forecast to reach 1.52 million in 2021.

Q. What’s driving up house prices?

Average house prices rose by 4.1% in the year up to April 2021, up from 2.3% in April last year.

Within this total, there was significant regional variation. Wales saw the strongest growth at 6.3%, followed by Yorkshire and the Humber at 5.4% and the North West at 5.3%.

At the other end of the scale, growth was slowest in London, with house prices rising by only 1.9% during the year to April, while Scotland and the South West posted gains of 3.4% and 3.5% respectively.

Prices are being underpinned by strong demand from buyers, which continues to outstrip the supply of homes coming on to the market, driving property values higher.

Growth is strongest in areas where affordability remains good, with the northern regions continuing to see the biggest house price gains.

Q. Where are the hottest and coldest housing markets across the UK - and why?

Wales, Yorkshire and the Humber and the North West are also the hottest regional markets at present, with properties in these regions moving more quickly than in the normal market conditions of 2017 to 2019.

The time between a property being listed and securing a sale subject to contract has fallen by between 10 and 15 days in all three of these regions. As with house price growth, the good affordability of homes in these regions is a key factor driving the markets.

By contrast, inner London is the coldest market, with homes taking just under two months to sell, two weeks longer than the average for 2017 to 2019.

Annual house price growth in inner London is also lagging behind the national average, at just 0.3%, while four central London boroughs have registered price falls for the third or fourth consecutive month.

London is a global real estate market, and inner London has been hit particularly hard by the global shutdown of international business and leisure travel due to the pandemic. Affordability constraints also continue to act as a drag on the wider London market.

Q. The stamp duty holiday on the first £500k of property is set to come to an end later this month. What impact will this have?

Although sales are currently being agreed quickly, there could be delays in getting them over the line due to a conveyancing backlog. This in turn could have a knock-on effect on whether or not buyers meet the stamp duty deadline at the end of June.

Some 53,500 sales were agreed in England for properties priced at above £250k between 8th March and 4th April. In a normal year, for example from 2017 to 2019, it would take on average three months for these transactions to progress from Sold Subject to Contract to completion.

However, given the uptick in activity over the past year, average transactions are now taking four months. This is because conveyancers, local authorities and mortgage lenders are trying to process record levels of sales.

If the 53,500 transactions cited above take four months to complete rather than three months, these buyers will miss out on the maximum stamp duty savings.

But even after this deadline passes, homeowners looking to move up or down the housing ladder will still not pay stamp duty on the first £250k of a purchase up until the end of September, because of the tapering off of the stamp duty holiday.

First-time buyers will also benefit from stamp duty relief on the first £300k of homes costing up to £500k, as they did before the stamp duty holiday was introduced.

Although demand levels are likely to moderate in the second half of the year as the stamp duty holiday is phased out, we still expect activity levels to remain elevated.

Overall, we think the housing market is on track for its busiest year since the global financial crisis.

Q. What’s the outlook for the months ahead as lockdown restrictions continue to ease?

The full reopening of the economy and the unwinding of lockdown restrictions is unlikely to be simple or smooth.

We have already seen the lifting of the remaining restrictions in England postponed from June 21 until July 19, although they will be reviewed in two weeks’ time.

However, we don’t expect this to dampen overall momentum in the housing market this year. The ‘once-in-a-lifetime reassessment’ has got further to run, and the stamp duty holiday extension and 95% mortgage guarantee scheme will also continue to help people move home this year.

Meanwhile, supply constraints will continue to underpin house prices. But even with the lack of supply hampering some sales, we still expect more than 1.5 million homes to change hands this year.

Mortgage lending soars to record high

The choice of mortgages available is on the rise as competition intensifies among lenders. Here’s what it could mean for you.

Mortgage lending has soared to a record high as the housing market is on course for its busiest year since the global financial crisis.

Homeowners collectively borrowed £35.6bn in March, the highest level since Bank of England records began in 1993.

The strong borrowing was driven by people rushing to complete property purchases before the expected end of the stamp duty holiday on 31 March - although the Chancellor later extended the deadline.

Lending looks set to remain buoyant, with 82,700 mortgages approved for home purchases in March, 13% higher than a year earlier.

The number of people remortgaging was more subdued, with just 34,800 mortgages approved for homeowners switching to a different lender, although this figure is likely to reflect seasonal trends, rather than a lack of mortgage availability.

In fact, lenders are very much open for business, with availability increasing across all corners of the mortgage market.

Keen to know what this could mean for you? Here’s what the mortgage landscape looks like for different borrowers.

First-time buyers

The number of mortgages available for first-time buyers has soared recently as banks and building societies flock back to lending to people with small deposits.

There are now nearly 200 different mortgages available for people with just a 5% deposit, up from only a handful at the beginning of the year.

The increase has been boosted by the launch of the 95% mortgage guarantee scheme, where the government ‘guarantees’ mortgages for buyers with 5% deposits.

But there is also a wide choice of mortgages available outside of the scheme, while renewed competition in this part of the mortgage market has led to a drop in average interest rates.

There has been a strong increase in the choice of mortgages available for people with a 10% deposit too, with the number of different deals soaring to nearly 500, compared with only 100 in the same period last year.

Meanwhile, the choice of mortgages for those with a 15% deposit has tripled, as recent strong house price growth has made lenders more confident about offering mortgages to people with small deposits.

But while the number of high loan-to-value mortgages - in other words, loans for people with small deposits - is on the rise, research suggests lenders are still picky about who they lend to.

A study by Aldermore found that only one in five first-time buyers were able to secure a mortgage on their first attempt, with the most common reasons for rejection being a poor credit history, not having a large enough deposit, not being on the electoral roll and being self-employed or having an irregular income.

The findings highlight the importance of taking steps to improve your credit worthiness before making a mortgage application to give yourself the best chance of success.

Existing homeowners

Homeowners moving up or down the property ladder currently have lots of choice, with the total number of mortgages available increasing every month so far this year.

There are now more than 4,000 deals on offer – 50% more than this time last year, bringing us close to pre-pandemic levels.

While existing homeowners typically have larger equity stakes in their home than first-time buyers, the greatest level of choice is no longer reserved for those with a deposit of 40% or more.

Instead, while there are more than 500 mortgages available for borrowers with a 40% deposit, the highest level of choice is for those with a 25% or 20% deposit, with more than 700 deals available in each tier.

And although average interest rates are holding steady, individual lenders are launching eye-catching deals as they look to win new business, with some offering rates of below 1%

However, the increase in competition has led to the average shelf-life of a mortgage – the time for which it is available before lenders withdraw it – falling to just 28 days.

As a result, borrowers will have to move quickly to secure a deal before it gets pulled by the lender.

Buy-to-let investors

Mortgage choice has also soared for buy-to-let investors, with nearly 2,500 different mortgages available to choose from. That's 1,000 more than last year - and more than there were in 2019 too.

A combination of strong house price growth, high tenant demand and rising rents, as seen in our Rental Market Report, has made lenders feel more confident about offering mortgages to investors with only small deposits, with 12 deals recently launched for people with just 15% to put down, ending a period in which the minimum deposit for buy-to-let was 20%.

There is also increased choice for people with a 20% deposit, with nearly 150 loans to choose from, compared with just 19 a year earlier.

Investors who have a 25% deposit have the most choice with nearly 900 mortgages available, more than double the number on offer 12 months ago.

There is more good news for landlords, as interest rates on buy-to-let mortgages have been on a steady downward trajectory since the start of the year, as competition in this sector of the market continues to hot up.

This trend has been seen across both two-year and five-year fixed rate deals and mortgages at all loan to value ratios, pushing average interest rates on two-year fixed rate products below 3%.

First-time buyers offered half-price homes under new scheme

First-time buyers in England could be offered half-price homes through a new government scheme to help people get on the property ladder.

A new government scheme offering local first time buyers and key workers a 30% to 50% discount on the purchase of their first home has launched.

Designed to help those struggling to afford a property in their local area, the First Homes initiative kicked off in the Bolsover district of Derbyshire at the end of last week.

Further sites are set to follow over the next few weeks, with an additional 1,500 homes joining the scheme this autumn.

The government has pledged a further 10,000 properties will be added to the First Homes scheme every year.

Housing secretary Robert Jenrick said: “Thanks to First Homes, we will offer more homes to local people and families, providing a route for first-time buyers to stay in their local areas, rather than being forced out due to rising prices.”

How does the scheme work?

Under the First Homes scheme, a portion of new homes being built will be sold to first-time buyers who meet the eligibility criteria.

They will be sold at a minimum discount of 30% of the open market price, although in some cases that discount could rise to 40% or even 50%.

When the property comes to be sold again, the same discount will be passed on to the next buyer, who must also be purchasing their first property and meet the other eligibility criteria, to ensure the homes will always be available to the local community at below market value.

Prices for the first sale are capped at £250,000, rising to £420,000 in Greater London, after the discount has been applied.

Several national and regional lenders, including big names such as Halifax and Nationwide, have agreed to provide 95% mortgages on properties being purchased under the scheme.

Who is eligible for First Homes?

The scheme is available to first-time buyers in England who are either local or key workers, or in the Armed Forces.

The definition of key workers includes doctors, nurses and teachers, as well as delivery drivers and supermarket staff.

Councils will be able to prioritise homes for key workers who have supported their community through the pandemic, while they can also set their own definition of a key worker to attract people in professions that are considered to be essential to their local area.

Individual local authorities can also set a local connection test for the properties, which may include people who live or work in the area, have family connections to it or need to live there due to special circumstances, such as caring responsibilities.

The scheme is also open to all current members of the Armed Forces, as well as divorced, separated or widowed spouses, and veterans who apply within five years of leaving the forces.

If a property is being purchased by a couple, both individuals must be first-time buyers with a combined annual household income of less than £80,000, rising to £90,000 in Greater London.

At least 50% of the purchase must be funded through a mortgage.

What’s the background?

First Homes is part of the government’s wider pledge to deliver one million new affordable homes by 2024 to help more people get on to the property ladder.

It follows the launch earlier this year of the 95% mortgage guarantee scheme which aims to increase the availability of mortgages for people with just a 5% deposit.

To coincide with the launch of First Homes, the government has also started a new campaign called ‘Own Your Home’ to highlight the support that is available for people getting on to the property ladder.

The campaign consists of a series of broadcast, digital and radio adverts flagging up schemes such as the Help to Buy equity loan, Shared Ownership and Right to Buy.

It is being backed by the Own Your Home website, which acts as a single gateway for aspiring homeowners to get information on the schemes that are available and to help them decide which one is right for their needs.

Top three takeaways

- First-time buyers in England could be offered half-price homes through a new government scheme to help people get on the property ladder

- Under the First Homes initiative, local first-time buyers and key workers will be able to purchase a property at a discount of between 30% and 50% of the market price

- When the property is sold, this discount is passed on to the next buyer

More than half of homeowners live in homes that fail to meet their needs

From pets buried in the garden to the draw of the local coffee shop or pub, our survey lifts the lid on what's stopping people from moving.

Just over half of UK homeowners claim to be stuck in a home that doesn't meet their needs.

The average homeowner says they would need a further £125,000 on top of the current value of their home in order to afford somewhere that's suitable for them.

Our survey of 2,400 homeowners also revealed that people typically stay in their home for more than four years after realising it's no longer right for them.

And when asked what finally prompted them to pluck up the courage to move, 25% of homeowners pointed to an increase in income, while 19% said having children made it vital.

Consumer spokesperson said: “We were blown away to see just how many Brits are living in homes that they don’t feel are right for the needs of themselves and their family.”

Why do homeowners feel their homes no longer meet their needs?

The need for more space was the key reason for why homes were no longer suitable, with 40% of homeowners surveyed citing this as a factor.

Meanwhile 25% said they were stuck in an area in which they did not want to live, and 23% said not having dedicated space in which to work from home was an issue.

The survey comes as many people reassess what they need from a home in light of the pandemic and successive lockdowns.

With working from home for at least part of the week likely to become the norm for many people, the need to have a dedicated space in which to work has increased as a priority, while many people feel they just need more space at home generally.

At the same time, not having to commute into the office every day means areas that are close to work or good transport links no longer hold the same appeal as they once did.

So what is stopping homeowners from moving?

Among those who said they live in a home that was not suitable for them, 39% said being unable to find somewhere that was right for them within their budget was the main factor stopping them from moving.

A quarter of those who did not like their home also said the cost of moving was a barrier preventing them from buying somewhere else.

Emotional ties

While some homeowners are unable to move for financial reasons, others feel tied to their current home for emotional ones.

Around 27% of those surveyed said they had an emotional attachment to their home, while 55% of parents said their children were attached to it.

Among this group, 13% of parents said they could not move from their current home because it would upset their children too much, and 36% said they could not bear to leave the home in which they had brought up their children.

One in five homeowners said they liked their neighbours too much to move, while 8% said they could not leave their property because they had buried pets in their garden.

Lure of the neighbourhood

Meanwhile, for many homeowners, their love of the neighbourhood prevented them from moving. Among these, 26% said their fondness of their local pubs stopped them from relocating, and 21% felt the same way about their local coffee shop.

What could it mean for you?

Our recent research showed that half of homeowners undervalue their property by an average of £46,000.

So if you think you can’t afford to move, it’s worth getting to grips with the current value of your home as you may be in for a nice surprise.

Top 3 takeaways

- Just over half of UK homeowners claim to be stuck in a home that fails to meet their needs

- The average person says they would need an additional £125,000 on top of the current value of their home in order to afford somewhere that is suitable for them

- Homeowners typically stay in their current home for more than four years after realising it is no longer appropriate for them