Interest Rates Soar to a 15-Year Peak of 5%

Bank of England's Latest Rate Hike Raises Monthly Repayments by £60 for Homeowners with a £200,000 Variable Mortgage.

The Bank of England has increased interest rates by 0.5% to 5% as it continues to battle high inflation.

It was the 13th consecutive meeting at which the Monetary Policy Committee (MPC) has hiked the official cost of borrowing, with the Bank Rate now standing at a new 15-year high.

The latest increase adds a further £60 a month to repayments for homeowners with a £200,000 variable mortgage.

People with variable rate mortgages have now seen their mortgage costs jump by £566 a month since the MPC first started to raise interest rates from their record low of 0.1% in December 2021.

An estimated 850,000 homeowners have a tracker mortgage, and 1.1 million are on their lender’s standard variable rate – both of which move up and down in line with changes made to the Bank Rate.

Meanwhile an estimated 1.4 million homeowners who have fixed rate deals that expire this year will also face significantly higher rates than when they previously remortgaged.

The MPC had been expected to increase the Bank Rate by 0.25% 22 June 2023, but figures released 21 June 2023 showed that core inflation was still rising surprised markets, prompting economists to predict it would impose a larger hike.

Why is this happening?

The MPC has been increasing interest rates since the end of 2021 in a bid to bring inflation back down to its 2% target.

But the most recent figures showed that core inflation, which excludes volatile categories such as food and energy, increased to 7.1% during May, while headline Consumer Prices Inflation stalled at 8.7%, after edging down the previous month.

The figures suggest inflation in the UK has now become entrenched and is being driven by internal factors, such as wage increases, rather than external factors, such as the conflict in Ukraine.

As a result, it will be harder to bring down and interest rates are expected to have to rise further than previously thought, with economists now predicting they could peak at 6%.

But there was some good news, with the MPC continuing to say it expects inflation to “fall significantly further” during the rest of the year, and markets expecting it to begin cutting interest rates by the middle of 2024.

While today’s higher than expected interest rate rise may have come as a shock, it is important to remember that if the Bank Rate does peak at 6%, this is only slightly higher than the 5.5% to 5.75% markets had previously pencilled in.

What does this mean for mortgages?

For those on variable rate mortgages, such as tracker deals and standard variable rates (SVR), today’s increase will mean their mortgage rate will also rise by 0.25%.

People on fixed rate deals will be protected from the latest hike until they come to remortgage, as fixed rates remain the same for the entire product term.

The mortgage market has already been responding to higher than expected inflation, with lenders withdrawing nearly 400 products for repricing during the past month.

This recent large-scale repricing means much of the bad news has already been factored in, with rates edging up only slightly more today, to stand at 6.19% for two-year fixed rate mortgages 5.81% for five-year ones.

Even so, people coming to the end of fixed rate deals are likely to face significant payment shock when they come to remortgage.

Rates averaged 2.59% and 2.92% when people coming to the end of two-year and five-year deals respectively took out their loan.

What should I do if I need to remortgage?

If you need to remortgage, it is probably worth considering using a mortgage broker to help you navigate the current market, which is changing very quickly.

While five-year fixed rate mortgages currently have lower interest rates than two-year ones, it might still be worth opting for the latter, as mortgage rates are currently elevated and interest rates are still expected to start falling next year.

If you take out a five-year deal, you will be locking into these higher rates for a five-year period, whereas if you opt for a two year one, you will have the opportunity to remortgage in two years’ time, by which point rates are expected to be lower.

Whatever rate you decide to go on to, with standard variable rates – the rate you are automatically moved to once your current mortgage deal expires – currently averaging 7.52%, you should try to line up your next deal before your current one ends.

What should I do if I’m struggling to pay my mortgage?

If you are struggling with your mortgage payments, there are two main ways you can make them more affordable.

The first is to increase your mortgage term.

For example, monthly repayments on a £200,000 mortgage on a fixed rate of 6% are £1,450 if you are repaying it over 20 years, but fall to £1,210 if you increase the term to 30 years.

They fall even further to £1,150 if you repay the mortgage over 35 years.

If you do decide to go down this route, it is important to understand that although it will reduce your monthly repayments in the short term, you will end up paying a lot more interest over the entire life of your mortgage.

The second option is to talk to your lender about being put on to an interest-only mortgage for a period of time.

Only paying interest significantly reduces your monthly payments, although it does mean that the amount you owe is not being reduced, so you will need to resume full repayments at some point.

For example, if you have a £200,000 mortgage on a fixed rate of 6%, monthly repayments would be £1,304 on a repayment basis, but £1,000 on an interest-only one.

If you are really struggling, you can ask your lender for a short-term payment holiday. This enables you to take a break from making repayments, with the interest portion of your monthly payment added to your outstanding mortgage debt.

If you think you may run into difficulties, it is important to contact your lender as soon as possible.

Chancellor Jeremy Hunt yesterday said he would ensure that banks were living up to the commitments they made to the government in December to help borrowers who got into difficulties.

At the time, lenders agreed to be more flexible in the way they approached borrowers impacted by the cost-of-living squeeze.

Alongside offering tailored support to those in difficulties, they also agreed to enable customers who were up to date with their payments to switch to a new mortgage deal without having to do another affordability test.

In addition, they pledged to ensure highly trained and experienced staff were on hand to help customers when needed.

Key takeaways

- The Bank of England has increased interest rates by 0.5% to 5% as it continues to battle high inflation

- It was the 13th consecutive meeting at which the Monetary Policy Committee (MPC) has hiked the official cost of borrowing

- The latest increase adds a further £60 a month to repayments for homeowners with a £200,000 variable mortgage

Mortgage Update: Current Trends and Developments in June 2023

Navigating the Mortgage Market Turmoil: Understanding the Causes and Exploring Options for Buyers and Homeowners

The latest inflation figures have spooked the financial markets, causing mortgage lenders to withdraw many of their deals for repricing.

Banks and building societies have pulled nearly 400 deals from the market in the past month, with some temporarily withdrawing their entire ranges.

We take a look at what’s happening in the mortgage market and what you should do if you need to remortgage.

Why are lenders withdrawing deals?

There are two different types of mortgage, fixed rate ones and variable rate ones.

The cost at which lenders borrow money for variable rate products is based on the Bank of England Bank Rate. When this goes up, so does the cost of variable rate mortgages, such as tracker deals.

Lenders’ borrowing costs for fixed rate mortgages are more complicated. These deals are based on so-called Swap rates – which is the rate at which lenders borrow money for a set period of time, such as two years or five years.

The cost of Swap rates are based on a number of different factors, including government borrowing costs and predictions on what the Bank Rate will be in future.

Swap rates shot up in the wake of the mini-Budget in September because government borrowing costs increased after financial markets lost confidence in the government’s plans for the economy.

This time around, Swap rates are increasing because inflation remains stubbornly high.

The Bank of England’s Monetary Policy Committee (MPC) has increased interest rates from a record low of 0.1% to 5% in a bid to lower inflation, but so far, these rate rises have had little impact.

The latest inflation figures, which showed that overall inflation was falling slower than expected and core inflation was actually increasing, has spooked markets.

Economists had previously predicted the Bank Rate would peak at 4.5%, but with inflation still remaining high, they now expect it to rise to 5.25% or 5.5%, with some predicting it could go as high as 6%.

These expectations have sent Swap rates higher, meaning lenders are withdrawing their fixed rate mortgage deals so that they can reprice them to reflect their own higher borrowing costs.

If you're looking to secure a new mortgage, the best thing you can do right now is to speak with a mortgage broker, who can help you to find the best deals out there.

What mortgage deals are being pulled in June 2023?

The number of different mortgage deals available has fallen by 387 products since the middle of May.

The majority of mortgages that have been withdrawn are fixed rate products, due to the recent increases in Swap rates.

In fact, the number of variable rate mortgages available has actually increased for some deposit bands.

Deals have been withdrawn across all deposit ranges, although products for people with smaller deposits have been less affected.

Lenders offer their most competitive deals to people with large deposits or equity stakes in their property and it is this part of the market that has borne the brunt of the withdrawals for repricing.

Around 100 fixed rate mortgages have been taken off the market in the past month for people with 40% to put down – the equivalent of 17% of all deals in this space.

A similar number of products have been withdrawn for both those looking to borrow 75% of their home’s value and those looking to borrow 80%.

Product withdrawals have been made by all types of lender, from large high street banks to smaller, regional building societies, as they all review the cost of their deals.

What mortgage deals are still available?

While headlines stating that mortgage choice has shrunk and some lenders have pulled their entire ranges may appear alarming, it is important to keep the situation in context.

There are still a total of nearly 5,000 different mortgage products available.

Unlike during the global financial crisis and the early stage of the Covid-19 pandemic, when lenders pulled products for people with only small deposits, mortgages remain available at all deposit levels – there is just a little less choice than previously.

The current round of withdrawals has been caused by lenders facing higher borrowing costs, so it is quite different to the liquidity issues seen during the global financial crisis and their reduced appetite for risk at the start of the pandemic.

As a result, lenders who have withdrawn their products are expected to return to the market, just charging slightly higher interest rates.

Are fixed rate deals still available?

While fixed rate deals have borne the brunt of the withdrawals, they are still very much available.

In fact, around two-thirds of all mortgages currently on the market are fixed rate ones.

The number of fixed rate mortgages on offer is expected to increase in the coming days as lenders who withdrew their products for repricing, relaunch them.

Can you still get a mortgage with a small deposit?

Mortgages for people with small deposits have been less impacted than other areas of the market.

There are currently 612 different products to choose from for people with only a 10% deposit, down from 682 a month earlier, and 218 for those with only 5%, compared with 242 in mid-May.

To put this into context, in the early stages of the pandemic, there were just 16 mortgages available for people with a 5% deposit and 75 for those with 10% to put down.

Although the latest data from the Bank of England signals that lenders are becoming more cautious, they seem to be cutting back on lending to people borrowing high multiples of their income, rather than those with smaller deposits.

It is also worth noting that the number of small deposit mortgages available has actually risen since the first week of June.

How much are mortgage rates rising by?

The average cost of a two-year fixed rate mortgage across all deposit levels is currently 6.01%, up from 5.3% at the beginning of May – an increase of 0.71%.

Five-year fixed rate mortgages have increased by broadly the same amount, rising to 5.67% from 4.97%.

The steepest increases have been seen for those borrowing 75% of their home’s value, with average two-year mortgage rates in this sector of the market rising by 0.89%.

But it is important to remember that these rates are averages and there are more competitive deals available if you shop around.

For example, there are still a number of two and five-year fixed rate products available with interest of around 4.5% or less.

Are mortgage rates likely to come down again soon?

The market is in a state of turmoil at the moment, and it is difficult to know how long this will last.

It is worth noting that when mortgage rates last shot up in the wake of the mini-Budget, it took a couple of months for the market to stabilise and rates to start falling again.

If the next set of inflation figures are more positive, markets may decide interest rates do not need to increase by as much as they previously thought, and mortgage rates could start to come down.

Even if the MPC does continue to increase the Bank Rate to combat inflation, most economists currently expect it to start cutting it again in 2024.

Can a lender withdraw an offer?

If you accepted a mortgage offer from a lender before the current turmoil started, you may be concerned they will now withdraw it.

While in theory lenders can withdraw mortgage offers, in practice this only tends to happen if the borrower’s circumstances change, or they cannot complete on the mortgage before the offer period expires, or issues with their property are uncovered.

Lenders tend not to withdraw fixed rate mortgage offers due to increased financing costs, as the offer is typically based on funding they already have in place.

What should I do if I need to remortgage?

If you need to remortgage in the near future, the current turmoil in the mortgage market is likely to be particularly stressful.

With things changing very quickly, it is probably worth considering using a mortgage broker to help you navigate the market.

Get an expert mortgage recommendation.

While five-year fixed rate mortgages currently have lower interest rates than two-year ones, it might still be worth opting for the latter.

Mortgage rates are currently elevated and interest rates are expected to start falling next year.

If you take out a five-year deal, you will be locking into these rates for a five-year period, whereas if you opt for a two year one, you will have the opportunity to remortgage in two years’ time, by which point rates are expected to have fallen again.

But with the average standard variable rate – the rate you are automatically moved to once your current mortgage deal expires – currently charging more than 7%, you should think about lining up your next mortgage before your existing one ends.

Key takeaways

- Lenders have withdrawn nearly 400 products since the middle of May. But to put this in perspective, there are still 5,000 deals available

- Deals have been withdrawn for repricing due to expectations that interest rates will rise more than previously thought

- However, there are still a number of two and five-year fixed rate products available with interest of around 4.5% or less

- Despite the situation, lenders are continuing to offer mortgages to people with only small deposits

The persistence of high inflation suggests that more challenges lie ahead in terms of interest rates.

May saw core inflation reach its highest level in 31 years, indicating that the Bank of England may need to raise interest rates beyond previous expectations.

Inflation rose to a new 31-year high in May, suggesting further interest rate rises will be needed to bring it under control.

Core inflation, which excludes volatile categories such as food and energy, increased to 7.1% during the month, while headline Consumer Prices Inflation stalled at 8.7%.

The data caught economists by surprise, as both the Bank of England and markets had expected the figures to show a fall in inflation.

It led to predictions that interest rates may have to rise to 6% to bring it back under control.

The figures came as the Bank’s Monetary Policy Committee (MPC) begins its two-day interest rate setting meeting, with some economists predicting it will now increase the Bank Rate by 0.5% - rather than the 0.25% previously expected - to 5% on Thursday.

Why is this happening?

While inflation is now falling in the US and Eurozone, it remains stubbornly high in the UK.

This is because inflation in the UK is now being driven by wage increases, rather than external factors, such as the conflict in Ukraine.

In fact, fuel price inflation, which had previously driven inflation up, fell from -8.9% to -13.1% in May, while the rate at which food prices are rising eased from 19.1% to 18.3%.

With inflation in the UK becoming more entrenched, it will take longer to tackle, and this means interest rates are likely to have to rise higher than previously expected.

But it is important to remember that if the Bank Rate does peak at 6%, this is only slightly higher than the 5.5% to 5.75% markets had previously been expecting, while some commentators think rates will only have to rise to 5.25%.

Despite today’s figures, economists continue to expect inflation to fall steeply in the second half of this year, enabling the MPC to begin cutting the Bank Rate during the first quarter of 2024.

What does this mean for mortgages?

The mortgage market is already responding to higher than expected inflation, with lenders withdrawing nearly 400 products for repricing during the past month.

The situation has pushed up the average cost of a two-year fixed rate mortgage up to 6.15%, while five-year ones now stand at 5.79%.

The recent large-scale reprising means much of the bad news has already been factored into mortgage rates, so they should not rise too much further in response to today’s news.

After increasing by nearly 1% during the past month, two-year Swap rates, upon which fixed rate deals are based, edged only fractionally higher in early trading.

What should I do if I’m struggling with my mortgage?

Chancellor Jeremy Hunt today said he would ensure that banks were living up to the commitments they made to the government in December to help borrowers who got into difficulties.

At the time, lenders agreed to be more flexible in the way they approached borrowers who have been impacted by the cost-of-living squeeze.

Alongside offering tailored support to those in difficulties, they also agreed to enable customers who were up to date with their payments to switch to a new mortgage deal without having to do another affordability test.

In addition, they pledged to ensure highly trained and experienced staff were on hand to help customers when needed.

If you are struggling to pay your mortgage, you should contact your lender as soon as possible.

Options to help you are likely to include increasing your mortgage term or switching you to an interest-only mortgage to help reduce your monthly repayments.

Your lender may also offer you a short-term payment holiday to give you some breathing space, although interest accrued during this time will be added to the total amount you owe.

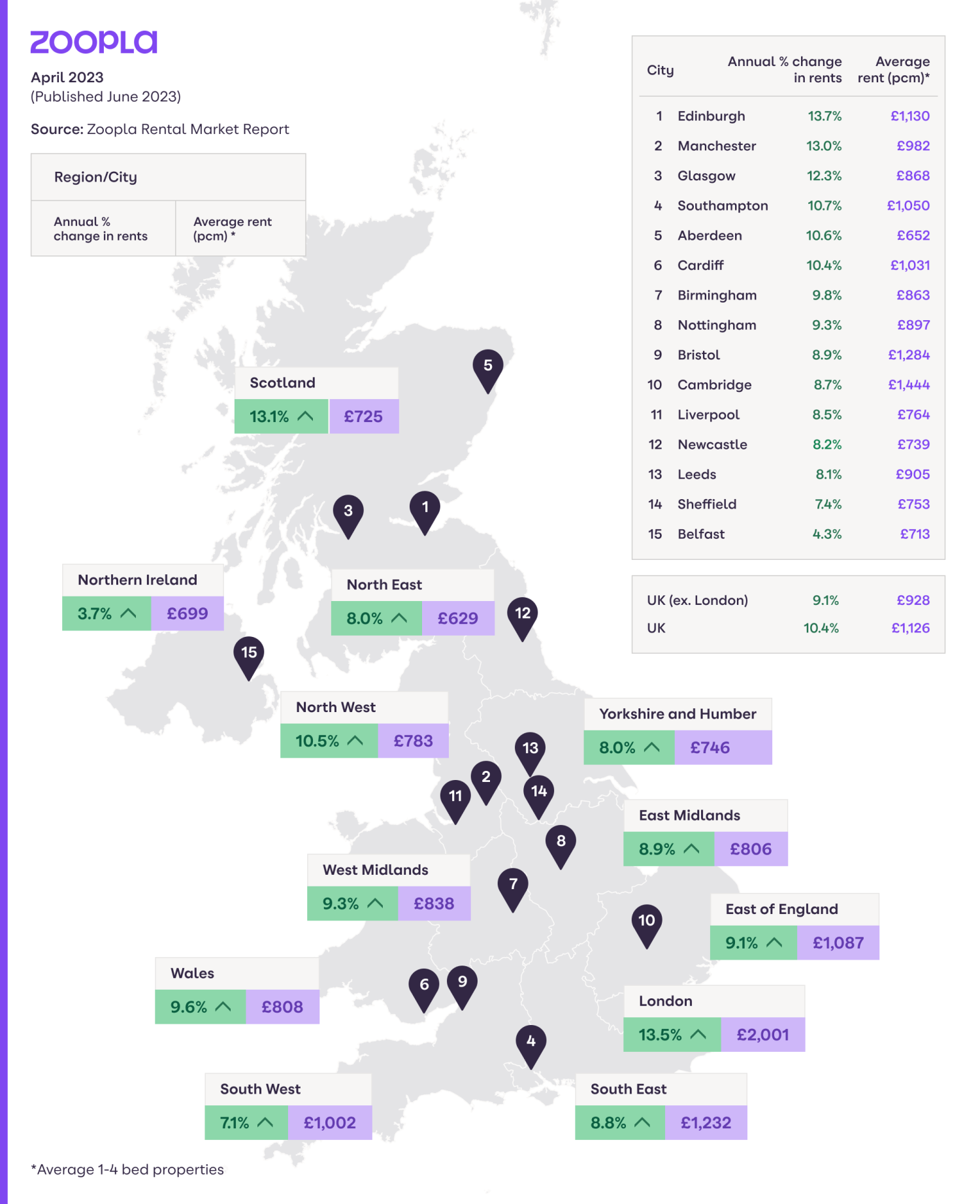

21 Months of Rental Increases Outpacing Earnings

The average monthly rent in the UK has reached £1,126, with London rents exceeding £2,000 per month. Discover the regions where rental prices are experiencing the fastest and slowest growth in the UK.

Rents increase by more than 10% for 15th month in a row

In April 2023, the average cost of a new let rose to £1,126 per month, following 21 consecutive months in which rental rises outstripped wage rises.

The average UK rent has now increased by £110-a-month - or 10.4% - since April 2022, marking the 15th consecutive month that we’ve seen double digit growth in rental inflation.

This level of rental inflation is high by historical standards and ahead of average earnings growth, which is currently at 6.5%.

The gap between these measures highlights the impact on rental affordability, which is now at a record high in seven out of 12 UK regions.

The good news is that rents for new lets have been starting to slow reflecting seasonal trends. In the last 3 months, the average rent increased by 0.6% - that’s the smallest amount since May 2021.

Rental inflation lowest in Northern Ireland

London and Scotland, two of the largest rental markets, have seen the highest level of rental inflation at +13% since April 2022. This is well ahead of the typical annual growth of 4.5% to 5% we’ve seen in these regions over the previous 5 years.

Northern Ireland remains the region with the lowest rental inflation - 3.7% or an increase of £30 per calendar month since April 2022.

Average rent in London reaches £2,000 per month

Over the last 2 years and since the economy reopened after Covid lockdowns, the average London rent has increased by £490 a month. This brings the average rent in the capital to £2,001.

At present, the largest annual increases are recorded in the eastern boroughs of Newham (+18.1%), Greenwich (+18.0%) and Tower Hamlets (16.5%).

Those living in the suburbs and western edges of central London are seeing a smaller level of rental growth. The annual rental inflation is weakest in Kensington and Chelsea (10.2%), Havering (11.3%) and Richmond (11.4%).

Prices of new lets in inner London start to slow down

The good news for many renters is that the rate of rental inflation is slowing down in inner London. The monthly rent for a new let in inner London is only £26 higher today than it was in January 2023.

This is an indication of prices hitting their ceiling in this area, as renters struggle to afford higher rents. We are yet to see if this trend will continue with the high-demand summer season ahead of us.

Prices of new lets are growing at a much faster rate in suburban boroughs. Over the last quarter, rental prices in outer London increased by 3% - or £47 - per month. These more affordable areas are now attracting more demand from renters looking for cheaper alternatives to inner London.

Varying rental growth in UK cities

Fast-growing rental inflation is not only a London problem.

Our rental index identifies three urban areas where rents are increasing faster than in London: Dundee (+14.5%), Luton (14.0%) and Edinburgh (13.7%).

Renters looking for new lets in these locations will find the average monthly rent has increased by up to £140 over last year.

We also record above-average rental inflation in Manchester, where the average monthly rent has increased by £110 over the last year.

The cities where rents are also increasing faster than average include Glasgow (12.3%), Southampton (10.7%) and Cardiff (+10.4%).

The average rent in these cities is now £100 higher than a year ago.

The lowest rental growth is currently happening in the city of Doncaster and the towns of Grimsby and Blackpool.

The typical monthly rent in these areas has increased by less than £30 per month - or 4.3% - since April 2022.

The cheapest and most expensive areas to rent in each region

|

Region |

Cheapest area to rent |

Monthly rent |

Most expensive area to rent |

Monthly rent |

|

North East |

Hartlepool |

£493 |

Newcastle upon Tyne |

£862 |

|

Yorkshire & the Humber |

North East Lincolnshire |

£569 |

York |

£1,034 |

|

Wales |

Powys |

£595 |

Cardiff |

£1,031 |

|

Scotland |

East Ayrshire |

£519 |

Edinburgh |

£1,130 |

|

West Mids |

Stoke-on-Trent |

£630 |

Warwick |

£1,107 |

|

North West |

Burnley |

£514 |

Manchester |

£1,099 |

|

East Mids |

East Lindsey |

£619 |

South Northamptonshire |

£1,076 |

|

South West |

Torridge |

£766 |

Bath and North East Somerset |

£1,333 |

|

East of England |

Waveney |

£732 |

Epping Forest |

£1,516 |

|

London |

Bexley |

£1,426 |

Kensington and Chelsea |

£3,538 |

|

South East |

Dover |

£929 |

Elmbridge |

£1,705 |

Key takeaways

- The average UK rent hit £1,126 in April, £110 higher than a year ago

- London remains the region with the fastest growing rents - up 13.5%, while rental inflation in Northern Ireland slows to 3.7%

- The average rent in London reaches £2,000 per month, but rental growth slows in inner London over last 3 months

- Outside the capital, rents are increasing the most in Dundee, Edinburgh and Luton

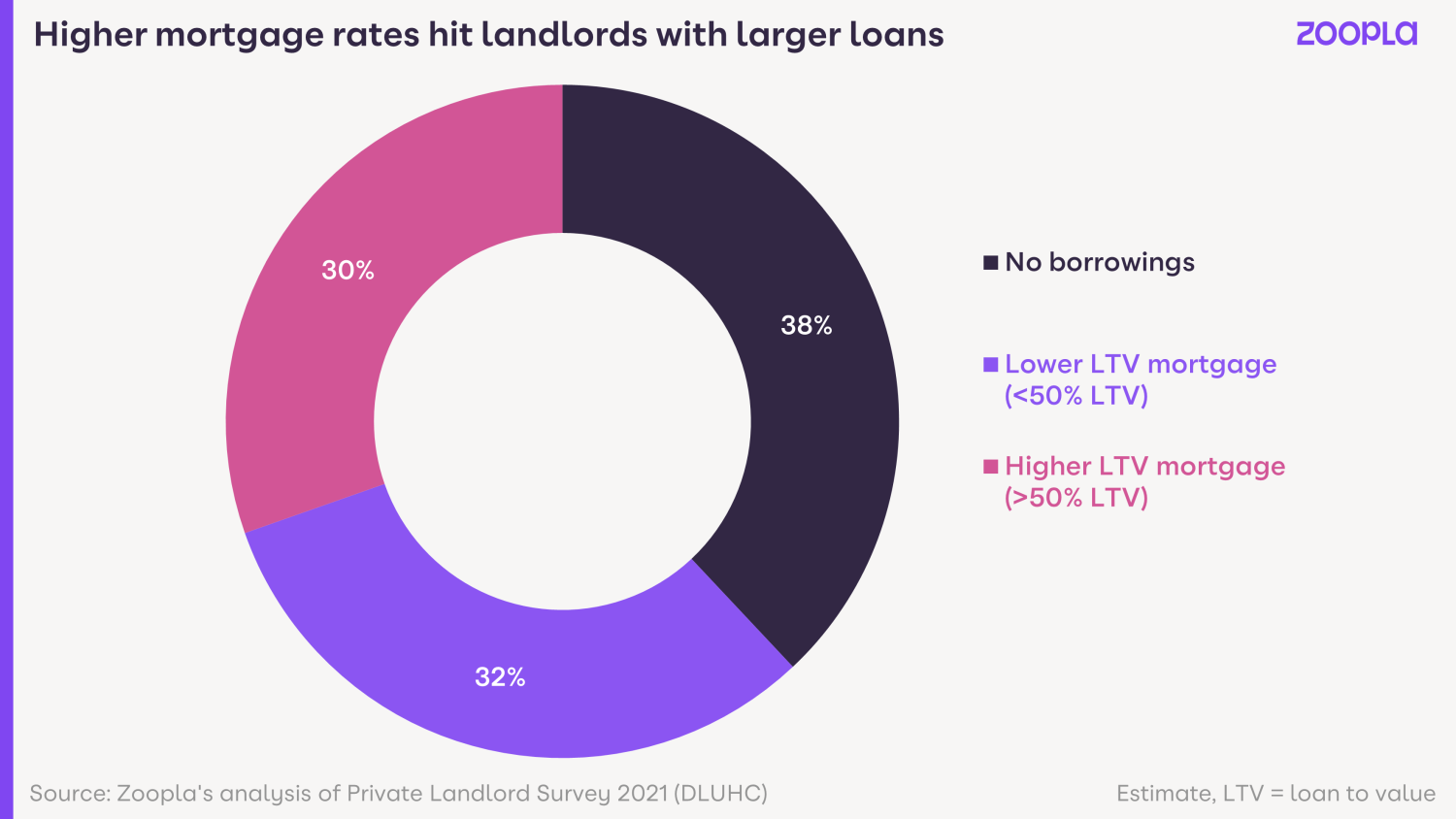

The Impact of Higher Mortgage Rates on Landlords: Squeezing Rental Home Availability

The number of rental homes available could face additional pressure as nearly a third of landlords are being affected by higher mortgage rates.

More than a third of landlords own their properties outright, while another third have loan to value mortgages of less than 50%.

But for the remaining 20-30% of landlords, whose mortgages have a loan to value of 50-75%, higher mortgage rates are hitting hard.

As mortgage rates creep up, landlords are forced to use more of their rental income paying back lenders, which in turn reduces their own income and creates a squeeze on cashflow.

The net result is the increased likelihood of a sale as landlords approach refinancing.

Higher mortgage rates are unwelcome but more manageable for landlords at lower LTVs as there is greater free rental cashflow to absorb higher mortgage rates.

In London and the South East, the two most expensive property regions in the UK, so many landlords are selling that these two regions account for 51% of all landlord sales.

Because homes in these areas are expensive to buy - and therefore offer low rental yields (or profit) once the monthly mortgage is paid, the economics of being a landlord here are tougher than other areas.

Rising mortgage rates are hitting profitability hardest in these regions, especially for higher rate taxpayers.

How can I keep my buy-to-let property in the face of rising mortgage rates?

The main option for landlords facing a big increase in mortgage interest payments is to inject equity at refinancing.

However, this will be an unattractive option for many with concerns over low yields and the risk of further price falls.

Is there a mass exodus of landlords selling up?

While some landlords are selling up, talk of an exodus is probably overdoing it.

Our sales data continues to show a steady, constant flow of private landlords selling up but this has been the case since 2018. And the level of landlords' sales isn’t accelerating.

Corporate and institutional landlords are continuing to invest in homes and for this reason the number of private rented homes available has remained at the same level since 2016.

We don’t expect to see a worsening of supply. However, the market does need significant investment from more private and corporate landlords to help with the demand for rental homes.

Right now, there are 33% less homes available to rent than the five year average, yet demand is currently running at 50-85% above average.

Key takeaways

- Higher mortgage rates are hitting landlords who have loan to value mortgages of 50-75% hard. And that accounts for 20-30% of landlords

- 51% of all landlord sales are taking place in London and the South East, the two most expensive property regions in the UK

- While some landlords are selling up, talk of an exodus is probably overdoing it

How to negotiate a rent increase in 2023

In a rental market characterized by fierce competition, rising costs, and a scarcity of available homes, renters may wonder what actions they can take.

Across the UK rents are rising amid fierce competition for rental properties.

Lack of stock is becoming a major issue, as tighter legislation and tax changes push some landlords to exit the market after years of low new investment.

Currently there are 20-40% less homes available for renters to live in than there were in 2019.

Yet across the UK, demand for rental properties is now running at 50-85% above normal levels.

How much are rents increasing by?

As renters are all too painfully aware, rents on new lets are up 10.4% year-on-year, and rents have risen by £2,800 over the last 5 years for the average renter.

There are several reasons why rent is increasing right now:

-

Landlords are facing increased mortgage costs and lenders are stress-testing their ability to repay those mortgages at much higher levels

-

The shortage of properties is leading some renters to pay more, if they are able to, to secure the property they want to live in

-

Many tenants are staying in their rental properties to avoid paying higher rents elsewhere, meaning fewer new rentals are coming to market

-

High immigration is adding to demand, especially in university towns and cities

The levels at which rents are increasing varies across different regions of the UK.

In London, a single renter now pays 40% of their pre-tax income on renting, while in the North East, that figure is closer to 19%

What can you do if your rent increases and you can’t afford the payments?

1. Talk to your landlord

Not all landlords are seeking to increase rents. If you have just moved in and are on a initial fixed term period the rent won't increase.

But if your landlord does ask to increase the rent and you’re worried you can’t afford to pay it, the best thing to do is have an honest and open conversation with them.

Have that conversation in person if you can, or on the telephone.

This subject is too important to discuss on email or via text messages, where sentiments can easily be misinterpreted or misunderstood.

See if you can find a compromise. And try to be understanding of each other.

It could be that your landlord is facing rising mortgage costs and is worried they may have to sell the property if they can’t cover those costs.

Most landlords would rather keep their tenants than risk the property being empty for a month or two, so if there’s a middle ground you can both reach it will be better for everyone.

In Scotland, unlike in England and Wales, the situation is slightly different as rent rises are capped until at least 30 September 2023.

Landlords cannot increase their tenants' rent by more than 3% of their current rent, unless they can prove that there has been an increase in certain costs.

2. Know your rights

For a periodic tenancy (a rolling weekly or monthly contract), your landlord cannot increase your rent by more than once a year without your prior agreement.

For a fixed-term tenancy, your landlord can only increase your rent if you agree.

If you don’t agree, the rent can only be increased when your fixed term ends.

3. Consider moving to a more affordable area

Rents are charged at vastly different rates across the UK. Could you consider moving to a cheaper area, or a smaller property, where the rent might be more affordable?

4. Consider becoming a first-time buyer

Saving for a deposit is the biggest hurdle many renters face when trying to step onto the property ladder

But 100% mortgages are now available for tenants with a strong track record of rental payments who can show they can afford a mortgage.

The new 5-year fixed rate mortgage comes at an interest rate of 5.49% over a maximum term of 35 years.

Discover more in 100% no-deposit mortgages back!

The 95% mortgage guarantee scheme is also running until the end of this year, meaning you don’t need to save up quite so much for a deposit.

How do you secure a rental property when so many people are competing for it?

1. Try to be the first one to view it if possible

If the first viewing is at 4pm, get there for 3.45pm.

2. Be ‘renter ready’

Have your ID with you and bring your proof of residency. (Landlords and agents are eventually going to ask for this, so if you have it with you, you’re already going up the list.)

3. Know what you can afford

Think about your finances and be realistic about what you can afford. The rule of thumb for affordability is that you generally need to earn 2.5 times the monthly rent.

So if the rent is £950 and you multiply that by 30, then you’ll need to earn £28,500 a year.

The credit check referencing companies want to know that you can afford the rent and still have enough money to be able to live. So don’t overstretch yourself.

What would a landlord look for in a perfect renter right now?

Having all your paperwork and documentation in place will help to speed the process up.

But really most landlords simply want someone who’s going to care for the property, be a good neighbour and be able to pay the rent.

Will the current situation in the rental market ease this year?

Unfortunately this is looking unlikely.

The chronic imbalance between the number of homes available for rent and the demand out there for them is likely to keep pushing rents higher across the whole of the UK.

And we’re about to enter the busiest time of the year for renting. In the summer, demand typically increases by 40%.

That said, there is only so much renters can afford to pay and we expect rental growth to slow towards 8% by the end of the year.

However, that is still above the rate of earnings growth, which is currently 6%.

The situation will only ease when there’s an increase in new investment from corporate and private landlords.

And right now, legislative changes and higher mortgage rates are putting the breaks on investment from the latter.

Key takeaways

- Have an honest conversation with your landlord or letting agent in person if you can, or on the telephone. Talking is better than emailing or messaging

- Know your rights as a renter, including how and when your landlord can increase your rent

- Consider moving to a more affordable area or smaller property

- Could now be the time to become a first-time buyer? 100% and 95% mortgages are available

What's the average first-time buyer deposit by region in 2023?

Discover the varying amounts being saved by first-time buyers across different regions in the UK to secure a home, ranging from £26,400 to £144,500. Explore the regional variations in savings required to purchase a property in the UK.

The average deposit paid by a UK first-time buyer for a 3-bed home in 2023 is £34,500 for a £240,000 home.

That amounts to a 15% deposit for the property.

However, the amount you need to save varies according to where you live in the UK and of course, the level of deposit you wish to pay.

100% mortgages are now available, meaning you don’t have to pay any deposit at all to buy a house.

The 95% mortgage scheme is also running until the end or 2023, meaning you only need to save a 5% deposit for the home you want to buy.

According to UK Finance, most first-time buyers try to put down a larger deposit for their first home - amounting to 24% of the total property price.

That’s because a bigger deposit opens up better mortgage rates from lenders.

To put a 24% deposit on a £240,000 property, you would need to save £57,600.

Let’s take a look at how much first-time buyers are paying to step onto the property ladder across the UK.

We’ve used our data to calculate the average property prices for first-time buyers in each region, based on sold house prices.

UK Finance have provided the information on the average deposit paid by first-time buyers within each region.

And we’ve also shown how much a 15% deposit would be for each regional property value.

From the most expensive areas to the cheapest, these are the average deposits paid by first-time buyers in 2023.

Average first-time buyer deposits paid across the UK

| Region | Average first-time buyer property price | Average deposit | 15% deposit |

|---|---|---|---|

| UK | £240,000 | £34,500 | £34,500 |

| London | £425,000 | £144,500 | £63,750 |

| South East | £300,000 | £72,000 | £45,000 |

| East England | £300,000 | £72,000 | £45,000 |

| South West | £220,000 | £52,800 | £33,000 |

| East Midlands | £190,000 | £45,600 | £28,500 |

| West Midlands | £190,000 | £45,600 | £28,500 |

| North West | £150,000 | £36,000 | £22,500 |

| Wales | £150,000 | £36,000 | £22,500 |

| Yorkshire & The Humber | £140,000 | £33,600 | £21,000 |

| Scotland | £135,000 | £32,400 | £20,250 |

| Northern Ireland | £130,000 | £31,200 | £19,500 |

| North East | £110,000 | £26,400 | £16,500 |

Zoopla

Working from home to help keep property affordable

According to a prominent economist at the Office for Budget Responsibility, it is anticipated that affordable rural areas will experience higher growth in house prices, while city centers are expected to witness a slower rate of growth.

The rise of remote working is anticipated to have a positive impact on the affordability of house prices for first-time buyers in the coming years. The Office for Budget Responsibility predicts a decline in house prices from their peak in the fourth quarter of 2022, followed by a recovery in the second quarter of 2024. Projections indicate that by the end of 2025, house prices will experience a year-on-year increase of 2.8%, with further uplifts of 3.6% in both 2026 and 2027.

Remote working, which gained momentum during the pandemic, is expected to bring about permanent changes in the housing market by allowing individuals to relocate from cities and opt for a countryside lifestyle. According to David Miles, a leading economist at the Office for Budget Responsibility, this shift will lead to an upward pressure on property values in rural areas, while house price growth in city centers and London is anticipated to slow down.

Why is this happening?

The Covid-19 pandemic has brought about lasting transformations in people's work habits, with a significant number of individuals now being granted the option to work remotely, either partially or entirely.

Traditionally, cities experienced more pronounced increases in house prices compared to rural areas, primarily due to a disparity between supply and demand driven by employees seeking residences within convenient commuting distance of their workplaces.

However, the ability to work from home has mitigated this imbalance, resulting in increased demand for homes in rural areas. As a result, house price growth in these countryside locations is expected to be higher, reflecting the shift in demand.

Who does it affect?

The trend is good news for first-time buyers. Earnings growth has failed to keep pace with house price rises for much of the past decade, making property increasingly unaffordable for those trying to get on to the housing ladder.

Slower house price growth not only gives earnings a chance to catch up, but it also means first-time buyers will not face the race to put together a deposit before they get priced out of the market.

The situation is also positive for those living outside of city centres, as it suggests house price growth will be more evenly spread going forward.

This should make it easier for people to relocate from the countryside to towns and cities if they choose to, as well as move between different regions.

What’s the background?

House price growth has already slowed down compared with previous years due to the impact of higher mortgage rates and the rising cost-of-living on affordability.

Latest UK House Price Index found that buyer demand is currently below average in the Midlands, South East, South West and East of England, areas that have seen the highest house price rises in the past three years, which has impacted affordability.

Across the UK as a whole, house prices have edged down by 1.3% during the past six months, and are expected to remain broadly unchanged for the rest of the year.

Key takeaways:

• The housing market will undergo permanent changes due to the rise of remote working, allowing individuals to relocate from cities to rural areas.

• This shift is expected to result in higher price growth in rural areas, while cities may experience lower growth, leading to a more balanced market for homebuyers.

• According to the Office for Budget Responsibility, house prices are projected to decline from their peak in the fourth quarter of 2022 but rebound in the second quarter of 2024.

House prices hold steady for sellers

Housing market activity levels recover as falling mortgage rates and a strong labour market boost buyer confidence.

UK house prices have fallen 1.3% over the last 6 months but the rate of price falls has now slowed.

Activity levels are recovering and more sellers are coming into the market as falling mortgage rates and a strong labour market boost buyer confidence.

And we’re not seeing any evidence of a build-up of unsold homes.

The number of homes listed for more than 90 days in most areas is in line with the 5-year average.

So while new sellers will need to set their asking prices carefully if they are serious about moving, there’s no need for larger price falls to clear stock at this stage.

The best areas to sell a home right now

Sellers in the North East, Scotland and London are seeing above average activity, with sales levels 10% higher than the rest of the UK.

That’s because the North East and Scotland are both more affordable markets.

And while London isn’t (homes in the capital cost twice as much as those in the rest of the UK on average), its affordability has improved over the last 7 years as prices failed to rise inline with the rest of the UK.

What's happening with house prices?

In fact, house price inflation in London is currently at -0.2% year-on-year.

That means homes are now better value for would-be buyers in the capital, especially those looking to buy flats, since their values haven’t risen since 2016.

Increased migration into the UK is also likely to be supporting above-average demand and sales rates here.

However, it’s a different picture in the South and Midlands, where house prices shot up over the last 3 years. Here demand remains below average.

That’s because higher prices, combined with higher mortgage rates and the cost of living, have taken more buyers out of the market in these areas.

That said, there are still active buyers in these markets, shown by above-average sales, albeit at a lower level.

Higher mortgage rates push landlords to sell-up

Some landlords are looking to sell their properties in the face of higher mortgage rates, which is also adding to the supply of homes for sale.

Some 1 in 10 (11%) of homes listed for sale were previously rented out, a level that peaked at 14% in 2020 and which has drifted lower over the last 3 years.

Ex-rental homes have an asking price that is 25% lower than previously owned homes (£190,000 v £250,000), which makes them appealing to first-time buyers.

What should I do if I’m planning to sell my home this year?

While more sales are being agreed, sellers must remain realistic on pricing to attract buyer interest.

Some 18% of homes currently listed for sale on Zoopla have had their asking price reduced by 5% or more, compared to 28% in February.

Price reductions typically come 8 weeks after a property is first listed, as sellers try to boost interest from buyers.

What’s going to happen to the housing market in the second half of this year?

While demand is down due to rising mortgage rates, lending regulations have helped to temper the impact this has on house prices.

That said, we do expect prices to continue to drift lower throughout 2023.

The increased likelihood of further interest rate rises, meaning higher mortgage rates, is likely to weaken demand and activity in the second half of 2023.

Rising mortgage rates reduce buying power and demand for homes, leading to a downward pressure on house prices.

And the number of home sales taking place in 2023 are on track to be 20% lower than last year.

Key takeaways

- Rate of house price falls slows as buyer confidence returns

- Sellers need to set asking prices carefully but no need for larger reductions

- Sales in the North East, Scotland and London are going well with activity levels 10% higher than the rest of the UK

New credit scoring to help first-time buyers get a mortgage

Leeds Building Society has teamed up with Experian to incorporate regular direct debit payments into credit scores for first-time buyers.

Leeds Building Society is taking a new approach to credit scoring to help more first-time buyers get a mortgage and buy a home.

The building society has joined forces with credit reference agency Experian. They’ll allow first-time buyers applying for a mortgage to prove their financial track record with a wider range of payments.

Traditionally, credit scores only incorporate repayments for debt, such as credit cards, mortgages or loans.

But Leeds will now consider other regular direct debits during the past 12 months. They’ll include payments for council tax, subscriptions and even Netflix or Spotify.

Richard Fearon, chief executive at Leeds Building Society, said: “We’re proud to be the first mortgage lender in the UK to make it easier for aspiring homeowners by incorporating free ‘boosted’ credit scores.”

Leeds offers mortgages that require only a 5% deposit, with rates starting at 4.94% for a five-year fixed rate deal with a £999 product fee.

How does the new credit scoring work for first-time buyer mortgages?

Leeds Building Society will incorporate information from Experian’s free Experian Boost service. This will show you have kept up with regular payments.

The service uses Open Banking to look at payments made through your current account.

The Open Banking initiative allows you to share your banking data with third parties that are regulated by the Financial Conduct Authority through secure connections. The data cannot be shared without your explicit consent.

While Experian Boost is free for consumers to use, Leeds is the first mortgage lender to use it for lending decisions.

How many first-time buyers will be helped by this credit-scoring approach for mortgages?

Testing for the new approach found that 7.5% of applicants improved their credit score through using Experian Boost.

For some first-time buyers, this could be the difference between qualifying for a mortgage and not qualifying for one.

Leeds believes Experian Boost is particularly helpful for younger borrowers, first-time buyers, and those on lower incomes, who typically face the toughest challenges in proving they are credit-worthy.

Fearton said: “Often through no fault of their own, these groups can struggle to build a good credit score because they need to spend most of their earnings on rent and other regular payments. Indeed, the vast majority of existing Boost users are renters.”

How is your credit score worked out?

Credit reference agencies like Experian collect information about you from registers, lenders and other service providers.

Lots of factors impact your credit score, including credit applications, the amount you’ve borrowed and missed or late payments.

What is a good credit score?

Most credit agencies in the UK use a points system to determine your credit score.

This usually ranges from 0 - which is the lowest possible credit score - to 999 or 1000, which is the best credit score.

With Experian for example, a good credit score is anything above 721, while scores above 961 are deemed ‘excellent’.

What credit score do you need for a mortgage?

In general, the higher your credit score, the better your chances of getting a mortgage.

Lenders will take your score into account to decide how risky it is to lend to you.

So if you’ve shown you can pay all your bills on time, they deem you safer to lend to. This can mean they offer you a lower interest rate.

However, lenders also look at other things like affordability, income and account history to decide if you’re eligible for a mortgage.

In some cases, you can still get a mortgage if you have a bad credit score.

Each mortgage lender considers different scores to be ‘bad’. How much you owe and whether you’ve repaid debts can also make a difference.

What other initiatives can help first-time buyers get on the property ladder?

The Leeds Building Society initiative comes as Skipton Building Society has launched the first 100% mortgage to be offered since 2008.

The mortgage enables first-time buyers to purchase a property without a deposit and without a guarantor.

Instead, borrowers must provide evidence they have paid their rent on time for the past 12 months, as well as meeting the lender’s credit score and affordability criteria.

Another innovative scheme that was launched earlier this year to help first-time buyers is the Save to Buy initiative.

Offered by housebuilder Fairview New Homes, Save to Buy enables first-time buyers to move into their home and pay ‘rent’ at a fixed cost for between six months and two years. The money is set aside until it is enough to use as a deposit to qualify for a mortgage.

Key takeaways

- Leeds Build Society will enable first-time buyers to use a wider range of payments as proof of their financial record when they apply for a mortgage

- It will include regular direct debits made during the past 12 months, including payments for council tax, subscriptions and even Netflix or Spotify

- Testing found the new approach improved the credit score for 7.5% of mortgage applicants