The first full week back after the new year has seen buyer interest jump out of the blocks faster than last year as mortgage rates drop. Get the latest with Richard Donnell.

The start of 2024 has seen a slew of more positive news on the housing market.

Over the last month, we’ve seen further signs that house price falls are slowing, alongside a further drop in average mortgage rates for new borrowers with some very competitive deals at 60% loan to value.

This reflects what we reported in our most recent house price index: a 17% increase in new sales agreed as buyers sought to lock down new deals at the end of 2023.

This improvement in market activity looks to be rolling over into the start of 2024, driven by improving mortgage rates.

London and South East lead fast start to 2024

The first full week back after the new year has seen buyer interest jump out of the blocks faster than last year and the pre-pandemic period in 2019.

It’s early days but our data shows demand at the end of the first week of January was more than 10% ahead of the same period a year ago.

Demand has jumped most in London and the South East, where house price gains over recent years have been much lower than the rest of the UK, which has helped improve housing affordability.

Modest house price falls over 2023

Our UK house price index shows that prices are 1.1% lower than a year ago, with signs that the scale of price falls is slowing.

Sales volumes are now starting to improve with buyers returning to the market.

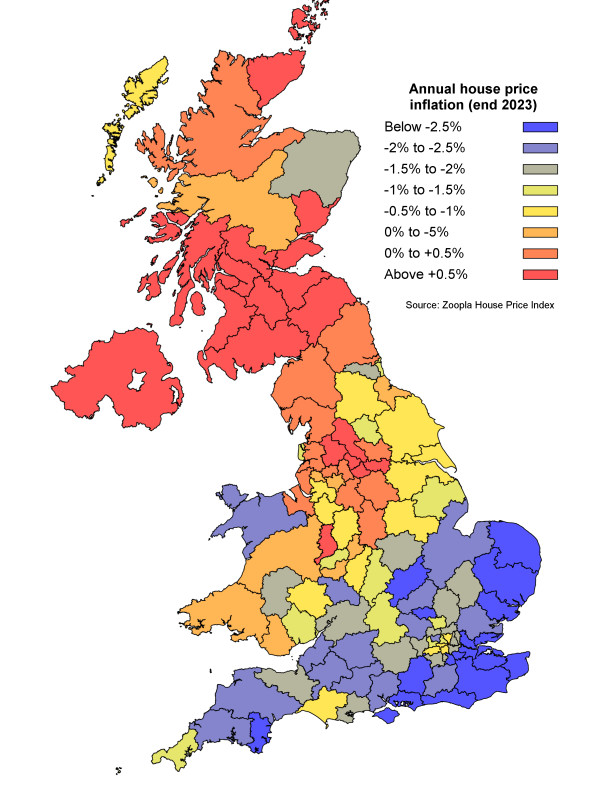

While the Zoopla house price index has recorded a modest fall in UK house prices over the last 12 months, the profile of price changes varies widely across the UK.

The largest price falls are up to 4% and concentrated across southern England in markets which saw the greatest demand over the pandemic, including those in the East of England and Kent.

Prices are also falling in areas where there has been strong demand for second homes, such as North Wales and the South West.

In contrast, house price inflation remains positive in many areas across northern England and Scotland. The rate of price gains has slowed quickly from double digit growth at the end of 2022 to close to 0% now but prices aren’t falling everywhere.

The greatest downward pressure on prices has been in southern England, where higher house prices mean a greater impact from higher mortgage rates.

This is where sellers are having to accept larger discounts to the asking price to achieve a sale, averaging around 6%.

While house prices are highest in London, they aren’t leading the fall. That’s because the London market has lagged behind the rest of the country in terms of price growth over the last 6 years, making homes slightly less expensive and more accessible to buyers.

Annual house price inflation by postcode area November 2023

Nearly all homeowners are sitting on gains vs the start of the pandemic

House price falls have been modest, despite higher mortgage rates, because of the mortgage regulations introduced in 2015 by the Bank of England.

These regulations stopped the development of a bubble in house prices and are a key reason why price falls have been small over 2023.

The net result is that most areas have house prices still well above the levels they were before the pandemic hit the market, which created a boom in demand for housing.

The average UK home is now worth 18% (or £41,000) more than it was at the start of the pandemic in March 2020.

The map below shows the difference in house prices between March 2020 and November 2023.

It shows that the Northern regions, Wales and the South West are where house prices pushed highest during the pandemic – and that average prices in these regions are still over 24% higher than their pre pandemic levels.

Price gains have been more modest in and around London, where affordability pressures and mortgage regulations have limited the scope for price gains.

So for those looking to sell and move in 2024, the vast majority of homeowners are sitting on price gains compared to the pre-pandemic period.

It’s a much better position than many people predicted we would be in a year ago, although not us however.

House price growth since the start of the pandemic March 2020

What does this mean for buyers and sellers?

We certainly expect news of lower mortgage rates to boost buyer demand and bring more interest into the market over the coming months.

Buyers understand that there is more room to negotiate on pricing with sellers but many will also still need to sell a home to unlock their next move.

Sellers will need to remain realistic over the value they expect to achieve from their property and be prepared to negotiate on price.

We saw a steady reduction in asking prices over 2023, as sellers worked with their estate agents to get the pricing right to attract demand and increase the chances of securing a sale.

Much depends on the type of property you’re selling and its location, so it’s essential to speak to your local agent to get a view of demand for a home like yours in the current market.

Key takeaways

- The number of buyers out home hunting has shot up 10% compared to this time last year

- House price falls are starting to slow as sales agreed rise by 17%

- The average UK home is worth 18% (or £41,000) more than it was in March 2020

- Mortgage rates drop further with some very competitive rates for borrowers with a 60% LTV