The rate at which rents are rising is at a 13-year high, while demand soared by 76% in the New Year. Get the latest with our Rental Market Report.

The average cost of renting a home is close to £1,000 a month, as soaring demand pushes prices higher.

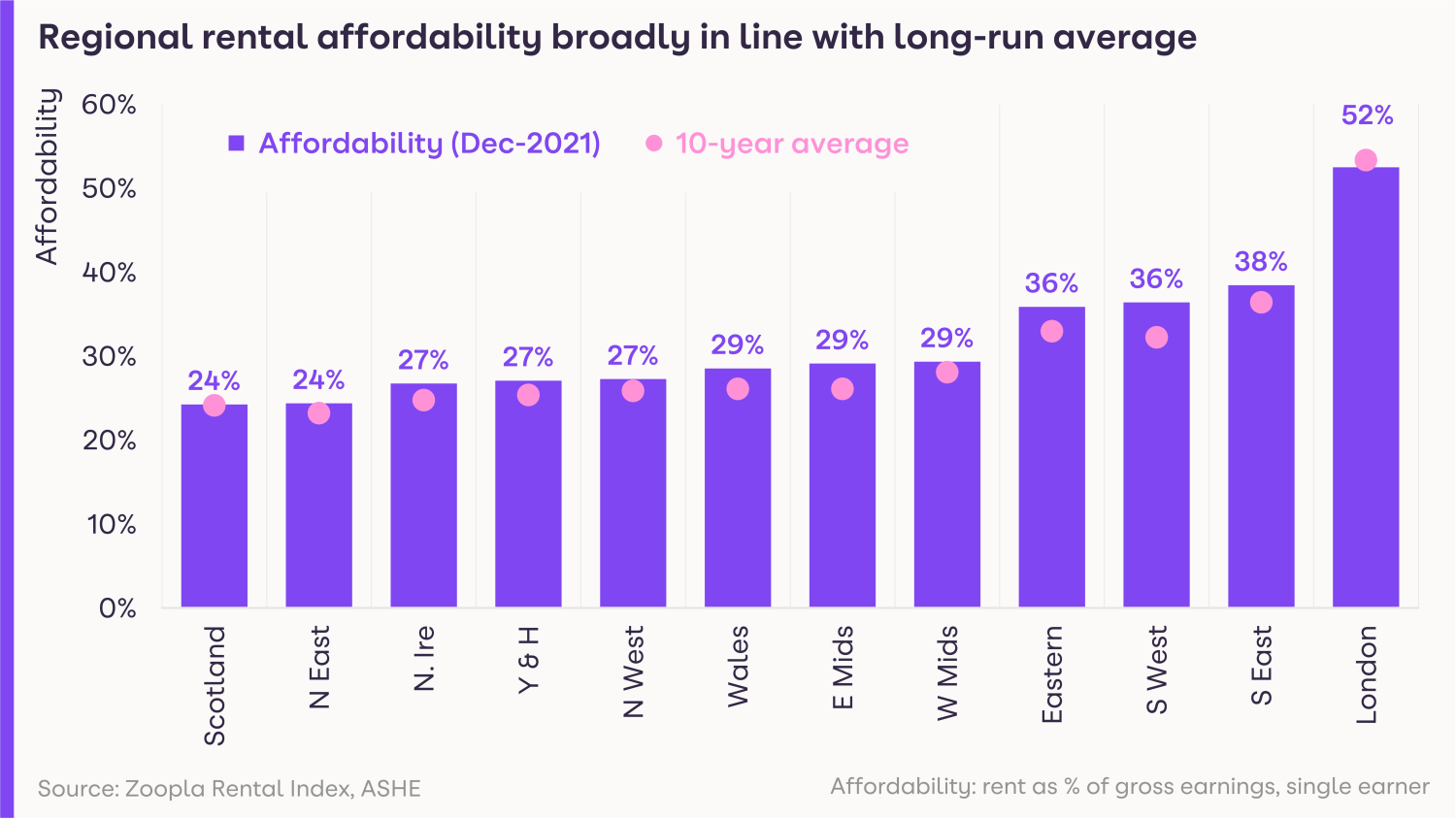

But despite the jump in the cost, rents account for an average of 37% of a single earner’s pay before tax, which is broadly in line with the 10-year average of 36%.

Renters are now paying £969 per month across the UK.

That’s £62 a month more than at the beginning of the pandemic, according to our latest Rental Market Report.

What’s happening to rents?

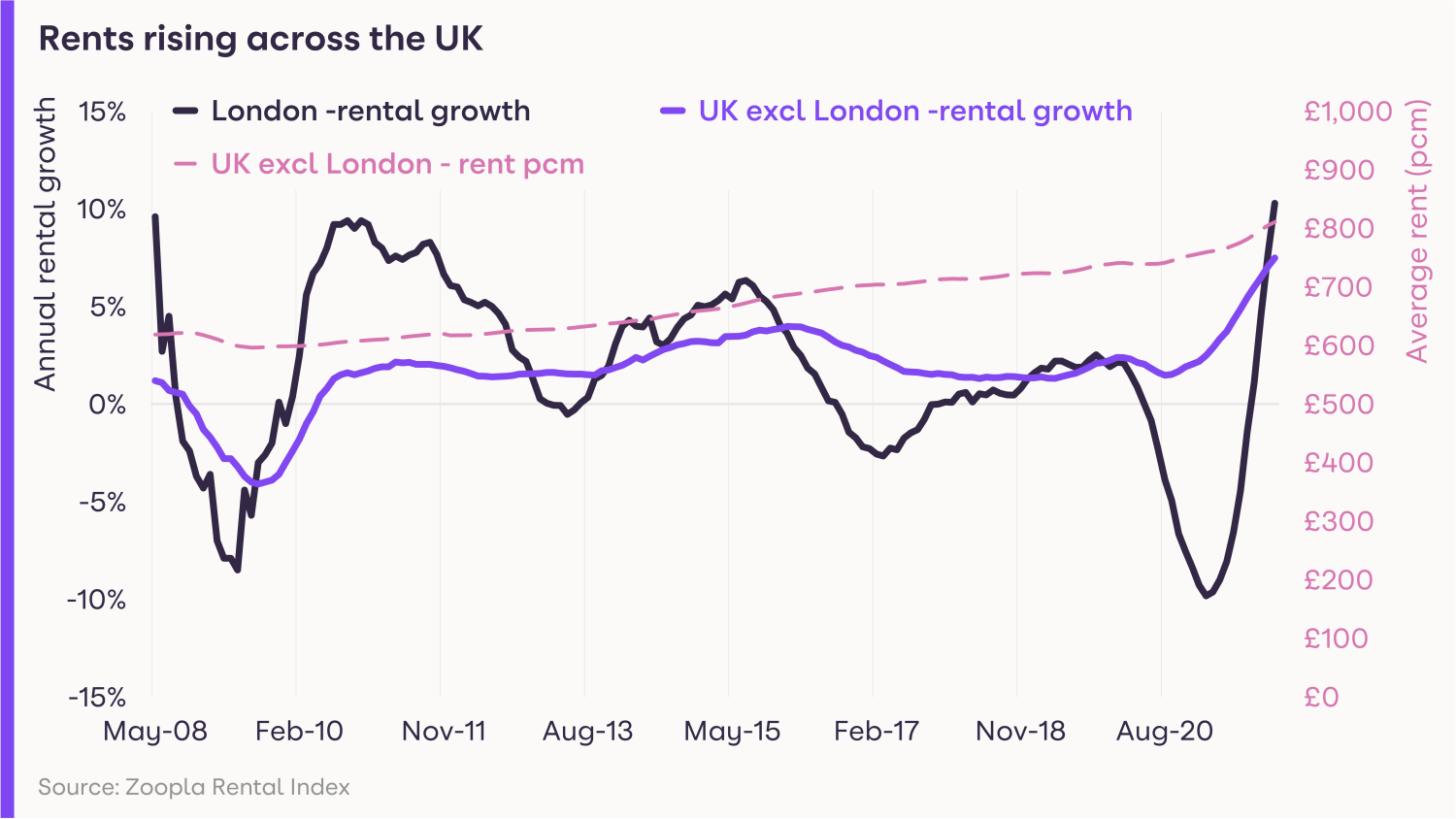

The rate at which rents are rising reached a 13-year high of 8.3% in the final three months of 2021.

The average annual rent for those agreeing a new let is now £744 higher than pre-pandemic levels.

Even so, rents are only 12% higher than they were five years ago, after they fell in some areas during the early stages of the pandemic.

Rents have risen in every region of the UK during the past year, with London seeing the strongest growth of 10.3%, while increases were weakest in Scotland at 4.8%.

However, because rents fell in the capital during the pandemic, they are now only £18 a month more than they were in March 2020.

What’s demand for rental homes like?

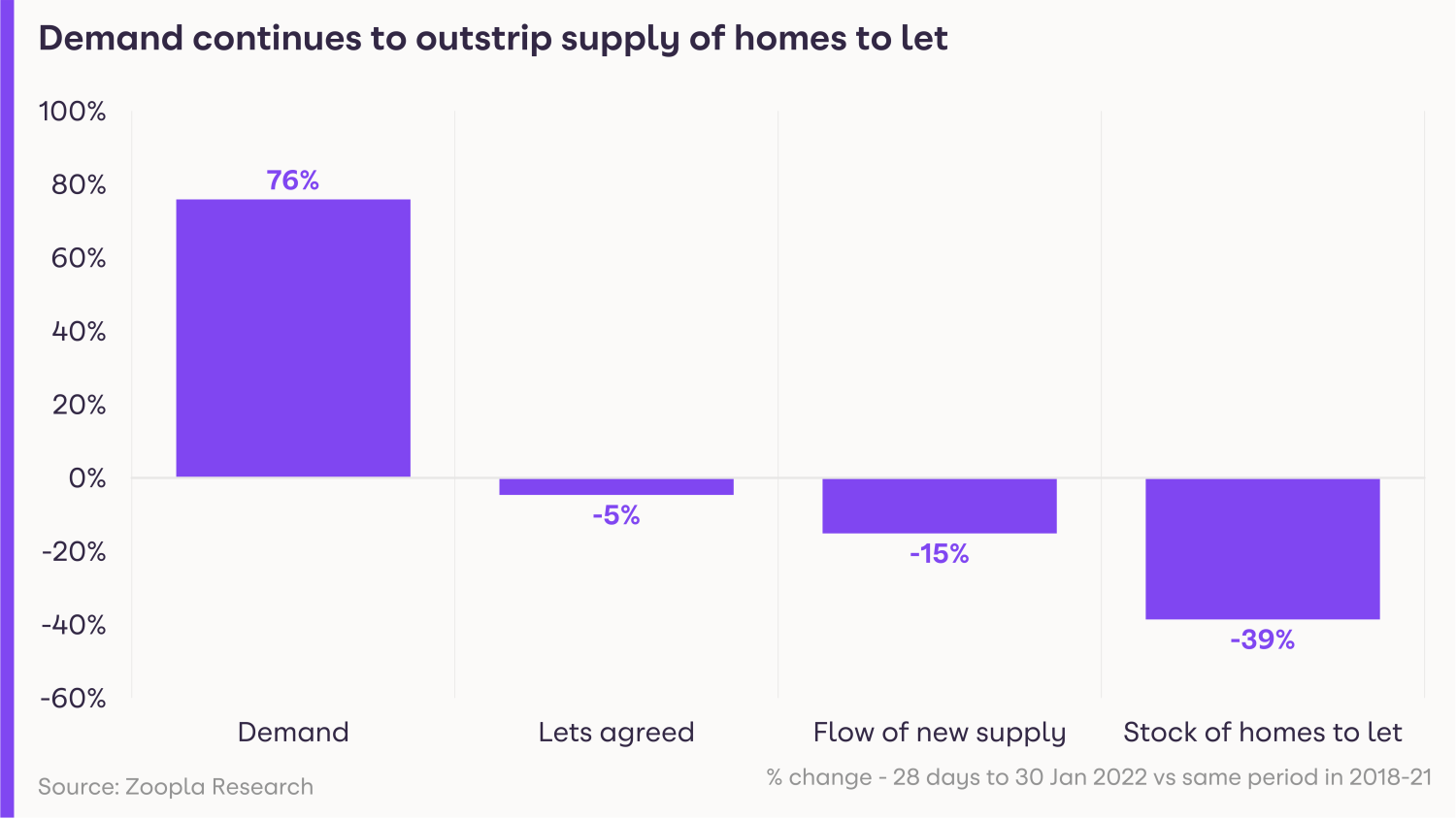

The New Year has seen soaring demand for rental homes, with the number of people looking for a property 76% higher than during the same period between 2018 and 2021.

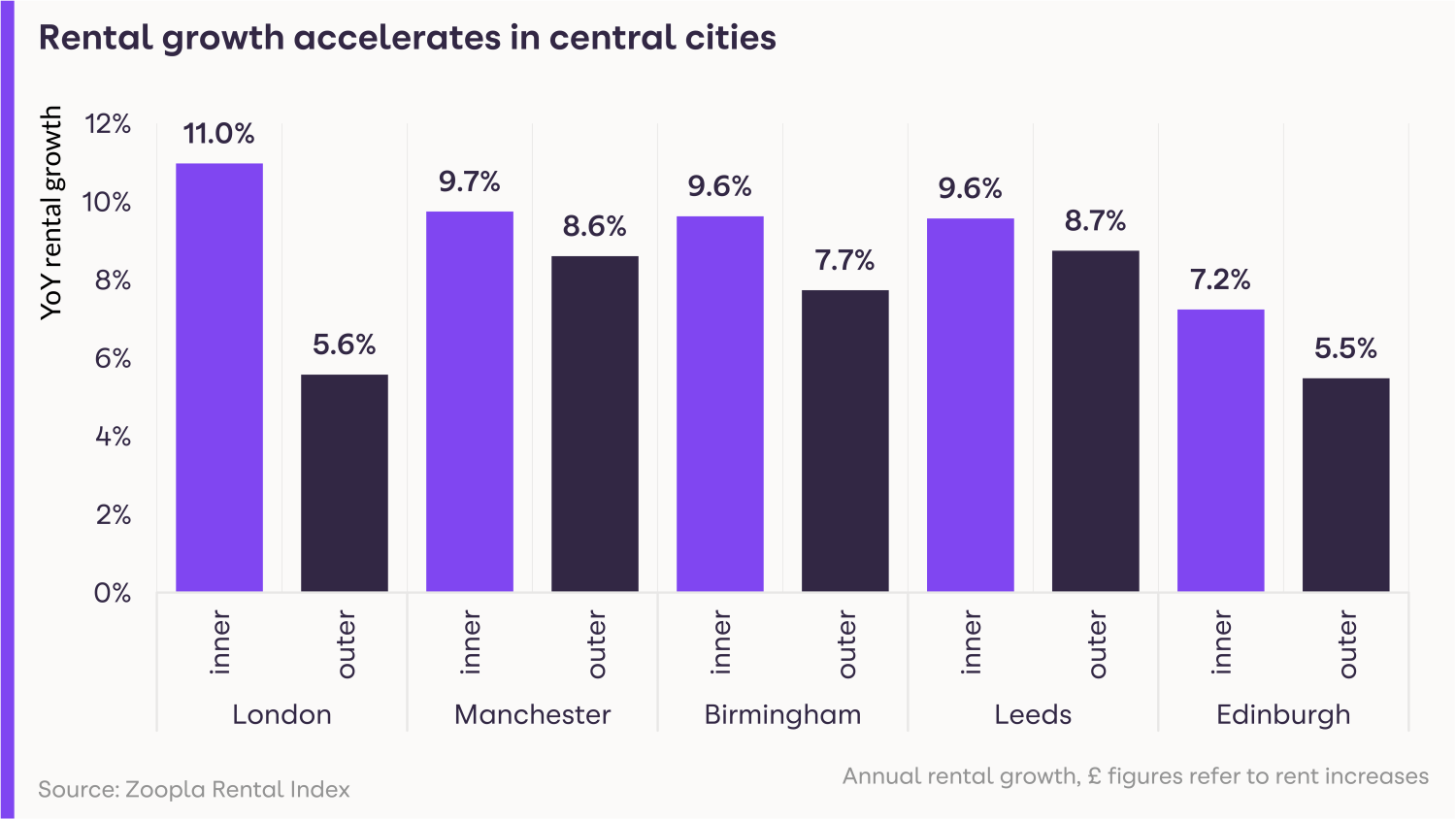

While the pandemic saw increased interest in wider commuter zones as renters also embraced the ‘search for space’, people are now returning to the centres of major cities, such as London, Manchester, Birmingham, Leeds and Edinburgh.

Is there a good supply of homes available to rent?

Unfortunately, the heightened demand in the rental market is not being matched by an increase in supply.

In fact, the number of homes available in January was 39% lower than is typical for the start of the year.

The imbalance between supply and demand is creating a fast-moving rental market with intense competition, pushing the cost of renting higher.

Meanwhile, homes are taking an average of just 14 days to let, compared with three weeks in late 2020.

The shortage of available rental properties is due to a fall in investment in the sector by buy-to-let landlords.

At the same time, rising costs are leading to many renters staying where they are, further limiting the turnover of rental homes available.

What could this mean for you?

Tenants

The rental market is currently moving quickly and there is intense competition from other would-be renters.

As a result, you must be prepared to move fast in order to secure a property, particularly if you are looking in a city centre, where demand has bounced back.

Landlords

The strong demand for rental accommodation, combined with the shortage of availability, means there will be high demand for property and landlords are unlikely to experience many void periods.

For new entrants to the market, average yields are currently at 4.86% across the UK.

What’s the outlook?

The ongoing shortage of rental homes is expected to underpin modest rental growth in the coming months, particularly in city centres, although affordability constraints will act as a brake on larger rises.

Head of research said: “The January peak in rental demand will start to ease in the coming months, putting less severe pressure on supply, which will lead to more local market competition, and more modest rental increases.

“The flooding of rental demand back into city centres, thanks to office workers, students and international demand returning to cities, means the post-pandemic ‘recalibration’ of the rental market is well underway.”

Going forward, rents are expected to rise by 4.5% across the UK excluding London in 2022, and by 3.5% in the capital.

Key takeaways

- Based on new lets agreed, average UK rents are now £969 per month

- The rate at which rents are rising reached a 13-year high of 8.3% in the final three months of 2021

- Demand for rental homes soared by 76% in the New Year, compared with the same period between 2018 and 2021