How have home buyers reacted since the mini budget? And what should those who are moving – or considering a move – do now?

It’s been a frantic two weeks for the housing and mortgage markets.

Any active home mover or household looking to buy will have read the headlines around mortgage availability and pricing with a growing degree of consternation.

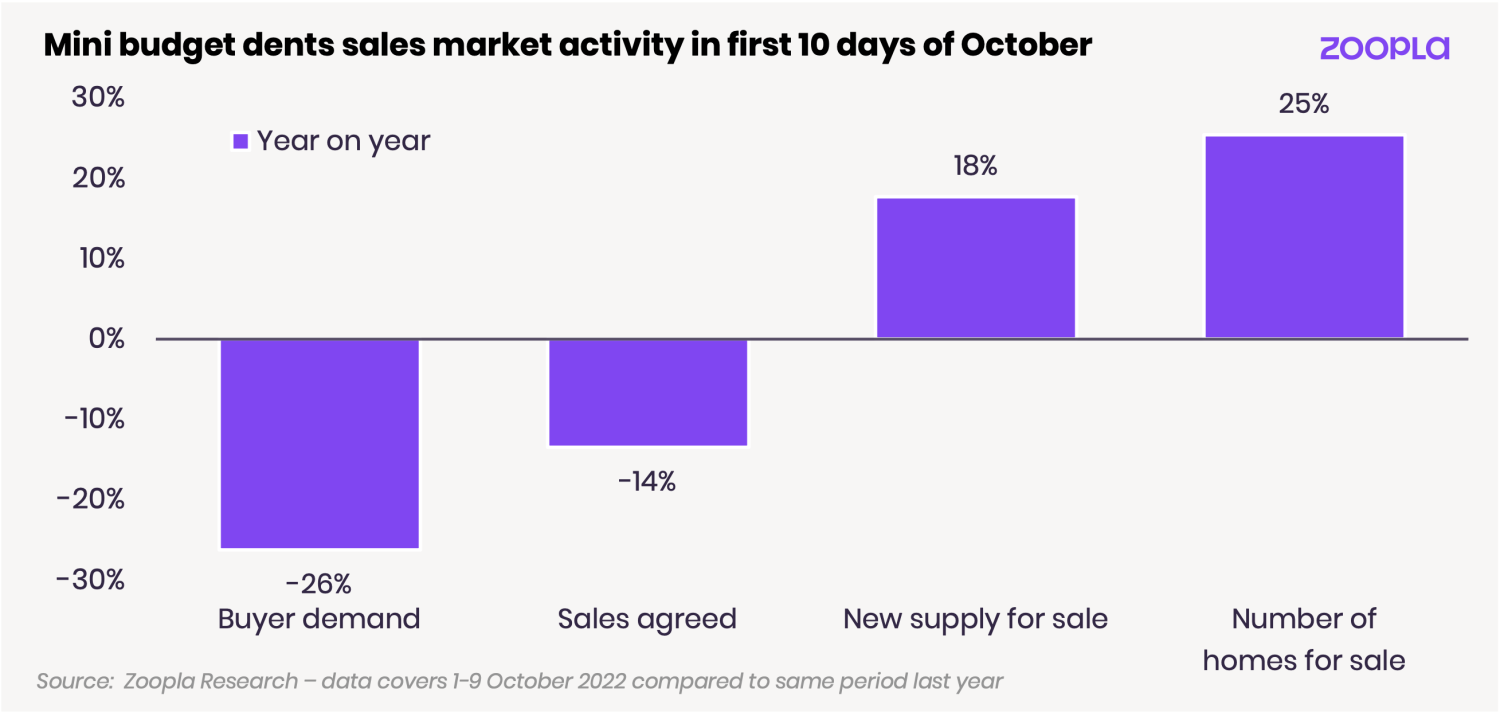

We have seen a drop in activity levels in the sales market, not precipitous, but a definite reaction from home buyers to increasing uncertainty and the disruption in the mortgage market.

The outlook for 2023 all depends on how quickly inflation is brought under control and financial markets getting more clarity on how the government will fund the recent tax cuts.

The longer mortgage rates stay at 6% or higher, the greater the impact on the housing market.

Sales market activity drops in wake of mini budget

Mortgage rates were set to rise to 4-5% over 2022 before the mini budget.

This, together with increases in the the cost of living, were starting to weaken demand for homes over the summer months.

The fall-out from the mini budget has effectively added an extra 1% to mortgage rates, which are now settling around the 6% mark.

This increase represents a 25-30% hit to the buying power of home buyers using a mortgage.

Rising mortgage rates set to reduce buying power by 28%

Widespread reporting of mortgages being pulled and the increase costs of mortgage payments have certainly dented market activity.

Buyer demand starts to fall

Buyer demand – enquiries about homes for sale on Zoopla – have dropped by over a fifth in the last two weeks.

Homeowners are continuing to express an interest in buying homes but increased uncertainty is putting some people off.

Demand for homes is now at the weakest level since the pandemic started, although still above 2019 levels.

The reduction in demand has been broadly uniform across all regions and countries of the United Kingdom, with Scotland holding up the best.

The number of new sales agreed has also dropped by 15% over the last week.

Buyers who have not locked in cheap mortgage deals, or those who are worried over the outlook are stepping back from the market.

However, those with cheap mortgage rates locked in below 4% will continue to seek out homes to buy.

The risk is that a growing chorus of predictions of national price falls will see more people stop actively looking for homes for the rest of this year, reducing demand and new sales.

Asking prices were being adjusted down over the summer in the face of higher borrowing costs and weaker demand.

The last two weeks have seen a spike in asking price reductions on homes for sale.

This is a seasonal trend as we start the autumn selling market, but nearly 8% of homes for sale registered a reduction in the asking price of more than 5% in the last month.

Will house prices fall this year, given the hit to demand?

This is unlikely. However, there is a likelihood that surveyors will start to down-value in the face of greater uncertainty and reports of deals falling through.

Some sellers may accept price reductions in order to get sales through to completion, which may be passed along buying chains and risk the chain progressing.

Those would-be sellers who need a certain sale price to unlock their next move will likely step back from the market in the short term and reconsider their position in early 2023.

We will need to see large downward moves in asking prices across the market before national measures of completed house price sales start to record price falls.

Measures of asking prices or valuations may move sooner.

The reality is that the rest of 2022 will be about closing out the pipeline of sales and minimising fall-throughs, rather than seeing a lot of homes come to the market for sale.

We will get a much clearer picture of pricing for new business from January 2023.

Will homeowners start experiencing negative equity?

There is a huge equity cushion to absorb any price falls. Home prices have jumped over the pandemic, with the cost of houses in Wales increasing by 27% over the last two years.

A nationwide 15% reduction in house prices from today’s levels would result in very few cases of negative equity for mortgaged sales up to the end of 2021.

This highlights how the housing market has become increasingly equity driven and is much less dependent on high loan to value (LTV) borrowing over 90%.

Winter 2022 will see a pause in activity as buyers look to refinance

The final three months of the year is not traditionally a strong period for new buyer activity in the sales market, accounting for less than a fifth of new buyer demand over the typical year.

We still expect continued demand from a smaller group of buyers who are committed to proceed.

Recent data from the Bank of England showed a surprising 17% increase in mortgage approvals in August as buyers looked to lock in deals ahead of higher mortgage rates.

Sellers and buyers need to be flexible and realistic given the shifting economic backdrop.

Estate agents and mortgage brokers will help those in the middle of home purchases to complete sales, minimising the fallout from fall-throughs and collapsing chains.

It’s not an easy task. But for committed movers with cheap mortgages, the desire to push ahead is likely to remain.

How can I keep my mortgage repayments down?

Banks are seeing strong demand from consumers on refinancing options in the face of £200-£500 monthly increases in mortgage repayments for a typical mortgage taken out 2 years ago.

The scale of this repayment shock can be reduced if borrowers and their lenders agree to extend the term of the mortgage a number of years.

This delivers a short term relief from higher repayments but at the cost of much bigger interest payments over the life of the loan.

That may not be an option for some with long mortgage terms, where extending may breach the age limits beyond which a mortgage can run. However, it will be one of many strategies banks and their customers consider and should keep arrears levels in check.

Keep watching the market and seeking advice

The outlook remains a balance of positives and negatives.

The importance of the home to households remains and pandemic and cost-of-living pressures will continue to stimulate home moves, probably from an older cohort of sellers.

Who will buy these homes and what they can afford will dictate the outturn for 2023. Some form of price correction is likely but the scale is far from clear and will vary by region and property type.

Buying a home is a long process lasting up to 9 or 12 months.

Existing homeowners wanting to move need to keep tracking their local market, the value of their home and considering the options for their next move.

It is a more challenging outlook for first-time buyers, who either live at home or rent before buying.

The cost of renting is rising fast, adding to affordability pressures, especially in southern England where prices are highest.

Many would-be buyers tend to focus on certain areas they know or have wanted to live in for years.

With higher mortgage rates hitting buying power, the key is looking more widely and considering other areas that might offer better value for money.

More working from home has opened up the options to look further afield.

Speaking to agents where you live today – and might want to move to tomorrow – early in the process is ever more important as households consider their next move.

Key takeaways

-

Demand for homes has fallen by a fifth since the mini budget

-

Homebuyers with cheap loans remain in the market and still want to complete on sales

-

The industry is focused on converting sales agreed into completions and minimising fall-throughs

-

To achieve a sale, sellers need to be realistic when pricing their homes