With mortgage rates set to hit 5% by the end of this year, which areas are going to be hit hardest and what can buyers do to combat rising rates?

The macro backdrop for the housing market has evolved rapidly over the summer

Central banks have increased interest rates to bring down inflation.

Rising energy prices are adding to the cost-of-living squeeze and UK consumer confidence has hit an all-time low.

The UK government has responded with tax cuts and an energy price cap to support housing demand.

But while changes to stamp duty will boost some segments, the recent spike in borrowing costs are set to push mortgage rates higher.

Most new loans are on fixed rates and the costs to secure financing for these mortgages does not directly follow base rates.

That said, costs for new mortgages have surged recently, and mortgage rates are on track to reach 5% by the end of this year and even higher.

That’s more than double the rates at the start of 2022.

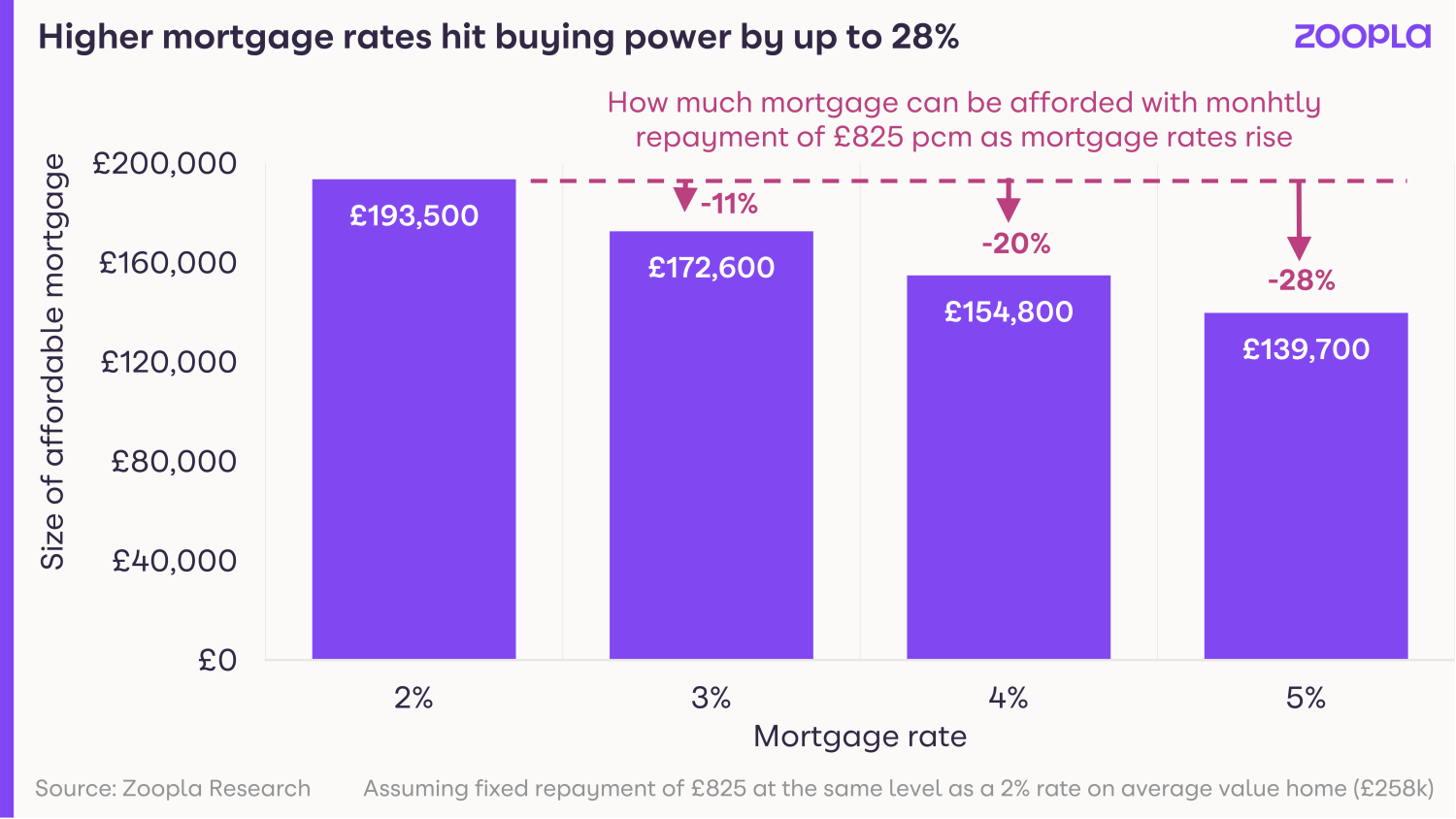

Our research shows that higher mortgage rates will reduce buying power by as much as 28% as rates rise from 2% to 5%.

That’s if buyers want to keep their monthly mortgage payments the same.

And the impact of this is likely to last into 2023.

Buyers now have four options to help combat rising mortgage rates

1: Put down larger deposits

2: Allocate more income to mortgage costs

3: Adjust their budgets by looking into smaller properties or cheaper areas

4: Wait on the sidelines until the outlook for borrowing costs becomes clearer.

Are we shifting to a buyers’ market as more homes are reduced in price?

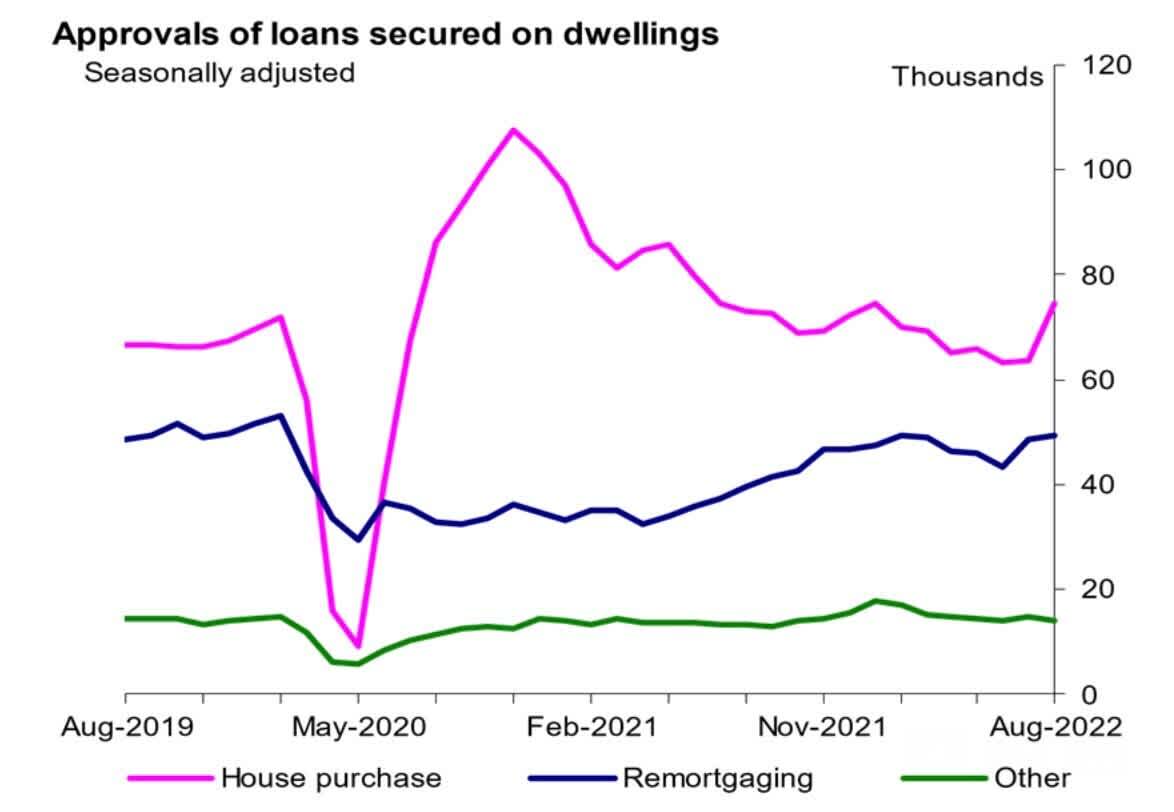

Mortgage approvals up 17% in August

Mortgage approvals for house purchases increased by 17% M/M, seasonally adjusted, to 74,300 in August, according to the Bank of England, showing the resilience of demand.

This is the highest level since January this year, where mortgage approvals hit 74,500, and above the 12-month pre-pandemic average up to February 2020 of 66,800.

The rise follows a downward trend over the previous several months, but suggests buyers and homeowners were getting ahead, ensuring they secured finance before rates rose.

On a non-seasonally adjusted basis, the Y/Y increase was 0.9%.

Areas with expensive homes and highest growth hit hardest

Rising mortgage rates are set to have the biggest impact on areas where homes are already at the higher end of the market, or where house prices have surged over the pandemic.

Pandemic house price boost adds to affordability troubles

The average UK home has risen by 8.2% – or £19,650 – in the last 12 months and although the quarterly growth rate is slowing, there are no immediate signs of a major slowdown in price inflation.

Looking ahead, higher mortgage rates will have the greatest impact on activity in these higher value markets and areas which have registered the greatest surge in prices over the the last two years.

Key takeaways

- Mortgage costs have surged recently, and mortgage rates are on track to reach 5% by the end of this year

- Buyers now have four options to combat rising mortgage rates:

- put down larger deposits

- allocate more income to mortgage costs

- adjust budgets by looking into smaller homes or cheaper areas

- wait until the outlook for borrowing costs becomes clearer

- Areas with more expensive homes are set to be hit hardest by the rising rates