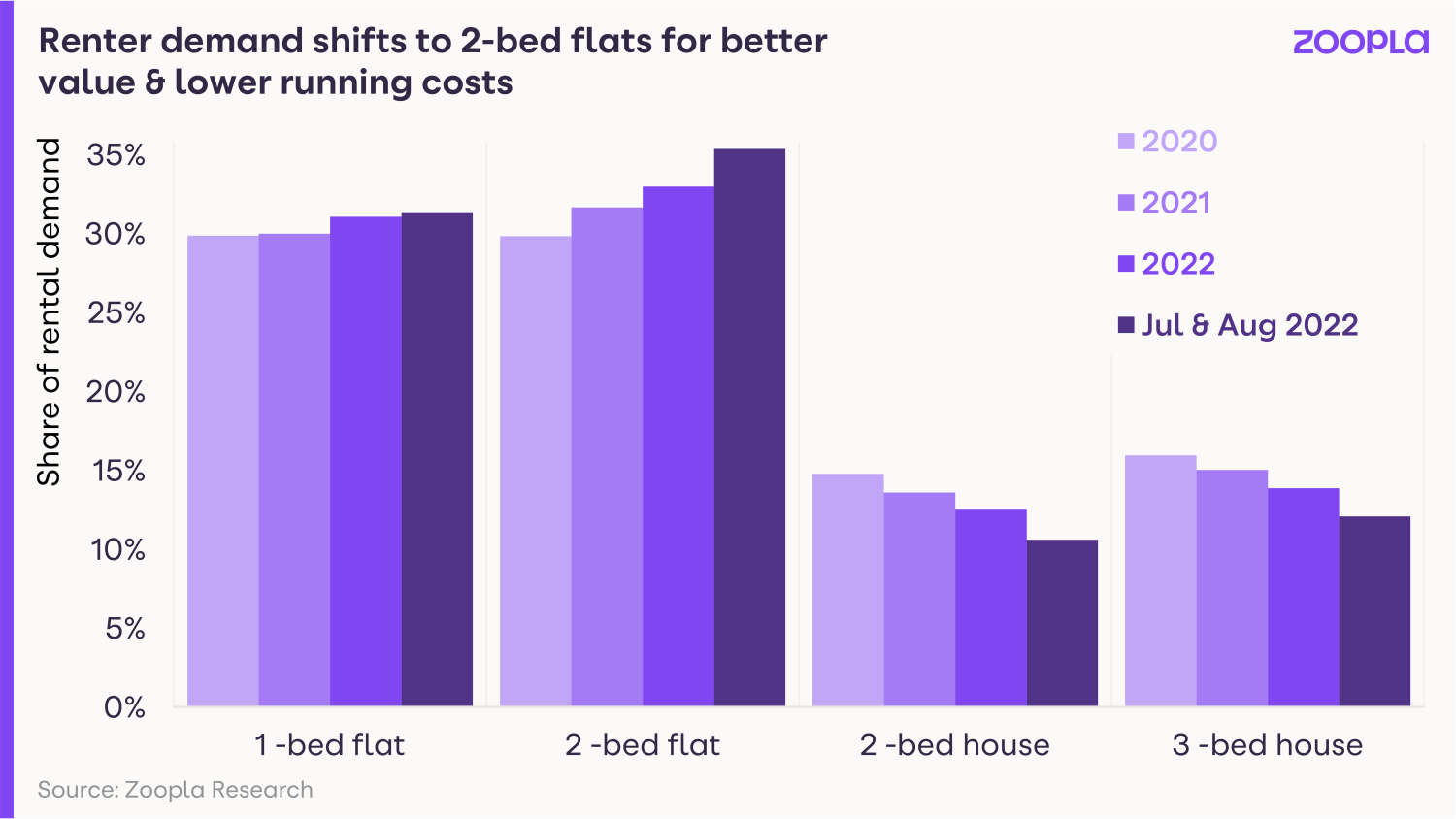

Demand for two-bed apartments on the up as renters try to combat rising rent and energy costs.

As the cost of living squeeze looms large, rising rents and energy bills are pushing renters to look for smaller homes in a bid to reduce outgoings.

Our latest data on rental demand shows that renters are shifting their focus from three-bed houses to two-bed flats. And that trend is growing.

With the gas needed to warm a purpose-built flat working out around 40% less than that needed to warm a three-bed family terraced home, or 25% less with a flat conversion, the savings are set to be substantial.

A one-bed home requires less than half the gas that’s needed for a three-bed home.

And D and E rated homes need 25% and 48% more gas to run compared to a C rated home.

The decline in the number of renters looking for two- and three-bed houses in the last year has been significant, as the pendulum of demand swings towards one- and two-bed flats.

And our data suggests the appeal of apartments and energy-efficient homes will only grow as we head into 2023.

The cost of renting is also having an impact on where renters are choosing to live.

Outside of London, the current difference in rents charged for a two-bed flat and a three-bed house is £105 per month.

This translates into £1260 per year in rent, so big savings can be made by moving into smaller apartments.

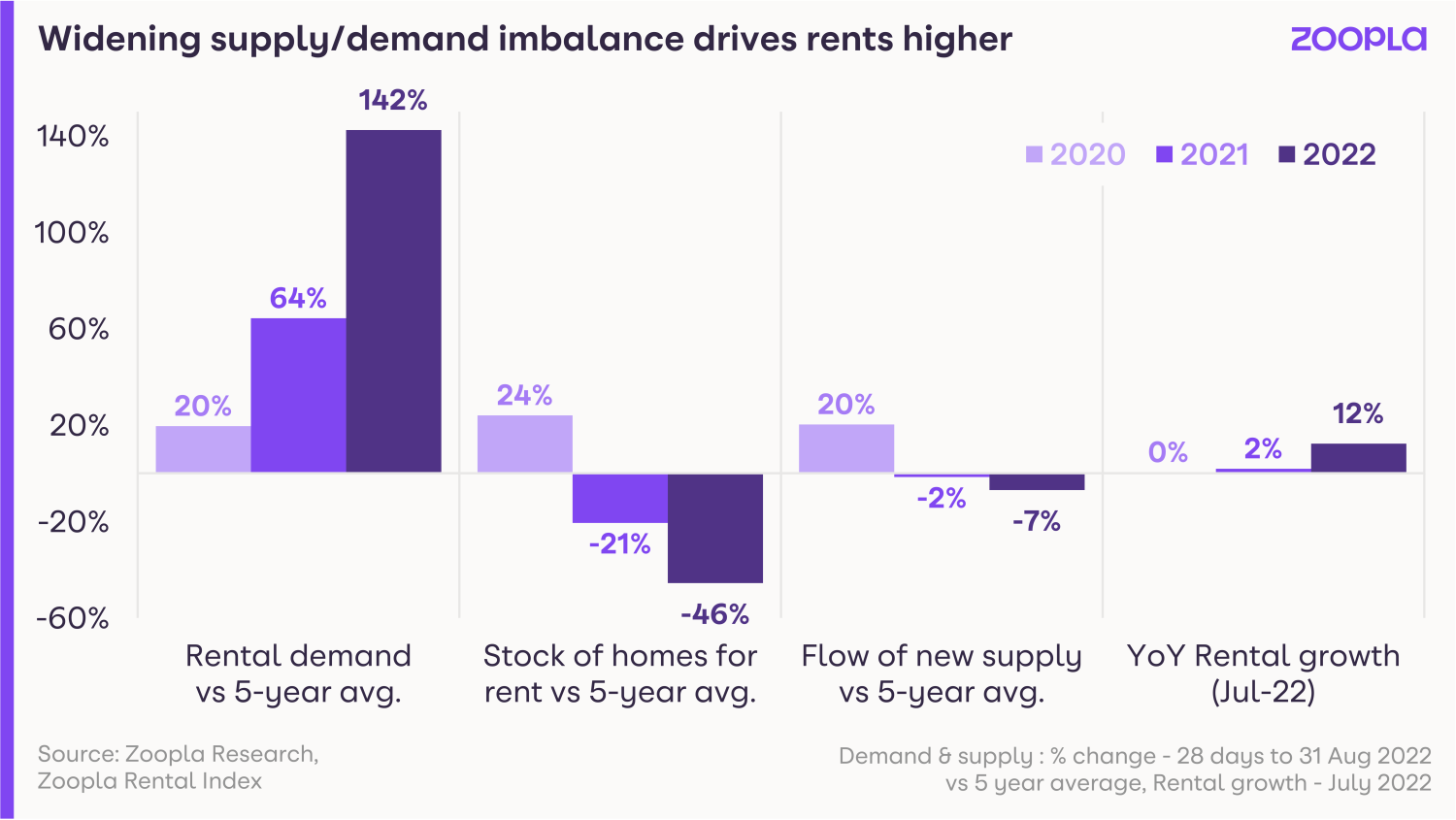

Yet conversely, despite all of these cost of living headwinds, a chronic undersupply of rental properties available on the market means rents will continue to grow at above average rates into 2023.

Massive supply shortage drives up rents

The average rent has gone up by £115 per month since September last year to £1,051 a month.

The rise is outpacing earnings growth across the country and basically boils down to a major shortage of available homes.

Right now, rental home stock levels are sitting at around half the numbers seen on the market in the past five years, so there’s a lot less choice out there for renters.

Many renters are also deciding to stay put with their current landlords to avoid future rent increases.

And from the landlords’ side, increasing taxes and regulations are causing many to sell up as letting a home becomes less affordable.

Hannah Gretton, Lettings Director at LSL’s Your Move and Reeds Rains brands says: “We are experiencing high levels of demand for rental properties with homes being snapped up within hours of hitting the market.

“With over 270 lettings branches nationwide, it’s a picture that is reflected up and down the country with particular demand in urban areas.

“On average, we are seeing double figures of enquiries per property with a one-bedroom property in Manchester last week receiving over 100 requests to view, highlighting just how busy our branches are and the challenges renters face when it comes to finding an appropriate property.”

Where are rents rising fastest?

The capital has long been the most expensive place to rent a home and rents here have gone up by 18% on average in the last year.

However, rents did fall by 10% in London during lockdown, so these rent rises are coming up from a low base.

When compared directly with pre-pandemic levels, rents are actually up 7.8% in London. But in the rest of the UK, they’ve risen by 13% on average.

Renters make a return to the cities

Strong employment growth in cities – and the growth in high quality, purpose built build-to-rent homes around the UK – is attracting renters into urban areas.

Energy efficient new-build homes are currently proving to be a big pull, and most new developments tend to be around city centres.

In fact, build-to-rent developments, featuring stylish apartments with luxury on-site facilities, are currently driving the growth of rental housing stock in the UK.

More cost-effective to heat, thanks to brand new energy-efficient boilers, double or triple glazing and low energy lighting, the appeal of new-build homes is growing fast.

However, fierce competition for homes is also leading rents to increase by 10.5% in urban areas, compared with 8.5% in the countryside.

How much higher can rents go?

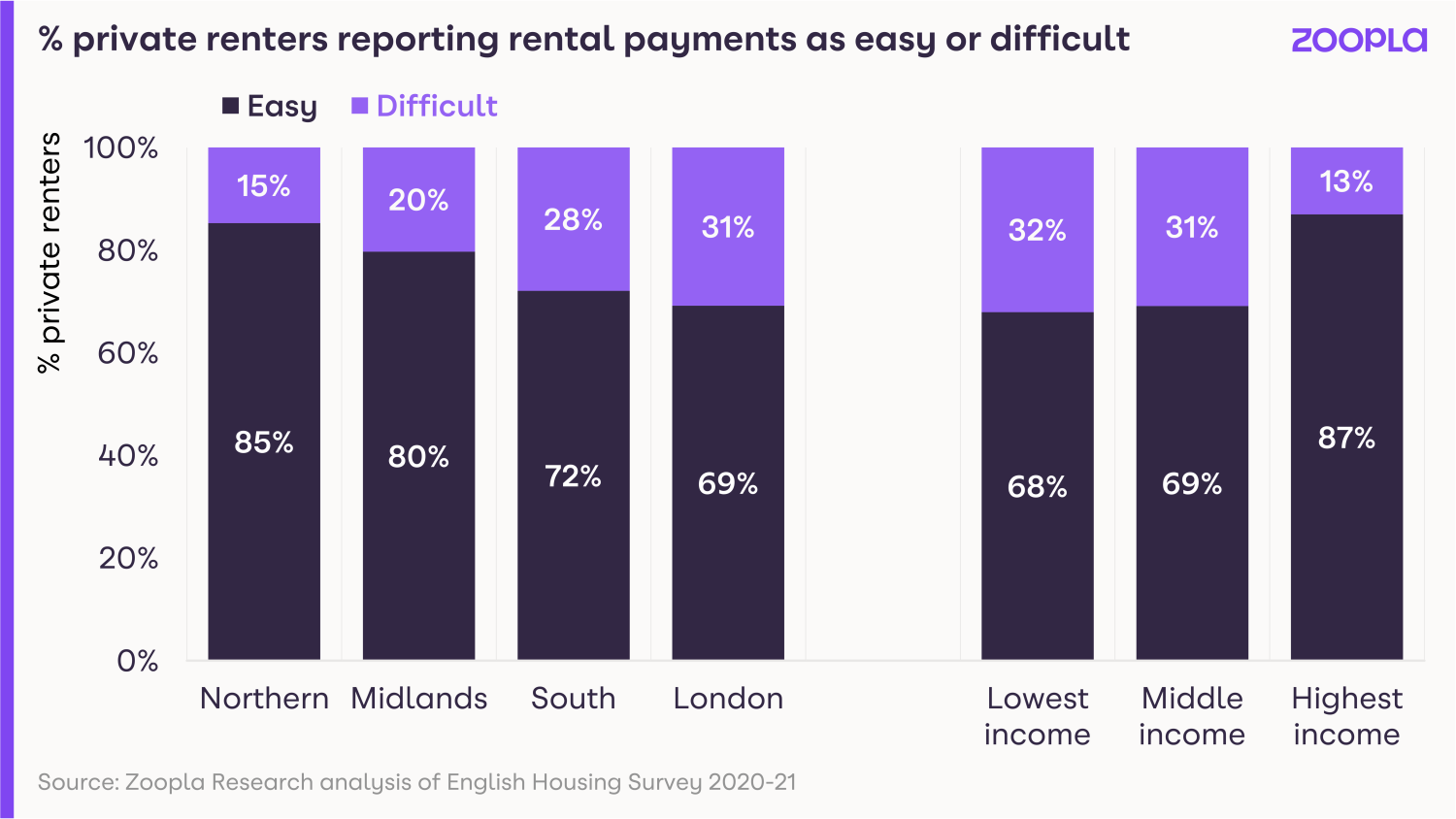

The private rental market caters for a range of households on low and high incomes, with a quarter of tenants receiving housing benefit.

And while rental affordability varies according to location and income, in the latest English Housing Survey from 2020 to 2021, three-quarters of private renters said they found rental payments very or fairly easy to meet.

Conversely 25% found them fairly or very difficult to pay.

In the North and the Midlands, where rents tend to be cheaper, more tenants found their rent easy to pay. However in the south, more tenants reported that their rent was difficult to pay.

The question of how much higher rents can go will depend on how much headroom renters have to pay more rent.

And while the pace of rent increases is beginning to plateau, our data on rental affordability suggests there is still further headroom for above-average growth in the less expensive areas of the UK.

Apartment rents rising faster at the top end of the market

Asking rents for two-bed flats are rising faster in the top 25% of the market, with growth lagging across the bottom 25% of the market (where demand is more price sensitive).

For three-bed houses, there is less of a difference, but in many regions, the asking rents in the more affordable segments are rising faster.

However, as rented family homes become less attainable, demand for two-bedroom apartments is climbing as renters seek homes that are better value for money.

Rents for non-movers rising at a much slower pace

The average renter moves every four years, so our data reflects rent prices on new lets for around 25% of the market.

However, the Office for National Statistics’ rental index shows rental increases across the board, for movers and non-movers.

It shows current rents across all rented homes are 3.7% higher than they were in July 2021.

However, those moving to a new rented property will find the cost of renting 12.3% higher – as rents for new lets are reflecting the current lack of supply amid high demand across the country.

What’s going to happen to rents in the rest of 2022 and into 2023?

There is no real prospect of a significantly improved rental supply in the near term, as private landlords continue to sell off homes and renters stay put for longer.

The imbalance in supply and demand is here to stay, and rents will continue to rise at above-average levels into 2023 across the more affordable markets.

There is headroom for some renters to pay more – especially outside London and the South East – where rents are already high.

We expect the headline rental growth to slow over the rest of 2022 and into 2023 – but it won’t happen quickly.

Executive Director says: “Rents have surged ahead over the last year but there are signs that the pace of growth is peaking and set to slow into 2023.

“Renters are responding and looking for smaller, better value for money homes to rent with an eye on energy costs as much as rental levels.

“What the rental market needs to combat these challenges is more new homes for rent.

“Greater regulation has discouraged some landlords from investing and more are exiting, meaning the rental market has stopped growing since 2016.

“There is a risk that more regulation to improve standards or potential new measures to dampen rental growth, as proposed in Scotland, may compound the supply problem which is pushing rents up in the first place.

Key takeaways

- Renters are choosing two-bed apartments over three-bed family homes to reduce outgoings as the cost of living rises

- Rents on new lets have gone up £115 per calendar month compared with this time last year, rising faster than wages

- In a market where demand is massively outstripping supply, rents are likely to keep going up into 2023