More properties come onto the market as homeowners look to make their next move and lock in recent house price gains. Demand for family houses remains strong.

Key takeaways

- The number of homes for sale increased in March but buyer demand remained unseasonably strong

- Now is a great time to sell your home, and if you have a family home to sell, it could get snapped up in record time

- House prices rose by 8.1% in the year to the end of February, making the average price for a home £245,200

- Higher mortgage rates and the rising cost of living are expected to slow the housing market in the coming months

The number of homes listed for sale increased in March as buyer demand remains unseasonably strong.

Estate agents reported a 3.5% rise in the level of stock they have on their books during the past month, according to our latest House Price Index.

The improvement in supply is being driven by existing homeowners looking to make their next move and lock in recent house price gains, with demand for family houses currently twice as high as is usual for this time of year.

Buyer activity is also being driven by the bounce back in demand for city and town centres that’s been growing since the beginning of 2022.

Thinking of selling your home? Let us put you in touch with an agent for a free valuation

But despite the increase in listings, there continues to be a mismatch between supply and demand, putting further upward pressure on house prices.

What’s happening to house prices?

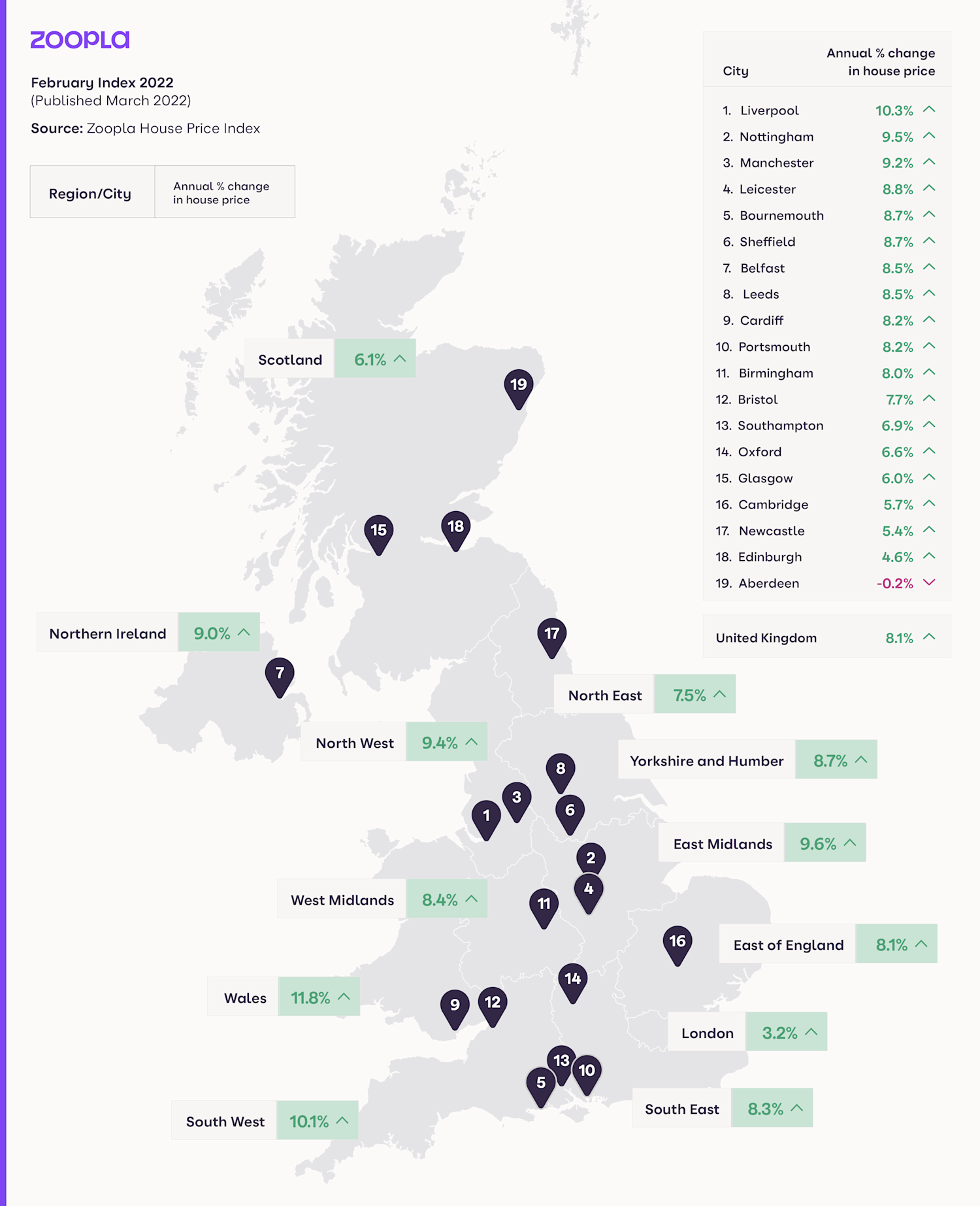

House prices rose by 8.1% in the year to the end of February, nearly double the annual rate of 4.2% recorded in February last year, meaning the average home now costs £245,200.

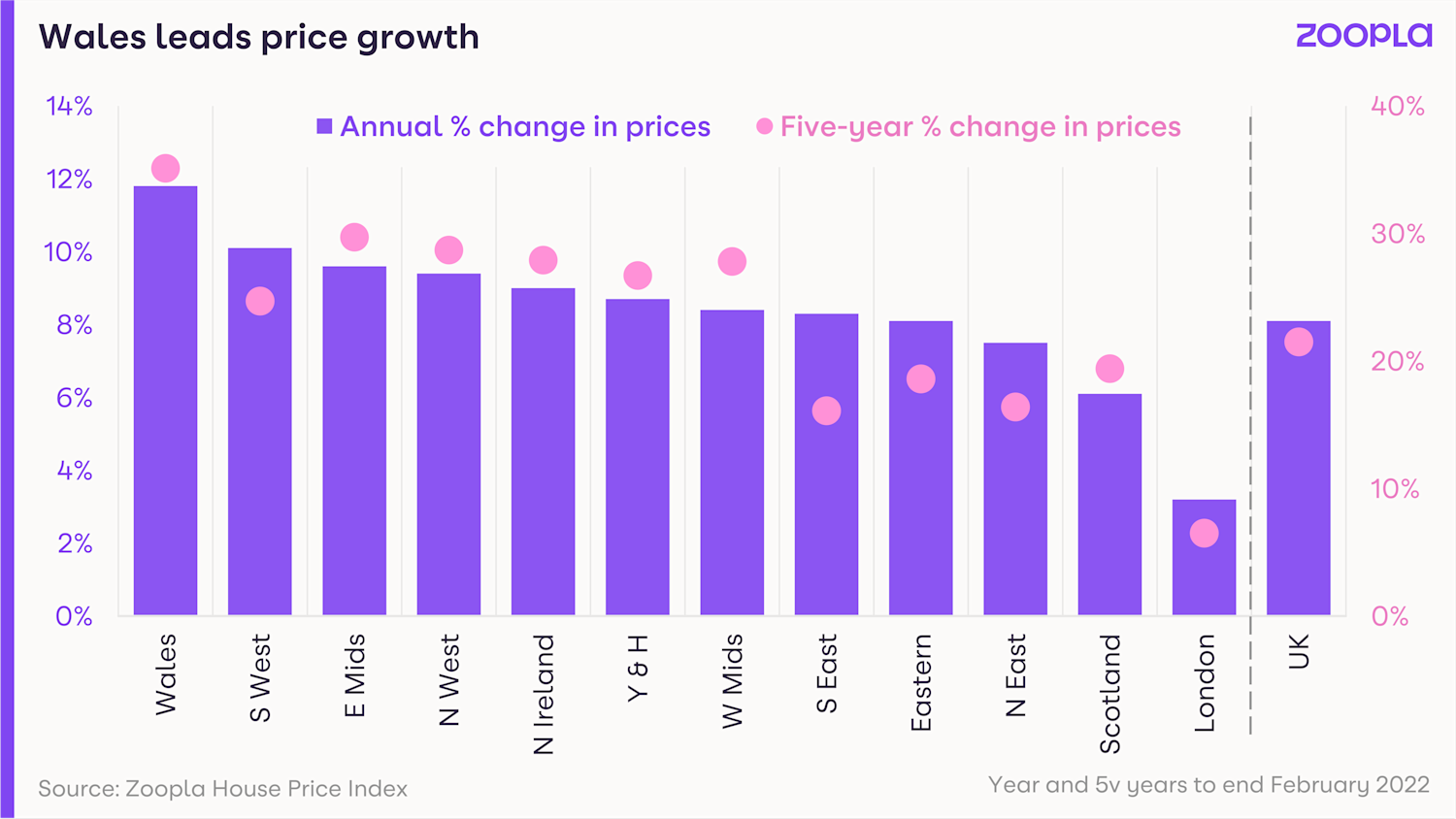

Wales continued to see the highest growth for the 12th consecutive month, with property values rising by 11.8%, followed by the South West at 10.1% and the East Midlands at 9.6%.

London continues to see the slowest growth, with prices rising by 3.2% during the past year, although gains in individual boroughs ranged from 6.8% in Bromley, to no change in the City of London.

Wales has also seen the strongest price growth during the past five years, with property values rising by 35%, compared with gains of just 6.5% in London.

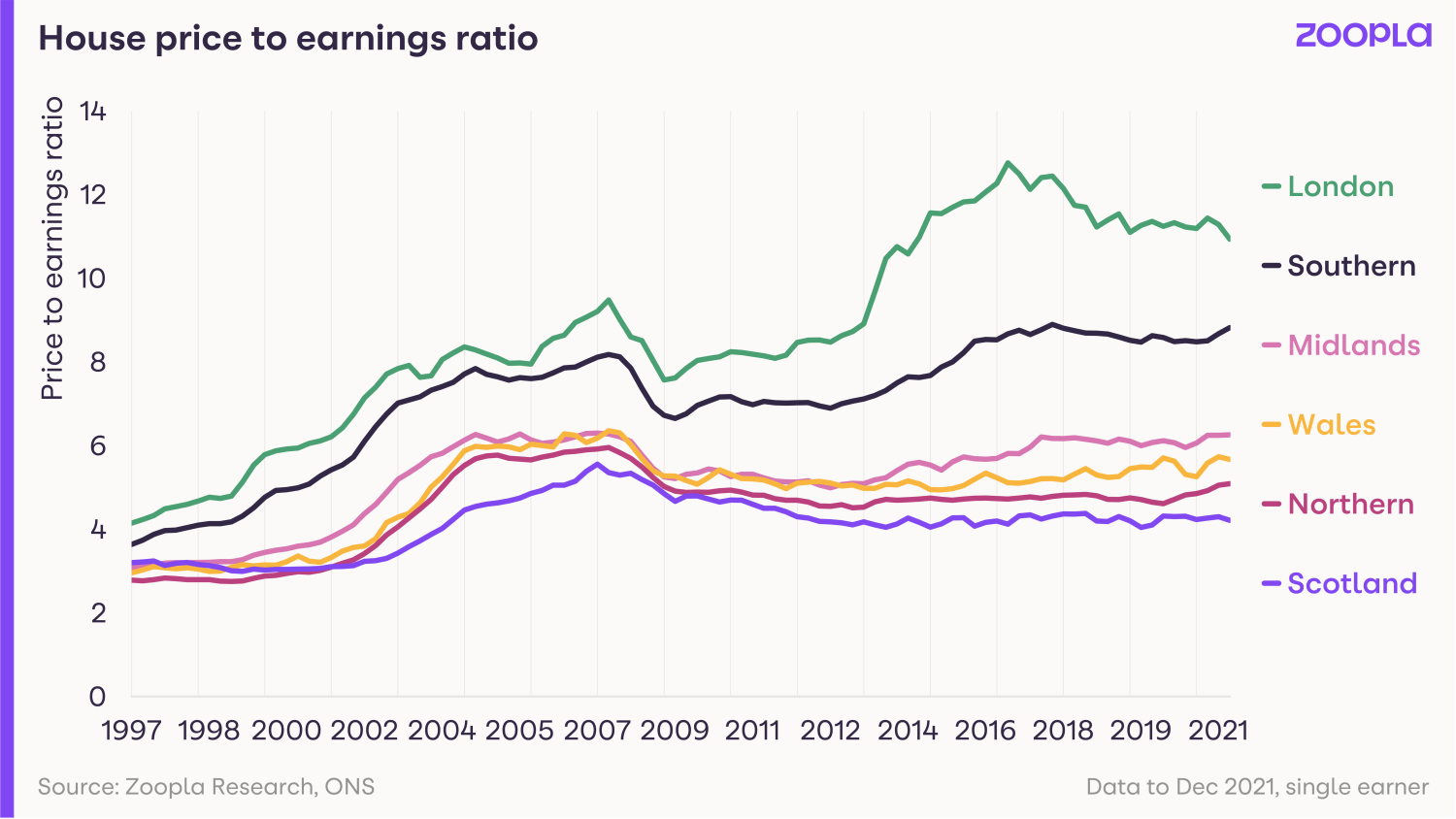

Affordability has played a big role in house price increases during this period, with growth strongest in areas where homes remain most affordable.

How busy is the market?

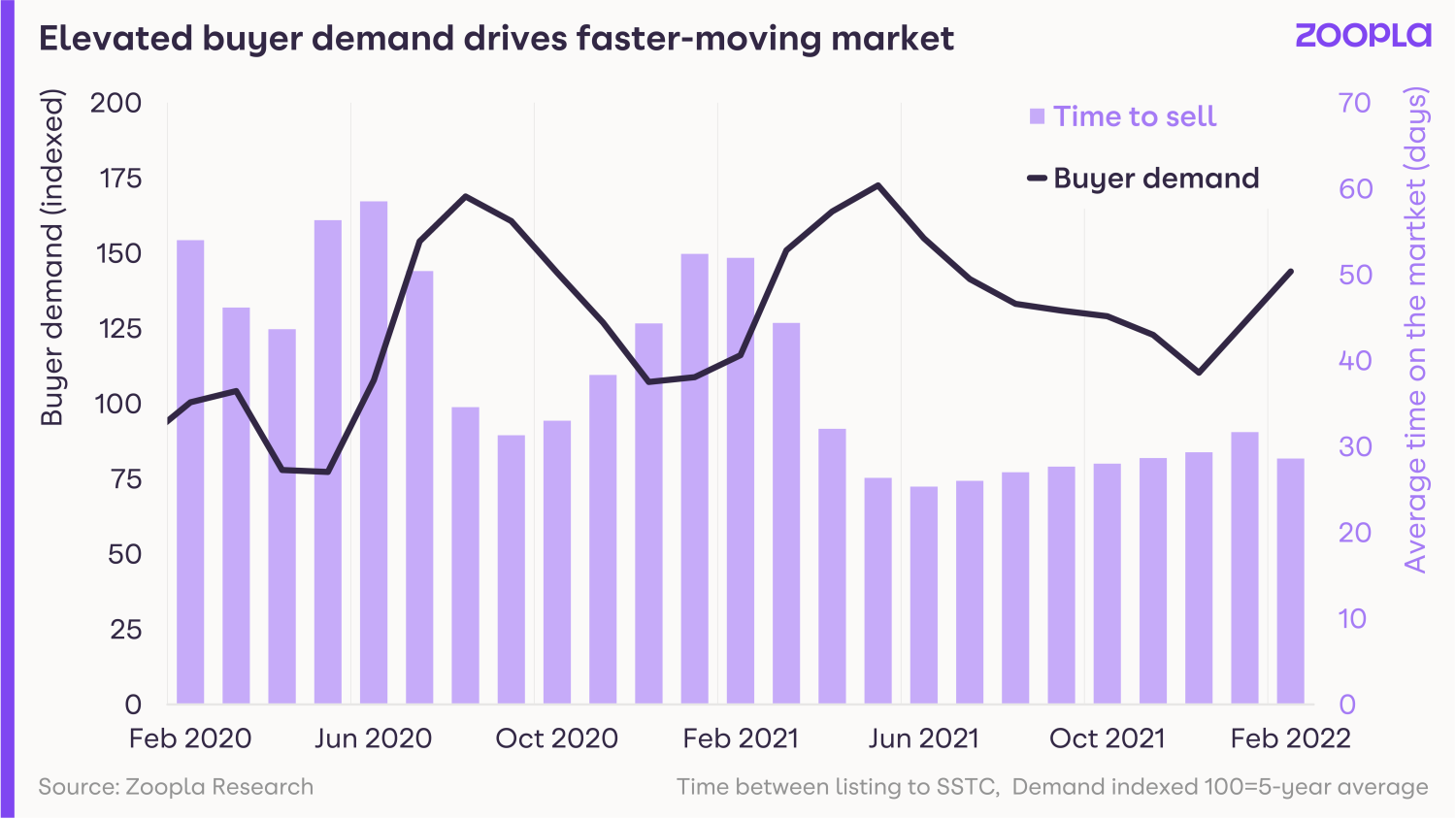

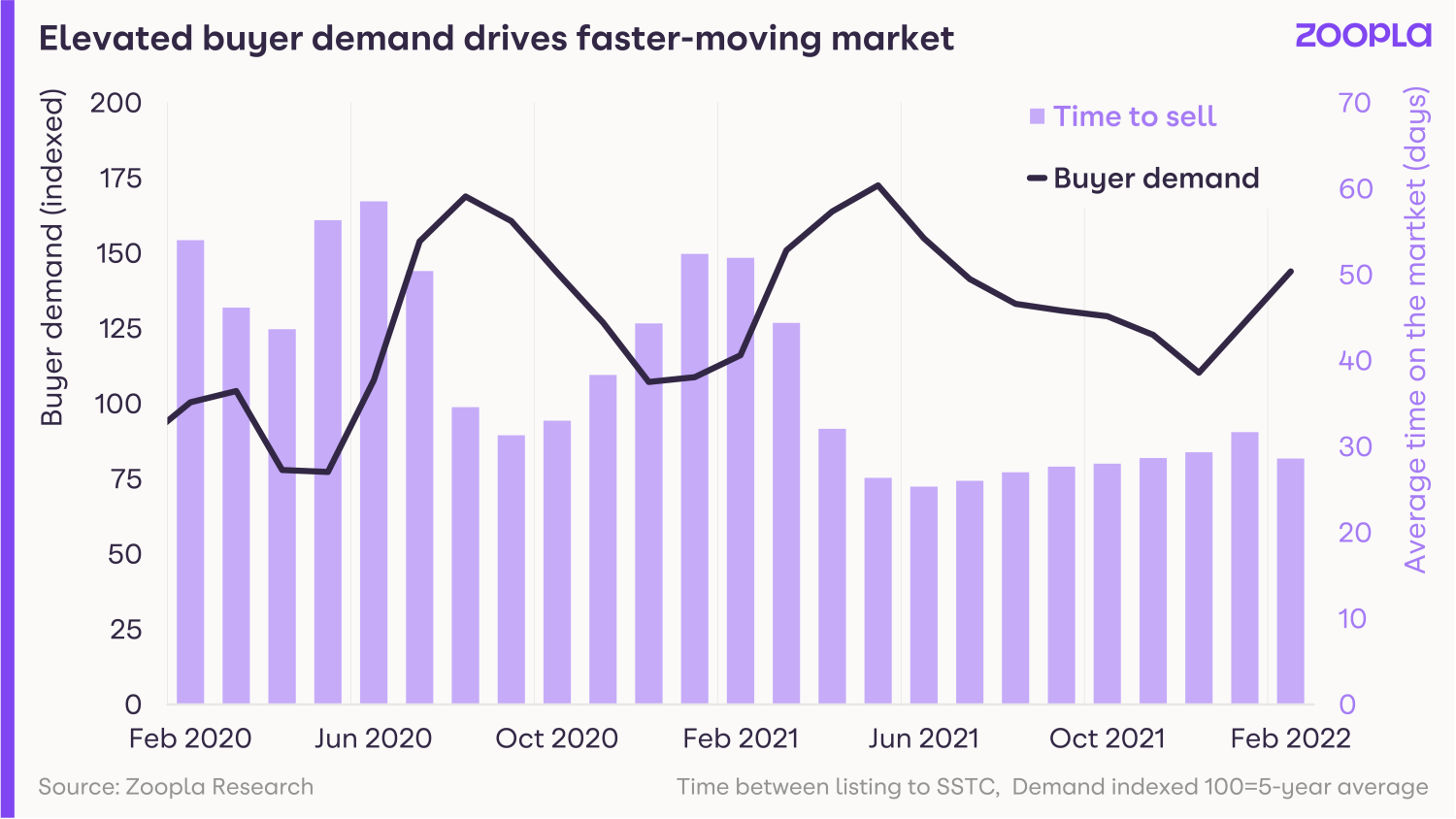

Buyer demand remains unseasonably high across the UK at 65% above the five-year average, but it has eased since January.

Even so, the number of sales agreed during the first three months of the year was 38% higher than in the same period of 2020.

In London, more sales were agreed in the first part of the year than in the same period of 2021, despite the elevated levels of activity in that period due to the stamp duty holiday.

There has also been a rise in buyer interest in other city centres, with demand up 7% in Newcastle in recent weeks, while it is 5% higher in Birmingham.

The increase is even more marked in smaller urban centres, with the number of buyers soaring by 20% in Blackpool, and 19% in Swindon.

Meanwhile, improvements in supply continued to ease, with the number of properties coming on to the market 5% higher than the five-year average.

This trend is expected to continue in the coming months, as recent strong price growth and high buyer demand triggers more homeowners to make a move.

Despite the improvements, the number of homes listed for sale is still 42% below the five-year average, although this is an improvement on December, when stock levels were 47% down on the five-year norm.

As a result, the market continues to be fast moving, with properties taking an average of just 29 days to sell.

What could this mean for you?

First-time buyers

With more homes coming on to the market as people look to trade up the property ladder, the choice for first-time buyers has improved.

But the market remains fast paced, with homes selling quickly.

As a result, if you see something you like, you need to be prepared to move fast, so try to get a mortgage offer in principle before you start house hunting.

The pace of the market is expected to ease in the months ahead.

Home-movers

If you are an existing homeowner thinking of moving, you have a window of opportunity in which to sell your property.

Demand from potential buyers is currently high across all property types, but particularly family homes, with twice as many people currently looking to purchase a three-bedroom home as this time last year.

As a result, you are in pole position to sell, while the rise in the number of homes coming on to the market means you will have more choice for your next home.

But don’t delay listing your property for too long, as the market is expected to start slowing soon.

What’s the outlook?

The housing market is expected to slow in the coming months as higher mortgage rates and the rising cost of living, as well as the uncertainty caused by the situation in Ukraine, acts as a brake on activity.

But the shortage of homes for sale will prevent prices from falling.

Head of research at said: “Buyer demand remains elevated as the trends that emerged during the pandemic – a reassessment among households about where and how they are living – continue to drive the market.

“High buyer demand and rising supply signal activity levels will remain elevated in the short term.

“As we move into the second half of the year, economic headwinds, including the rising cost of living and rising mortgage rates will act as a brake on price growth, with annual value rises returning to more sustainable levels.”