Some buyers are set to fork out thousands of pounds more in stamp duty once the tax break draws to a complete close at the end of September. Could you be one of them?

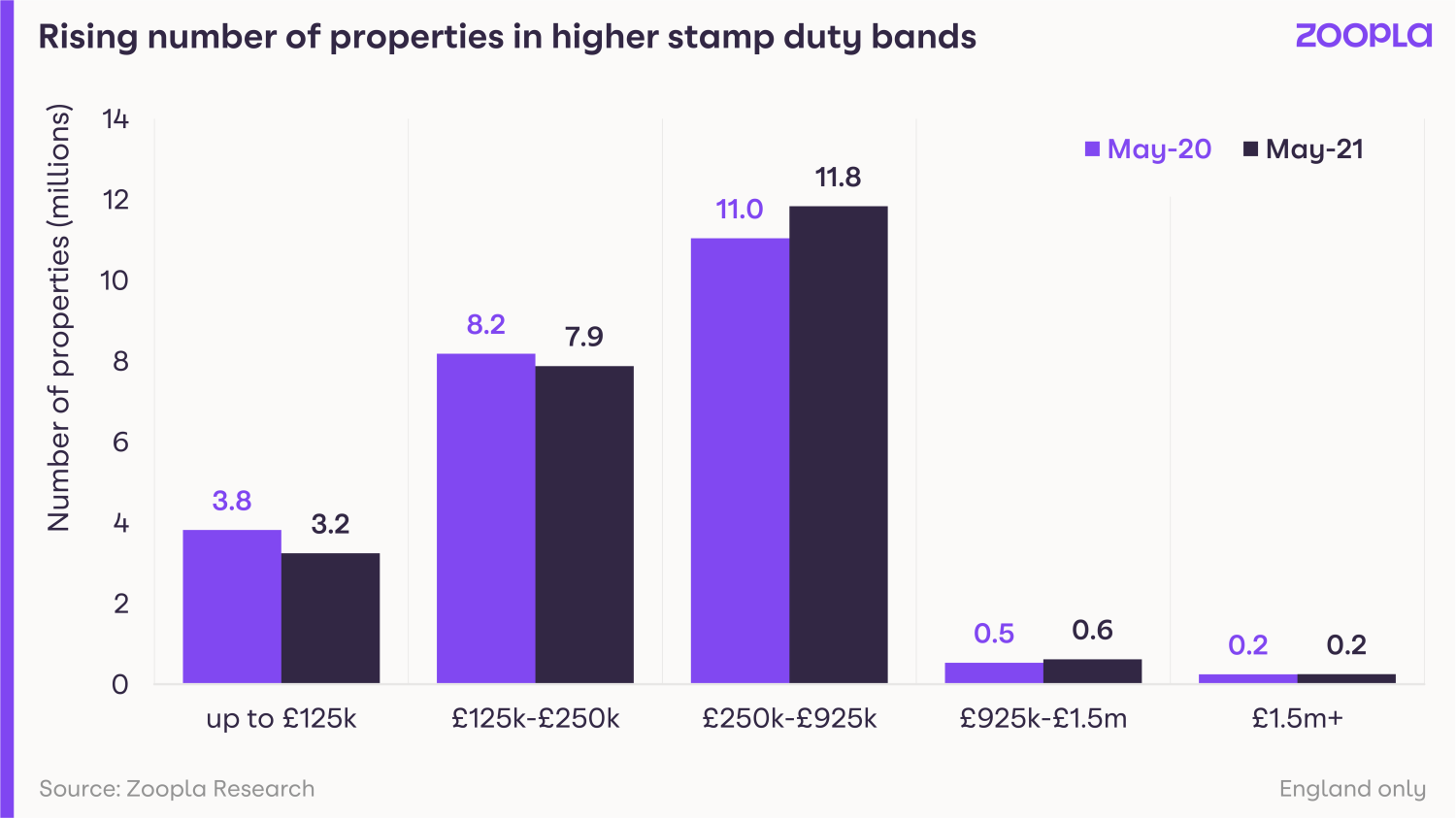

Soaring house price growth has pushed more than 1.8m homes in England into higher stamp duty bands.

House prices have jumped by more than £10,000 during the past year as the scramble for homes continues.

And this house price growth is having a knock-on effect on stamp duty bills because the tax is based on a property’s price. It is charged on a tiered basis so buyers only pay the higher rates on the slice above any threshold – the same as income tax.

An estimated 940,000 properties have moved into the 5% stamp duty band, while 130,000 have moved into the 10% one.

At the same time, the number of homes in the lower stamp duty bands is falling.

Find out more about how stamp duty works further down this article.

What could this mean for you?

Put simply, some buyers face a bigger stamp duty bill.

Buyers purchasing a home that has moved into the 5% band face an additional cost of £725 on average once the tapered stamp duty holiday ends on 30 September.

Meanwhile those buying a property that has moved into the 10% band could expect to pay £6,100 more.

The situation should have less impact on first-time buyers, as they do not pay the tax on the first £300,000 of a property purchase, as long as the home they are buying does not cost more than £500,000.

But the strong house price rises seen during the past year could still make it harder for first-time buyers to get onto the property ladder, as affordability may be more stretched, and they will need a bigger deposit.

Why is this happening?

The housing market has been booming during the past year due to a combination of the stamp duty holiday and successive lockdowns causing people to re-evaluate the type of home they want to live in.

Our latest House Price Index shows that annual house price growth was running at 4.7% in May, more than double the rate of 2.2% seen in the same month last year.

The strong price growth has added £10,246 to the value of the typical home, enough to push many properties into a higher stamp duty band.

The lowdown on stamp duty

Buyers pay stamp duty when purchasing a property in England or Northern Ireland.

Last year, the Chancellor introduced a stamp duty holiday on properties costing up to £500,000. Although this has now ended, the threshold at which the tax kicks in will remain at £250,001 until 30 September 2021.

After this date, no stamp duty will be charged on the first £125,000 of a purchase, with the tax charged at:

- 2% on the portion from £125,001 to £250,000

- 5% on the portion from £250,001 to £925,000

- 10% on the portion from £925,000 to £1.5m

- 12% on the portion above £1.5m

It’s worth remembering that stamp duty rates in England and Northern Ireland are different for first-time buyers and people buying additional property.

Top three takeaways

- Strong house price growth has pushed more than 1.8m homes in England into a higher stamp duty bracket during the past year

- Buyers purchasing a home that has moved into the 5% band face an additional cost of £725 on average once the tapered stamp duty holiday ends on 30 September.

- Meanwhile those buying a property that has moved into the 10% band could expect to pay £6,100 more.