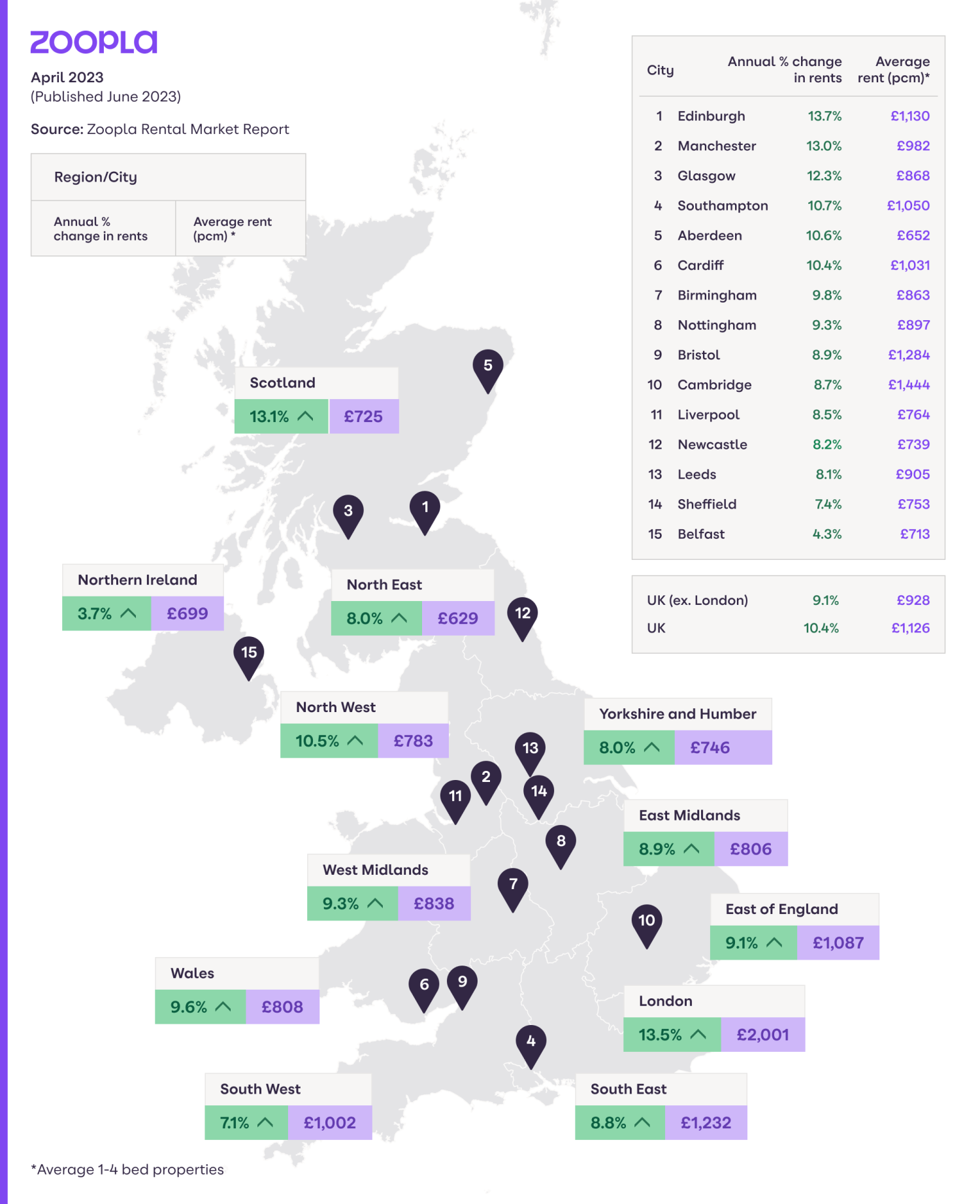

The average monthly rent in the UK has reached £1,126, with London rents exceeding £2,000 per month. Discover the regions where rental prices are experiencing the fastest and slowest growth in the UK.

Rents increase by more than 10% for 15th month in a row

In April 2023, the average cost of a new let rose to £1,126 per month, following 21 consecutive months in which rental rises outstripped wage rises.

The average UK rent has now increased by £110-a-month – or 10.4% – since April 2022, marking the 15th consecutive month that we’ve seen double digit growth in rental inflation.

This level of rental inflation is high by historical standards and ahead of average earnings growth, which is currently at 6.5%.

The gap between these measures highlights the impact on rental affordability, which is now at a record high in seven out of 12 UK regions.

The good news is that rents for new lets have been starting to slow reflecting seasonal trends. In the last 3 months, the average rent increased by 0.6% – that’s the smallest amount since May 2021.

Rental inflation lowest in Northern Ireland

London and Scotland, two of the largest rental markets, have seen the highest level of rental inflation at +13% since April 2022. This is well ahead of the typical annual growth of 4.5% to 5% we’ve seen in these regions over the previous 5 years.

Northern Ireland remains the region with the lowest rental inflation – 3.7% or an increase of £30 per calendar month since April 2022.

Average rent in London reaches £2,000 per month

Over the last 2 years and since the economy reopened after Covid lockdowns, the average London rent has increased by £490 a month. This brings the average rent in the capital to £2,001.

At present, the largest annual increases are recorded in the eastern boroughs of Newham (+18.1%), Greenwich (+18.0%) and Tower Hamlets (16.5%).

Those living in the suburbs and western edges of central London are seeing a smaller level of rental growth. The annual rental inflation is weakest in Kensington and Chelsea (10.2%), Havering (11.3%) and Richmond (11.4%).

Prices of new lets in inner London start to slow down

The good news for many renters is that the rate of rental inflation is slowing down in inner London. The monthly rent for a new let in inner London is only £26 higher today than it was in January 2023.

This is an indication of prices hitting their ceiling in this area, as renters struggle to afford higher rents. We are yet to see if this trend will continue with the high-demand summer season ahead of us.

Prices of new lets are growing at a much faster rate in suburban boroughs. Over the last quarter, rental prices in outer London increased by 3% – or £47 – per month. These more affordable areas are now attracting more demand from renters looking for cheaper alternatives to inner London.

Varying rental growth in UK cities

Fast-growing rental inflation is not only a London problem.

Our rental index identifies three urban areas where rents are increasing faster than in London: Dundee (+14.5%), Luton (14.0%) and Edinburgh (13.7%).

Renters looking for new lets in these locations will find the average monthly rent has increased by up to £140 over last year.

We also record above-average rental inflation in Manchester, where the average monthly rent has increased by £110 over the last year.

The cities where rents are also increasing faster than average include Glasgow (12.3%), Southampton (10.7%) and Cardiff (+10.4%).

The average rent in these cities is now £100 higher than a year ago.

The lowest rental growth is currently happening in the city of Doncaster and the towns of Grimsby and Blackpool.

The typical monthly rent in these areas has increased by less than £30 per month – or 4.3% – since April 2022.

The cheapest and most expensive areas to rent in each region

|

Region |

Cheapest area to rent |

Monthly rent |

Most expensive area to rent |

Monthly rent |

|

North East |

Hartlepool |

£493 |

Newcastle upon Tyne |

£862 |

|

Yorkshire & the Humber |

North East Lincolnshire |

£569 |

York |

£1,034 |

|

Wales |

Powys |

£595 |

Cardiff |

£1,031 |

|

Scotland |

East Ayrshire |

£519 |

Edinburgh |

£1,130 |

|

West Mids |

Stoke-on-Trent |

£630 |

Warwick |

£1,107 |

|

North West |

Burnley |

£514 |

Manchester |

£1,099 |

|

East Mids |

East Lindsey |

£619 |

South Northamptonshire |

£1,076 |

|

South West |

Torridge |

£766 |

Bath and North East Somerset |

£1,333 |

|

East of England |

Waveney |

£732 |

Epping Forest |

£1,516 |

|

London |

Bexley |

£1,426 |

Kensington and Chelsea |

£3,538 |

|

South East |

Dover |

£929 |

Elmbridge |

£1,705 |

Key takeaways

- The average UK rent hit £1,126 in April, £110 higher than a year ago

- London remains the region with the fastest growing rents – up 13.5%, while rental inflation in Northern Ireland slows to 3.7%

- The average rent in London reaches £2,000 per month, but rental growth slows in inner London over last 3 months

- Outside the capital, rents are increasing the most in Dundee, Edinburgh and Luton