Average rent in London: April 2024

The average rent in London is now £2,121 per month after +4.2% growth in the last year. The cheapest average rent is in Bexley (£1,520) and the highest average rent is in Kensington and Chelsea (£3,459), although rental increases are slowing in the most expensive parts of the city.

London is by far the most expensive place to rent a home in the UK with an average rent of £2,121 for new lets. Average rents in London are almost double the UK average of £1,220.

However, rental inflation in London has slowed in the last 12 months, now at +4.2% versus +14.8% a year ago. This is lower than UK-wide growth of +7.2% over the last year.

Average rental prices in London

|

Average monthly rent in London in February 2024 |

% change in the last 12 months |

£ change in the last 12 months |

|---|---|---|

|

£2,121 |

+4.2% |

+£90 |

Average rent by borough in London

The table sets out the average rent for every local authority in London, starting with the cheapest. It also shows how much rents for new lets have increased in the last 12 months in each location.

|

Local authority area |

Average monthly rent |

% change in the last 12 months |

£ change in the last 12 months |

|

Bexley |

£1,520 |

10.40% |

£140 |

|

Croydon |

£1,541 |

8.70% |

£120 |

|

Sutton |

£1,547 |

11.80% |

£160 |

|

Havering |

£1,584 |

12.90% |

£180 |

|

Bromley |

£1,609 |

8.10% |

£120 |

|

Enfield |

£1,649 |

9.40% |

£140 |

|

Hillingdon |

£1,656 |

9.50% |

£140 |

|

Barking and Dagenham |

£1,657 |

11.30% |

£170 |

|

Redbridge |

£1,721 |

11.60% |

£180 |

|

Lewisham |

£1,741 |

5.00% |

£80 |

|

Harrow |

£1,775 |

9.10% |

£150 |

|

Waltham Forest |

£1,783 |

11.00% |

£180 |

|

Kingston upon Thames |

£1,801 |

6.80% |

£120 |

|

Hounslow |

£1,845 |

6.10% |

£110 |

|

Greenwich |

£1,866 |

4.80% |

£90 |

|

Barnet |

£1,890 |

7.00% |

£120 |

|

Haringey |

£1,919 |

7.90% |

£140 |

|

Brent |

£1,948 |

4.70% |

£90 |

|

Ealing |

£1,957 |

7.00% |

£130 |

|

Merton |

£1,979 |

5.30% |

£100 |

|

Newham |

£1,984 |

4.00% |

£80 |

|

Richmond upon Thames |

£2,098 |

6.00% |

£120 |

|

Lambeth |

£2,182 |

3.60% |

£80 |

|

Southwark |

£2,219 |

4.60% |

£100 |

|

Hackney |

£2,332 |

4.80% |

£110 |

|

Tower Hamlets |

£2,333 |

2.30% |

£50 |

|

Islington |

£2,384 |

4.50% |

£100 |

|

Wandsworth |

£2,385 |

4.80% |

£110 |

|

Hammersmith and Fulham |

£2,619 |

4.30% |

£110 |

|

City of London |

£2,625 |

1.50% |

£40 |

|

Camden |

£2,672 |

3.80% |

£100 |

|

City of Westminster |

£3,155 |

1.30% |

£40 |

|

Kensington and Chelsea |

£3,459 |

3.10% |

£100 |

Rental growth has slowed the most in Inner London boroughs, which are also commonly the most expensive with average rents sitting well above £2,000 per month. For example, the average rent in Kensington and Chelsea and the City of Westminster exceed £3,000 but growth has stalled to +3.10% and +1.30% respectively.

This slowdown is a response to affordability challenges and lower demand for new lets in the centre of the capital. It suggests landlords are becoming more realistic in pricing their rentals and may be taking cost-of-living struggles into consideration when setting new rates, which tend to be exacerbated for those in the rental market.

However, the experience of renters in Outer London is a different story, with ongoing double-digit rental inflation in several areas. The rises stretch to +12.9% in Havering, where the average annual rental bill is now £2,160 more expensive than a year ago.

Rents have also risen by more than +11% in the last year in more affordable boroughs of Sutton, Redbridge, Barking and Dagenham, and Waltham Forest.

The chart shows how rents have risen in London boroughs over the last year, highlighting the difference between inner and outer boroughs.

What’s next for the London rental market in 2024?

We expect the growth of London rents to slow to around +2% on average in 2024.

It’ll be a reprieve for London renters as they already face the highest rents and lowest affordability of anywhere in the country. The average renting household in London (1.25 people) already spends 40.4% of their earnings on rent compared to a UK average of 28.4%.

Average rent in the UK: February 2024

Demand from London renters will continue to drop as many cannot afford further rent rises amidst other affordability pressures.

London renters will continue to look for lower rental prices in the outer boroughs and nearby commuter towns, which will keep average rents rising more quickly in these places.

Key takeaways

- London’s average rent is currently £2,121 after +4.2% growth in the last year

- Growth has slowed from +6.4% last month and +14.8% a year ago

- The current annual increase is lower than the UK as a whole as London rents have started to reach an affordability ceiling

- The borough of Bexley has the cheapest average rent in London at £1,520 but rents are rising quickly in these comparatively cheap spots on the outskirts

- Rents are much higher in Inner London boroughs like Kensington and Chelsea, the City of Westminster and Camden - but rents are rising more slowly at between +1% and +4%

Sales on the up as house prices hold steady

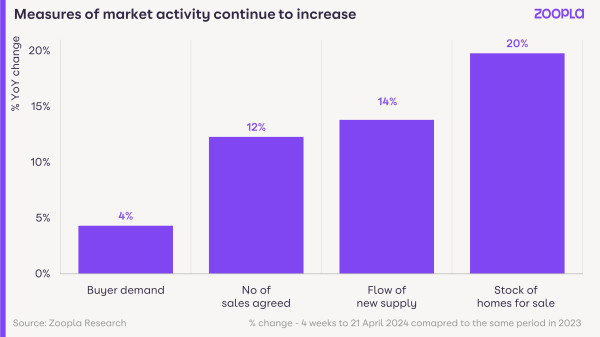

Buyer confidence is improving and 12% more homes are going under offer compared to this time last year. Mortgage approvals for home purchases are also up 32%.

The housing market is now more balanced than it was before the pandemic, which is good news for sellers, as it means more people have a chance of moving home in 2024.

The number of homes available for sale is continuing to grow but house price inflation remains broadly static.

And static house prices are good for buyers, who are already struggling to cope with a 60% increase in mortgage payments in 2024.

Meanwhile, more homes for sale and renewed buyer confidence means more sales are being agreed: in fact sales agreed are up 12% compared to this time last year.

And for the first four months of 2024, the number of homes going under offer has also been higher than in the first 4 months of 2023.

Our Executive Director of Research, Richard Donnell, says: ‘The housing sales pipeline is now rebuilding after a period of lower sales, when mortgage rates spiked higher in 2022 and 2023.

‘Our data shows that the housing market remains on track for 1.1m sales completions in 2024, up 10% on 2023.’

Mortgage approvals up more than 30%

Mortgage approvals for home purchases went up 32% year-on-year in February 2024, marking another return towards pre-pandemic levels.

‘The 4 to 6+ month time lag between agreeing a sale ‘subject to contract’ and moving in, means sales completion data is yet to register an upturn but this will emerge in the coming months,’ says Donnell.

House prices firming as market activity improves

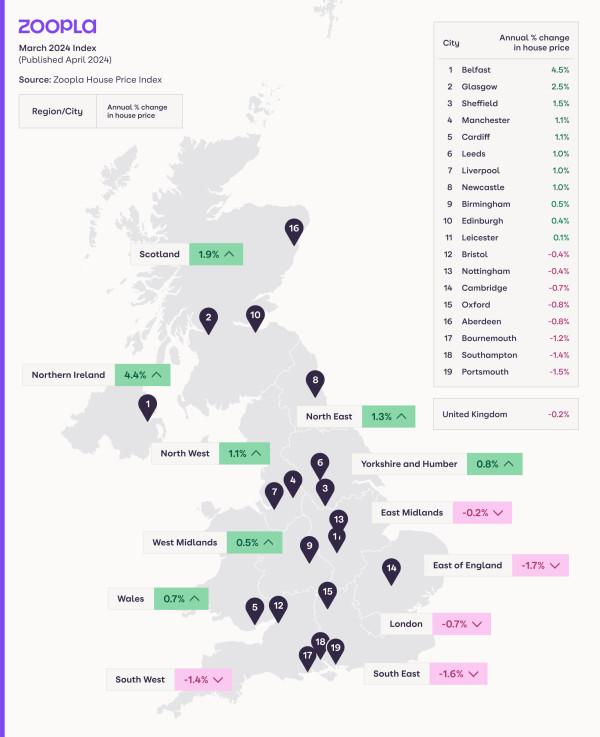

House prices are continuing to hold steady right now, and annual house price inflation is largely unchanged since last month. It currently stands at -0.2% at the end of March 2024.

‘House prices continue to fall, at a slowing rate, across five English regions covering southern England and the East Midlands, with prices down the most in the East of England (-1.7%),’ says Donnell.

‘However, in the north of England, West Midlands, Wales, Scotland and Northern Ireland, house price inflation has moved into positive territory, with prices in Belfast rising by 4.5%.’

Higher mortgage rates continue to affect buyer affordability

In southern England, where homes are more expensive, buyers are being hit harder by higher mortgage rates, low income growth and rising living costs.

This, in turn, is affecting house prices, as sellers set lower asking prices in order to attract a sale. Our data shows that 95-100% of homes in southern England are in markets where prices are currently falling.

However, at a national level, only 64% of homes are in markets registering annual price falls. Back in October last year, that number was much higher: 82%.

‘The scale of these price falls is relatively modest, in most cases between 0% and -3%,’ says Donnell.

‘We expect house prices to continue to firm over 2024 but we don’t expect house price inflation to start accelerating. The current trends in price inflation, and the divergence between the south and the rest of the UK, are expected to continue over the coming months.

‘Much depends on the outlook for interest rates and how this influences mortgage rates. Fixed rate mortgages today already reflect expectations for interest rate reductions in the future and we don’t expect any major changes in average mortgage rates over the rest of the year.

‘What the housing market needs most is continued price stability, which will create the right environment for continued growth in sales.’

Key takeaways

- Sales agreed volumes up 12% year-on-year as house prices stay static

- Homes in the south are currently seeing negative price inflation in the UK

- 64% of homes are in markets with price falls, but this is down from 82% last October

Mortgage repayments up 60% since 2021

Home buyers are currently facing an annual increase of £4,300 on their mortgage repayments, rising to £7,500 in London.

How much have mortgages risen since 2021?

Across the whole of the UK, the average buyer is having to find an extra £4,320-a-year to pay their mortgage in 2024, when buying an average priced home with a 30% deposit.

Back in 2021, the average annual mortgage payment was £7,000. Today, it’s £11,400.

And higher mortgage rates are hitting southern England the hardest.

In London, the average buyer will need to find an extra £7,500-a-year to cover the cost of their mortgage, which is now amounting to £23,000-a-year. In 2021, that figure was closer to £15,000.

In the South East, annual repayments on mortgages have risen by £6,000, while in the South West, they’ve gone up by £5,300 a year.

Across the rest of the UK, the picture is less bleak, with buyers in the Midlands needing to find an extra £3,900, while buyers in the North East are paying an extra £2,350.

Our Executive Director of Research, Richard Donnell, says: ‘At a region and country level there has been a 50% to 70% increase in mortgage repayments for a typical buyer between 2021 and 2024.

‘The largest monetary impact is in southern England, where house prices are higher. The annual cost of mortgage repayments for an average priced home is more than £5,000 higher per annum in 2024 than 2021 across the South West, South East, East of England.

‘Two thirds of this increase is a result of higher mortgage rates. However, one third is also down to the fact that average house prices are still 13% higher than they were in March 2021.’

Annual mortgage payments across the UK: 2021 vs 2024

We’re all missing the ultra-low lending rates enjoyed in 2021

Since 2022, mortgage rates have spiked twice: at the end of that fateful autumn budget year and again in the summer of 2023, as interest rates increased to combat rising inflation.

Aside from massively reducing purchasing power for buyers and spare income for homeowners, higher mortgage rates have also affected the housing market in two major ways:

-

A 23% drop in sales over 2023

-

Modest house price falls

And while the average mortgage rate for a 5-year fix at 75% loan-to-value has fallen back to 4.5% in recent months, rates are starting to drift higher again amid shifting expectations for interest rate cuts later this year.

Our view is that mortgage rates will average out at 4.5% over 2024. However, affordability remains a challenge for buyers and first-time buyers, as mortgages are now costing an average of 60% more than they did three years ago.

Mortgage rates set to plateau at 4.5% this year

While, in good news, the Bank of England’s base rate looks to have reached a plateau, the reality is that the annual mortgage repayments for a typical buyer using a 70% LTV loan for an average priced home are still much higher than 3 years ago.

‘This continues to act as a drag on buying power and levels of house price inflation,’ says Donnell.

‘When mortgage rates started to rise, we reported that the shift from 2% mortgage rates to 5% would deliver a 30% reduction in buying power for mortgaged home buyers, assuming the borrower kept their repayments and deposits the same,’ says Donnell.

‘Buyers withdrew from the market in the face of higher borrowing costs and general uncertainty over the economic outlook and this drove transactions lower over 2023.’

Then there’s stamp duty to think about

Stamp duty is a tax that’s mainly paid by homebuyers in the south of England, since it only kicks in on properties over £425,000 for first-time buyers, or £250,000 for home movers in England.

What are buyers doing in the face of higher mortgage rates?

Buyers are open to widening their searches in the hunt for better value homes.

And while they aren’t looking to compromise on the size of the home they need or the number of bedrooms they require, some are looking further afield to secure the right home for them and their families.

Our latest consumer research shows that a third of households who want to move are now looking beyond their local area to secure the home they require.

In fact, despite higher mortgage rates, confidence among buyers is high, and the number of sales agreed is now 12% higher than this time last year.

And for the first 4 months of 2024, the number of sales agreed has been higher than the first 4 months of 2023.

More choice in the number of homes available is enticing more buyers back to market.

‘The housing sales pipeline is now rebuilding after a period of lower sales when mortgage rates spiked higher in 2022 and 2023,' says Donnell.

‘Our data shows that the housing market remains on track for 1.1m sales completions in 2024, up 10% on 2023.’

Key takeaways

- The annual mortgage repayments for the average buyer in 2024 have now reached £11,400

- In London, that figure rises to more than £23,000-a-year

- Buyers in the south east are paying £16,600-a-year, while in the east of England, annual repayments average out at £14,530