Rents for new lets rise 10.3% over the last year

The average rent for a new tenancy has increased by 10.3% since September 2022, with renters now paying £1,164 per month on average.

An ongoing supply-demand imbalance continues to push rents higher, despite demand for rental properties peaking earlier than usual this summer.

Over the last year, the average rent for a new tenancy has increased by 10.3% to stand at £1,164 per month.

The average annual rental bill is now £1,320 higher than a year ago at nearly £13,970 a year, compared to £12,670 last September.

This marks the 19th consecutive month of our index reporting a rental inflation of over 10%.

Rental growth for renters staying in their existing home is much lower at 5.5%, according to the Index of Rental Prices from the Office for National Statistics.

Rental inflation in Scotland boosted by rent controls

Scotland is registering the highest level of rental inflation in the UK at 12.8%.

Landlords in Scotland are maximising rents for new tenancies to cover increased costs and allow for the fact that future rent increases will be limited over the life of the tenancy.

The average rent in Scotland is now £750 per month, which is £90 higher than a year ago.

Rental inflation in Scotland has now started to moderate from 13.7% six months ago, but we expect the above-average rental inflation to continue.

Rents are growing at the fastest rate in the cities of Edinburgh (16.3%), Dundee (14.6%) and Glasgow (13.6%). Renters looking for new lets in areas neighbouring Edinburgh and Glasgow are also seeing double-digit increases compared to August 2022.

| Region | Annual rental price change (%) | Annual rental price change (£) | Average rent (per calendar month) |

|---|---|---|---|

| United Kingdom | 10.3% | £110 | £1,164 |

| Scotland | 12.8% | £90 | £750 |

| London | 11.5% | £210 | £2,055 |

| North West | 11.3% | £80 | £796 |

| Wales | 10.2% | £80 | £815 |

| West Midlands | 10.1% | £80 | £853 |

| East of England | 9.8% | £100 | £1,112 |

| East Midlands | 9.8% | £70 | £817 |

| South East | 9.8% | £110 | £1,254 |

| North East | 9.2% | £50 | £649 |

| Yorkshire and the Humber | 8.3% | £60 | £759 |

| South West | 8.1% | £80 | £1,017 |

| Northern Ireland | 4.4% | £30 | £744 |

Zoopla Rental Index, September 2023

Cardiff, Southampton and York are now £1,000 rent cities

The number of cities in which renters pay more than £1,000 per month on average when they start a new tenancy is growing.

In 2023, new additions to this group were Southampton and York, where it now costs £1,057 and £1,045 per month to rent a home.

The latest place to join the club is Cardiff, where average rents increased by 11.2% over last year to reach £1,012.

High rents in London makes renting expensive, pushing demand into more affordable areas. This boost in demand in commuter areas in the South East has led to an increase in the number of commutable towns with average rents exceeding £1,000.

Here are the towns and cities where average rents on new lets have just breached £1,000 per month.

| Town/city | Average rent (per calendar month) | Annual rental price change (%) | Annual rental price change (£) |

|---|---|---|---|

| Worthing | £1,104 | 10.7% | £110 |

| Basingstoke | £1,096 | 11.3% | £110 |

| Luton | £1,096 | 15.3% | £150 |

| Southend-on-Sea | £1,085 | 9.3% | £90 |

| Eastbourne | £1,046 | 7.6% | £70 |

| Colchester | £1,044 | 6.0% | £60 |

Rental Index, September 2023

Manchester next in line to become a city with £1,000 average rent

Manchester is in the top 5 for cities recording the highest rates of rental growth.

Average rents in the city are £996 per month, making it the most expensive city to rent in northern England. We can expect average rent to increase to £1,000 by the end of this year.

Central Manchester, Trafford and Salford already have average rents in excess of £1,000.

Higher rents in these central Manchester areas are likely to turn value-seeking renters towards neighbouring areas such as Bolton, Oldham or Rochdale. This will boost demand and is likely to lead to rental growth in those areas as well.

What are renters doing to minimise the impact of higher rents?

Faced with higher rents and limited supply of homes on the market, renters are more commonly considering renting smaller homes, moving to cheaper areas or sharing a property with other renters to reduce costs.

House sharing reduces the cost per renter but comes at the personal expense of privacy and space. Data from the Resolution Foundation found private renters have experienced a 16% reduction in floor space per person over the last 20 years.

What’s next for the rental market?

We expect rental inflation to remain above 9% for the rest of the year, as earnings growth remains strong while high mortgage rates stop many renters from moving into home ownership.

We anticipate national rental growth of 5% to 6% in 2024. Cities are likely to continue registering rental inflation above this level.

Key takeaways

- Residential rents for new tenancies are 10.3% higher than in September 2022

- Rents have increased the most in Scotland, where new rent controls are encouraging landlords to secure higher rents at the start of a tenancy

- More cities have breached the £1,000 average rent mark - new additions include Cardiff, Southampton and York

- Average rent in Manchester is on track to reach £1,000 by the end of 2023

Southerners searching further for their next home while Northerners stay local

The average buyer looks for their next home 3.9 miles down the road, but people in the south and in cities are much more likely to spread their wings.

As a nation we don't look far for our next home. We tend to think local first, and search in areas that we know and love.

But looking in a wider search area may give you more affordable options or help you buy a bigger property.

Let’s explore the trends in how far people are looking to move and how this varies across the country.

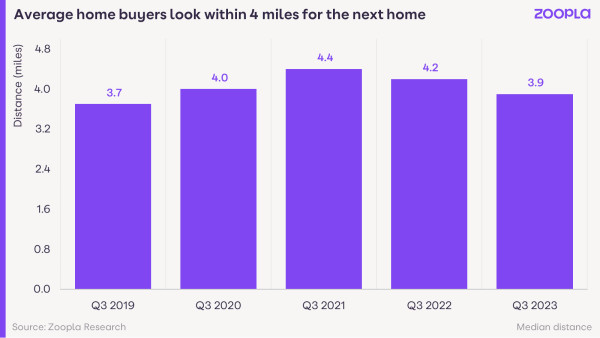

People search for a home 3.9 miles away on average

Our data shows that the average buyer is looking for their next home 3.9 miles down the road, while 3 in 4 people only enquire on homes in one or two neighbourhoods.

In 2021, the distance between someone's home and a home they enquired about was slightly higher at 4.4 miles.

During the pandemic, many households were open to a change in lifestyle and, as markets became more competitive, buying further away was a useful tactic. It helped people find a home that fitted within their budget as house prices soared.

Back in summer 2019, buyers only searched 3.7 miles away on average. The difference now is that there are more properties for sale across the UK, which is creating greater choice locally and supports people to search closer to home.

Southerners look further away while buyers in the North stay local

Our data shows large regional differences in where people are looking for their next property.

Half of buyers in the East of England and 43% of buyers in the South East are looking for a home 10 miles away or further. They're more open to the idea of moving to a town down the road or to the other side of a city.

On the other hand, buyers in the North of England and Midlands are generally enquiring for local properties. 60% of buyers in these regions look for their next home within a 5-mile radius - higher than the national average of 50%.

Importantly, these trends mirror the pre-pandemic moving patterns. They tell us that distance is inherent in moving decisions for many buyers in the south. People may choose to buy further away because of different local economies, the availability of different property types and how expensive properties are in a given area.

In the peak of the Covid-19 home-moving boom, headlines cited a mass exodus from the capital. Our data shows that the proportion of London-based buyers enquiring about properties located 20 miles or further away from their home increased from 18% in summer 2019 to 24% in summer 2021. This is a meaningful change, but not enough to call it a mass exodus.

Londoners are looking closer to home now, but a third of buyer demand from Londoners is for homes at least 10 miles away. Housing unaffordability and lack of houses in inner London create pressure on buyers to move further away.

| Buyer's home region | Median distance to enquiry property (miles) | Proportion of buyers looking for their next home beyond 10 miles |

|---|---|---|

| East of England | 8.9 | 50% |

| South East | 5.7 | 43% |

| Scotland | 4.7 | 35% |

| London | 4.6 | 34% |

| South West | 3.4 | 31% |

| Wales | 3.3 | 25% |

| North West | 3.0 | 25% |

| North East | 2.9 | 22% |

| West Midlands | 2.9 | 21% |

| East Midlands | 2.8 | 26% |

| Yorkshire and the Humber | 2.6 | 20% |

| UK | 3.9 | 32% |

September 2023

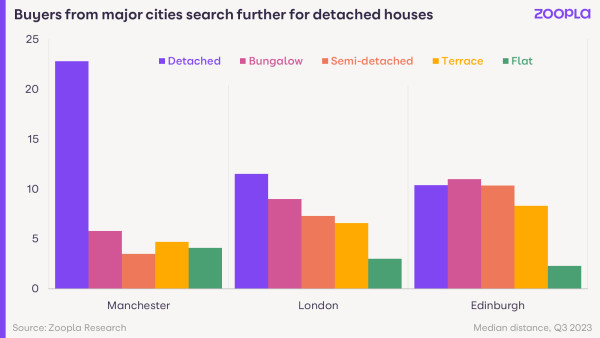

City dwellers search further so they can buy houses over flats

People looking for less common property types, such as bungalows or detached houses, are more likely to look further afield. Certain property types are simply not available to buy in some areas.

For instance, people in Manchester, where only 1 in 27 properties on the market is a detached house, look 23 miles away on average to buy such a home.

Similarly, London-based buyers looking for detached houses enquire for properties typically located 11.5 miles away from their current home.

In Edinburgh, where 64% of homes on the market are flats, those aspiring to buy a house typically look for them 10 miles away from their current location.

What are the benefits of moving further away?

For many, choosing where to move next is a balancing act of selecting areas that have the right type of homes at the right price point and fit well with your lifestyle.

People with jobs in the market services sector, which are concentrated in major UK cities but allow for remote working, have more flexibility to move further afield. For others, moving choices will be more driven by employment opportunities.

It also comes down to what type of home you want to live in. People in cities struggle to find larger houses, while those based in more rural locations have limited options when it comes to flats. As a buyer, you may have to explore more than one or two areas to find your dream property type.

If you're based in a region where it’s more expensive to buy, looking further afield into more affordable areas could mean better value for money and smaller mortgage repayments.

Key takeaways

- Most people search for their next home locally, with the average buyer looking just 3.9 miles away

- Those in the South East and East of England are more likely to move beyond 10 miles to find more space and value

- People in the North of England and the Midlands are more likely to stay local - 60% of buyers in these regions search for their next home within a 5-mile radius

- City dwellers look as far as 23 miles away to find larger properties

- Looking further away for a home can open up your options to different types of properties and more affordable house prices

New legal support service for tenants at risk of losing their home

The new Housing Loss Prevention Advice Service gives free legal support to tenants if their landlord is seeking possession of their home.

The government has today updated its How to Rent Guide with information about how to get free support if you are at risk of losing your rental home in England or Wales.

The new Housing Loss Prevention Advice Service means you can get government-funded legal advice and representation as soon as you receive written notice from your landlord or a creditor.

The update to the How to Rent Guide comes after a string of changes in March 2023, including a mandatory requirement to have smoke and carbon monoxide alarms in rental homes with combustible gas appliances.

What is the Housing Loss Prevention Advice Service?

The Housing Loss Prevention Advice Service offers legal advice and representation if you are at risk of losing your rental home.

The new service replaces the previous Housing Possession Court Duty Schemes (HCPDS).

You can apply for legal help from the moment you receive written notice that your landlord (or a creditor) is seeking possession of the property. It does not matter what your financial situation is and you will not need to pay for the service.

A housing expert will work with you to find a potential solution. They can advise you on:

-

illegal eviction

-

disrepair and other problems with housing conditions

-

rent arrears

-

mortgage arrears

-

welfare benefits payments

-

debt

If you’re asked to attend a court hearing as part of the eviction, the housing expert can give you free legal advice and representation at the court.

How to apply

Find your nearest Housing Loss Prevention Advice Service provider. Type in your postcode and tick the box for the service.

You’ll be shown all the providers nearest to you, along with their websites and contact details.

To apply, you’ll need to:

-

Contact a provider directly

-

Have the written notice from your landlord or creditor ready to show you’re facing losing your home

There’s no government guidance on which provider you should choose, but we recommend contacting the closest ones to you first. Some firms may only support those in their local area, plus it’ll be more practical if you need them to represent you in court.

The service is only available to tenants living in England or Wales. If you live in Scotland, there are other ways to get help with a rent dispute.

What is the How to Rent Guide?

The How to Rent Guide is a government document that outlines the rental process in England.

It details your rights and responsibilities as a tenant, as well as what your landlord is legally responsible for.

When you start a new tenancy, your landlord must provide you with a copy of the latest How to Rent Guide. They’ll normally send you a link to the government website rather than provide a printed version.

If they don’t provide you with the latest How to Rent Guide, they lose the right to evict you using a Section 21 notice.

Key takeaways

- The Housing Loss Prevention Advice Service offers free legal support to tenants at risk of losing their home

- Anyone can use the support service - it doesn’t matter what your financial situation is and you will not have to pay

- You can get help as soon as you receive written notice that your landlord or a creditor wants to possess your home

- Apply by finding a service provider on the government’s website and contacting them directly

- If you end up having to attend a court hearing, a housing expert will represent you in court for free

Mortgage rates expected to go down this autumn

Mortgage rates are on track to drop below 5% this autumn, boosting buyer confidence as more return to market.

What's happening with mortgage rates right now?

Mortgage rates are on track to fall below 5% this year.

The latest pause in the Bank of England’s base rate rises, amid better than expected inflation news, is good news for buyers, mortgagees and sellers.

The amount banks need to pay for borrowing money has now fallen, giving them wiggle room to reduce mortgage rates - and they are starting to creep downwards.

What 4% mortgage rates mean for the housing market

The closer mortgage rates get to 4%, the more buyers will come back to market.

That’s good news for sellers, as it will support both house sales and house prices.

Our Executive Director of Research, Richard Donnell, says: ‘Our consistently held view is that mortgage rates over 5% mean lower sales and year-on-year price falls.

‘We expect mortgage rates to start falling slowly in the coming weeks into the high 4% range.’

Right now, across the UK’s biggest lenders, the average cost of a 5-year 75% LTV fixed-rate mortgage is 5.1%.

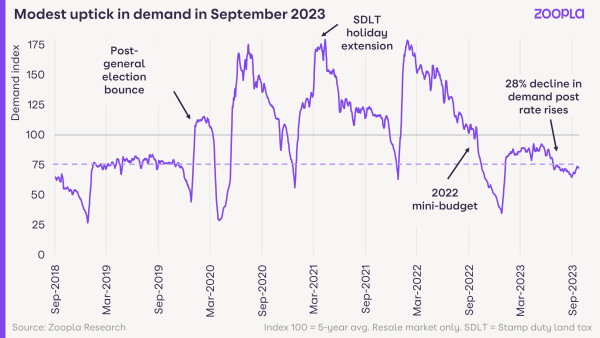

Back in spring 2023 it fell to 4.2%, which boosted buyer demand and the number of sales agreed.

There is still some uncertainty over the outlook for inflation and how quickly it will fall back to the Bank of England’s 2% target, but it is ultimately lower mortgage rates that will increase buying power over the next 12-18 months.

More buyers will come to market once mortgage rates get below 4.5%

House prices have fallen at a modest rate this year, despite the 20% hit to buying power triggered by mortgage rates increasing since early 2022.

However, a silver lining is beginning to emerge in the housing market: this September saw more buyers coming back to the market.

And enquiries to estate agents are up 12% since the August bank-holiday weekend.

While this improvement comes from a low base (demand remains 33% down on what it was a year ago), it means the housing market is now tracking more closely to where it was in 2019.

And while this uptick is partly seasonal, it also reflects improving consumer confidence, which is now at a two-year high, amid expectations of lower mortgage rates.

Donnell adds: ‘It’s clear that some buyers are returning to the market this autumn, having delayed home moving decisions as base rates moved ever higher.

‘Many others are waiting on the outlook for mortgage rates and holding their requirements for their next purchase.

‘The quicker average mortgage rates (for 5-year 75% LTV fixed-rates) move towards 4.5% or lower, the sooner we will see buyers return to the market.

‘This doesn't mean prices will start to rise but it will support sales volumes.’

Why house prices aren’t tumbling in 2023

Stricter lending regulations, where mortgagees are stress-tested to prove they can still pay their mortgages at up to 8% rates, have prevented larger house price falls this year.

That’s because we’re not seeing high numbers of forced sales, where mortgagees can no longer afford their repayments.

Instead, homeowners are using alternative routes, like extending their mortgages over a longer period of time, to lower their monthly repayments amid higher borrowing costs.

A buoyant jobs market is also helping mortgagees to keep up with those repayments.

But it remains a buyers’ market right now, with the average seller offering a £12,125 discount to sell their home.

Key takeaways

- Lenders reduce mortgage rates as bank rate holds

- Buyer confidence increases as borrowing rates edge closer to sub 5%

- Estate agents report 12% increase in enquiries