What do higher interest rates mean for the housing market?

The UK base rate continues to increase but mortgage rates are close to peaking.

Base rate up 0.25% - fewer increases expected

The Bank of England has raised rates again to 5.25% in an effort to cool inflation. City expectations of how much higher interest rates need to rise have moderated in recent weeks. Most expect only one more increase. This is an improvement on a few weeks ago when market expectations were for base rates to rise above 6%.

Mortgage rates for fixed rate deals are close to peaking

Changing market expectations for base rates has led to a fall in the underlying cost of finance for fixed rate mortgages. Some banks have already started to reduce mortgage rates as a result. These are modest reductions so far, but a sign mortgage rates are peaking.

We expect mortgage rates to fall further in the months ahead but how much depends on the outlook for inflation and what this means for City expectations for base rates. We could well see sub 5% mortgage rates return this autumn.

9 in 10 mortgage holders on fixed rates

The vast majority of people buying homes in recent years have taken mortgages with fixed rates. Almost 9 in 10 outstanding mortgages (87%) are on fixed rates meaning today’s rate rise will not have an impact on their monthly repayments.

However, 15% of mortgage holders will see their fixed deal come to an end in 2023, meaning the need to refinance onto higher rates and pay an extra £200-£250 per month on average. In some areas with higher property prices this increase will be much greater.

The remaining 13% of mortgagees are on variable rates which means higher mortgage repayments almost straight away. The fact over 1 in 10 loans are on variable rates probably reflects those with smaller loans where changes in rates have a much smaller impact on their monthly repayments.

Jump in borrowers paying down mortgages

Households with access to savings are paying down mortgage debt at a much faster rate as they look to reduce the impact of higher rates. This trend is being exacerbated by lower savings rates which makes paying down debt more attractive, especially for those who are higher rate taxpayers.

Bank of England data shows households paying off an extra £2.2 billion a month over and above regular debt repayments - this is 66% higher than the 10 year average.

Higher mortgage rates have a variable market impact

The rise in mortgage rates has hit demand from new buyers by 18% over the last 2 months. Sales have also slowed but Zoopla has not seen a drop in activity as severe as over the period immediately after 2022’s mini budget.

Home buyers are steadily accepting that we are returning to a period of more normal mortgage rates in the 4-5% range rather than the ultra low, sub 2% mortgage rates of recent years.

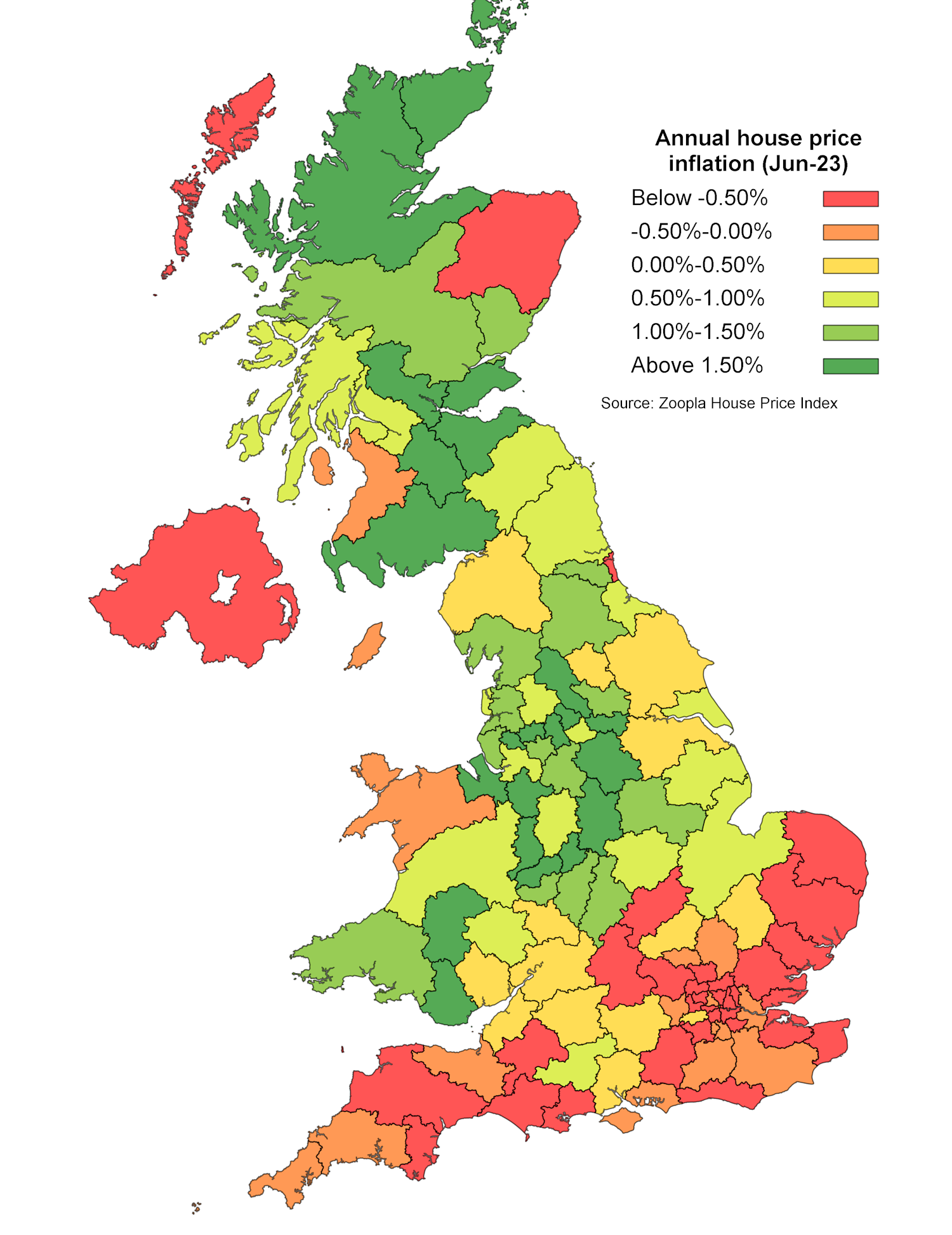

Higher mortgage rates hit buyers hardest in higher value housing markets where the size of the mortgage is larger and buyers need a larger income to buy. House Price Index shows prices falling across southern England as the hit to buying power pushes prices lower.

However, in the north of England and Scotland house prices are still rising as the impact of higher mortgage rates is less pronounced. These trends are explained by the income needed to buy and how accessible the market is for first-time buyers.

It’s cheaper to buy than rent at 5.5% mortgage rates across lower value housing markets in the north of England and Scotland. In contrast, in southern England, would-be first-time buyers face much greater challenges which weakens demand and keeps house prices under downward pressure.

UK house prices to fall 5% over 2023

Higher mortgage rates have reduced the buying power of households and this will need to be reflected in house prices which fell at the end of 2022 but started to increase this spring as mortgage rates reduced to 4%.

Now mortgage rates are rising again we expect further modest price falls in the second half of 2023. Overall we expect the average UK house price to fall 5% over 2023 but they will still remain 15% higher than the start of the pandemic.

The longer term outlook depends on the strength of the economy and labour market and how long mortgage rates remain over 5%. We expect house price growth to remain very low over 2024 and into 2025 as the market adjusts to higher borrowing costs.

There is no quick rebound in prospect as mortgage rates start to fall and anyone serious about moving needs to set their price carefully if they want to move home.

Key takeaways

- The Bank of England base rate has risen but the underlying cost of a fixed rate mortgage has been falling in recent weeks

- Mortgage rates are close to peaking

- 15% of households with a mortgage will need to refinance this year

- The impact of higher mortgage rates on demand and house prices is not uniform across the country

Are You Paying Too Much for Your London Mortgage?

27% of homeowners with a mortgage are on their lender’s standard variable rate. Could you be one of them?

When your mortgage deal period ends, you’ll normally move onto your lender’s standard variable rate.

A standard variable rate (or SVR) is usually a lot higher than your existing rate. Currently the average is around 7.5%, and it can change at any time your lender decides.

Some lenders move you onto a ‘follow on’ rate instead, which can be even higher than their standard variable rate.

According to recent research by mortgage broker Habito, one in 10 mortgagees believe that paying a more expensive rate on their mortgage meant they’d be paying off their mortgage quicker.

It doesn’t. It simply means you’re paying the lender more interest instead.

Your lender will be able to tell you in advance what your monthly payment will be once your current deal ends.

How much more expensive is a lender’s standard variable rate?

An SVR or ‘follow on’ rate can be between 2% and 3% higher than the average five-year or two-year fixed rate mortgage.

And the lender can raise the rate at any time.

When the Bank of England increases the Base Rate (which has currently risen 13 times since December 2021) SVR and tracker rate mortgages may increase too, as they usually follow the Base Rate.

However there are exceptions. And some lenders have opted not to increase the rate on their SVR mortgages when the Base Rate has risen.

Your lender will always let you know what’s happening with your mortgage rate.

Current SVRs and fixed rate deals from major lenders

Let’s take a look at the standard variable rate and fixed rate mortgage deals currently being offered by some of the major lenders.

|

Lender |

SVR |

10-year fixed |

5-year fixed |

2-year fixed |

|

Barclays |

7.99% |

5.15% |

5.32% |

5.9% |

|

Halifax / Lloyds |

8.49% |

5.33% |

5.83% |

5.23% |

|

HSBC |

6.99% |

- |

5.61% |

6.14% |

|

Nationwide |

7.99% |

5.04% |

5.59% |

6.09% |

|

Santander |

7.75% |

- |

5.84% |

5.44% |

|

The Mortgage Works (buy to let) |

8.49% |

5.49% |

5.74% |

6.19% |

|

Virgin Money |

8.74% |

5.18% |

5.63% |

6.13% |

|

Yorkshire BS |

7.99% |

5.72% |

5.6% |

5.34% |

If you had a £200,000 mortgage spread over 25 years on a £250,000 property, you could end up paying several hundred of pounds more in interest each month on the lender’s SVR.

To cite Virgin Money’s rates above as an example:

On the standard variable rate of 8.74%, you’d be paying £1,642 a month.

At the two-year fixed rate of 6.13%, you’d be paying £1,304 a month.

With the five-year fixed rate of 5.63%, you’d be paying £1,243 a month.

And with the 10-year fixed rate of 5.18%, you’d be paying £1,190 a month.

That’s a potential difference of £452 a month, or £5,424 a year, between a lender’s standard variable rate mortgage and fixed rate deal.

Use our mortgage calculator to work out what your monthly payments could be.

Why are so many people on standard variable rate mortgages?

Habito’s research suggests many homeowners are slipping onto their lender’s SVR without even realising it or knowing that they have an alternative.

But it’s always worth contacting a broker 3-6 months before your current mortgage deal is due to end.

You can book in a new deal up to six months in advance.

And if a better rate comes up between the time you booked the deal and the time it’s due to begin, you can simply book in that rate instead.

Your mortgage broker will be the best person to advise you on what to do.

Trusted partner is Mojo Mortgages, a free online mortgage broker.

Financial concerns

One in 10 homeowners were frightened of lenders scrutinising their finances, given the current economic climate.

This is where a broker can help. They have an in-depth knowledge of the mortgage market and know the rules that different lenders operate by.

Once your broker has an understanding of your financial circumstances, they’ll know which lenders to approach on your behalf.

Unaware of mortgage alternatives

One in 10 didn’t realise it could be possible to get a cheaper mortgage deal.

A mortgage broker will scour the market for you to find the cheapest mortgage rates available to you.

Too much hassle to switch mortgages

In a recent survey by Which?, 41% of homeowners on an SVR mortgage said they’d be unlikely to switch to a cheaper deal.

They felt it ‘wasn’t worth the hassle’ or they ‘hadn’t really thought about it’.

This in part may be because homeowners with smaller mortgages are less likely to feel the financial hit when moving onto an SVR.

But when the savings can run into hundreds of pounds a month, it’s a call to a broker that’s worth making.

Fears of being in negative equity

Other homeowners were concerned that they might be in negative equity.

Negative equity is when a property you own is worth less than the mortgage you're paying on it.

What is negative equity?

Most lenders won't let people with negative equity switch to a new mortgage deal when their existing one ends. Instead, they'll normally be moved onto their standard variable rate.

You can find out if you’re in negative equity by checking the balance left on your mortgage and inviting estate agents round to value your home.

If you are in negative equity, it could still be worth speaking with a mortgage broker, as they may be able to find a lender that could help.

Mortgage rates are set to come down this autumn

In good news for homeowners and buyers, mortgage rates look set to hit their peak this summer.

Inflation is now on its way down and so are swap rates - the rates the banks pay to borrow money.

Swap rates are based on what the markets think the interest rate will be in the future.

Right now, the average mortgage rate for a 5-year fixed rate at 75% loan to value has reached 5.4%, compared to 4% in the Spring.

The reduction in swap rates will take time to feed through into mortgage rates, but our Executive Director - Research, Richard Donnell, believes they could fall below 5% this autumn.

Whether you need to remortgage now or in six months time, if your current mortgage deal is coming to an end soon, it’s well worth contacting a mortgage broker.

They will be fully up to speed on the latest mortgage market trends and current rates available.

And they are in the best place to advise you on getting the cheapest possible mortgage deal for you.

Which Properties Are Selling Best in London Right Now?

The UK property market is currently in a state of flux, with rising mortgage rates and a cost-of-living crisis putting pressure on buyers. However, there are still some properties that are selling well, especially in London.

Family-sized homes are still in demand, but buyers are looking for bargains.

In the past, 3- and 4-bedroom family homes were the most popular type of property in London. However, rising mortgage rates have made these homes more expensive, and buyers are now looking for good deals.

Flats are also selling well, especially in central London.

Flats are often seen as a more affordable option than houses, and they are also becoming more popular with investors. In central London, flats are selling at a premium, and there is a shortage of supply.

What does this mean for sellers?

If you are selling a family-sized home in London, you may need to be prepared to negotiate on price. However, if you are selling a flat, you may be able to get a good price, especially if it is in a desirable location.

Here are some tips for sellers in London:

- Get your property valued by a professional.

- Price your property competitively.

- Make sure your property is in good condition.

- Market your property widely.

The London property market is always changing, so it is important to stay up-to-date on the latest trends. If you are thinking of selling your property, it is a good idea to speak to a property expert to get advice on the current market conditions.

Here are some additional details about the UK property market:

- The average house price in the UK is currently £280,000.

- The average house price in London is currently £525,000.

- The number of house sales in the UK fell by 12% in July 2022.

- The number of house sales in London fell by 10% in July 2022.

Key takeaways

- Demand falls as higher mortgage rates prompt buyers to reassess what they can afford

- Family-sized homes are hardest hit as buyers have less money to spend on larger properties

- Flats make a comeback, gaining popularity as buyers look for more affordable options