Renters' Reform Bill comes to Parliament next week

Notice periods for rent increases to be doubled, no-fault evictions banned and minimum housing standards established. What's in the Renters' Reform Bill?

A new bill protecting renters from unfair rent increases and ‘no fault’ evictions is set to be introduced to Parliament next week.

The Renters' Reform Bill contains a package of measures to improve the private rented sector and increase the rights of tenants.

The bill, which will be published for the first time next week is expected to set minimum standards that all rental homes will have to meet, make it easier for renters to have pets, and prevent landlords from having blanket bans on families with children or people receiving benefits.

The government has described the measures as the biggest shake up to the private rented sector for 30 years.

But it is unclear when the measures will come into force. The bill will take time to go through the legislative process, so it could be 12 to 18 months before it becomes law.

The bill comes as renters face a shortage of homes in the private rented sector, pushing rents higher at a time when renters are already struggling with the cost-of-living squeeze.

What will change?

While the exact contents of the bill are not yet known, many of the measures have been widely flagged by the government.

The key aim of the bill is to enhance renters’ rights and ensure their homes are fit to live in.

Here's what's expected to be announced:

-

Arbitrary rent review clauses will be outlawed.

-

The amount of notice renters will be given about rent increases will be doubled.

-

Renters will have stronger powers to challenge rent rises if they think they are unjustified.

-

The Decent Homes Standard will be extended to cover the private rented sector for the first time, to ensure all private rented properties are fit for occupation. If homes fall below this standard, people will have their rent repaid.

-

Section 21 ‘no fault’ evictions will be banned, meaning tenancies will only end if a renter wants them to, or the landlord has a valid reason, defined in law, to do so.

-

Going forward, all renters will be moved into a single system of ‘periodic tenancies’, enabling them to leave poor quality housing without remaining liable for the rent, and making it easier for people to move if their circumstances change.

-

Councils will be given stronger powers to tackle rogue landlords, including larger fines for serious offences.

-

A new Private Renters’ Ombudsman will also be created to settle disputes between renters and landlords quickly, at a low cost and without having to go to court.

-

Renters will be given the right to ask to have a pet in their home. Landlords must consider the request and cannot unreasonably refuse it.

-

Renters will also be able to demand information on their landlord and rate them following the introduction of a mandatory landlords’ register.

Why is this happening?

Around 4.4 million people currently rent their home in the private sector.

But one in five live in properties that are deemed to be unfit, more than half of which pose a risk to renters’ health and safety, according to the government.

Meanwhile, research shows that more than a fifth of private renters who moved in 2019 and 2020 did not do so by choice.

The government hopes the new bill will redress the balance between landlords and tenants and, by banning ‘no fault’ evictions, provide renters with more stability.

Who does it affect?

While the bill is good news for renters and provides them with additional protections, there are concerns that it could lead to some landlords leaving the private rented sector.

Research by the National Residential Landlords Association found that 76% of landlords felt their business was threatened by the bill, with 93% saying it would increase the financial risk of being a private sector landlord.

Rents have increased by 10.9% during the past year to average £1,120.

The rise has been caused by a large increase in demand combined with a shortage of available homes to rent, according to our latest research.

A combination of tax changes, increased regulation and higher interest rates have caused many buy-to-let landlords to exit the sector in recent years.

If the bill causes more landlords to sell up, it could put further upward pressure on rents.

Key takeaways

- A new bill protecting renters from unfair rent increases and ‘no fault’ evictions is set to be introduced to Parliament next week

- The Renters Reform Bill is expected to set minimum standards that all rental homes will have to meet, make it easier for renters to have pets and prevent landlords from having blanket bans on certain tenants

- The bill could take 12 to 18 months to go through Parliament and become law

First-time buyers need to earn an extra £7.5K to step on the property ladder

The rapid rise in house prices over the last three years means first-time buyers now need to earn more to buy a home. Let’s look at the options.

Higher mortgage rates have a major impact on first-time buyers.

But many first-time buyers come from the rental market, where there have been steep increases in rental costs over the last year, with rents up £1,120.

This, combined with a chronic shortage of supply, which is currently down by a third, is now pushing more first-time buyers towards home ownership.

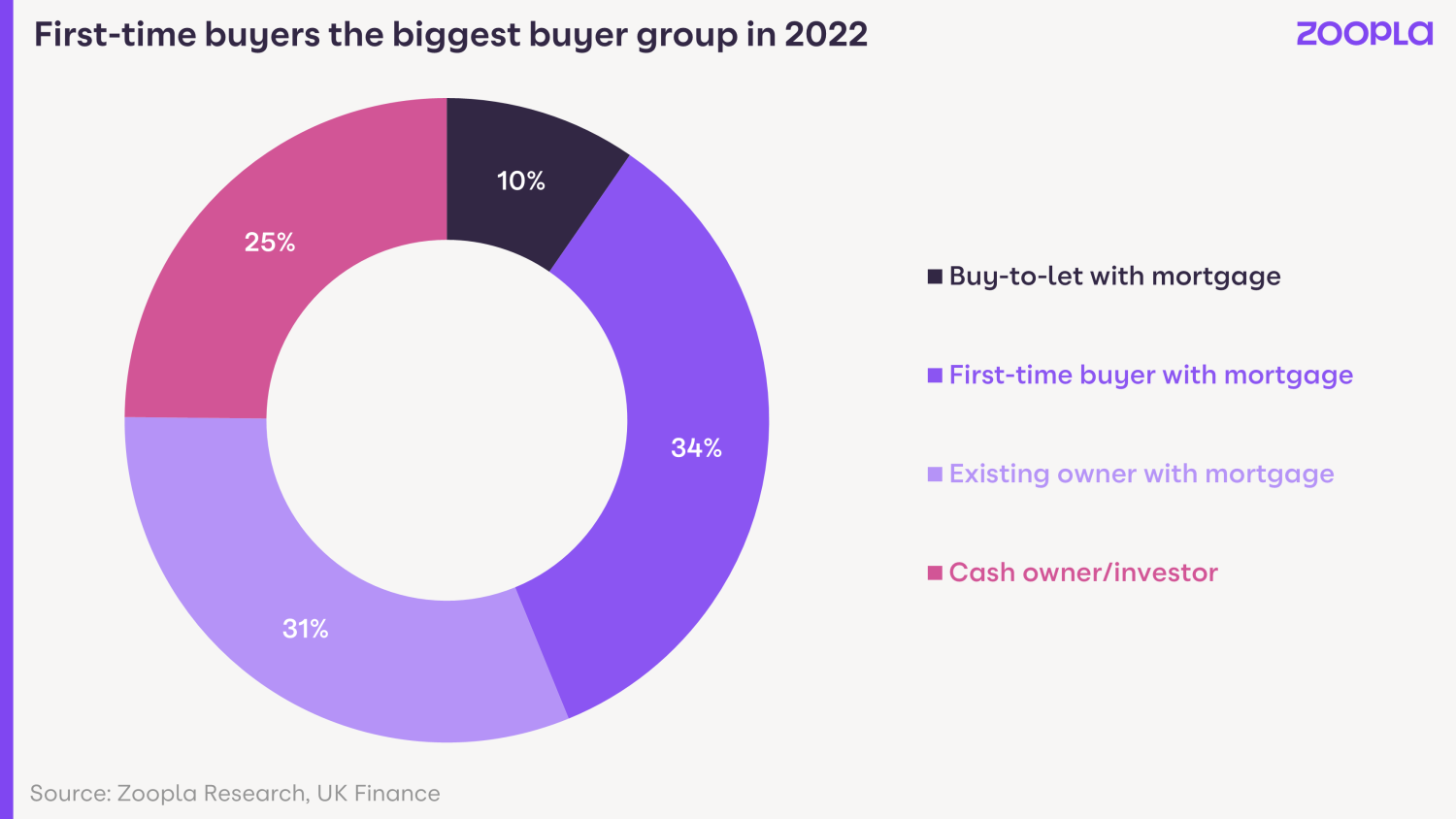

In fact in 2022, first-time buyers have proven to be highly resilient. We estimate that first-time buyers using a mortgage accounted for over 1 in 3 sales last year (34%).

This made them the largest group of home buyers, followed by existing owners using a mortgage (31%) and cash buyers (25%).

The main constraints to stepping onto the property ladder for first-time buyers are access to a suitable deposit and the right level of income to afford a mortgage.

While the jump in house prices over the last 3 years has increased the amount of income and deposit needed to buy a first home.

How much money do first-time buyers need?

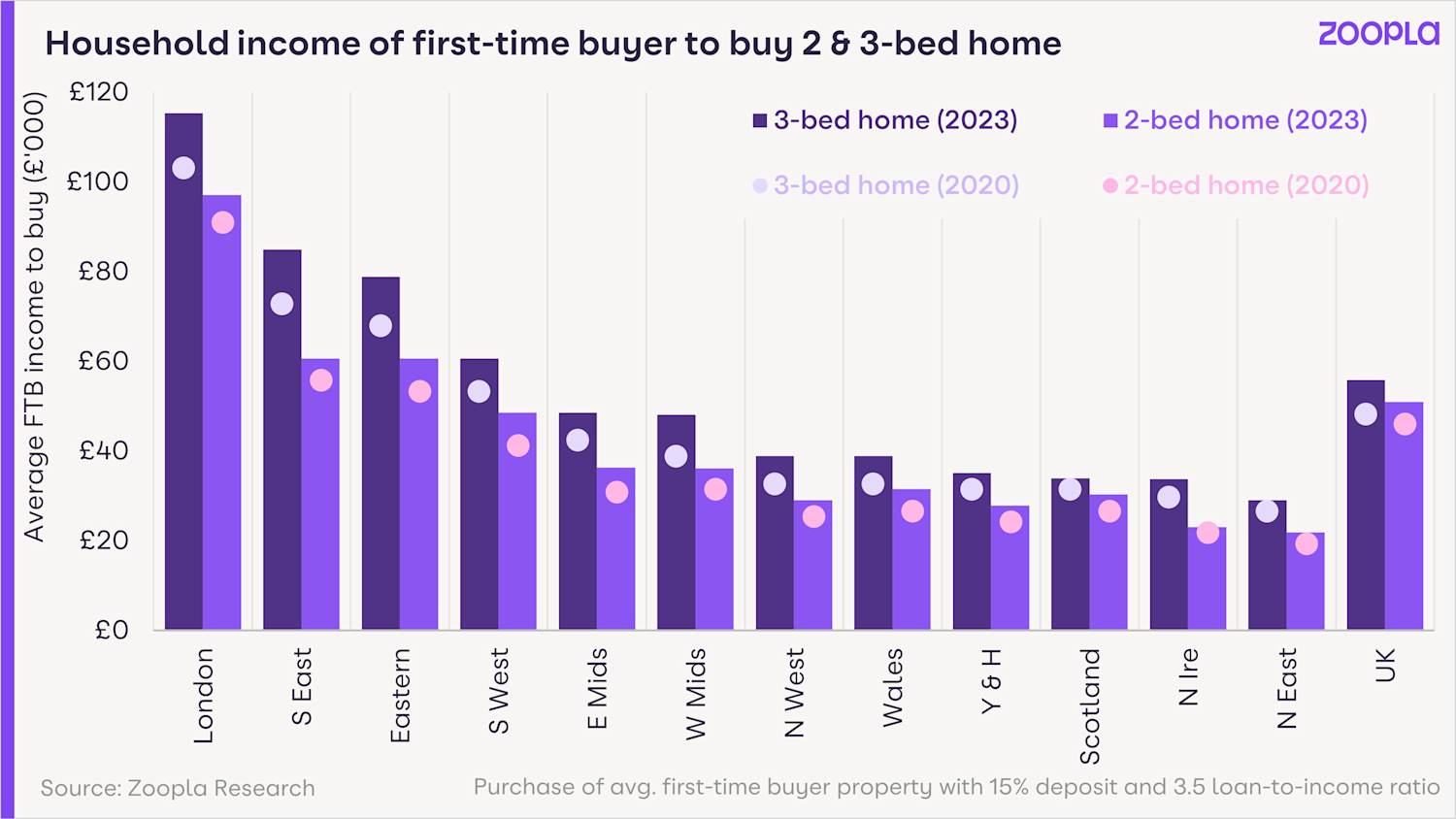

First-time buyers now need to earn nearly £7.5K more to buy a home than they did in 2020.

That means you’ll need to earn a household income of £55,900 for a 3 bed home, or £51,000 for a 2 bed home (an increase of £4,900) .

In London and the South East, the income needed to buy a home has now increased by over £12,000 to buy a 3-bed home and £7,300 to buy a 2-bed home.

Yet wages have only risen by £4,800 since 2020, according to the Office for National Statistics.

The average amount needed for a house deposit has also risen.

For the average three-bed home costing £230,000, a first-time buyer would need to have a deposit of £34,500 (an increase of nearly £5,000).

For a two-bed home costing £210,000, you would need a deposit of £31,500 (an increase of £3,000).

Traditionally, 3-bed houses have been the most popular choice for first-time buyers, but we are seeing clear evidence of first-time buyers seeking better value for money with one and two-bed flats.

The ability to work from home has also enabled first-time buyers to look further afield to secure the home they need at the right price.

So what can first-time buyers do in 2023?

A quick checklist:

1: Save for a larger deposit

One option is to try and save for a larger deposit, which may be challenging when rental costs are taking up a larger portion of people’s earnings.

2: Borrow from the bank of mum and dad

Another might be to borrow from the ‘bank of mum and dad’ if that’s a possibility.

3: Look to buy a more affordable home

We’re seeing that some first-time buyers are looking to purchase cheaper and lower-cost homes.

Lower mortgage rates in recent years have enabled first-time buyers to purchase larger, typically 3-bed homes.

But higher mortgage rates and prices are now pushing some to adjust their requirements, particularly in the areas where prices have increased the most since 2020.

Three-bed homes are still the most in-demand property type but buyer interest has fallen back to 40% in Q1 2023, while demand for 1 and 2-bed flats increases.

Outside of London, the average asking price for a 2-bed flat (£200,000) is 29% lower than a 3-bed house (£280,000).

4: Take out a longer term mortgage

Finally, you might consider taking out a longer term mortgage.

In the past, mortgage terms have usually been around 25 years.

But there has been a steady increase in the number of mortgages with terms of over 30 years.

Taking out a 35-year loan gives buyers an extra 20% boost to buying power, compared to a 25 year loan.

But it’s important to be aware that this comes at the cost of an extra 48% in mortgage interest payments over the longer term.

Key takeaways

- Rising rents and a shortage of rental properties are pushing more renters to become first-time buyers

- In 2023, first-time buyers need to earn a household income of £55,900 to buy a 3-bed home, or £51,000 to buy a 2-bed home

- There are options available for first-time buyers, including saving for larger deposits, extending the mortgage term or looking for more affordable housing in less expensive areas

What are the main advantages of making mortgage overpayments?

To combat rising mortgage rates, homeowners have begun making record numbers of overpayments in a bid to reduce how much they owe.

Homeowners overpaid their mortgages by a record £6.7 billion in the final three months of 2022.

It marks the first time overpayments have exceeded £6 billion in one quarter since records began in 1999.

According to the Equity Release Council, the total value of mortgage overpayments reached £23.3 billion last year.

The jump in overpayments is likely to have been triggered by rising interest rates as the Bank of England tries to bring down stubbornly high inflation.

By making mortgage overpayments, homeowners reduce the amount they owe, helping to offset some of the impact of higher borrowing costs.

What are mortgage overpayments?

Mortgage overpayments refer to the money you pay to your lender that’s above the standard monthly repayments you have to make.

You can generally make them as either a one-off lump sum payment or by increasing the amount you pay each month over your mortgage term.

Most lenders will allow you to make overpayments of up to 10% of the outstanding amount you owe each year without incurring a penalty, with some allowing you to repay as much as 20%.

What are the main advantages of making mortgage overpayments?

There are many advantages to making mortgage overpayments.

The main one is that it reduces the amount of interest you pay over the lifetime of your mortgage.

For example, if you borrow £200,000 over 25 years at an interest rate of 4%, you will pay a total of £116,702 in interest.

But if you increase your monthly repayments by £100 a month, from £1,055 to £1,155, you will pay only £98,681 in interest, saving you just over £18,000.

Not only that, but you will also repay your mortgage three years and five months sooner, meaning you will be mortgage-free quicker.

What other benefits are there to mortgage overpayments?

Making mortgage overpayments can also help to offset the impact of rising interest rates.

For example, if you have a £200,000 mortgage on which you are currently paying interest of 2%, your monthly repayments will be £848.

But if you are coming to the end of your deal and need to remortgage, your monthly repayments will jump to £1,055, based on a best-buy mortgage rate of 4%.

However, you can offset some of this increase by overpaying your mortgage to reduce the outstanding amount you owe.

For example, it you make a 10% overpayment reducing your outstanding mortgage to £180,000, based on the example above, your new monthly repayments will rise to only £950.

If you are able to make a 20% overpayment, the impact will be even bigger, reducing your new monthly repayments to £845 – broadly in line with what you are currently paying.

Another advantage of making overpayments is that it reduces the amount you owe relative to your home’s value. Lenders call this your loan to value (LTV) ratio.

Banks and building societies typically reserve their best deals for people with an LTV of 60% or less.

Even if you don’t qualify for one of the best deals, making overpayments could still help you move into a lower LTV tier, enabling you to benefit from a lower mortgage rate.

Finally, if you are struggling to keep up with your mortgage payments, lenders are often more likely to grant you a payment holiday if you have made overpayments in the past.

How to overpay your mortgage

There are two ways to make overpay your mortgage. You can either make a lump sum one-off overpayment or smaller, regular overpayments.

Both types of overpayment have benefits, and the most important thing is to only do what you can afford.

But if you are struggling to decide what to do, making one-off overpayments tends to have a bigger impact on your mortgage.

For example, if you take out a £200,000 mortgage with a 4% interest rate, making a one-off overpayment of £20,000 at the beginning of the term will save £30,179 in interest.

It will also mean you repay your loan three years and 11 months early.

By contrast, making overpayments of £100 a month on the same deal will save you just £18,020 in interest, even though the amount you are overpaying will amount to £25,900.

It will also knock three years five months off your mortgage term.

Can you overpay an interest-only mortgage?

When you overpay a repayment mortgage, you reduce the total amount you owe, which means you'll pay less interest on your mortgage and you'll pay it off more quickly.

When you overpay on an interest-only mortgage - and it is possible to do this - you don't get the same benefits.

With interest-only mortgages, you're only ever paying the interest on the loan, rather than reducing the actual debt itself.

Overpaying an interest-only mortgage can help to reduce future interest payments or the overall interest you pay, but it can't help to pay down the overall debt you owe.

Key takeaways

- Homeowners have overpaid their mortgages by a record £6.7 billion

- The jump is likely to have been triggered by rising interest rates, as the Bank of England tries to bring down stubbornly high inflation

- You can either overpay your mortgage using a lump sum, or by overpaying by smaller amounts each month