What’s happening in the housing market right now?

Three different prime ministers within the space of three months, a mini-Budget and a mini-Budget reversal.

The political turmoil in recent weeks has compounded the rise in borrowing costs, resulting in mortgage rates spiking above 6% and growing uncertainty over the UK’s economic outlook.

The health of the housing market is inextricably linked to the health of the economy and, in particular, the cost of borrowing.

Higher mortgage rates squeeze out new buyers

The sudden increase in mortgage rates represents the largest interest rate shock for new buyers since the late 1980s.

The immediate impact has been felt by the households who don’t have mortgages arranged at the cheaper rates that were available prior to - and during - the pandemic.

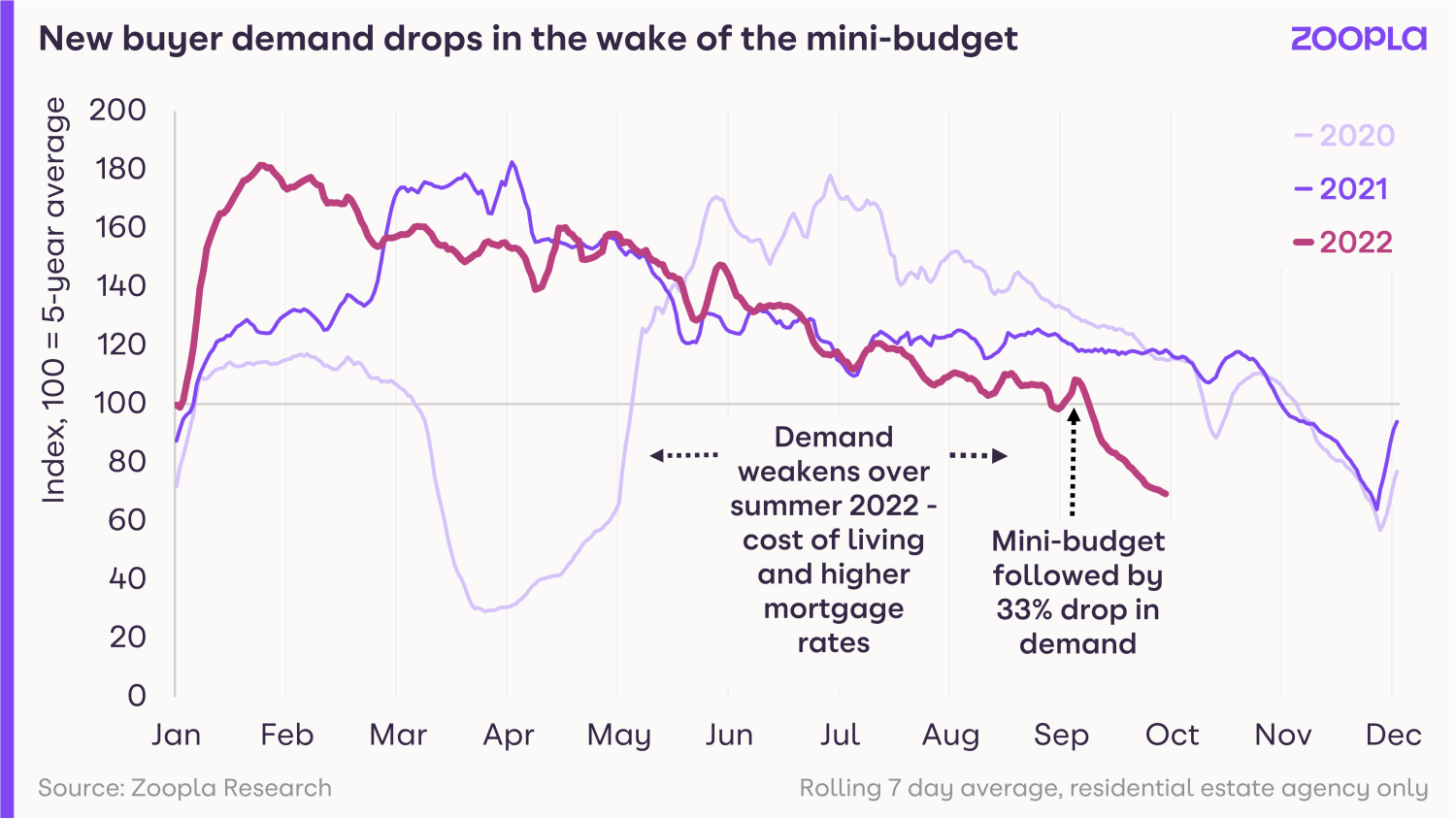

It explains why new buyer demand has fallen by a third since the mini budget.

That drop in buyer interest has been spread across all UK markets, as the pool of buyers with cheap mortgage offers dwindles.

The South East has seen the biggest drop, with demand down 40%, followed by the West Midlands, where demand is down 38%.

What we’re seeing right now is very similar to what we typically see in late November ahead of the Christmas slowdown.

However, those with cheap loans secured, as well as cash buyers, are continuing to make offers and agree sales, albeit at a slower rate than this time last year.

Dwindling pool of interested buyers with cheap mortgages

The pent-up demand to move remains.

In fact, many households rushed to secure low-cost mortgages over the summer as the rates started to rise.

The Bank of England data for mortgage approvals in August showed an unseasonal jump of 17%.

This demonstrates an underlying desire to move among a proportion of households, largely driven by the pandemic-led search for space and cost-of-living factors.

Large pipeline of sales remains

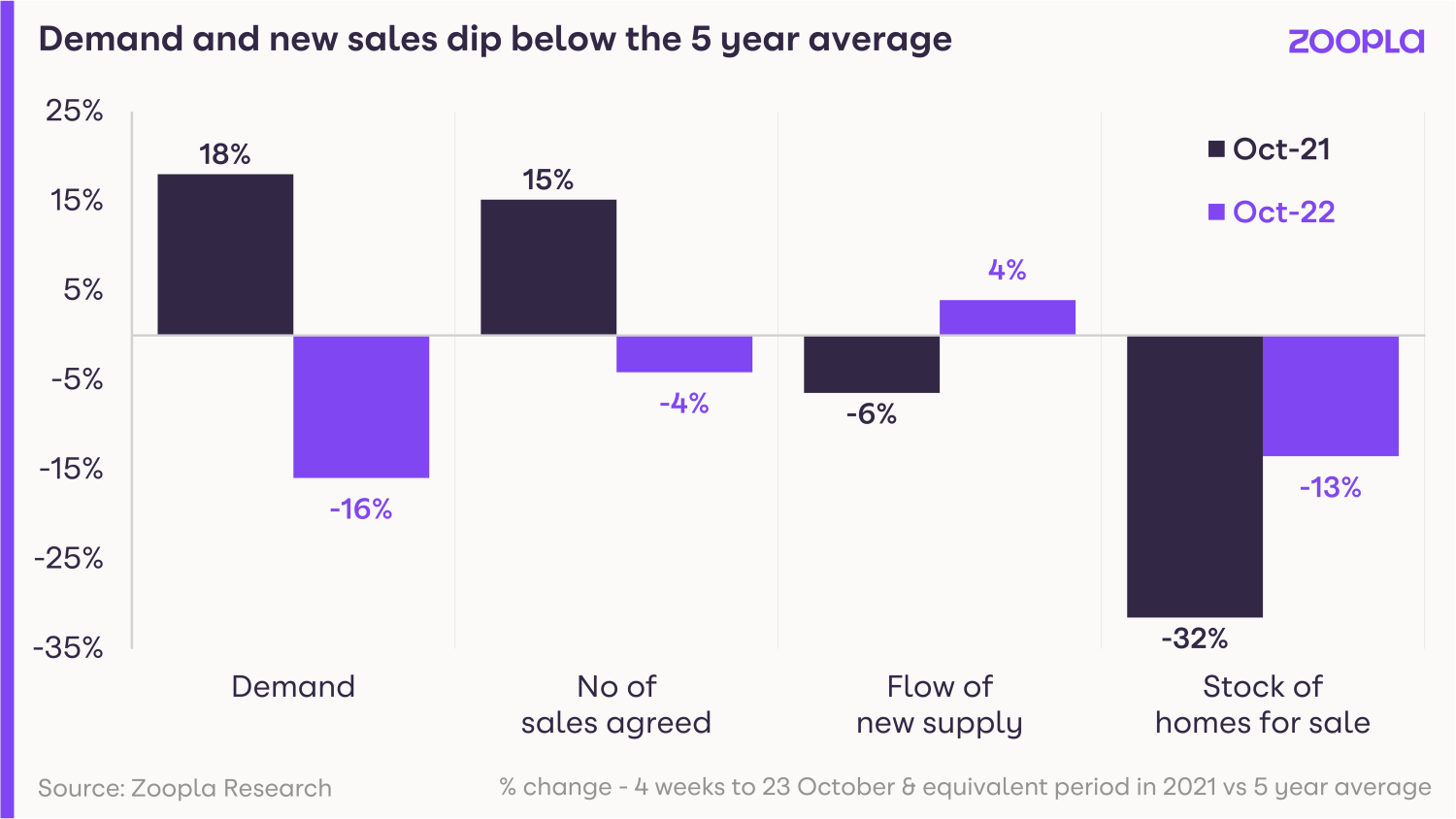

All that being said, 2022 was a strong year for the housing market and there are still around 293,000 sales still going through in the pipeline, most of which we expect to complete.

The number of sales falling through is beginning to increase, mainly as a result of a lack of affordable finance, but in total, we are still on track for nearly 1.3m sales this year.

Large scale price reductions not expected this year

We don’t expect any pricing impact to materialise until the first quarter of 2023.

Typically, it takes several months for pricing to adjust in the face of weaker demand.

There has been a short-lived surge in the number of homes coming to the market, although the number of homes for sale still remains below average, which is supporting pricing.

At the same time, around 7% of homes for sale have seen their asking price reduced by more than 5% - an increase on recent months but still below 2018 levels.

Average house prices have increased by 8.1% over the last year, thanks to the strength of demand and the number of sales agreed over the last six months.

This demand, combined with an ongoing shortage of homes available for sale, will continue to push prices higher for the rest of 2022.

But the annual rate of growth is starting to slow across all areas, and this will accelerate further into 2023.

Key takeaways

- Buyer demand has dropped by a third since the mini-Budget, across all UK markets

- That said, 2022 was a strong year for property - and nearly 300,000 sales are still going through this autumn, taking the year's total sales to 1.3m

- A shortage of supply means prices will remain buoyant for the rest of the year and we don't anticipate any impact on house prices to be felt until 2023

Mortgage rates expected to fall in 2023

In good news for buyers and homeowners wishing to remortgage, mortgage rates look set to fall towards the end of this year and into 2023.

Events are moving fast in the worlds of politics and the financial markets.

Already, the money markets are adjusting to a changing political outlook, where stability in the UK’s public finances is an imperative.

The big unknown that remains is how much further central banks will need to raise interest rates to bring inflation back under control.

A recent speech from the Bank of England suggested markets were over-estimating how much higher interest rates will rise. Only time will tell.

What is clear is that mortgage rates are not going to return to the ultra-low levels of recent years and home buyers need to adjust to the fact that 4-5% rates are set to become the norm in future.

Spike in mortgage rates makes housing less affordable

Tighter lending criteria inevitably impacts the buying power of new borrowers.

Lenders will now be testing affordability at up to 8% mortgage rates, squeezing that buying power even further.

Will mortgage rates keep rising in 2023?

The outlook for transactions and pricing in 2023 will all depend on what happens with the economy and with mortgage rates.

As buyers are affected by higher borrowing rates, so in turn are sellers, since reduced buying power will impact the asking prices sellers are able to achieve when marketing their homes.

The most important part of this equation is how long mortgage rates for new buyers stay at over 6%, and how quickly they might fall back to a more manageable 5%, a level we see as a tipping point for house price reductions.

Should mortgage rates fall back quickly in the next quarter, the outlook for next year will be very different, compared with the prospect of mortgage rates remaining at or above 6% for the next 12 months.

A return to 5% will bring some stability to the housing market and is likely to reduce the need for sellers to drop their asking prices to achieve a sale.

Key takeaways

- The money markets are already adjusting to the changing political outlook, where stability for the UK's finances is essential

- Mortgage rates are expected to fall to 4-5% next year and this is likely to be the new norm. The days of ultra cheap money are now behind us

- A return to 5% mortgages will bring some stability to the housing market and is likely to reduce the need for sellers to drop their asking prices to achieve a sale

What's going to happen to the housing market in 2023?

Will mortgage rates rise or fall, will house prices remain stable and is negative equity a real concern? Get the latest with our House Price Index.

Mortgage rates look set to fall in 2023

Events are moving fast in the worlds of politics and the financial markets.

On balance, we believe that mortgage rates will start to decline before the start of 2023 and this decline will continue into next year.

There are signs that the money markets are already adjusting to a changing political outlook where stability in the UK’s public finances is an imperative.

The big unknown remains how much further central banks need to move on interest rates to bring inflation under control.

A recent speech from the Bank of England suggested markets were over-estimating how much higher interest rates will rise. Only time will tell.

What is clear is that mortgage rates are not going to return to the ultra-low levels of recent years.

Home buyers need to realise that mortgage rates of 4 to 5% are set to become the norm in future.

Spike in mortgage rates delivers a quick reality check for home buyers

Many homebuyers are continuing with their agreed purchases.

Others did not expect to be buying with mortgage rates three-times higher than they were at the beginning of the year and are sitting it out for the rest of 2022.

That said, the broader motivations to move home will remain into next year.

These searches will largely be supported by pandemic factors, including the need for more space and a home office, as well as cost-of-living pressures, including the need for homes that are cheaper to heat and run.

For many households, a move will come down to what they can get for their current home and what this value unlocks for their next one.

Are house prices set to fall in 2023?

Any price reductions will come out of equity for most households but it can take time before everyone who wants to move accepts these pricing adjustments.

However, we expect this adjustment process will be quicker than normal, given the step change in the outlook and the scale of recent price gains.

While the focus has mainly been on mortgage rates, it’s important to note that the labour market remains buoyant and on average, wages increased by 5.4% in the year leading up to August.

The proposed cuts to National Insurance and the government’s support for energy bills will also help to offset some of the financial pressures homeowners are currently experiencing.

The housing market in 2023 mainly looks set to be one of re-adjustment as we return to normal levels of mortgage rates.

How will the hit to buying power affect the market in 2023?

A rapid reversal in mortgage rates would have the greatest impact on buying power, enabling buyers to borrow for their next move without over-stretching themselves.

If a modest decline in house prices took place too, that desire to buy could be further accelerated.

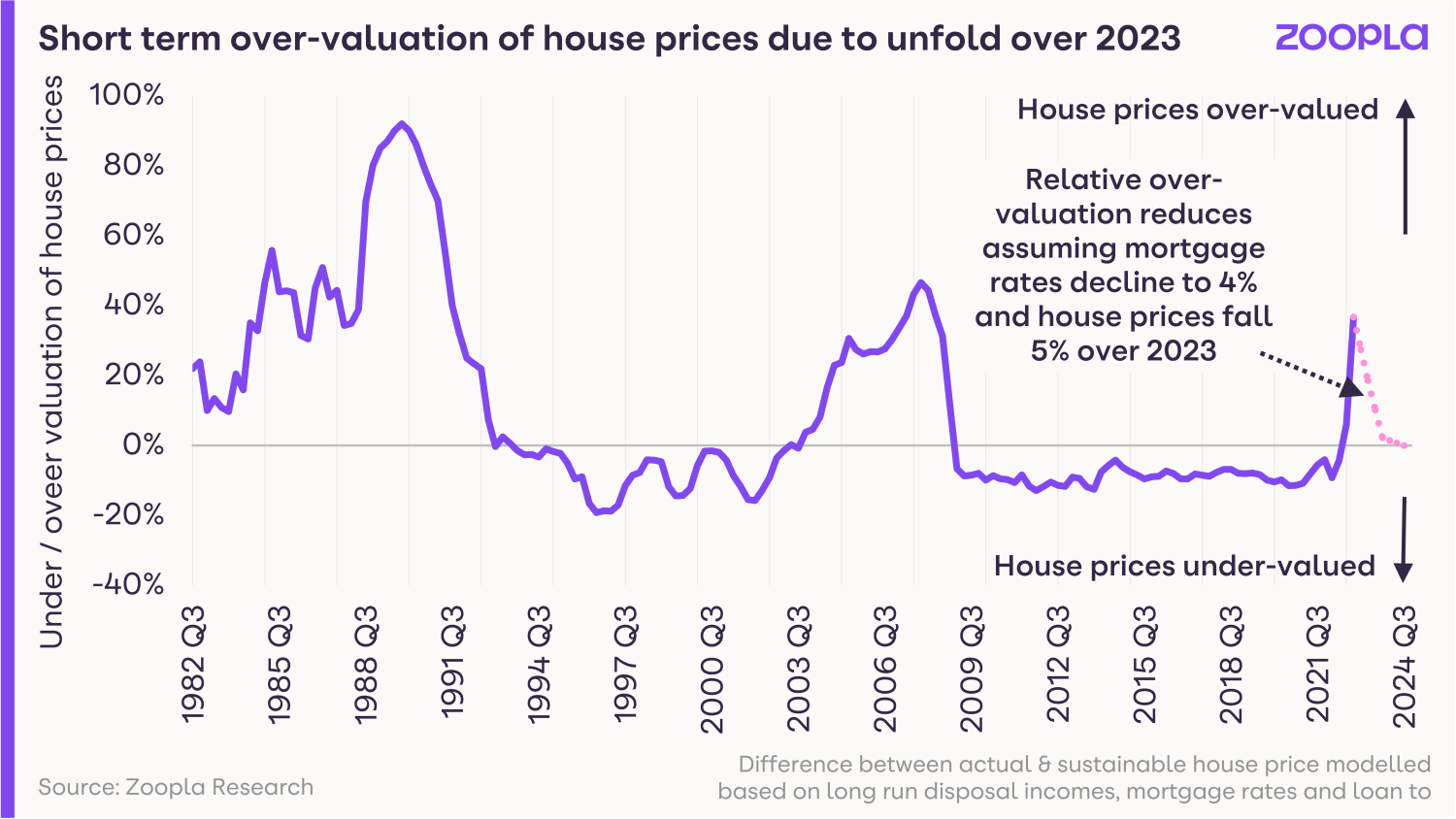

Mortgage rates moving back towards 4% by the end of 2023 and a 5% fall in house prices would see most of the market’s current over-valuation reversed by December next year.

At present, we believe this will be the most likely outcome, accompanied by a modest decline in sales volumes from 1.3m to 1m in 2023.

Key takeaways

- Mortgage rates look set to return to 4 to 5% next year - and these rates are set to become the norm in future. The days of ultra cheap money are behind us

- Pandemic and cost-of-living factors will continue to drive the search for new homes in 2023

- A 5% fall in house prices next year would see most of the market’s current over-valuation reversed by December 2023

What does a Rishi Sunak prime ministership mean for the housing market?

A new era of financial and economic stability, falling mortgage rates and rental market reforms. What Rishi Sunak has in store for the housing market.

It’s been a political roller coaster over the last few months, accompanied by growing economic uncertainty for UK households at a time when the cost of living is having a growing impact on financial decisions.

So what does the new prime minister have at the top of his inbox when it comes to the housing market and supporting people with their home-related decisions?

Financial and economic stability

It is fair to say everyone is looking for more stability and calm.

The arrival of Rishi Sunak as the new prime minister seems to have gone down well in financial markets, supported by several big policy U-turns from the new Chancellor Jeremy Hunt last week.

The top priority for the new prime minister is how to get the UK’s finances in order to help bring down borrowing costs for business and households and to help tackle the cost of living squeeze.

The health of the housing market is inextricably linked to the health of the economy and in particular the cost of mortgages, which have shot up to average over 6% in recent weeks.

This has delivered a big hit to buying power for those looking to move home, especially when we’ve been used to sub 2% mortgage rates.

Mortgage rates will start to fall

The cost of borrowing for government and business has fallen in the last 2 weeks and is set to fall further in the weeks ahead, as markets react to the messaging from the Government about balancing the books.

Mortgage rates for new business are starting to fall but still remain well above where they started the year.

The outlook for interest and mortgage rates is still out of the Government’s hands.

We don’t know how much further central banks will have to increase base rates to calm inflation, which is adding to everyone’s cost of living and eroding the value of our incomes.

There is hope that we are approaching the end of interest rate increases, which is good news for savers after a barren decade of low returns on savings, but means buying a home has become more expensive.

It looks like mortgage rates will return to 4-5% in 2023. But anyone looking to buy a home needs to realise that we are not going back to the days of ultra cheap money.

Home ownership and house building

Both Labour and the Conservatives have stated policies to increase home ownership. But it’s hard to grow home ownership if we aren’t building more homes.

The appointment of Michael Gove back into the housing and the levelling up ministerial role is a signal that the 2019 manifesto commitment remains to boost jobs and investment right across England. This will, in turn, boost housing delivery.

Gove was also the minister who pushed through the industry solution to address the cladding problems for homeowners in tall residential buildings, removing a big area of uncertainty for consumers and lenders.

Building more homes is often a contentious topic for local residents, who fear extra demands on local services.

Comments on house building from the new prime minister in the summer leadership election suggest he sees the importance of making sure we build homes and the infrastructure to support them.

This would help to ease any extra pressure on local services.

Sunak said he favours “reforms to increase density in our inner-cities, investing in regenerating brownfield land across the country, and pursuing developments that have community support.”

Sticking to reforms for private renting?

There are also big reforms planned in the private rented sector in England, aimed at improving standards of accommodation and shifting the balance of the relationship between landlords and renters.

Again, these were promoted by Michael Gove when he was the housing minister earlier this year.

The rental market is particularly stretched at present, with a lack of new investment by landlords since big tax changes and increased regulation were introduced from 2016 onwards.

The rental market has stopped growing in size, yet the demand for renting is growing, compounded by the rising cost of buying a home.

Rents are rising fast - up 12% in the last year according to our latest index - adding to cost of living pressures.

The case for reform in the rental market is important but it needs to be balanced against how much this pushes landlords out of the market, eroding supply and choice for renters.

This hits those on the lowest incomes hardest and drives calls to increase housing benefit to reduce the risk of people falling into homelessness.

Plenty of work to do on housing

So there is plenty for the new prime minister to cover on the housing brief at a time of rising prices and rents but with the additional risks from higher borrowing costs.

The reality is that the government shouldn’t worry about the short term outlook for housing.

They need to focus on delivering long term stability that gives businesses and households a steady platform to make long term decisions.

The top priority is keeping the economy growing and borrowing costs affordable, while creating an attractive environment to ensure we get the right glow of new investment into growing and improving our ageing housing stock across all areas and housing tenures.

Key takeaways

- Mortgage rates look set to return to 4-5% in 2023, but the days of ultra cheap mortgages are behind us

- On house-building, Sunak says he favours “reforms to increase density in our inner-cities, investing in regenerating brownfield land across the country, and pursuing developments that have community support”

- The rental market has stopped growing in size, yet the demand for renting is growing. The government needs to tread carefully with reforms to prevent more private landlords from leaving the sector

Mortgage market shows signs of stabilising

Mortgage product choice increases as nearly 900 deals are added, while mortgage rates could ease as the market shows signs of stabilising.

Mortgage rates have hit a 14-year high in the wake of the chaos caused by the mini-Budget.

The average cost of a two-year fixed rate deal has soared to 6.65%, while the typical interest rate charged on a five-year fixed rate product is 6.51%, according to financial information group Moneyfacts.

The rates on both deals are the highest since 2008, and significantly above the 4.24% and 4.33% that two-year fixed rate and five-year fixed rate deals respectively stood at in early September.

But the total number of products available to choose from has stabilised in recent days as lenders relaunch their ranges.

After hitting a low of just 2,258 different deals in the first weekend of October, availability has increased to 3,128 products now.

There are hopes that the market will stabilise further and mortgage rates could drop slightly following the resignations of both former Prime Minister Liz Truss and former Chancellor Kwasi Kwarteng.

Why is this happening?

The cost of fixed rate mortgages has been on an upward trend since the beginning of the year, when it became clear the Bank of England would have to increase interest rates significantly to get high inflation back down to its 2% target.

But the mortgage market became highly volatile following the former Chancellor’s mini-Budget in late September.

The unfunded tax cuts and the cost of the energy price guarantee spooked markets, leading to a steep increase in the cost of government borrowing – known as gilt yields.

Gilt yields influence the price of Swap rates – which is the cost lenders pay to borrow money for fixed rate mortgage deals.

The good news is that following the resignations of Truss and the reversal of many of the measures announced in the mini-Budget, gilt yields have fallen slightly.

It is hoped that they will fall further as political stability is restored, enabling lenders to reduce the interest they charge on fixed rate mortgages.

What should I do now?

The current situation is difficult for people who need to remortgage.

Anyone who takes out a fixed rate mortgage now will be locking into the current high rates for two to five years.

What type of mortgages are there?

While the cost of fixed rate deals may come down slightly as gilt yields fall, there is no guarantee that this drop will be passed on by lenders.

Meanwhile, with inflation remaining above 10%, the Bank of England’s Monetary Policy Committee is widely expected to raise interest rates when it meets in early November.

Some economists are predicting it could increase them by as much as 1% to 3.25%.

It is important to factor in the impact of future interest rate rises when deciding what to do.

At 5.63%, the typical standard variable rate – the rate borrowers are automatically moved to when their existing deal ends – is lower than both two-year and five-year fixed rate mortgages.

But if the MPC does increase rates by 1% in November, and lenders pass this on in full to customers on their standard variable rate, it will be on a par with fixed rate deals.

Meanwhile, tracker rates have started to look good value again, with interest on the average two-year product standing at 3.71%.

But it is important to remember that the rates charged on tracker mortgages automatically move up and down in line with changes to the Bank of England base rate.

Economists are predicting the Bank Rate could peak at 5% next year.

If this happens, a tracker rate of 3.71% now would rise to 6.46%.

For many borrowers the decision is likely to come down to whether they want the security that their monthly repayments won’t change with a fixed rate mortgage, or whether they are happy to risk interest rates peaking at 5% and opt for a tracker deal.

What’s the background?

With the mortgage market in such a state of flux, it may be a good idea to consult a mortgage broker, who can help you find the deal that is best for you.

Whatever you decide to do, you are likely to need to move quickly.

The final three months of the year is traditionally a busy time for remortgaging, and this year is likely to be even busier than usual, as homeowners scramble to remortgage before interest rates rise further.

The situation has recently led to lenders withdrawing mortgages in order to maintain their service standards, after receiving high levels of applications.

As a result, good deals are unlikely to be around for long.

Key takeaways

• After hitting a low of just 2,258 different deals in the first weekend of October, availability has increased to 3,128 products now

• Tracker rates have started to look good value again, with interest on the average two-year product standing at 3.71%

• The average cost of a two-year fixed rate deal has soared to 6.65%, while the typical interest rate charged on a fix-year fixed rate product is 6.51%