House prices jump by £10,000 in a year

High demand from potential buyers and a shortage of homes for sale makes it the fastest-moving housing market for five years, our latest House Price Index report shows.

House prices have soared by more than £10,000 during the past year as the scramble for homes continues.

The increase, which is the largest rise in value recorded since October 2016, left the average home costing £229,300 in May, according to our latest monthly House Price I report.

This house price growth has pushed 1.8 million properties into a higher stamp duty bracket.

High demand from potential buyers has also led to the average time it takes to sell a home nearly halving to just 22 days, down from 42 days in May 2019. It makes it the fastest-moving housing market for five years.

But there are signs that the market is beginning to cool as the stamp duty holiday on homes costing up to £500,000 comes to an end.

What’s happening to house prices?

Annual house price growth was 4.7% in May – more than double the 2.2% it was running at in the same month of 2020.

House prices are rising fastest in the most affordable markets, with growth in Wales hitting a 10-year high of 7.1%, while property values rose by 6.8% in Northern Ireland and 6.2% in Yorkshire & the Humber.

Meanwhile, in London house prices rose by just 2.2% – the seventh month running during which the capital recorded the lowest gains in the UK.

In terms of individual cities, Liverpool and Manchester continued to record the highest price growth at 7.9% and 7.2% respectively.

Buyer demand is down 28% from its pandemic peak, moderated by the end of the full stamp duty holiday on the first £500,000 of property this month. But to put this into context, it remains 55% higher than in the more ‘normal’ market of 2019.

Demand is being driven by a combination of greater mortgage availability for first-time buyers, the stamp duty holiday (which draws to a complete close at the end of September) and a pandemic-led once-in-a-lifetime reassessment of housing needs, which has seen many people search for more space.

Demand is highest for homes costing up to £250,000, which are exempt from stamp duty until the end of September.

While the number of buyers looking for properties below £250,000 is down 24% from April’s highs in England, it remains 75% higher than the average recorded in the ‘normal’ market of 2019.

At the same time, demand for homes worth more than £250,000 has dipped by a third since April, but it remains up 86% compared to average levels in 2019.

Meanwhile, the number of homes for sale is 24% lower in the first half of this year compared to 2020.

One of the reasons for this is that first-time buyers are flocking to the housing market and buying a home without having one to sell - in other words, they are not replenishing stock levels. Aspiring homeowners are being spurred on in part by the first-time buyer stamp duty exemption that extends beyond the June deadline as well as having a wider range of mortgages to choose from.

What could this mean for you?

First-time buyers and home-movers

Activity levels remain high among first-time buyers and home-movers, and the supply of homes for sale is not keeping pace with demand.

As a result, you can expect to face stiff competition for those homes that are on the market, particularly if you are looking for somewhere costing up to £250,000.

You should try to get your ducks in a row, such as lining up a mortgage offer in principle or having a clear idea of exactly how much you can borrow, so that you can move quickly and put in an offer when you do see somewhere you like.

Sellers

With demand remaining strong and a shortage of homes for sale, now is a great time to list your property if you are thinking of selling, particularly if your home is worth less than £250,000.

Things are likely to be trickier if you are also looking to purchase a home as well, as while your current property is likely to sell quickly, it may take longer to find a home to buy, given the current shortage of listings. As a result, do your homework before you list your property.

Co-ordinating your sale and purchase could be tricky in the current market due to the mismatch between supply and demand, so it may be worth considering doing it in stages if you have somewhere you could stay in the interim.

What’s the outlook?

While the stamp duty holiday boosted activity, demand from potential buyers remains high despite the first phase of the holiday ending, suggesting the once-in-a-generation reassessment of housing needs still has further to run.

Meanwhile, although demand may ease as the economy continues to reopen, enabling people travel more widely and enjoy leisure activities that have previously not been allowed, many workers are likely to receive clarification on whether they are going to be expected back in the office full time.

Those who are not, may decide to go ahead with a move they had been putting off until they had received clarification on this issue.

Head of research said: “The total stock of homes for sale continues to run well below historical norms, and this will underpin pricing.

“At the same time, it may also constrain potential activity, especially for buyers looking for family houses. Even so, we forecast that this year will be one of the busiest for the housing market since the global financial crisis - with 1.5 million residential transactions.”

Garage conversions on the up: we reveal the most popular home improvements in the UK

If successive lockdowns have had you reassessing your home and lifestyle, you’re not alone. We look at the home improvements that are in hot demand.

Homeowners focused on increasing their space and improving their gardens during 2020 as successive lockdowns forced people to spend more time at home.

With the housing market closed for business in the early part of the year, many people looked to improve their existing space instead of trading up the property ladder.

Successive lockdowns also led to a significant desire among homeowners to have a better property, particularly as working from home looks likely to become the new normal for many.

Meanwhile, as people spent less money on holidays, entertainment and eating out, they had more spare cash to invest in their property, with the Bank of England estimating households collectively set aside £125bn of extra savings between March and November 2020.

The net result was a 25% jump in the number of planning applications for home improvements submitted in 2020, compared with the five-year average.

Which home improvements are on the up?

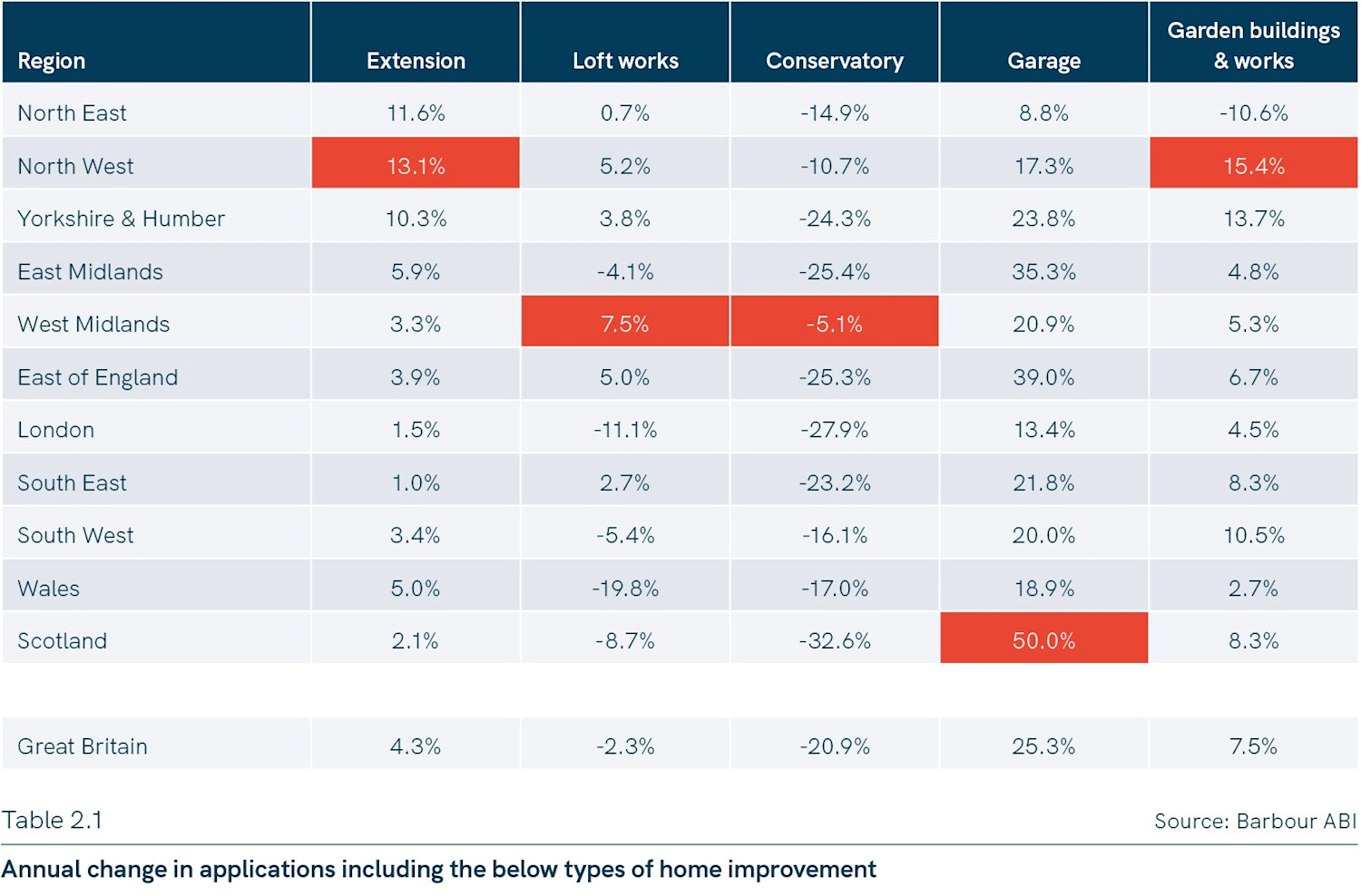

Planning applications to develop garages soared by 25.3% during the year, while there was a 7.5% rise in people seeking permission for garden buildings and works.

Meanwhile, planning applications for an extension were up 4.3%, according to research by Barbour ABI.

By contrast, planning applications submitted for conservatories dived by 20.9% year-on-year, while the number of people looking to do a loft conversion fell by 2.3%.

The group said the trends showed that people were not only looking for more space during 2020, but they were also keen to make the best use of the space they had.

Another notable trend was a significant increase in homeowners seeking to install solar panels towards the end of the year, which Barbour ABI attributed to people becoming more conscious of environmental issues during the pandemic, as well as an increased desire to be self-sufficient.

Why is this happening?

Successive lockdowns have led to people spending more time at home, with many people working from home for the first time.

As a result, homeowners have become very focused on making better use of the space they have.

Rather than seeing garages as a place for cars, people were instead viewing them as somewhere to store things to free up space in their home, a place to transform into a home office or even as an extension of their property, according to Barbour ABI.

Lockdowns have also prompted people to reconnect with their gardens, particularly due to the good weather during the first national lockdown.

What are the most popular home improvements?

House prices, population density and outside space all greatly influenced the type of home improvements that were undertaken in different regions of the country.

Extensions

Building an extension continued to be the most popular type of home improvement, accounting for 81.7% of all planning applications for homes across the UK.

They were most popular in northern regions, many of which saw double-digit increases in planning applications.

This trend is likely to have been driven by the strong house price growth the northern regions have seen in recent years, making building an extension more attractive financially than moving home.

Garages

Extensions were followed by garages in the popularity stakes, as people looked to build or convert a garage as a way of expanding their home.

The steep increase in planning applications for garages reversed the previous declining trend. It is likely that in many cases, garages were doubling as a home office or workspace.

While applications for garages rose most in Scotland, big increases were also recorded in the East of England and East Midlands.

Loft conversions

Loft conversions were most popular in London and the south east, where they accounted for nearly one in five of all improvement applications.

The group said this is likely to reflect the shortage of garden space homeowners in London may have in which to build an extension, with loft conversions tending to be popular in areas where garden space is at a premium.

At the same time, the higher cost of having a loft conversion done compared with an extension meant house prices needed to be correspondingly higher to justify the work.

Conservatories and garden buildings

Conservatories and garden buildings were most popular in the south west and Wales, possibly reflecting the more rural nature of these regions and the larger gardens of those living there, as well as the popularity of conservatories with retirees.

That said, it should be noted that most conservatory providers offer products with dimensions that do not require planning permission to be installed, so the figures may not reflect the true popularity of conservatories.

The important role played by gardens last year across the whole of Great Britain is reflected by the fact that applications for outside-the-house improvements saw a sizable jump in all regions of the country apart from the north east.

Basements

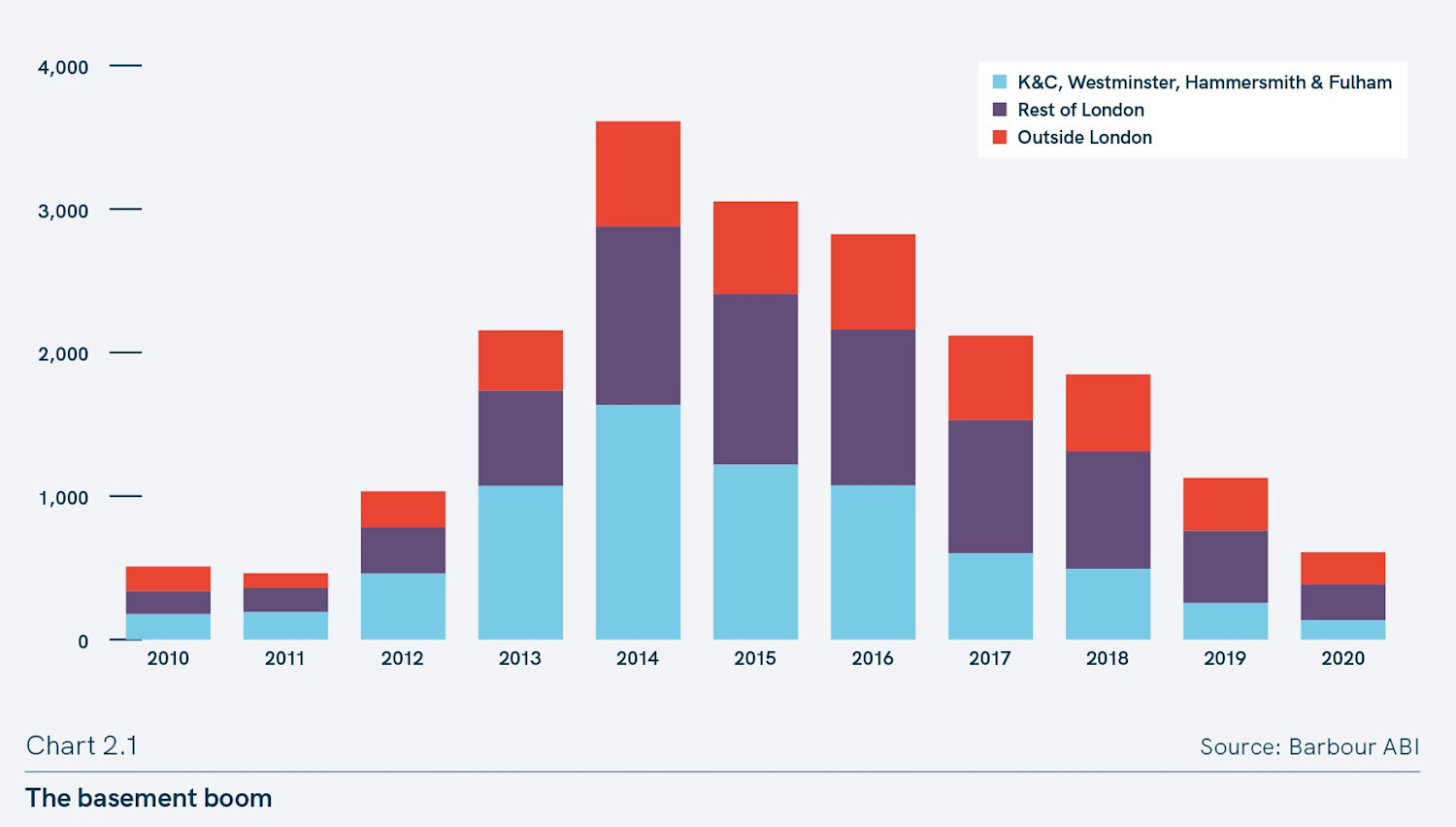

After a steep rise in the popularity of basement developments in London between 2013 and 2016, applications for this improvement have been in steady decline.

ABI Barbour explains that economically, basements only tend to work in locations with high land prices, so that the high cost of having the work done translates into a sufficiently large increase in the value of the property to make it worthwhile.

As money flooded into the London market, basement applications boomed, but once the market started to lose its heat around 2016, demand for basement developments fell back again.

Who are the big spenders?

During the past 15 to 20 years baby boomers have had the biggest impact on home improvements, as this generation not only benefited from high levels of housing wealth, but they also appreciated the value home improvements could add to their property and aspired to live in a home tailored to their own needs.

While those aged between 57 and 75 are still significant home improvement spenders, it is people aged between 30 and 49, an even split of younger generation X and older Millennials, who are now spending the most.

In terms of household type, families with two adults and children are the biggest spenders on home improvements, followed by homes occupied by two retired adults, and those with three or more adults and no children, possibly reflecting the trend for adult children to return to their parent’s home.

Home improvement need-to-knows

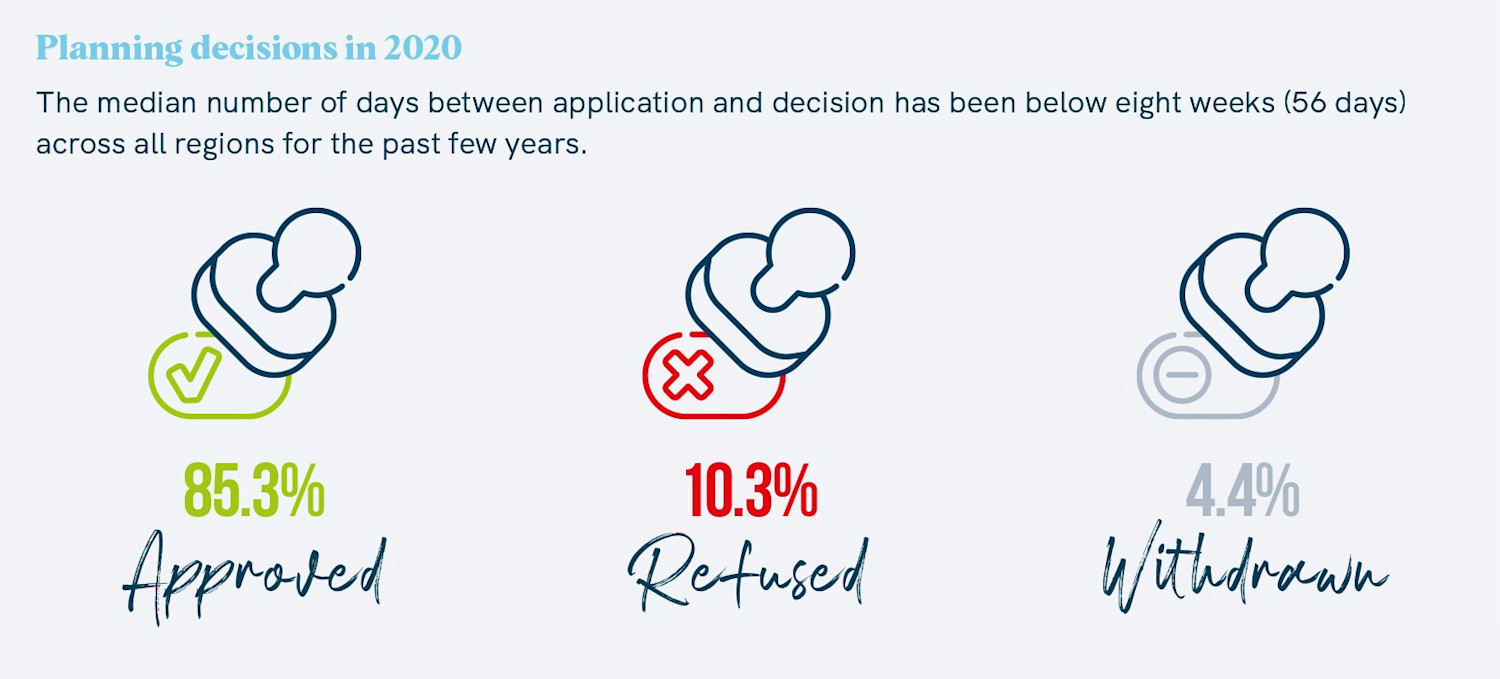

It took an average of 55 days to receive a decision on a planning application across all regions of Great Britain in 2020, slightly up on the 54 days taken in 2018 and 2019.

More than 85% of applications were approved, with just 10% refused, while just over 4% were withdrawn.

London had the lowest level of approvals with 75% of applications given the go-ahead. In the south east and east of England approvals were also slightly below the national average.

But in other regions of the country, around nine out of 10 applications were approved.

London’s lower approval rate is likely to be due to a combination of higher housing density in the capital, meaning neighbours may be more likely to object to applications, as well as higher house prices, which may incentivise applicants to submit more ambitious improvement plans, as the potential gains of adding to their home are proportionately greater.

Top three takeaways

- Homeowners focused on increasing their space and improving their gardens during 2020 as successive lockdowns forced people to spend more time at home

- Building an extension continued to be the most popular type of home improvement

- There was a steep increase in applications for garages and garden buildings. By contrast, planning applications for conservatories and loft conversions fell