Tax loophole on second homes set to be closed

The Government is looking to clampdown on people who claim ‘holiday let’ tax breaks on their second home.

People with second homes will soon no longer be able to claim tax breaks on the properties by stating they are holiday lets.

Under current rules, owners who declare they rent out second properties as holiday lets are charged business rates on the homes, rather than council tax.

Many of the properties qualify for Small Business Rate Relief, meaning if the property has a rateable value of £12,000 or less, they do not have to pay any tax at all, representing a significant saving compared with the council tax bill they would have faced.

But the Treasury is concerned that many people may be stating they let out their second home in order to claim the tax break, while making little effort to actually do so.

As a result, it plans to tighten the rules, forcing people who claim to be operating a holiday let to prove the property is actually let out for at least 140 days each year.

The move was included in the Government’s Tax policies and consultations publication.

Who does it affect?

Government figures show there are 60,000 self-catering premises in England that are registered for business rates, 96% of which have a rateable value that means they are likely to qualify for Small Business Rates relief. It is not clear how many of these are second homes and how many are genuine holiday lets.

Second-home owners who have been claiming business rates will now face the choice of either opting to pay council tax on their property instead, or ensuring it is let out for at least 140 days a year to continue benefiting from the tax break.

What other property-related taxes were in the publication?

While the change to the tax treatment of holiday lets was the most eye-catching change in the tax policy document, there were a number of other changes relating to property.

A new residential property developer tax

The Government announced plans to launch a consultation on introducing a new tax on the largest residential property developers in 2022.

The money raised will be used to cover the cost of replacing unsafe cladding for leaseholders in residential buildings that are more than 18 metres (the equivalent of six storeys) high.

Further details on how developers will be taxed have not yet been released, but the Government has previously said it plans to raise £2 billion over the coming decade through the levy.

Simplified inheritance tax reporting

Plans to simplify inheritance tax reporting requirements were also announced by the Government, which is good news for property owners, as their family home is most people’s most valuable asset.

Under the move, more than 90% of estates that are not liable for the tax will no longer have to complete inheritance tax forms when probate is required from January next year.

It is estimated the change will reduce red tape for more than 200,000 estates every year.

Land and property VAT simplification

The Government is looking for ways to make rules on land and property VAT exemptions clearer.

Transactions involving certain types of land and property, such as the sale of a freehold, are liable for VAT.

Certain transactions are exempt, for example if a landowner converts a commercial building into a residential one. But the current rules are complex.

The Government plans to publish a call for evidence on the issue of simplifying exemptions shortly.

Financial Secretary to the Treasury Jesse Norman said: "We are making these announcements in order to increase the transparency, discipline and accessibility of tax policymaking.

"These measures will help us to upgrade and digitise the UK tax system, tackle tax avoidance and fraud, among other things.

"By grouping them together, we want to give Members of Parliament, tax professionals and other stakeholders a better opportunity to scrutinise them."

Q&A: 'The strength of the housing market later in the year depends on the transition from an economy in lockdown towards normality'

Head of research, explores the latest housing trends – and looks at what's in store for home movers in the months ahead.

Q. First things first, what’s happening to house prices? What are the hottest markets?

A. House prices edged up by 0.3% in January. It means that annual house price growth now stands at 4.3%, the highest rate since April 2017.

The hottest markets in terms of house price growth are Wales and the north of England. At a country and regional level, annual house price growth ranges from 5.6% in Wales and 5.5% in the north west of England, through to 2.8% in London.

Breaking it down to a city level, Manchester and Liverpool continue to lead the way with the strongest house price rises, with annual growth at 6.3% and 6.8% respectively.

Q. What’s the level of demand like from people wanting to buy a home at the moment?

A. It’s been a really strong start to the year. A lot of buyers have been motivated by the stamp duty holiday, with savings of up to £15,000 on offer. There’s also a cohort of buyers who, driven by the experience of successive lockdowns and restrictions, are searching for homes with more space.

As a result, the level of interest from buyers looking for a new home is up 12.4% on last year.

And this buyer demand is translating into transactions, with the number of housing sales agreed also up 10.1% year-on-year.

.png)

Q. And how has the current lockdown impacted sellers?

A. Although the housing market remains open for business, the current lockdown has stifled the supply of homes for sale. The number of homes on the market in the first six weeks of 2021 is down 13.8% year-on-year. And the level of homes being listed for sale is also 14.5% down compared with the same period last year.

Our data also points to increasing interest from first-time buyers, who have no property to sell when they move.

This mismatch between the level of interest from buyers and the supply of homes for sale is apparent in most regions across the country. In the north east, buyer demand is running more than 40% higher than the same period last year – yet the level of new supply has shrunk.

The one exception to this trend is London. It’s important to note that while buyer demand is down 17% year-on-year, it’s still well ahead of the average based on previous years.

Q. How are these trends impacting different people in the housing market?

A. Our data suggests that first-time buyers are returning to the housing market. The level of interest from people looking to step onto the housing ladder was up 5% in the first six weeks of this year compared with the last three months of 2020.

We’ve also seen a 18% increase in the number of sales agreed on homes worth between £100,000 and £250,000, a price band typically associated with first-time buyers, in the first seven weeks of this year.

We expect this trend to continue beyond the newly-extended stamp duty holiday as most first-time buyers are not affected by the tax break.

This comes as the availability of mortgages for buyers with a 5% or 10% deposit gradually picks up. While mortgage lending to buyers with small deposits have not returned to the levels seen in early 2020, it is on an upward trajectory.

Existing homeowners continue to be motivated by a once-in-a-lifetime reassessment of their homes and lifestyles after successive lockdowns.

However, some have been reluctant to list their homes for sale, possibly deterred by social distancing measures. We expect homeowners to press the green light on marketing their homes as lockdown eases and further progress is made on the vaccine roll-out.

Our research also points to a growing number of previously rented properties being listed for sale. This is particularly noticeable in London, where 13% of homes marketed in the last three months of 2020 were previously rented.

There’s several possible reasons for landlords reassessing their portfolios. Firstly, landlords may be looking to crystallise capital gains amid speculation that capital gains tax changes could be on the way.

Secondly, they may also be eager to take advantage of momentum in the housing market, with house prices close to a four-year high.

And thirdly, they may be reacting to the changing dynamics of the rental market, with negative pressure on some city centre rents.

It’s an interesting trend, but it’s worth noting that the rented homes being put up for sale account for less than 1% of private rented sector stock.

Q. The Chancellor made some important announcements in the Budget. How will they affect the housing market over the coming weeks and months?

- The Chancellor’s announcements at the Budget, which included the extension of the stamp duty holiday and the launch of a 95% mortgage guarantee scheme, has already prompted a spike in interest from people looking to buy a home.

This demand jumped 23% in the days immediately following the Budget. To put the figure into context, that’s 47% higher than this time last year.

We expect the housing announcements unveiled by the Chancellor to fuel buyer demand for the next three to four months.

Meanwhile, the flow of homes being listed for sale is gradually improving as lockdown restrictions begin to ease. However, the number of homes being actively marketed remains almost 25% down on last year.

The Budget announcements mean that there will be less of a drop-off in housing sales than we had initially thought for the months ahead, with the tapering of the stamp duty holiday preventing a ‘cliff edge’. However, we do expect housing market activity in general to slow down through the summer.

The strength of the housing market later in the year depends on the transition from an economy in lockdown towards normality. Current trends suggest that house prices will continue to rise and there’ll be a modest uplift in the number of homes that are sold in 2021.

Q. What impact will the stamp duty extension have on people looking to move home?

- The stamp duty holiday extension is great news for all buyers who agreed a sale over the last two months with little or no expectation of completing their purchase in time to secure the stamp duty savings.

Tens of thousands of buyers who are currently in the process of agreeing a sale may save up to £15,000. We estimate that a further 280,000 buyers will benefit from savings of up to £2,500 as a result of the tapered extension, as long as they complete their purchase by the end of September.

Our research shows how the savings vary across the country. Buyers in London are set to save £8,000 in stamp duty, the highest figure in England. Some 22,000 buyers who have already agreed a sale in the city are set to benefit from £174m in savings in total.

Meanwhile, 46,000 buyers who have already agreed a sale in the south east of England will collectively save £271m, more than anywhere else in the country. The average buyer in the region will save nearly £6,000.

Thank you.

Buyer demand soars as stamp duty holiday is extended

But the supply of homes for sale remains tight, pushing prices higher.

Buyer demand spiked by 24% in the week following the Budget as people scrambled to take advantage of the stamp duty holiday extension.

Overall demand was also 80% higher in that same week compared to the same time period over the previous four years, due to a combination of the tax break and the ‘search for space’ triggered by the Covid-19 pandemic.

But the supply of new homes coming on to the market remains constrained, putting further upward pressure on prices, according to our latest House Price Index.

These factors contributed to annual house price inflation of 4.1% in February, more than double the rate of 1.8% recorded in the same month of 2020.

How busy is the housing market?

The Budget announcement that the stamp duty holiday on homes costing up to £500,000 will be extended until 30 June, with a tax-free threshold of £250,000 in place for a further three months, has triggered a fresh wave of interest among potential buyers.

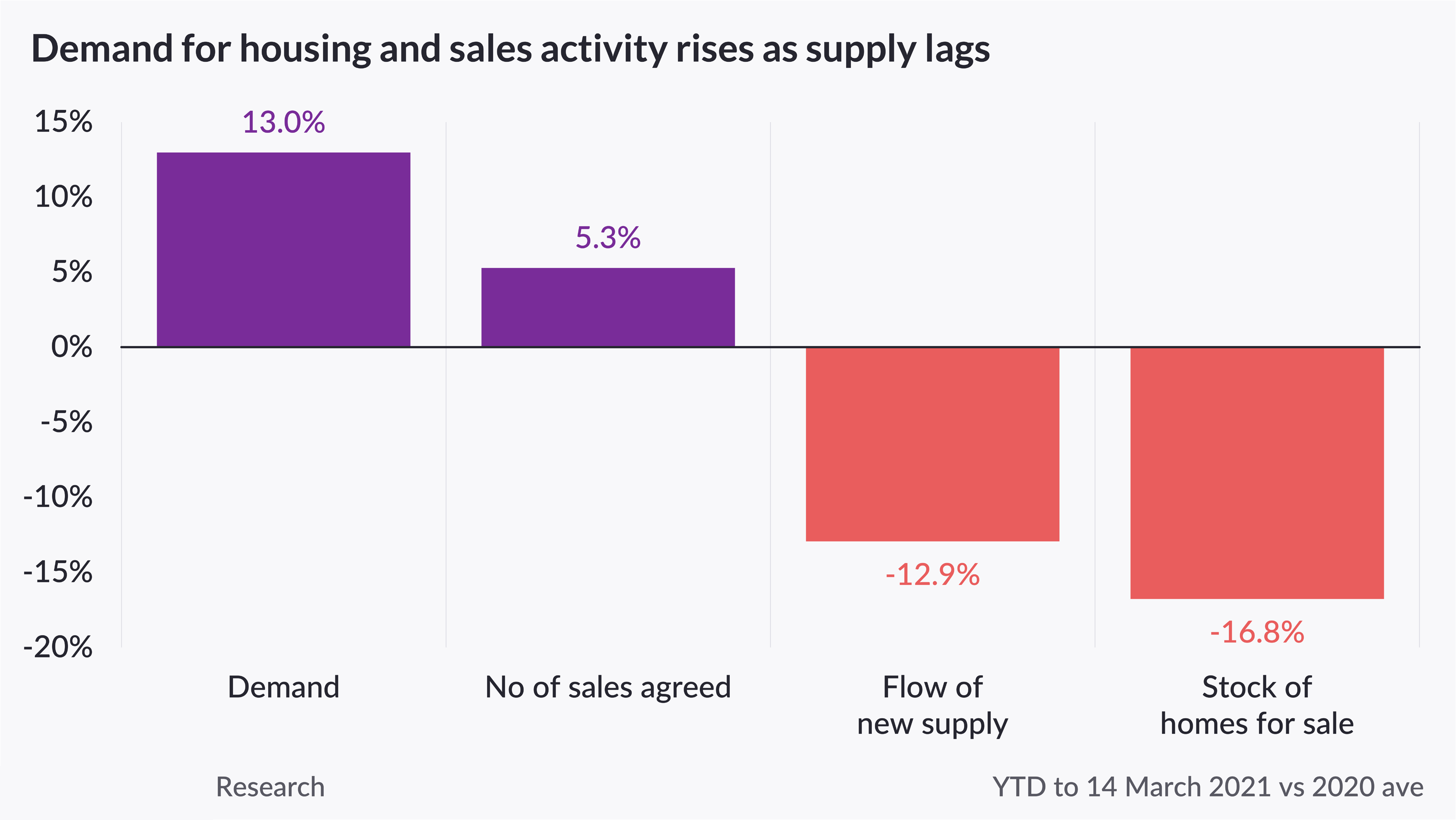

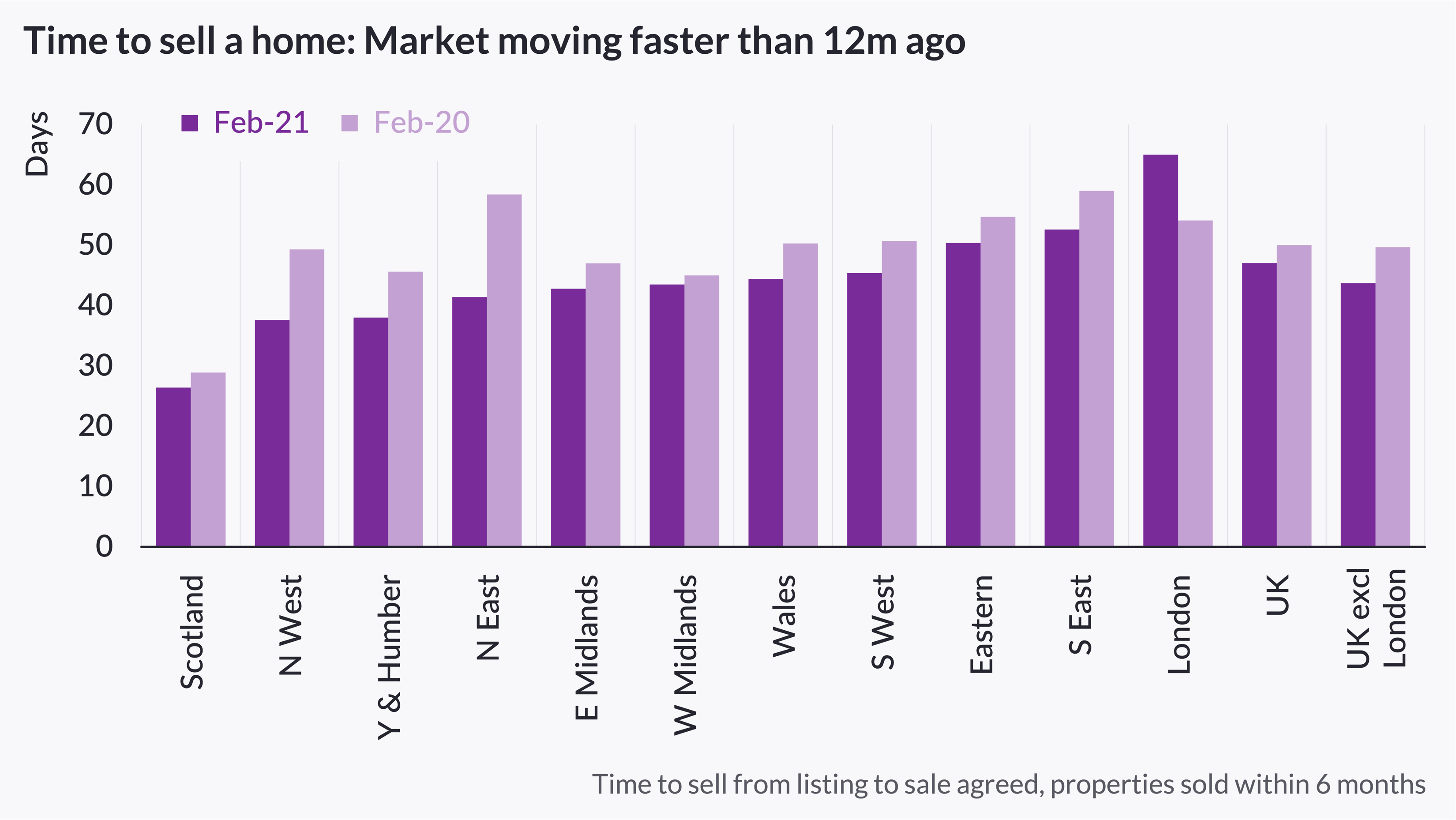

The number of sales agreed is 5.3% higher than it was a year ago, while the average time it takes to sell a property, excluding London, has fallen by nearly a week to just 44 days.

But while buyer demand is 80% higher than the long-run average, the supply of homes being put on the market has actually fallen by 13%, compared with the same period of 2020.

That said, the volume of homes for sale is expected to start to recover as the Covid-19 vaccine programme continues to gather pace and lockdown restrictions are lifted.

What’s happening to house prices?

Unsurprisingly, the mismatch between supply and demand is continuing to drive house prices higher.

The typical value of a home is now 4.1% higher than at the start of the first national lockdown in 2020, with prices rising by an average of £8,907 during the past year or £750 a month.

February marked the fourth consecutive month during which house price growth was above 4%, matching levels last seen in the summer of 2017.

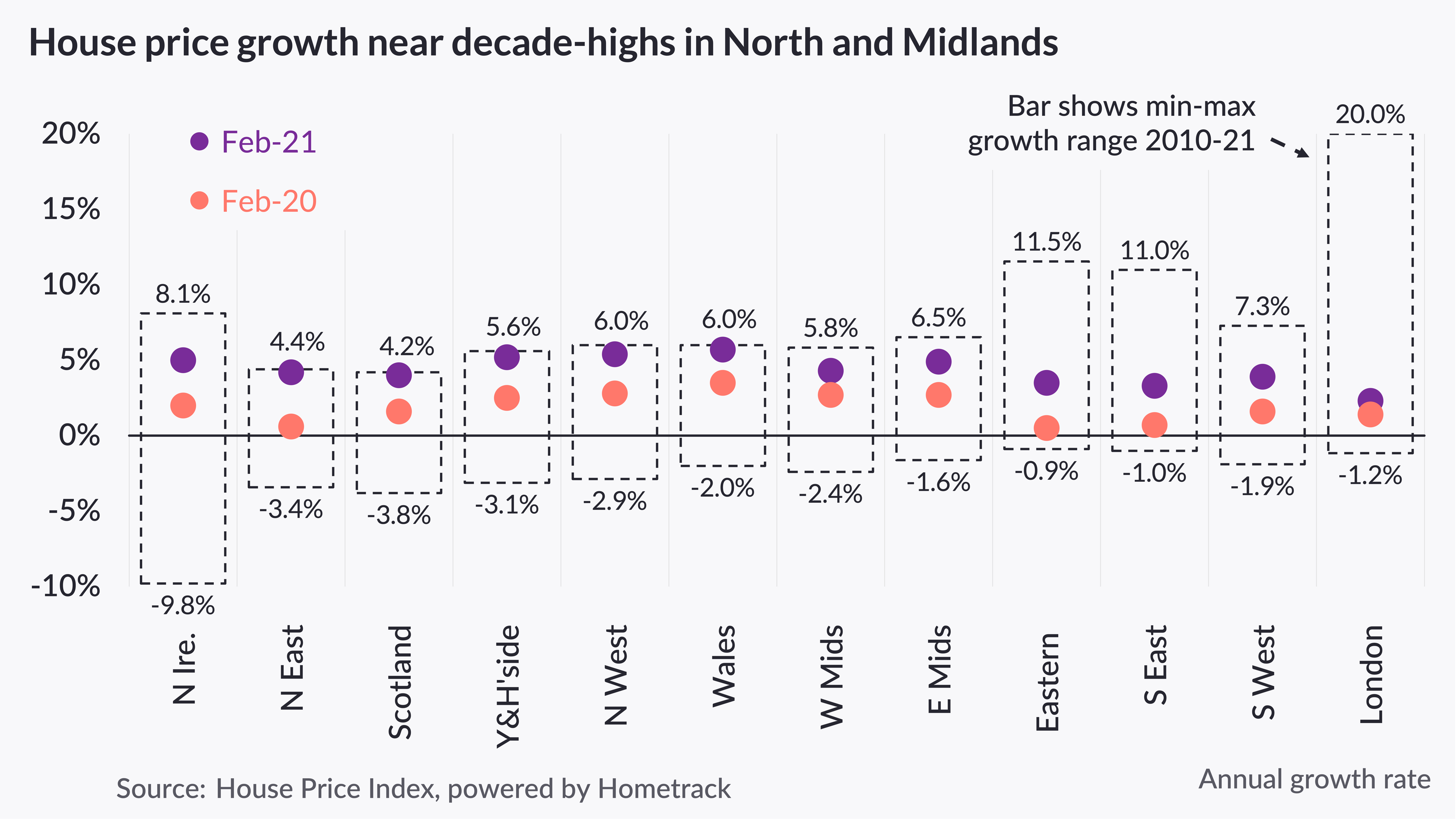

Wales has seen the strongest gains during the past year at 5.7%, followed by the North West at 5.4% and Yorkshire and Humber at 5.2%.

Meanwhile, house price growth in the Midlands, North of England, Wales and Scotland is at an almost 10-year high, fuelled by the relative affordability of these markets.

Growth is slowest in southern regions, where affordability has become increasingly stretched, with prices rising by only 2.3% in London, 3.3% in the South East and 3.5% in the East of England.

Northern cities also continued to outperform their southern counterparts.

Manchester led the way with year-on-year price increases of 6.6%, followed by Liverpool at 6.4% and Leeds at 5.4%.

At the other end of the scale, prices edged ahead by just over 2% in Cambridge, Oxford and Southampton, while Aberdeen, where the property market has been struggling for some time due to the low oil price, saw property values drop by 1.3%.

What could this mean for you?

The jump in demand, which is feeding through into faster selling times, is good news for anyone with a property to sell.

But sellers who are also looking to move up the property ladder are likely to find themselves facing increased competition for their next home.

This is likely to particularly be the case for people in northern regions, where the property market is hottest, and those looking for houses, rather than flats.

Our data also points to an increase in demand among first-time buyers following the Budget announcement about the new 95% mortgage guarantee scheme, which launches on 1 April.

The share of mortgages taken out by first-time buyers fell in 2020 as lenders withdrew loans for people with small deposits, so if you are planning to take your first step on the property ladder this year, you can expect to face more competition for entry level properties.

What’s the outlook?

People’s reassessment of their homes in the light of the pandemic looks set to continue, as homeowners look for more space both inside and outside of their property.

As lockdowns start to ease, more homes should come on to the market, as sellers feel more comfortable about inviting potential buyers into their home, further driving market activity.

Head of research said: “The prospects for the housing market over the next year have improved on the back of the Budget. The continued search for space, the stamp duty extension and mortgage guarantees will support activity levels and headline house price growth up to the end of Q2 2021.

“Yet the pathway out of the lockdown, and the route to a full re-opening of the economy and unwinding of support measures, is unlikely to be simple or smooth.

“We still expect house price growth to moderate later in the year, but overall transactions are set to benefit from an additional boost following the stamp duty extension and tapering.”

Top three takeaways

-

Buyer demand spiked by 24% in the week following the Budget as people scrambled to take advantage of the stamp duty holiday extension

-

But the supply of new homes being put up for sale remains constrained putting further upward pressure on prices

-

At a national level, house price growth stood at 4.1% in February, more than double the rate of 1.8% recorded in the same month of 2020